|

市场调查报告书

商品编码

1684049

电力和公共产业用 MLCC -市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Power and Utilities MLCC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

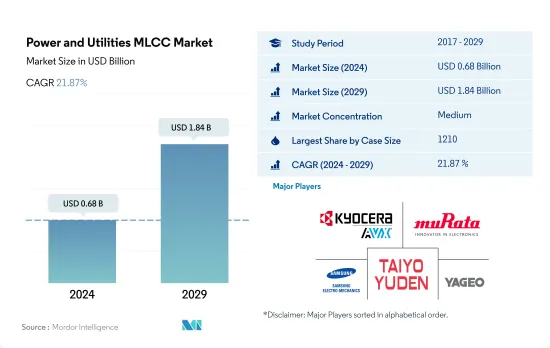

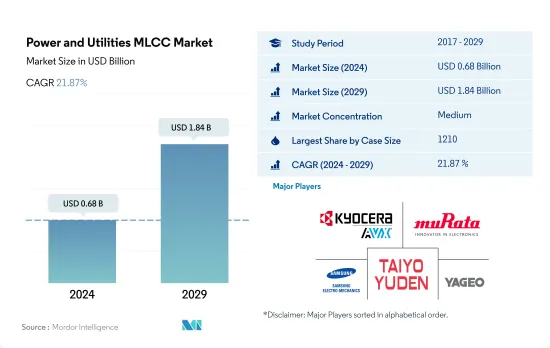

电力和公共产业MLCC 市场规模预计在 2024 年达到 6.8 亿美元,预计到 2029 年将达到 18.4 亿美元,预测期内(2024-2029 年)的复合年增长率为 21.87%。

电力和公共产业MLCC 市场的变革趋势以及不同外壳尺寸的动态正在再形成能源模式

- 按外壳尺寸对电力和公共MLCC 市场进行细分,可以全面了解这些关键电子元件如何促进能源格局的演变。截至 2023 年,由于发电、配电和公共管理对电子系统的依赖性日益增强,市场正在经历显着增长。

- 采用这种特定的外壳尺寸反映了 MLCC 对于解决该领域的独特挑战和机会的战略重要性。 1,210 箱装市场表现出显着的韧性,2022 年实现了 1.3206 亿美元的可观收益。 2023 年至 2028 年的复合年增长率为 20.65%,预计 2028 年的销售额将达到 4.0225 亿美元。

- 同时,1,812 外壳尺寸细分市场在电力和公共产业MLCC 市场中处于领先地位,反映了亚洲和大洋洲对清洁能源解决方案日益增长的需求。随着该地区追求雄心勃勃的可再生能源目标,预计该领域的需求将激增。在欧洲,2,220 箱尺寸部分在支持欧洲大陆向更清洁、更永续的发电转型方面发挥关键作用。清洁能源占欧洲电力产量的55%左右,该地区正积极减少对煤炭的依赖。

- 最后,3,640 和 4,540 型号的錶壳尺寸部分分别在北美和亚洲经历了显着变化。在北美,3640 MLCC 的采用反映了发电动态的变化,其中煤炭发电量大幅下降,而风能和太阳能发电量不断扩大。

电力及公共事业MLCC市场的区域变化

- 按地区细分电力和公共产业MLCC 市场可以揭示亚太地区、欧洲、北美和亚洲其他地区的明显趋势和机会。亚太地区是中国、印度等发展中经济体的聚集地,该地区的电力消耗和公共工程需求正在稳步增长。

- 印度政府雄心勃勃的目标是到 2026 年安装 2.5 亿个智慧电錶,这将推动对 MLCC 的需求,尤其是在智慧电錶製造业。印度正积极致力于实现能源基础设施现代化,为 MLCC 製造商创造了巨大的成长机会。

- 美国智慧电錶的安装取得了长足进步,目前已有超过1亿个智慧电錶投入使用。 MLCC 对于确保高效能的能源管理至关重要,并且该市场预计将进一步成长。加拿大正在大力推行更节能的街道照明系统,这也推动了对 MLCC 的需求,从而支持节能工作。

- 沙乌地阿拉伯设定了2030年50%的电力来自可再生能源的开创性目标,为工业MLCC市场创造了巨大的机会。此举符合沙乌地阿拉伯到2035年将二氧化碳排放减少15%(即4,400万吨)的目标。 MLCC,尤其是高容量MLCC,预计将在支援可再生能源计划和自动化系统方面发挥至关重要的作用,从而进一步提升该地区在MLCC市场中的重要性。

全球电力和公共产业MLCC市场趋势

更严格的排放标准预计将增加需求

- 预计逆变器出货量将从2021年的622.963亿台增加至2022年的934.129亿台。 MLCC采用电容变化较小的温度补偿陶瓷,非常适合用作逆变器中使用的缓衝电路的元件,这些逆变器在开关过程中会处理大电压,并且需要小尺寸和耐热性。

- 随着世界各地排放法规变得越来越严格,汽车製造商正逐渐从传统引擎汽车的生产转向混合动力汽车汽车和电动车。不同类型的逆变器,例如牵引逆变器和软开关逆变器,用于电动车的不同用途。世界各国政府正向电动车计划投资数十亿美元,以鼓励消费者采用电动车。此外,电动车需求的成长预计将推动电动车所用零件(如电源逆变器)的销售。 2021年,太阳能光伏发电量创纪录地成长了179太瓦时,比2020年增加了22%。太阳能光电占全球发电量的3.6%,仍是继水力发电和风力发电之后的第三大再生能源技术。随着全球对工业化污染的担忧日益加剧,各国政府纷纷推出政策鼓励太阳能的推广。例如,2022年8月,美国联邦政府推出了《通膨削减法案》,该法案将在未来十年透过税额扣抵等方式大幅扩大对可再生能源的支持。

智慧照明在各种应用中的使用率正在上升

- LED出货量将从2021年的130万台增加到2022年的265万台。 MLCC用于LED中以抑制电磁干扰(EMI)、平滑直流电源并降低声学杂讯。 LED 中使用的 MLCC 通常必须满足某些电气和环境要求,包括高电容值、低等效串联电阻 (ESR)、高额定电压和良好的温度稳定性。

- LED照明可用于各种应用,包括商业照明、住宅照明、汽车照明、装饰照明和户外照明。人口成长导致住宅和商业设施建设增加,这是增加对各种基础设施(尤其是电力)的需求的主要因素之一。新冠肺炎疫情为全球经济造成了重创。由于建筑工地停工和关闭,LED照明的需求下降。然而,由于新计画和升级计划的推出,2021年下半年建设量激增,推动LED照明产业稳步復苏。

- 2021年,住宅和旅馆业照明电力消耗增加了约5%,推动了排放的增加。虽然一些国家在十多年前就开始逐步淘汰白炽灯,但现在许多国家开始逐步淘汰萤光,使 LED 成为首选照明技术,同时大幅减少二氧化碳排放。

电力和公共产业MLCC产业概况

电力和公共产业MLCC市场适度整合,前五大公司占据59.90%的市场份额。市场的主要企业有:京瓷AVX元件株式会社(京瓷株式会社)、村田製作所、三星电机、太阳诱电和国巨株式会社。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 电力及公共设备销售

- 逆变器全球销售

- LED全球销售

- 全球智慧电錶销量

- 太阳能逆变器和优化器的全球销售

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 錶壳尺寸

- 1210

- 1812

- 2 220

- 3 640

- 4 540

- 其他的

- 电压

- 600V~1100V

- 小于600V

- 1100V以上

- 电容

- 10μF至100μF

- 小于10μF

- 100μF 以上

- 介电类型

- 1级

- 2级

- 地区

- 亚太地区

- 欧洲

- 北美洲

- 世界其他地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Kyocera AVX Components Corporation(Kyocera Corporation)

- Maruwa Co ltd

- Murata Manufacturing Co., Ltd

- Nippon Chemi-Con Corporation

- Samsung Electro-Mechanics

- Samwha Capacitor Group

- Taiyo Yuden Co., Ltd

- TDK Corporation

- Vishay Intertechnology Inc.

- Walsin Technology Corporation

- Wurth Elektronik GmbH & Co. KG

- Yageo Corporation

第 7 章 CEO 的关键策略问题CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50001994

The Power and Utilities MLCC Market size is estimated at 0.68 billion USD in 2024, and is expected to reach 1.84 billion USD by 2029, growing at a CAGR of 21.87% during the forecast period (2024-2029).

Transformative trends in the power and utilities MLCC market with different case size dynamics are reshaping the energy landscape

- The power and utilities MLCC market, segmented by case size, offers a comprehensive view of how these critical electronic components contribute to the evolving energy landscape. As of 2023, the market witnessed substantial growth, paralleling the increasing reliance on electronic systems in power generation, distribution, and utility management.

- The adoption of specific case sizes reflects the strategic importance of MLCCs in addressing the unique challenges and opportunities in this sector. The market demonstrated remarkable resilience in the 1210 case size segment, achieving significant revenue of USD 132.06 million in 2022. Projections indicate robust growth potential, with an estimated revenue of USD 402.25 million by 2028, driven by a substantial CAGR of 20.65% from 2023 to 2028.

- Meanwhile, the 1812 case size segment stands at the forefront of the power and utilities MLCC Market, reflecting the growing demand for clean energy solutions in Asia and Oceania. The segment is poised to experience a surge in demand as this region pursues ambitious renewable energy goals. In Europe, the 2 220 case size segment plays a pivotal role in supporting the continent's transition toward cleaner and more sustainable electricity generation. With clean power sources contributing to approximately 55% of Europe's electricity production, the region is actively reducing its reliance on coal.

- Lastly, the 3640 and 4540 case size segments are witnessing notable shifts in North America and Asia, respectively, as these regions grapple with their energy landscapes. In North America, the adoption of 3 640 MLCCs reflects the changing dynamics of power generation, with a significant decline in coal-based electricity and an expansion in wind and solar sources.

The shifting landscape of the power and utilities MLCC market across regions

- The power and utilities MLCC market, segmented by region, exhibits distinct trends and opportunities in Asia-Pacific, Europe, North America, and the Rest of the World. Asia-Pacific, home to thriving economies like China and India, is witnessing robust growth in power consumption and utility demand.

- The Indian government's ambitious goal of installing 250 million smart meters by 2026 is driving significant demand for MLCCs, particularly in smart meter production. With its proactive efforts in modernizing its energy infrastructure, India presents a substantial growth opportunity for MLCC manufacturers.

- The United States has made significant progress in the installation of smart electric meters, with over 100 million units already in use. MLCCs are integral in ensuring efficient energy management and are poised for further growth in this market. Canada's transition to energy-efficient street lighting systems also boosts MLCC demand, supporting energy conservation efforts.

- Saudi Arabia's groundbreaking commitment to renewable energy, aiming to generate 50% of its electricity from renewables by 2030, presents a substantial opportunity for the Industrial MLCC Market. This move aligns with their target to reduce carbon emissions by 15% or 44 million tonnes by 2035. MLCCs, particularly high-capacity ones, are expected to play a pivotal role in supporting renewable energy projects and automation systems, further reinforcing the region's significance in the MLCC market.

Global Power and Utilities MLCC Market Trends

Stringent emission standards are expected to increase demand

- Inverter shipments increased from 62296.3 million units in 2021 to 93412.9 million units in 2022. MLCCs use a temperature-compensating ceramic with minimal capacitance variation, making them ideal for use as components in snubber circuits used in inverters that handle large voltages during switching and where compactness and heat tolerance are required.

- With growing stringent emission standards globally, automakers are gradually shifting their production from conventional engine vehicles to hybrid and electric vehicles. Inverters of various varieties, including traction inverters and soft-switching inverters, are used in electric vehicles for a variety of applications. Governments in various countries are spending heavily on electric mobility projects and encouraging customers to adopt electric vehicles, which will provide an opportunity for electric vehicle power inverter manufacturers. The rise in the demand for electric vehicles is also expected to increase the sales of the components used in electric vehicles, such as power inverters. Power generation from solar PV increased by a record 179 TWh in 2021, marking 22% growth in 2020. Solar PV accounted for 3.6% of global electricity generation, and it remains the third largest renewable electricity technology behind hydropower and wind. With the rising concerns over pollution worldwide due to industrialization, governments are introducing policies to drive solar PV deployment. For instance, in August 2022, the federal government of the United States introduced the Inflation Reduction Act, a law significantly expanding support for renewable energy in the next 10 years through tax credits and other measures.

Increasing utilization of smart lighting in various applications

- LED shipments increased from 1.3 million units in 2021 to 2.65 million units in 2022. MLCCs are used in LEDs to suppress electromagnetic interference (EMI) and provide DC supply smoothing and acoustic noise reduction. MLCCs used in LEDs typically need to meet specific electrical and environmental requirements, such as high capacitance values, low equivalent series resistance (ESR), high voltage ratings, and appropriate temperature stability.

- LED lighting can be used in various applications, including commercial and residential, automotive, decorative, and outdoor lighting. The rising population leading to rising residential and commercial construction is one of the major factors that has increased the demand for various basic amenities, especially power. The COVID-19 pandemic harmed the global economy. The demand for LED lighting was lowered due to construction site suspensions and lockdowns. However, the second half of 2021 witnessed a surge in construction due to the launch of new and upgraded projects, contributing to the industry's steady recovery for LED lighting.

- In 2021, electricity consumption by lighting in the residential and services sectors grew by around 5%, which drove the increase in emissions. Although several countries began to phase out incandescent bulbs more than 10 years ago, many are now beginning to phase out fluorescent lighting to make LEDs the leading lighting technology while saving significant CO2 emissions.

Power and Utilities MLCC Industry Overview

The Power and Utilities MLCC Market is moderately consolidated, with the top five companies occupying 59.90%. The major players in this market are Kyocera AVX Components Corporation (Kyocera Corporation), Murata Manufacturing Co., Ltd, Samsung Electro-Mechanics, Taiyo Yuden Co., Ltd and Yageo Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Power And Utilities Equipment Sales

- 4.1.1 Global Inverters Sales

- 4.1.2 Global LEDs Sales

- 4.1.3 Global Smart Meters Sales

- 4.1.4 Global Solar PV Inverters and Optimizers Sales

- 4.2 Regulatory Framework

- 4.3 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Case Size

- 5.1.1 1210

- 5.1.2 1812

- 5.1.3 2 220

- 5.1.4 3 640

- 5.1.5 4 540

- 5.1.6 Others

- 5.2 Voltage

- 5.2.1 600V to 1100V

- 5.2.2 Less than 600V

- 5.2.3 More than 1100V

- 5.3 Capacitance

- 5.3.1 10 μF to 100 μF

- 5.3.2 Less than 10 μF

- 5.3.3 More than 100 μF

- 5.4 Dielectric Type

- 5.4.1 Class 1

- 5.4.2 Class 2

- 5.5 Region

- 5.5.1 Asia-Pacific

- 5.5.2 Europe

- 5.5.3 North America

- 5.5.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Kyocera AVX Components Corporation (Kyocera Corporation)

- 6.4.2 Maruwa Co ltd

- 6.4.3 Murata Manufacturing Co., Ltd

- 6.4.4 Nippon Chemi-Con Corporation

- 6.4.5 Samsung Electro-Mechanics

- 6.4.6 Samwha Capacitor Group

- 6.4.7 Taiyo Yuden Co., Ltd

- 6.4.8 TDK Corporation

- 6.4.9 Vishay Intertechnology Inc.

- 6.4.10 Walsin Technology Corporation

- 6.4.11 Wurth Elektronik GmbH & Co. KG

- 6.4.12 Yageo Corporation

7 KEY STRATEGIC QUESTIONS FOR MLCC CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219