|

市场调查报告书

商品编码

1684047

印度MLCC:市场占有率分析、产业趋势与统计、成长预测(2025-2030)India MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

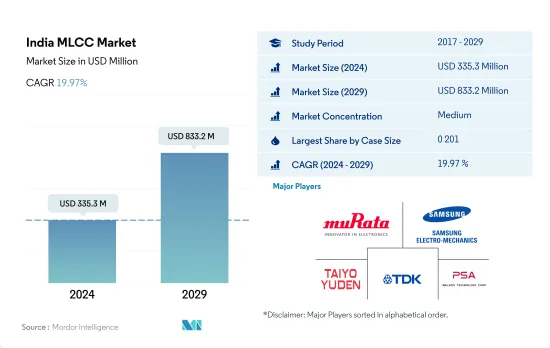

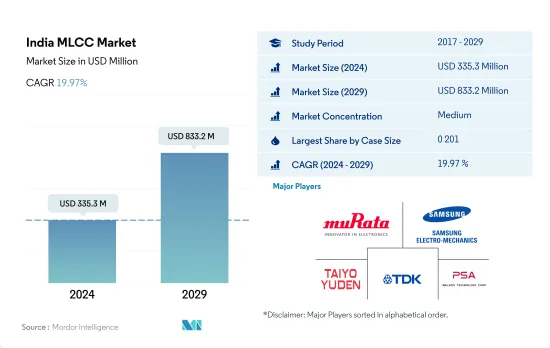

印度 MLCC 市场规模估计和预测在 2024 年为 3.353 亿美元,预计到 2029 年将达到 8.332 亿美元,在市场估计和预测期(2024-2029 年)内以 19.97% 的复合年增长率增长。

可携式和连网设备的日益普及正在推动更小的设计,同时又不牺牲效能

- MLCC 外壳尺寸包括 0 201、0 402、0 603、0 805、1 005、1 206、1 210 等。就销量而言,0201 型机壳占据最大的市场占有率,为 34.84%,预计 2022 年将产生 6,689 万美元的收益。 1005 型机壳将成为成长最快的细分市场,复合年增长率为 25.70%(2022-2029 年)。

- 持续的小型化趋势加上对更高组件密度的需求正在推动对这些组件的需求。可携式和连网型设备的日益普及也推动了对 0 201 MLCC 元件的需求。

- 0 1005 MLCC 具有广泛的应用,尤其是在智慧型手机、穿戴式装置和物联网设备等小型电子设备中,使製造商能够在不影响效能的情况下创造出时尚、紧凑的设计。由于智慧手錶价格实惠且选择范围广泛,印度的智慧型手錶智慧型手錶持续成长。

- 紧凑的 0402 外壳尺寸是表面黏着技术陶瓷电容器的流行外形规格。在汽车产业,0402MLCC 用于各种应用,包括引擎控制单元、资讯娱乐系统、ADAS(高级驾驶辅助系统)和照明控制。这些电容器在恶劣的汽车环境中提供可靠的性能。印度政府计划根据一项新计划,在截至 2026 年的五年内注入 35 亿美元的奖励投资,以促进干净科技汽车的生产和出口,这将促进该国的汽车产量并创造对 0402 MLCC 的需求。

印度MLCC市场趋势

电子商务产业发展可望推动轻型商用车产量

- 在印度,电子商务和物流业的扩张正在创造对皮卡日益增长的需求。因此,轻型商用车的产量正在增加,2019 年产量为 54,280 辆。

- 柴油是传统的燃料发动机,动力更强,而且容易获得,因此印度销售的商用车大部分都是柴油动力商用车。柴油是商用车辆的必需品。然而,政府规范、对电动车的认识、充电基础设施的发展以及奖励正在推动印度商用车市场电池电动车 (BEV) 领域的发展。电子商务、建筑和物流等多个行业的扩张,以及对节能运输的需求,正在刺激印度各地轻型商用车的兴起。相反,由于政府倡议推动电动车发展以及物流业推动电动卡车需求等因素,轻型商用车 (LCV) 市场预计将在预测期内受到正面影响。

- 在部署电动车(EV)方面,与其他脱碳努力相比,印度的进展仍然缓慢。公司正在推出电动货运车辆。例如,2022年5月,塔塔汽车推出了轻型商用车ACE的电动版,并与Bigbasket、Flipkart、亚马逊等公司签署了谅解备忘录,将交付39,000辆。

- 这些关键因素正在推动印度对重型卡车生产的需求。预计2022年该国产量将达61,730辆,并将持续成长。

向电动车转变推动市场成长

- 近年来,乘用车产量大幅成长,2019年产量达362万辆。然而,2020年却遭遇了史上最大跌幅,较去年同期下降21.84%。随着新冠疫情限制因素缓解及企业復工復产,乘用车市场呈现回暖态势,2021年年比2020年小幅成长28.01%。

- 在内燃机汽车需求逐渐下降的同时,印度目前正将重点转向电动车以减少排放气体。随着汽车电气化的推进以及2035年石化燃料汽车的禁令,印度的乘用车市场预计将蓬勃发展。在印度,塔塔的纯电动SUV「Nexon」是最畅销的车型,占电动车销量的三分之二,其他车型大多为SUV。

- 一系列政府激励和回扣计划正在推动全国对电动车的需求。一些州政府已经更新了电池电动车补贴政策和资金水准。 2021年,印度将其主要的电动车需求刺激政策FAME II延长至2024年。此外,印度还增加了电动两轮车的补贴,并累计了电池更换政策以及电动车製造和电池供给能力发展的预算。由于这些因素,预计未来印度对电动乘用车的需求将会增加。

印度MLCC产业概况

印度MLCC市场适度整合,前五大公司占64.47%的市占率。市场的主要企业有:村田製作所、三星电机、太阳诱电、TDK株式会社和华新科技株式会社。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 价格趋势

- 铜价走势

- 镍价趋势

- 原油价格趋势

- 白银价格趋势

- 锌价趋势

- 家电销量

- 空调销售

- 桌上型电脑销量

- 游戏机销售

- 笔记型电脑销售

- 冰箱销售

- 智慧型手机销量

- 仓储设备销售

- 平板电脑销量

- 电视销售

- 汽车製造

- 客车生产

- 重型卡车生产

- 轻型商用车生产

- 乘用车生产

- 汽车製造

- 电动汽车生产

- BEV(纯电动车)生产

- PHEV(插电式混合动力汽车)产量

- 工业自动化销售

- 工业机器人销售

- 服务机器人销售

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 介电类型

- 1级

- 2级

- 錶壳尺寸

- 0 201

- 0 402

- 0 603

- 1 005

- 1 210

- 其他的

- 电压

- 500V~1000V

- 小于500V

- 1000V以上

- 电容

- 100uF~1,000uF

- 小于100uF

- 超过 1,000uF

- Mlcc安装类型

- 金属盖

- 径向引线

- 表面黏着技术

- 最终用户

- 航太和国防

- 车

- 家用电子电器

- 工业设备

- 医疗设备

- 电力和公共产业

- 通讯设备

- 其他的

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第 7 章 CEO 的关键策略问题CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001992

The India MLCC Market size is estimated at 335.3 million USD in 2024, and is expected to reach 833.2 million USD by 2029, growing at a CAGR of 19.97% during the forecast period (2024-2029).

The increasing popularity of portable and connected devices is contributing to achieving compact designs without compromising on performance

- The case sizes for MLCCs are 0 201, 0 402, 0 603, 0 805, 1 005, 1 206, 1 210, and others. Case size 0 201 holds the largest market share of 34.84% in terms of volume and was expected to generate a revenue of USD 66.89 million in 2022. Case size 1 005 is the fastest growing segment, with a CAGR of 25.70% (2022-2029).

- The ongoing trend of miniaturization, coupled with the need for higher component density, drives the demand for these components. The increasing popularity of portable and connected devices further contributes to the demand for 0 201 MLCC components, as they enable manufacturers to achieve compact designs without compromising on performance.

- The usage of 0 1005 MLCCs spans diverse applications, particularly in compact electronic devices such as smartphones, wearables, and IoT devices, enabling manufacturers to achieve sleek and compact designs without compromising performance. The smartwatch sector in India has continued to grow owing to the affordability of smartwatches and a range of options.

- The compact 0 402 case size is widely adopted as a form factor for surface-mount ceramic capacitors. The automotive industry relies on 0 402 MLCCs for various applications, including engine control units, infotainment systems, advanced driver-assistance systems (ADAS), lighting control, and more. These capacitors provide reliable performance in harsh automotive environments. The Indian government plans to invest USD 3.5 billion in incentives over five years ending in 2026 under a new scheme to promote the production and export of Clean Technology Vehicles, thereby increasing automotive production in the country, creating a demand for 0 402 MLCCs.

India MLCC Market Trends

Development of the e-commerce industry is expected to propel the production of light commercial vehicles

- In India, there is an increasing need for pickup trucks due to the expansion of the e-commerce and logistics industry. This has led to a rise in the production of light commercial vehicles, with a total of 54.28 thousand units manufactured in 2019.

- The majority of commercial vehicle sales in India consisted of diesel-fueled CVs, as diesel is the traditional fuel engine, generates more power, and is easily available. It is a must in commercial usage. However, norms by the government, awareness of e-mobility, development in charging infrastructure, and incentives are boosting the Battery Electric Vehicles (BEV) segment in the Indian commercial vehicle market. The expansion of diverse sectors like e-commerce, construction, and logistics, coupled with the demand for fuel-efficient transportation, is fueling the rise of light commercial vehicles throughout India. Contrarily, the light commercial vehicles (LCV) market is predicted to be positively influenced during the projected time frame due to factors like the government's increase in initiatives to promote e-mobility and the logistics sector's growing demand for electric trucks.

- With regard to EV (Electric Vehicle) deployment, India continues to move slowly compared to its other decarbonization initiatives. Companies are launching electric goods carriers. For instance, in May 2022, Tata Motors launched an electric version of the ACE light commercial vehicle, and the company signed MOUs with Bigbasket, Flipkart, Amazon, and other companies for the delivery of 39,000 units.

- These key elements are fueling India's production demand for heavy trucks. The country produced 61.73 thousand units in 2022, which is expected to increase in the future.

Shifting focus to electric cars to boost the market growth

- Passenger car production has grown significantly over the past few years, and 3.62 million units were produced in 2019. However, the market witnessed its worst fall of 21.84% in 2020 over 2019. Relaxation in the COVID-19 pandemic-induced restraints and the resuming of business operations revived the passenger cars market with a slight growth of 28.01% in 2021 over 2020.

- While the demand for ICE vehicles is declining gradually, India is currently shifting focus to electric cars to reduce emissions. An increase in the electrification of vehicles and the banning of fossil fuel vehicles by 2035 is expected to boost the Indian passenger cars market in the future. In India, Tata's Nexon BEV SUV was the bestselling model, accounting for two-thirds of EV sales, and most other offerings were SUVs.

- The government's numerous incentives and rebate programs are increasing the demand for battery electric cars nationwide. The governments of several states have updated the policies and amount levels on battery electric car subsidies. In 2021, India extended its main EV demand stimulating FAME II policy to 2024. It also increased subsidies for electric two-wheelers and made budgetary commitments for battery swapping policies and the development of EV manufacturing and battery supply capacity. These factors are expected to increase demand for electric passenger cars in India in the future.

India MLCC Industry Overview

The India MLCC Market is moderately consolidated, with the top five companies occupying 64.47%. The major players in this market are Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd, TDK Corporation and Walsin Technology Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Price Trend

- 4.1.1 Copper Price Trend

- 4.1.2 Nickel Price Trend

- 4.1.3 Oil Price Trend

- 4.1.4 Silver Price Trend

- 4.1.5 Zinc Price Trend

- 4.2 Consumer Electronics Sales

- 4.2.1 Air Conditioner Sales

- 4.2.2 Desktop PC's Sales

- 4.2.3 Gaming Console Sales

- 4.2.4 Laptops Sales

- 4.2.5 Refrigerator Sales

- 4.2.6 Smartphones Sales

- 4.2.7 Storage Unit Sales

- 4.2.8 Tablets Sales

- 4.2.9 Television Sales

- 4.3 Automotive Production

- 4.3.1 Buses and Coaches Production

- 4.3.2 Heavy Trucks Production

- 4.3.3 Light Commercial Vehicles Production

- 4.3.4 Passenger Vehicles Production

- 4.3.5 Total Motor Production

- 4.4 Ev Production

- 4.4.1 BEV (Battery Electric Vehicle) Production

- 4.4.2 PHEV (Plug-in Hybrid Electric Vehicle) Production

- 4.5 Industrial Automation Sales

- 4.5.1 Industrial Robots Sales

- 4.5.2 Service Robots Sales

- 4.6 Regulatory Framework

- 4.7 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Dielectric Type

- 5.1.1 Class 1

- 5.1.2 Class 2

- 5.2 Case Size

- 5.2.1 0 201

- 5.2.2 0 402

- 5.2.3 0 603

- 5.2.4 1 005

- 5.2.5 1 210

- 5.2.6 Others

- 5.3 Voltage

- 5.3.1 500V to 1000V

- 5.3.2 Less than 500V

- 5.3.3 More than 1000V

- 5.4 Capacitance

- 5.4.1 100µF to 1000µF

- 5.4.2 Less than 100µF

- 5.4.3 More than 1000µF

- 5.5 Mlcc Mounting Type

- 5.5.1 Metal Cap

- 5.5.2 Radial Lead

- 5.5.3 Surface Mount

- 5.6 End User

- 5.6.1 Aerospace and Defence

- 5.6.2 Automotive

- 5.6.3 Consumer Electronics

- 5.6.4 Industrial

- 5.6.5 Medical Devices

- 5.6.6 Power and Utilities

- 5.6.7 Telecommunication

- 5.6.8 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219