|

市场调查报告书

商品编码

1684039

电动车 MLCC:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Electric Vehicles MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

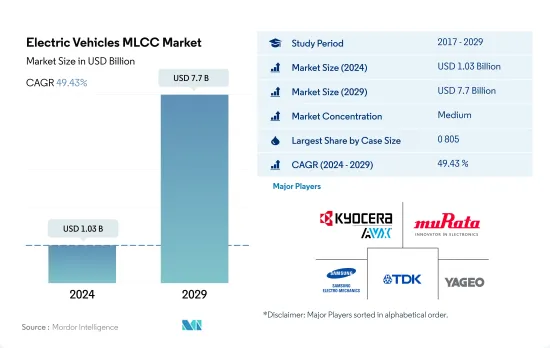

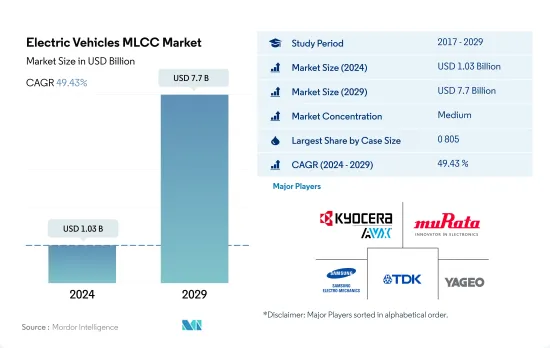

电动车 MLCC 市场规模预计在 2024 年为 10.3 亿美元,预计到 2029 年将达到 77 亿美元,预测期内(2024-2029 年)的复合年增长率为 49.43%。

透过采用 MLCC 对汽车系统进行创新来提高效率,进一步推动了对不同外壳尺寸的需求。

- 在汽车产业的动态发展中,MLCC已经超越了其作为单纯电子元件的传统角色。这个紧凑的动力装置现在是现代汽车系统的核心,协调各种功能,包括配电、噪音抑制、讯号调节和电压调节。

- 在此背景下,0 603 段显得紧凑而重要。这些电容器具有紧凑且节能的设计。随着汽车技术的不断进步,对精简解决方案的需求正在推动 0 603 领域的重要性达到新的高度。

- 0.805 电容器占据着突出的位置,尤其是在电动车 (EV) 占据中心地位的情况下。电动车的快速普及凸显了高效配电和控制的必要性,也凸显了 0 805 段的关键作用。在电动车重新定义的时代,这些电容器成为提高性能和效率的催化剂。

- 1 206 段在尺寸和多功能性之间实现了微妙的平衡,使其成为各种汽车应用的首选。随着汽车行业技术的快速进步,与尖端技术无缝整合的 1 210 细分市场的必要性变得越来越明显。

- 其他类别包括一系列精心定制的电容值,以满足特定的汽车要求。从新兴技术到独特的应用,这一动态部分展示了 MLCC 无与伦比的适应性,可以满足汽车领域独特且不断变化的需求。

推动电动车市场积层陶瓷电容(MLCC) 成长的关键催化剂

- 从市场动态来看,亚太地区占据主导以金额为准,市场占有率达 44.97%,而北美和欧洲分别占有 23.57% 和 22.80% 的份额。

- 亚太地区处于电动车 (EV) 革命的前沿,在政府支持、技术进步和不断增长的消费者需求的推动下,呈现出显着的成长。该地区以中国等主要企业为主导,在电动车生产和技术创新方面处于领先地位,巩固了其在全球电动车市场中的活跃地位。

- 欧洲以其对永续性的承诺而闻名,率先采用电动车作为减少排放和应对环境挑战的解决方案。严格的排放法规和奖励计画正在支持欧洲国家迅速推广电动车。主要汽车製造商正在大力投资电动车生产、充电基础设施和电池技术,以确保更环保的未来。

- 在北美,由成熟和新兴企业组成的多元化格局正在塑造电动车市场。政府奖励、日益增强的环保意识和技术进步正在推动向电动车的转变。特斯拉的影响力依然巨大,刺激了该地区的创新和竞争,并帮助推动了电动车市场的成长。

- 世界其他地区(RoW)正在以其独特的方式拥抱电气化。电动两轮车发展势头强劲,解决了城市交通拥堵问题并带来了经济效益。随着全球汽车产业继续走向电气化,这些地区正在联合起来帮助塑造电动车 MLCC 市场的未来。

全球电动车MLCC市场趋势

政府支持公共充电基础设施建设的政策将促进纯电动车的销售

- 电池电动车(BEV)是一种没有汽油引擎的电动车。整个车辆由电池组动力来源,透过电网充电并为车辆提供动力。 BEV 是零排放汽车,不会像传统汽油汽车那样产生有害废气排放或空气污染的风险。电池电动车中使用的 MLCC 必须具有高品质,并且能够在 250V 至 4kV 的高电压下工作。陶瓷 MLCC 是分布电容的首选,因为它们可以承受高温。

- 预计 2022 年纯电动车出货量将达 1,318 万辆,2029 年将增加至 2,714 万辆。 2020 年第一波新冠疫情导致纯电动车销量出现历史性下滑,但同时也获得了政策制定者的进一步支持。 2022年,纯电动车销量成长。

- 更严格的法规和日益增长的消费者兴趣最近加速了市场向电动车的转变。一些公司正在考虑建造新的纯电动车专用生产设施,以提高纯电动车的生产能力,尤其是在需求量大的地区。一些政府正在采取倡议增加其所在地区的电动车产量和销售量。欧洲为OEM提供电动车生产奖励与目标车队平均二氧化碳排放量 95 克/公里挂钩。 2016年至2019年间,受电池价格持续下降和纯电动车平均电池尺寸增加的推动,市场渗透率稳定扩大。所有地区的大多数车辆领域都提供纯电动车 (BEV)。

加氢站基础建设持续推动销售成长

- 燃料电池电动车(FCEV)利用燃料电池将储存的氢能转化为电能,其推进机制与电动车类似。与传统内燃机动力来源的汽车相比,FCEV 不会排放有害废气。

- 预计燃料电池电动车的出货量将在2022年达到4万辆,在2029年达到6.6万辆。随着风能和太阳能等可再生能源对氢气生产过程的贡献越来越大,对节能型FCEV的需求可能会大幅增加。

- 随着对低排放气体汽车的需求不断增加,二氧化碳排放标准变得更加严格,快速加油等优点使得燃料电池汽车的采用更加受到重视。为了促进燃料电池电动车的发展,多个政府机构和商业实体正在共同投资燃料电池技术的进步和加氢基础设施的建设。根据国际能源总署的数据,截至 2021年终,全球约有 730 个加氢站 (HRS) 为约 51,600 辆 FCEV 提供燃料,这意味着全球 FCEV 库存量较 2020 年增加了近 50%,加氢站数量增加了 35%。预计这些因素将有助于未来 FCEV 的高速成长。

电动汽车MLCC产业概况

电动车MLCC市场适度整合,前五大公司占41.80%的市占率。市场的主要企业有:京瓷AVX元件株式会社(京瓷株式会社)、村田製作所、三星电机、TDK株式会社和国巨株式会社(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 电动汽车销量

- 全球BEV(纯电动车)产量

- 全球FCEV(燃料电池电动车)产量

- 全球HEV(混合动力电动车)产量

- 全球ICEV(内燃机汽车)产量

- 全球插电式混合动力汽车(PHEV)产量

- 其他的

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 錶壳尺寸

- 0 603

- 0 805

- 1 206

- 1 210

- 1 812

- 其他的

- 电压

- 50V~200V

- 小于50V

- 200V以上

- 电容

- 10μF 至 1,000μF

- 小于10μF

- 1,000μF 以上

- 介电类型

- 1级

- 2级

- 地区

- 亚太地区

- 欧洲

- 北美洲

- 世界其他地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第 7 章 CEO 的关键策略问题CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001982

The Electric Vehicles MLCC Market size is estimated at 1.03 billion USD in 2024, and is expected to reach 7.7 billion USD by 2029, growing at a CAGR of 49.43% during the forecast period (2024-2029).

Driving efficiency through revolutionizing automotive systems with MLCCs is further propelling the demand for different case sizes

- In the dynamic evolution of the automotive sector, MLCCs have transcended their conventional role as mere electronic components. These compact powerhouses now serve as the linchpin of contemporary vehicular systems, orchestrating a harmonious interplay of functions spanning power distribution, noise suppression, signal conditioning, and voltage regulation.

- In this landscape, the 0 603 segment emerges as a compact yet indispensable contributor. These capacitors are characterized by compact and energy-efficient designs. As automotive technologies continue to advance, the demand for streamlined solutions has propelled the significance of the 0 603 segment to new heights.

- The 0 805 capacitors hold a noteworthy position, particularly as electric vehicles (EVs) take center stage. The surging adoption of EVs accentuates the imperative of efficient power distribution and control, thereby underscoring the pivotal role of the 0 805 segment. In an era redefined by EVs, these capacitors emerge as catalysts for enhanced performance and efficiency.

- The 1 206 segment strikes a delicate balance between size and versatility, rendering it a preferred choice for diverse automotive applications. As the automotive industry embraces rapid technological strides, the indispensability of the 1 210 segment becomes increasingly evident, seamlessly integrating with cutting-edge advancements.

- The others category encompasses a diverse array of capacitance values meticulously tailored to address specialized automotive requisites. From emerging technologies to unique applications, this dynamic segment exemplifies the unparalleled adaptability of MLCCs in catering to the unique and evolving needs of the automotive realm.

Key catalysts that are fueling multilayer ceramic capacitor (MLCC) growth in the electric vehicle market

- The market dynamics demonstrate, in terms of value, Asia Pacific supremacy with a dominant 44.97% market share, while North America and Europe maintain 23.57% and 22.80% shares, respectively.

- The Asia-Pacific region is at the forefront of the electric vehicle (EV) revolution, showcasing remarkable growth driven by government support, technological advancements, and rising consumer demand. Dominated by key players like China, the region leads in EV production and innovation, solidifying its position as a dynamic force in the global EV market.

- Europe, renowned for its commitment to sustainability, is pioneering the adoption of EVs as a solution to emissions reduction and environmental challenges. Stringent emission regulations and incentivized programs propel rapid EV adoption across European countries. Major automakers are investing significantly in EV production, charging infrastructure, and battery technology to ensure a greener future.

- In North America, a diverse landscape of established and emerging players is shaping the EV market. Government incentives, growing environmental consciousness, and technological advancements are driving the transition toward electric mobility. Tesla's influence remains prominent, fostering innovation and competition within the region, thereby fueling the growth of the electric vehicle market.

- The Rest of the World (RoW) is embracing electrification with unique characteristics. Electric two-wheelers are gaining momentum, addressing urban congestion and offering economic benefits. As the global automotive industry navigates the path to electrification, these regions collectively contribute to shaping the future of the electric vehicle MLCC market.

Global Electric Vehicles MLCC Market Trends

Supportive government policies for the deployment of public charging infrastructure will promote battery electric vehicle sales

- Battery electric vehicles, or BEVs, are electric automobiles without a petrol engine. The entire vehicle is powered by the battery pack, which is recharged through the grid and powers the vehicle. BEVs are zero-emission vehicles because they produce no harmful tailpipe emissions or air pollution hazards like traditional gasoline-powered vehicles. The MLCCs consumed in battery electric vehicles must be of high-quality construction and operate at high voltages ranging from 250V to 4kV. Ceramic MLCCs are the preferred choice for distributed capacitance because of their ability to withstand high temperatures.

- Battery electric vehicle shipments were 13.18 million units in 2022 and are projected to rise to 27.14 million units in 2029. The first COVID-19 wave in 2020 triggered a historic decline in BEV sales while garnering more policymakers' support. In 2022, BEV sales increased.

- Stronger regulations and growing consumer interest have recently accelerated the market shift toward EVs. Several companies are considering adding a new dedicated BEV production facility to boost BEV production capability centered on high-demand regions. Several governments are taking initiatives to increase EV production and sales in the regions. Europe is providing OEMs with EV-production incentives tied to its targeted fleet average of 95 grams of CO2 per km. The continuous decline in battery prices and increase in the average battery size in BEVs contributed to the growth and helped market penetration grow steadily from 2016 through 2019. BEVs are being offered in most vehicle segments in all regions.

Infrastructure improvement for hydrogen stations continues to increase sales

- Fuel cell electric vehicles (FCEVs) use hydrogen energy stored as fuel, which is then converted into electricity by the fuel cell and has a propulsion mechanism similar to that of an electric vehicle. Compared to vehicles powered by conventional internal combustion engines, FCEVs don't emit any harmful exhaust emissions.

- Fuel cell electric vehicle shipments accounted for 40 thousand units in 2022 and are expected to reach 66 thousand units by 2029. As renewable energies like wind and solar contribute to the hydrogen manufacturing process, there will be a huge increase in the demand for energy-efficient FCEVs.

- As the demand for low-emission vehicles is rising, there are stricter carbon emission standards, and more emphasis is being placed on the adoption of FCEVs due to benefits like quick refueling. To encourage the development of FCEVs, several government and commercial organizations are collaborating and investing in advancing fuel cell technology and the development of hydrogen refueling infrastructure. According to the IEA, at the end of 2021, there were about 730 hydrogen refueling stations (HRSs) globally providing fuel for about 51,600 FCEVs, representing an increase of almost 50% in the global stock of FCEVs and a 35% increase in the number of HRSs from 2020. These factors are expected to contribute to the high growth of FCEVs in the future.

Electric Vehicles MLCC Industry Overview

The Electric Vehicles MLCC Market is moderately consolidated, with the top five companies occupying 41.80%. The major players in this market are Kyocera AVX Components Corporation (Kyocera Corporation), Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, TDK Corporation and Yageo Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Ev Sales

- 4.1.1 Global BEV (Battery Electric Vehicle) Production

- 4.1.2 Global FCEV (Fuel Cell Electric Vehicle) Production

- 4.1.3 Global HEV (Hybrid Electric Vehicle) Production

- 4.1.4 Global ICEV (Internal Combustion Engine Vehicle) Production

- 4.1.5 Global PHEV (Plug-in Hybrid Electric Vehicle) Production

- 4.1.6 Others

- 4.2 Regulatory Framework

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Case Size

- 5.1.1 0 603

- 5.1.2 0 805

- 5.1.3 1 206

- 5.1.4 1 210

- 5.1.5 1 812

- 5.1.6 Others

- 5.2 Voltage

- 5.2.1 50V to 200V

- 5.2.2 Less than 50V

- 5.2.3 More than 200V

- 5.3 Capacitance

- 5.3.1 10 µF to 1000 µF

- 5.3.2 Less than 10 µF

- 5.3.3 More than 1000µF

- 5.4 Dielectric Type

- 5.4.1 Class 1

- 5.4.2 Class 2

- 5.5 Region

- 5.5.1 Asia-Pacific

- 5.5.2 Europe

- 5.5.3 North America

- 5.5.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219