|

市场调查报告书

商品编码

1685674

美国发泡聚苯乙烯 (EPS):市场占有率分析、行业趋势和成长预测(2025-2030 年)US Expandable Polystyrene (EPS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

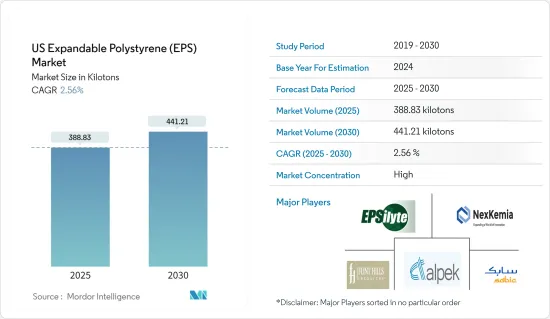

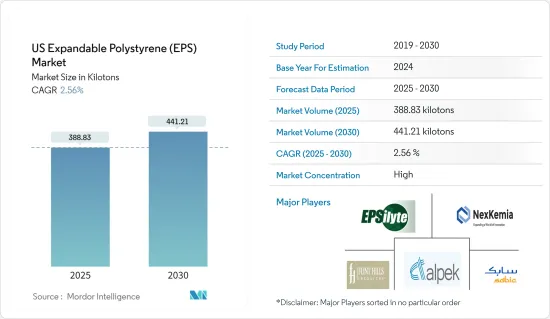

美国发泡聚苯乙烯市场规模预计在 2025 年为 388.83 千吨,预计在 2030 年达到 441.21 千吨,预测期内(2025-2030 年)的复合年增长率为 2.56%。

由于新冠疫情 (COVID-19),美国发泡聚苯乙烯 (EPS) 市场遭遇挫折。全球封锁和严格的政府监管导致大面积製造工厂关闭。不过,预计市场将在 2021 年復苏,并在未来几年内大幅成长。

主要亮点

- 短期内,国内建设活动的增加和包装产业需求的成长是推动研究市场需求的关键因素。

- 然而,环保替代品的出现预计会阻碍市场的成长。

- 然而,发泡聚苯乙烯 (EPS) 产业的回收利用有望为市场带来新的机会。

- 预计建筑业在预测期内将实现快速成长,成为研究市场中最大的终端用户产业。

美国发泡聚苯乙烯 (EPS) 市场趋势

灰色和银色 EPS 市场占据主导地位

- 灰色和银色的 EPS 在发泡体製造中极为重要,尤其是在隔热材料。其独特的颜色来自于聚合物基质中嵌入的微量碳或石墨。

- 热增强型灰色和银色 EPS 在绝缘应用方面表现出色,并且比传统 EPS 材料更耐用、更耐劣化。

- 这些材料对于生产发泡板和麵板等隔热材料至关重要。

- 灰色 EPS 是一种创新改进,它结合了石墨来改善屈光和反射性能并提供更好的绝缘性。石墨巧妙地增强了红外线光的屈光,使热量更难直接散发。灰色 EPS 具有独特的灰色至黑色、坚固的机械性能、高耐水性和增强的耐火性,可与传统 EPS 在同一设备上进行加工。

- 灰色 EPS 的独特性能可将热导率降低 20%,从而使板厚减少 20%,而不会影响性能。其应用范围广泛,包括外墙隔热、屋顶系统、地基、地板隔热、隔热隔音、绝缘模板製造和轻质建筑砌块生产。

- EPS 的使用可改善新旧建筑的隔热效果,有助于降低能源成本。灰色 EPS 的密度与白色 EPS 相当,但其绝缘性能却高出 20%。

- 这些改进的性能特点使得灰色 EPS 在美国特别有吸引力,因为在美国,住宅重建正在兴起,降低维护成本是首要任务。

- 在建筑领域,灰色和银色的 EPS 用于建筑隔热材料、屋顶和地板材料。

- 除了建筑之外,它对于包装也是必不可少的,例如保护性包装和缓衝材料。

- 根据国际纸业的资料,预计 2023 年美国瓦楞包装出口量将达到 3,910 亿平方英尺,2024 年将增至 4,060 亿平方英尺。

- 灵活的包装显着减少了饮料和产品的浪费,并允许线上品牌重新设计其包装以获得卓越的电子商务体验。

- 根据美国商务部预测,电子商务销售额将从2022年的1.4兆美元飙升至2023年的约1.119兆美元,年增率为7.6%。

- 预计2024年电子商务销售额将达到1.25兆美元,成长率约10.5%。这对美国EPS 市场来说是个好征兆。

- 鑑于这些动态,预测期内对灰色和银色 EPS 的需求可能会受到影响。

建筑业占据市场主导地位

- 发泡聚苯乙烯 (EPS) 在建设产业中至关重要,它使建筑更节能、永续性且经济实惠。

- 美国是世界上最大的经济体,拥有从重工业到小规模工业的多元化工业格局,并以其活跃的商业活动而闻名。

- 美国也是建筑和建设产业一个巨大的市场。根据美国人口普查局的资料,2023年美国建筑价值将达到19,787亿美元,比2022年的18,487亿美元高出7%。然而,2023年住宅建筑价值估计仅8,649亿美元。

- 预计 2023 年将允许建造 1,469,800 套住宅,比 2022 年的 1,665,100 套下降 11.7%。此外,根据美国人口普查局的资料,2023 年开工住宅数量估计为 1,413,100 套,比 2022 年的 1,552,600 套下降 9.0%(+2.5%)。

- 预计2024年8月建筑支出经季节性已调整的的年率为21,319亿美元,较7月的21,339亿美元略有下降0.1%(+1.2%)。不过,8 月的数字比 2023 年 8 月的 2.0474 兆美元增加了 4.1%(+1.6%)。根据美国人口普查局的资料,2024年1-8月建筑支出为1.4285兆美元,较2023年同期的1.327兆美元成长7.6%(+1.2%)。

- 鑑于建筑业的这些趋势,预测期内美国对 EPS 的需求可能会增加。

美国发泡聚苯乙烯 (EPS) 产业概况

美国发泡聚苯乙烯 (EPS) 市场本质上是高度整合的。主要公司(不分先后顺序)包括 Epsilyte LLC、NexKemia Petrochemicals Inc.、Flint Hills Resources、Alpek SAB de CV (Styropek) 和 SABIC。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 该国建设活动增加

- 包装产业需求不断成长

- 其他驱动因素

- 限制因素

- 绿色替代品的可用性

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 类型

- 白色的

- 灰色和银色

- 最终用户

- 建筑与施工

- 包装

- 其他最终用户

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Alpek SAB de CV(Styropek)

- Dart Container Corporation

- Epsilyte LLC

- Flint Hills Resources

- Foam Holdings, Inc.

- Harbor Foam

- NexKemia Petrochemicals Inc.

- NOVA Chemicals Corporate

- Ravago

- SABIC

- Styrotech, Inc.

- TotalEnergies

第七章 市场机会与未来趋势

- 发泡聚苯乙烯 (EPS) 产业的回收利用

- 其他机会

The US Expandable Polystyrene Market size is estimated at 388.83 kilotons in 2025, and is expected to reach 441.21 kilotons by 2030, at a CAGR of 2.56% during the forecast period (2025-2030).

The United States Expandable Polystyrene (EPS) market faced setbacks due to COVID-19. Global lockdowns and stringent government regulations led to widespread shutdowns of production hubs. However, the market rebounded in 2021 and is projected to grow significantly in the upcoming years.

Key Highlights

- Over the short term, increasing construction activities in the country and increasing demand from the packaging industry are the major factors driving the demand for the market studied.

- However, the availability of green alternatives is expected to hinder the market's growth.

- Nevertheless, recycling in the expandable polystyrene (EPS) industry is expected to create new opportunities for the market studied.

- The building and construction segment is expected to account for the largest end-user industry in the market studied while registering rapid growth over the forecast period.

United States Expandable Polystyrene (EPS) Market Trends

Grey and Silver EPS Segment to Dominate the Market

- Grey and Silver EPS are pivotal in foam production, especially for insulation materials. Their unique coloration stems from a trace amount of carbon or graphite embedded in the polymer matrix.

- With enhanced thermal performance, Grey and Silver EPS excel in insulation applications and outlast traditional EPS materials in durability and resistance to degradation.

- These materials are integral to producing insulation solutions like foam boards and panels.

- Grey EPS, an innovative variant, incorporates graphite to boost its refractive and reflective properties, enhancing thermal insulation. The graphite subtly amplifies IR light refraction, making heat escape less direct. With its distinctive gray-to-black hue, robust mechanical properties, high water resistance, and enhanced fire resistance, grey EPS can be processed using the same equipment as conventional EPS.

- Owing to its unique attributes, grey EPS achieves a 20% reduction in thermal conductivity, allowing a 20% decrease in board thickness without compromising performance. Its applications span insulating external walls, roof systems, foundations, and floors, as well as thermo-acoustic insulation, manufacturing insulated formwork, and creating lightweight building blocks.

- EPS usage boosts insulation in both old and new buildings, aiding in power cost reductions. While it matches the density of white EPS, its isolation capability is 20% superior.

- This enhanced performance has made grey EPS especially appealing in the United States, where there's a growing trend towards housing renovations and a focus on lower maintenance costs.

- In construction, grey and silver EPS find applications in building insulation, roofing, and flooring.

- Beyond construction, they're vital in packaging, serving roles in protective packaging and cushioning materials.

- According to data from International Paper, the United States exported 391 billion square feet of corrugated packaging in 2023, with projections indicating an increase to 406 billion square feet in 2024.

- Flexible packaging significantly curtails waste in beverages and products, enabling online brands to refresh their packaging for a superior e-commerce experience.

- The US Department of Commerce notes that e-commerce sales jumped from USD 1.040 trillion in 2022 to approximately USD 1.119 trillion in 2023, marking a 7.6% annual growth.

- Looking ahead, this upward trajectory is set to persist into 2024, with e-commerce sales projected to hit USD 1.25 trillion, reflecting an estimated growth rate of 10.5%. This bodes well for the EPS market in the United States.

- Given these dynamics, the demand for grey and silver EPS is poised to be influenced during the forecast period.

Building and Construction Segment to Dominate the Market

- In the building and construction industry, expandable polystyrene (EPS) is pivotal, enhancing energy efficiency, sustainability, and affordability in structures.

- The United States, recognized as the world's largest economy, boasts a diverse industrial landscape, from heavy to small-scale industries, and is renowned for its vibrant commercial activities.

- The United States is also a huge market for the building and construction industry. As per the data from the US Census Bureau, the value of construction in the United States in 2023 was USD 1,978.7 billion, 7% higher than the USD 1,848.7 billion spent in 2022. However, the residential construction in 2023 was only USD 864.9 billion.

- In 2023, an estimated 1,469,800 housing units were authorized by building permits, 11.7 percent below the 2022 figure of 1,665,100. Moreover, an estimated 1,413,100 housing units were started in 2023, 9.0 percent (+-2.5 percent) below the 2022 figure of 1,552,600, as per the data from the US Census Bureau.

- In August 2024, construction spending was projected at a seasonally adjusted annual rate of USD 2,131.9 billion, slightly down by 0.1% (+-1.2%) from July's USD 2,133.9 billion. This August figure, however, shows a 4.1% (+-1.6%) increase from August 2023's USD 2,047.4 billion. For the first eight months of 2024, construction spending totaled USD 1,428.5 billion, marking a 7.6% (+-1.2%) rise from the USD 1,327.0 billion during the same timeframe in 2023, as per the data from the US Census Bureau.

- Given these trends in the construction sector, the demand for EPS in the United States is poised to rise during the forecast period.

United States Expandable Polystyrene (EPS) Industry Overview

The United States expandable polystyrene (EPS) market is highly consolidated in nature. The major players (not in any particular order) include Epsilyte LLC, NexKemia Petrochemicals Inc., Flint Hills Resources, Alpek S.A.B. de C.V. (Styropek), and SABIC, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Construction Activities in the Country

- 4.1.2 Increasing Demand from Packaging Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Green Alternatives

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 White

- 5.1.2 Grey and Silver

- 5.2 End User

- 5.2.1 Building and Construction

- 5.2.2 Packaging

- 5.2.3 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Alpek S.A.B. de C.V. (Styropek)

- 6.4.2 Dart Container Corporation

- 6.4.3 Epsilyte LLC

- 6.4.4 Flint Hills Resources

- 6.4.5 Foam Holdings, Inc.

- 6.4.6 Harbor Foam

- 6.4.7 NexKemia Petrochemicals Inc.

- 6.4.8 NOVA Chemicals Corporate

- 6.4.9 Ravago

- 6.4.10 SABIC

- 6.4.11 Styrotech, Inc.

- 6.4.12 TotalEnergies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Recycling in the Expandable Polystyrene (EPS) Industry

- 7.2 Other Opportunities