|

市场调查报告书

商品编码

1685673

氰化氢-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Hydrogen Cyanide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

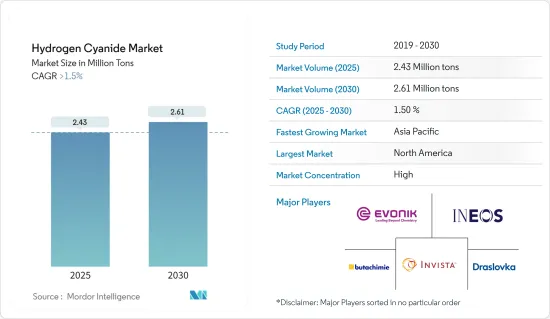

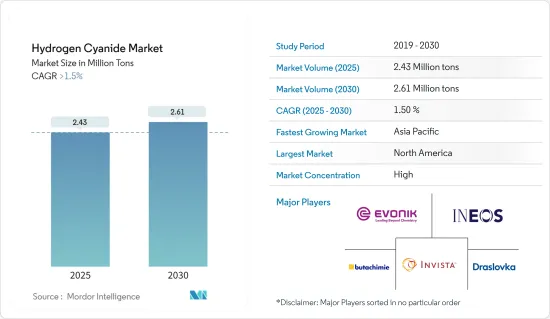

预计 2025 年氢氰酸市场规模为 243 万吨,2030 年将达到 261 万吨,预测期间(2025-2030 年)的复合年增长率将超过 1.5%。

产生的氢氰酸大部分用作生产己二腈的原料,而己二腈又用于製造尼龙 66,用于纤维和塑胶生产。己二腈(AND)用于生产六亚甲基二胺(HMDA),其中大部分(约92%)用于製造尼龙6,6纤维和树脂。

从中期来看,对氰化钠和氰化钾的高需求以及在己二腈生产中氰化氢的使用增加是推动市场成长的关键因素。

另一方面,氰化氢毒性极强,阻碍了市场成长。

在尚未开发的市场中使用氰化氢生产螯合剂可能会在未来带来机会。

预计北美将主导全球氰化氢市场,而亚太地区预计将成为预测期内成长最快的市场。

氰化氢市场趋势

氰化钠和氰化钾的应用将成为成长最快的领域

- 氰化氢是氰化钠和氰化钾的前驱物,常用于电镀和银、金等金属的开采。

- 在湿式製程中,它是透过用氢氧化钠中和氰化钠(NaCN)或氰化氢来生产的。以气体或液体形式添加氰化氢,并以水溶液形式添加 NaOH,形成 NaCN 水溶液。此外,在 NaCN 水溶液蒸发过程中可能会形成固体NaCN结晶。

- 氰化钾(KCN)是透过用氢氧化钾水溶液处理氰化氢,然后在真空下蒸发溶液而生成的。

- 氰化钠和氰化钾都是用于各种工业製程的重要化学品,包括黄金提取、电镀和化学製造。

- 氰化钠和氰化钾主要用于从低品位矿石中提取金和银。

- 氰化钾和氰化钠也广泛用于生产腈和羧酸。

- 根据美国地质调查局的数据,2022年全球黄金产量将达3,100吨。预计到 2022 年,中国金矿产量将达到 330 吨,位居全球首位;其次是澳大利亚,同年产量约 320 吨。

- 估计黄金蕴藏量最多的国家是澳洲、俄罗斯和南非。此外,加拿大采矿业是世界上最大的钾肥生产国,也是五大黄金生产国之一。加拿大最新的金矿,PureGold 位于安大略省的红湖矿计划,预计将于 2021 年 8 月开始商业运营,每年增加 87.8 层黄金。

- 继俄罗斯入侵乌克兰之后,化学工业在 2022 年经历了能源和原材料成本上涨、疫情、经济不确定性和政治动盪的一年,这些因素进一步加剧了本已因疫情而紧张的全球供应链的瓶颈。

- 根据BASF发布的2022年报告,预计2023年全球化学品产量(不包括医药)将与前一年同期比较增2.0%,与前一年同期比较2.2%。

- 在中国这个全球最大的化学品市场,预计2023年化学品产量成长将略有放缓。 2022年,中国化学品产量增加了5.9%。预计中国经济的开放将促进国内需求的成长,特别是在消费品和健康与营养领域,从而为该行业的积极成长做出贡献。

- 考虑到所有这些因素,预计整体市场在预测期内将呈现正成长。

北美占据市场主导地位

- 根据ITC贸易地图,美国将在2022年成为最大的氰化氢出口国,出口量约87吨。

- 目前,全国范围内尚无禁止氰化物产品的重大法规。然而,包括蒙大拿州、科罗拉多和威斯康辛州在内的一些州制定了一些法规,禁止在其境内使用某些氰化物。

- 该地区对氰化氢的需求主要源于以下应用:用于生产尼龙和聚酰胺的己二腈、用于油漆和被覆剂的丙烯酸塑料的丙酮氰醇、用于回收黄金的氰化钠和氰化钾,以及用于农药和其他农产品的氰尿酰氯。

- 该国是世界主要黄金和白银生产国之一。根据美国地质调查局的数据,2022 年该国成为世界第五大黄金生产国,总产量约 170 吨。

- 根据白银协会的数据,2022 年美国白银产量将位居世界第九,达到 4,110 万盎司(约 1,165.17 吨),比 2021 年的产量增加 6%。

- 除了上述用途外,该国所研究的市场需求也受到该国农业产业的推动,因为使用氰化氢生产的氰尿酰氯也用于製造杀虫剂和其他农产品。

- 塑胶产业对丙酮氰醇的需求进一步刺激了市场消费。

- 目前,大量塑胶废弃物造成环境污染日益严重,影响塑胶工业的发展。根据加拿大政府统计,该国每年使用约150亿个塑胶购物袋和5,700万根塑胶吸管。

- 含氢氰酸的化学物质,即氰化钠和氰化钾,在金矿和银矿开采过程中有着重要的应用。

- 据美国地质调查局称,该国是继中国、澳洲和俄罗斯之后的第四大黄金生产国,预计 2022 年黄金产量将达到约 220 吨。

- 它也是世界十五大白银生产国之一。根据白银协会的数据,政府白银产量约为 870 万盎司(246.64 吨),与 2021 年相比下降了约 5%。

- 农业对杀虫剂和其他化学物质的需求也导致该国氢氰酸消耗量居高不下。

- 农业是加拿大经济的主要贡献者。根据加拿大农业和食品部(AAFC)的数据,2022 年,加拿大是世界第五大农业出口国。

- 所有这些趋势都可能影响预测期内的市场需求。

氰化氢产业概况

全球氰化氢市场已部分整合。主要企业包括(排名不分先后)INVISTA、Evonik Industries、INEOS、Butachimie Chalampe、Drasslok 和 Asahi Kasei。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 氰化钠和氰化钾生产需求旺盛

- 己二腈生产中氢氰酸的使用增加

- 限制因素

- 氢氰酸毒性大

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 结构类型

- 液态氰化氢

- 氰化氢气体

- 应用

- 氰化钠和氰化钾

- 己二腈

- 丙酮氰醇

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 马来西亚

- 泰国

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 俄罗斯

- 土耳其

- 北欧国家

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率分析(%)**/排名分析

- 主要企业策略

- 公司简介

- Air Liquide

- Asahi Kasei Corporation

- Ascend Performance Materials

- Butachimie

- Draslovka

- Evonik Industries AG

- Hindusthan Chemicals Company

- INEOS

- INVISTA

- Kuraray Co. Ltd

- Matheson Tri-Gas Inc.

- Sumitomo Chemical Co. Ltd

- Taekwang Industrial Co. Ltd

第七章 市场机会与未来趋势

The Hydrogen Cyanide Market size is estimated at 2.43 million tons in 2025, and is expected to reach 2.61 million tons by 2030, at a CAGR of greater than 1.5% during the forecast period (2025-2030).

The majority of the hydrogen cyanide manufactured is used as a raw material for adiponitrile production, which is used in producing nylon 66 for fiber and plastic production. Adiponitrile (AND) is used to make hexamethylene diamine (HMDA), the majority of which (approximately 92%) is used to make nylon 6,6 fibers and resins.

Over the medium term, the major factors driving market growth were the high demand for sodium and potassium cyanide and the increasing use of hydrogen cyanide in producing adiponitrile.

On the flip side, the highly toxic nature of hydrogen cyanide hampers the market's growth studied.

Its use in the production of chelating agents in untapped markets is likely to present opportunities in the future.

North America is expected to dominate the global hydrogen cyanide market, while the Asia-Pacific region is expected to be the fastest-growing market during the forecast period.

Hydrogen Cyanide Market Trends

Sodium and Potassium Cyanide Application to be the Fastest Growing Segment

- Hydrogen cyanide, as a precursor of sodium cyanide and potassium cyanide, is commonly used for electroplating and mining of metals such as silver and gold.

- The wet process produces sodium cyanide (NaCN) or the neutralization of hydrogen cyanide with sodium hydroxide. The HCN is added both in the form of a gas or liquid, and NaOH is added as an aqueous solution to form an aqueous NaCN solution. Furthermore, solid NaCN crystals can be formed during evaporation of the aqueous NaCN solution.

- Potassium cyanide (KCN) is formed by the treatment of hydrogen cyanide with an aqueous potassium hydroxide solution, followed by the vacuum evaporation of the solution.

- Both sodium cyanide and potassium cyanide are important chemicals used in various industrial processes, including gold extraction, electroplating, and chemical manufacturing.

- Sodium cyanide and potassium cyanide are majorly used in the extraction of gold and silver from low-grade ores.

- Potassium cyanide and sodium cyanide are also widely used for the production of nitriles and carboxylic acids.

- According to the US Geological Survey, in 2022, global gold production reached 3,100 metric tons. China led global gold mine production, with an estimated 330 metric tons produced in 2022, followed by Australia, producing about 320 metric tons in the same year.

- The countries with the largest estimated gold reserves are Australia, Russia, and South Africa. Furthermore, Canada's mining industry is the world's biggest producer of potash and is in the top five producers of gold. The Pure Gold Red Lake Mine project in Ontario, Canada's newest gold mine, began commercial operations in August 2021 and was estimated to add 87.8 koz of gold yearly.

- Following Russia's invasion of Ukraine, the chemical industry experienced a year marked by further bottlenecks in global supply chains already strained by rising energy and raw material costs, a pandemic, economic uncertainty, and political turmoil in 2022.

- According to a report published by BASF 2022, global chemical production (excluding pharmaceuticals) is expected to increase by 2.0% in 2023, with a Y-o-Y increase of 2.2% from 2022.

- In China, the world's largest chemicals market, a slight slowdown in chemical production growth is expected in 2023. The country's chemical production grew by 5.9% in 2022. The opening up of the Chinese economy is expected to boost domestic demand growth in China, especially in the consumer goods and health and nutrition sectors, and contribute to positive growth in the industry.

- With the consideration of all these factors, the overall market is expected to witness positive growth during the forecast period.

North America to Dominate the Market

- According to the ITC trade map, the United States was the largest exporter of hydrogen cyanide in the year 2022, exporting about 87 tons of hydrogen cyanide in 2022.

- Currently, there are no major country-wide regulations regarding the cyanide product ban. However, states such as Montana, Colorado, and Wisconsin have some restrictions preventing specific cyanide usage in the country.

- The demand for hydrogen cyanide in the region is driven by applications such as the production of adiponitrile, which is used for nylon and polyamides production; the production of acetone cyanohydrin for acrylic plastics, which is further used in paints and coatings; for production of sodium cyanide and potassium cyanide for gold recovery, and cyanuric chloride for pesticides and other agriculture products.

- The country is among the world's major producers of gold and silver. According to the US Geological Survey, in 2022, the country was the 5th largest producer of gold globally, with a total production of about 170 metric tons.

- According to the Silver Institute, the United States was the world's ninth-largest producer of silver in 2022, producing 41.1 million ounces (~1,165.17 metric tons) of silver, which is 6% more than the production in 2021.

- Along with the abovementioned applications, the demand for the market studied in the country is also driven by the agricultural industry in the country, as cyanuric chloride produced using hydrogen cyanide is also used for the production of pesticides and other agricultural products.

- Plastic industries' demand for acetone cyanohydrin further adds to the market's consumption.

- The plastic industry's growth is currently affected by increasing environmental pollution due to the huge amount of plastic waste. According to the Canadian government, about 15 billion plastic bags and about 57 million plastic straws are used annually in the country.

- Hydrogen cyanide-based chemicals, i.e., sodium cyanide and potassium cyanide, find significant applications in the mining process of gold and silver.

- According to USGS, the country is 4th largest producer of gold after China, Australia, and Russia, with gold production of about 220 tons in the year 2022.

- The country is also among the top 15 major silver-producing nations in the world. According to the Silver Institute, the government has produced about 8.7 million ounces of silver (246.64 metric tons ), a decline of about 5% compared to 2021.

- The agriculture industry's demand for pesticides and other products also contributes to the country's significant consumption of hydrogen cyanide.

- The agriculture industry is a significant contributor to the Canadian economy. Agriculture and Agri-Food Canada (AAFC) said that in 2022, Canada was the world's fifth largest agricultural exporter.

- All such trends are likely to impact the market demand over the forecast period.

Hydrogen Cyanide Industry Overview

The global hydrogen cyanide market is partially consolidated. The major companies include (not in a particular order) INVISTA, Evonik Industries, INEOS, Butachimie Chalampe, Drasslok, and Asahi Kasei Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Favorable Demand for Manufacturing of Sodium Cyanide and Potassium Cyanide

- 4.1.2 Increasing Usage of Hydrogen Cyanide for the Production of Adiponitrile

- 4.2 Restraints

- 4.2.1 Highly Toxic Nature of Hydrogen Cyanide

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Structure Type

- 5.1.1 Hydrogen Cyanide Liquid

- 5.1.2 Hydrogen Cyanide Gas

- 5.2 Application

- 5.2.1 Sodium Cyanide and Potassium Cyanide

- 5.2.2 Adiponitrile

- 5.2.3 Acetone Cyanohydrin

- 5.2.4 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Indonesia

- 5.3.1.6 Malaysia

- 5.3.1.7 Thailand

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Turkey

- 5.3.3.8 NORDIC Countries

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis (%)** /Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Air Liquide

- 6.4.2 Asahi Kasei Corporation

- 6.4.3 Ascend Performance Materials

- 6.4.4 Butachimie

- 6.4.5 Draslovka

- 6.4.6 Evonik Industries AG

- 6.4.7 Hindusthan Chemicals Company

- 6.4.8 INEOS

- 6.4.9 INVISTA

- 6.4.10 Kuraray Co. Ltd

- 6.4.11 Matheson Tri-Gas Inc.

- 6.4.12 Sumitomo Chemical Co. Ltd

- 6.4.13 Taekwang Industrial Co. Ltd