|

市场调查报告书

商品编码

1685677

英国可再生能源:市场占有率分析、产业趋势与统计、成长预测(2025-2030)United Kingdom Renewable Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

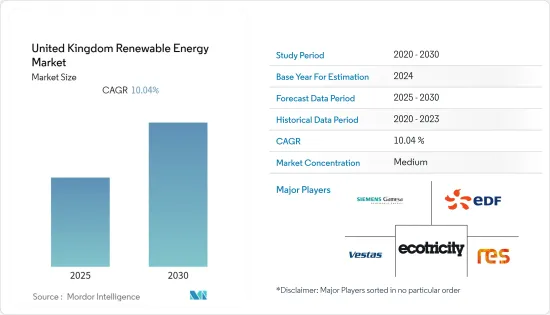

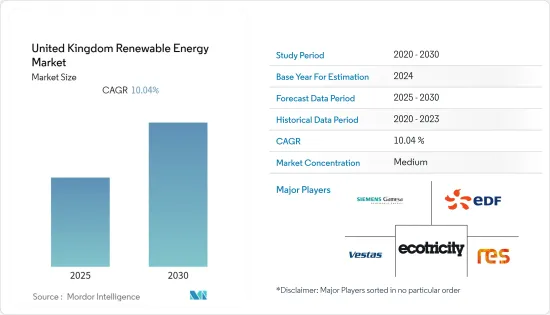

预测期内英国可再生能源市场预计复合年增长率为 10.04%

主要亮点

- 从中期来看,政府的支持性政策和利用再生能源来源满足日益增长的电力需求、减少对石化燃料的依赖以减少二氧化碳排放等措施将对市场成长做出重大贡献。

- 然而,预计在预测期内,政府对各种清洁能源技术增加增值税以及取消小规模太阳能发电补贴等政策的变化将阻碍市场成长。

- 然而,随着2030年雄心勃勃的可再生能源目标的製定,可再生能源公司在不久的将来将面临巨大的市场机会。

英国可再生能源产业的趋势

风力发电可望主导市场

- 对可靠、廉价、清洁和多样化电力供应的日益增长的需求促使全国各地的政府和公用事业公司考虑使用风力发电。此外,该国拥有无与伦比的风能资源,有充足的机会最大限度地发挥风力发电开发的经济和环境效益。

- 2022年,英国风电装置容量将达到5,242万千瓦,高于2021年的4,889万千瓦。英国也是世界领先的离岸风力发电国家之一,预计2022年装置容量将超过1,345万千瓦。目前,英国已有多个雄心勃勃的计划正在开发中,政府的目标是到2030年终达到20吉瓦。

- 2022 年 1 月,壳牌公司与苏格兰电力有限公司的合资企业赢得了该风电场的开发竞标。该合资企业赢得了在英国开发 5GW浮动式风力发电的竞标。两家公司计划在英国建造和营运全球首批两座大型浮体式海上风电场,发电容量分别为3GW和2GW。预计此类计划将在未来几年促进市场成长。

- 该国的目标是到 2030 年将离岸风力发电扩大到 50GW 。风力发电机在 2023 年第一季提供了英国总电力的 32.4%,比 2022 年第一季高出 3%。

- 因此,风力发电的高成长率使英国成为可再生能源市场的领导者之一,并正在推动迈向更绿色的未来。

政府政策不确定性抑制市场需求

- 英国对上网电价进行监管,即当某个物业或组织使用风能和太阳能等再生能源来源发电时,能源供应商需要支付费用。

- 英国政府决定将屋顶太阳能板的补贴削减 65%,使该国成为上网电价下采用家用太阳能发电最慢的国家。此外,2019 年 3 月,政府关闭了该计划,对英国太阳能光电市场的成长产生了负面影响。

- 自2022年起,受严重影响的太阳能光电新增装置容量总合将维持在约613兆瓦,而2022年太阳能光电累积设置容量约为14,412兆瓦。太阳能上网电价计画鼓励一些家庭在屋顶安装太阳能发电系统。政府还推出了其他几项计划,例如智慧出口保证(SEG),以抵消取消上网电价对市场造成的负面影响,但预计市场成长将比以前更慢。

- 在SEG系统下,很少有公司(例如特斯拉和社会能源)提供高于5披索/千瓦时的费率方案,但EDF和AEON等大型老牌能源供应商很少提供低于3.5披索/千瓦时的费率方案。这些公司也有可能在未来几年降低费率。因此,与 FiT 计划相比,预测期内 SEG 提供的电价透明度预计会较低。

- 英国政府的政策和法规将成为决定可再生能源市场未来的关键因素。无论如何,上述因素都可能抑制市场成长。

英国可再生能源产业概况

英国可再生能源产业相当分散。市场的主要企业(不分先后顺序)包括 Vestas Wind Systems AS、Siemens Gamesa Renewable Energy SA、Electricite de France SA、Renewable Energy Systems Ltd 和 Ecotricity Group Ltd。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 可再生能源装置容量及2028年预测

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 政府支持政策

- 加强减少对石化燃料的依赖,以减少二氧化碳排放

- 限制因素

- 政府政策变化,涉及增加各种清洁能源技术的增值税

- 驱动程式

- 供应链分析

- PESTLE分析

第五章市场区隔

- 来源

- 风

- 太阳的

- 水力发电

- 生质能源

- 其他能源(地热、潮汐)

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Ecotricity Group Ltd.

- Octopus Energy Ltd.

- Tonik Energy Ltd.

- E.ON UK PLC

- Electricite de France SA

- Good Energy Group PLC

- Renewable Energy Systems Ltd.

- Vestas Wind Systems AS

- Mitsubishi Corp.

- Siemens Gamesa Renewable Energy SA

第七章 市场机会与未来趋势

- 雄心勃勃的2030年海上风力发电目标

简介目录

Product Code: 46208

The United Kingdom Renewable Energy Market is expected to register a CAGR of 10.04% during the forecast period.

Key Highlights

- Over the medium term, factors such as supportive government policies and efforts to meet the rising power demand using renewable energy sources and decrease the dependency on fossil fuels to reduce carbon emissions are significant contributors to the market growth.

- On the other hand, changes in government policies related to increasing VAT on various clean energy technologies and the withdrawal of subsidies on small-scale solar are expected to hinder market growth during the forecast period.

- Nevertheless, with ambitious renewable energy targets in place by 2030, huge market opportunities exist for renewable energy market companies in the near future.

UK Renewable Energy Sector Trends

Wind Energy is Expected to Dominate the Market

- With the increasing need for a reliable, affordable, clean, and diverse electricity supply, the government and utilities nationwide are increasingly considering wind power. Moreover, with the country's unparalleled wind resources, ample opportunities exist to maximize wind energy development's economic and environmental benefits.

- The country's installed wind energy reached 52.42 GW in 2022, representing an increase from 48.89 GW in 2021. The United Kingdom is also one of the leading countries worldwide in offshore wind energy, with an installed capacity of more than 13.45 GW in 2022. With several ambitious projects already in development, the government aims to reach 20 GW by the end of 2030.

- In January 2022, Shell plc and Scottish Power Ltd. Joint ventures won bids to develop 5 GW of floating wind power in the United Kingdom. Both companies plan to build and operate two of the world's first large-scale floating offshore wind farms in the United Kingdom with a power generation capacity of 3 GW and 2 GW. Such projects are expected to aid market growth in the coming years.

- The country aims to expand the offshore wind sector to around 50 GW capacity by 2030. Wind turbines provided 32.4% of Britain's total electricity in the first quarter of 2023, which 3% is higher than the first quarter of 2022.

- Therefore, the high growth rate of wind energy makes the United Kingdom one of the renewable market leaders and drives toward a green future.

Uncertainties in Government Policies are Restraining the Market Demand

- The United Kingdom regulated the feed-in tariff, through which energy suppliers give payments if a property or organization generates its electricity using a renewable source like wind or solar.

- The United Kingdom government decided to reduce the subsidies for rooftop solar panels installed by 65%, leading to the slowest deployment of domestic solar seen under the FiT scheme in the country. Further, in March 2019, the government closed this scheme, which negatively affected the growth of the solar market in the United Kingdom.

- The total new installed solar energy capacity was only around 613 MW, which had been severely affected since 2022, and the cumulative installed solar power was around 14,412 MW in 2022. The solar feed-in tariffs had encouraged several homes to install solar PV systems on their rooftop. Although the government rolled out several other schemes to counter the adverse effects of removing the tariff on the market, such as the Smart Export Guarantee (SEG), the market is expected to attain a lower growth rate than before.

- Under the SEG scheme, although few companies, like Tesla and Social Energy, offer tariff rates above 5 p/kWh, major and well-established energy suppliers, such as EDF and EON, offer very few tariffs - below 3.5 p/kWh. There is also a chance that these companies can lower the tariff rates in the coming years. Therefore, the tariff prices offered under SEG are expected to remain uncertain during the forecast period compared to the FiT scheme.

- The United Kingdom government's policies and regulations are significant factors that will decide the future of the renewable energy market. The above factors can restrain the market growth in either way.

UK Renewable Energy Industry Overview

The United Kingdom's renewable energy sector is moderately fragmented. Some of the major players in the market (in no particular order) include Vestas Wind Systems AS, Siemens Gamesa Renewable Energy SA, Electricite de France SA, Renewable Energy Systems Ltd, and Ecotricity Group Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Installed Capacity and Forecast in GW, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Supportive Government Policies in the Country

- 4.5.1.2 Rising Efforts to Decrease the Dependency on Fossil Fuels to Reduce Carbon Emissions

- 4.5.2 Restraints

- 4.5.2.1 Changes in Government Policies Related to Increasing VAT on Various Clean Energy Technologies

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Source

- 5.1.1 Wind

- 5.1.2 Solar

- 5.1.3 Hydro

- 5.1.4 Bioenergy

- 5.1.5 Other Sources (Geothermal, Tidal)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Ecotricity Group Ltd.

- 6.3.2 Octopus Energy Ltd.

- 6.3.3 Tonik Energy Ltd.

- 6.3.4 E.ON UK PLC

- 6.3.5 Electricite de France SA

- 6.3.6 Good Energy Group PLC

- 6.3.7 Renewable Energy Systems Ltd.

- 6.3.8 Vestas Wind Systems AS

- 6.3.9 Mitsubishi Corp.

- 6.3.10 Siemens Gamesa Renewable Energy SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Ambitious Offshore Wind Energy Targets in Place by 2030

02-2729-4219

+886-2-2729-4219