|

市场调查报告书

商品编码

1685690

汽车燃料电池系统:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Automotive Fuel Cell System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

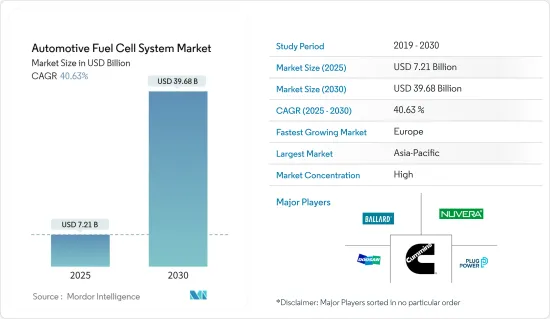

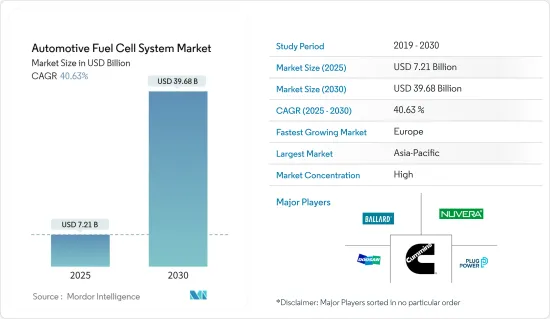

预计 2025 年汽车燃料电池系统市场规模为 72.1 亿美元,到 2030 年将达到 396.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 40.63%。

主要亮点

- 新冠疫情对市场的影响不如对其他汽车领域严重。儘管封锁期间需求有所下降,但预计市场将在 2021 年获得成长动力,并在整个预测期内保持高成长。

- 随着环保意识的增强,各国政府和环保机构制定了更严格的排放气体法规和立法,预计未来几年节能柴油引擎的製造成本将会增加。因此,预计短期内新型商用车柴油引擎领域将出现成长乏力的局面。

- 此外,传统的石化燃料动力来源的商用车辆,尤其是卡车和公共汽车,也增加了运输排放气体。燃料电池商用车被认为是低排放或零排放气体汽车,其出现有望减少重型商用车的排放气体。

- 此外,全球各国政府机构选择绿色能源出行来抑制交通污染的倡议是预计在不久的将来推动燃料电池系统市场发展的关键因素。

汽车燃料电池系统市场趋势

政府清洁能源措施推动氢燃料需求

- 预计在不久的将来推动燃料电池商用车市场发展的关键因素是世界各国政府主动选择绿色能源出行来限制和减少交通污染。全球多个政府已推出计划,鼓励燃料电池电动车(FCEV)在道路上行驶,这也将有助于汽车燃料电池产业的发展。

- 2022年2月,日本环境省宣布将支持地方政府和企业建立氢能商业联盟。该部正在与一些公司和地方政府合作,实施一个氢气供应链平台,生产低碳氢化合物并在当地利用。目标是到2030年左右在日本全国开展示范实验,并实现氢气供应链平台。

- 2022年2月,印度新和可再生能源部宣布了一项「可再生能源研究与开发」计划,以支持可再生能源各个方面的研究,包括基于氢能的运输和燃料电池开发。该部列出了一些关键进展。印度科学研究所(IISc)建立了一座透过生物质气化生产高纯度氢气的工厂。国际粉末冶金和新材料高级研究中心(ARCI)燃料电池技术中心将安装一条综合自动化生产线,用于製造20kW PEM燃料电池堆。

- 2022年1月,德国政府宣布支持氢动力卡车CryoTRUCK计划。测试专家 IABG 和慕尼黑工业大学将共同开发用于远距氢气卡车的带有加油系统的 CRYOGAS 氢气罐。 CryoTRUCK计划为期三年半,总预算超过 2500 万欧元,将开发和检验用于重型燃料电池卡车的低温压缩氢气 (CRYOGAS) 储存和加油系统的第一代技术。

- 这些倡议正在加速燃料电池运输的采用并推动市场向前发展。然而,燃料电池车在全球市场广泛应用的一个主要障碍是缺乏氢能基础设施。全球加氢站数量少的原因是投资高,氢气生产采用传统方法,导致排放量高,难以遵守严格的能源政策法规。

- 建立新的加氢基础设施成本非常高(但比建立甲醇或乙醇基础设施便宜)。由天然气生产的氢气可能比汽油便宜。氢气是透过水和电的水解产生的,除非使用低成本的非高峰电力或太阳能电池板,否则使用传统方法生产的氢气比汽油更昂贵。

欧洲:预计高成长

- 欧盟计画大幅减少运输部门的温室气体排放。因此,一些欧洲国家已将部署燃料电池(主要是 PEMFC)等创新技术作为实现这些目标的手段。预计这将为不久的将来参与该市场的燃料电池製造商创造巨大的机会。

- 欧洲占全球整体氢能投资提案的 30% 以上(约 760 亿美元),总合提案近 314 个计划,其中 268 个项目计划到 2030 年全面或部分试运行使用。

- 欧盟正在提案世界上最严格的排放标准,以减少传统燃料汽车的使用,并鼓励该地区使用替代燃料汽车。这些排放法规预计将推动市场和汽车製造商向零排放汽车迈进。

- 已经启动了多个计划来探索和开发解决车辆排放气体问题的解决方案。例如,正在进行的欧盟支持计划,如将部署 1,000 辆氢动力公车和基础设施的 H2BusEurope 项目,以及将在 22 个欧洲城市投入运营约 300 辆燃料电池电动公交车 (FCEB) 的 JIVE 和 JIVE 2计划,将获得欧盟 (EU) 地平线电动公车 (FCEB) 的 JIVE 和 JIVE 2项目,将获得欧盟 (EU) 地平电动公车 (FCEB) 的 JIVE 和 JIVE 2项目,将获得欧盟 (EU) 地平电动公车 2020 燃料和电池架构计画下的万欧元的津贴。计划联盟由来自七个国家的22个成员组成。

- 此外,在市场上营运的公司正在采用新产品开发、联合开发、合约、协议等策略来保持其市场地位。例如

- 2022 年 9 月,现代汽车公司和依维柯集团在汉诺威 IAA 交通运输展上推出了首款 IVECO eDAILYFuel 电池电动车。两家公司于 7 月初推出了配备现代燃料电池系统的氢动力 IVECO BUS 车辆。 eDAILY 燃料电池电动车 (FCEV) 代表着依维柯最畅销、运行时间最长的大型货车的光明未来。

- 此外,该地区氢技术的发展可能有助于扩大市场。

- 例如,2022年3月,康明斯宣布位于德国黑尔滕的全新氢燃料电池系统生产中心已成功运作。这一重要发展加强了该公司扩展替代能源解决方案的努力,并有望促进整个欧洲采用氢技术。该工厂的初始生产能力为每年 10 兆瓦,用于燃料电池系统的工程和组装。

- 在该地区营运的公司正在不断开发新材料和新燃料电池技术。我们也正在努力扩大我们的设施。随着一些公司宣布即将进行的投资,表明他们对燃料电池技术的承诺,预计这一趋势将持续下去。

汽车燃料电池系统产业概况

- 汽车燃料电池系统市场主要由 Ballard Power Systems Inc.、Doosan Fuel Cell、Hydrogenics 和 Nedstack Fuel Cell Technology BV 等公司主导。这些公司正在利用新技术和创新技术扩展业务,以获得竞争优势。

- 2023年2月,斗山燃料电池公司与南澳政府及斗山物产旗下子公司HyAxiom签署了合作声明。根据协议,南澳大利亚州和斗山燃料电池公司承诺「交换生产绿色氢气及其衍生物的设备和经验」、「制定策略和合作伙伴关係,以实现氢气出口的全球竞争力」以及「共用氢气生产的最佳实践」。

- 2022 年 7 月,依维柯集团透过其品牌 IVECO BUS 宣布与 HTWO 合作,为未来欧洲製造的氢动力公车配备世界上最先进的燃料电池系统。 HTWO 于 2020 年 12 月首次发布,是现代汽车集团基于燃料电池系统的氢能业务品牌,同时也体现了现代汽车对氢能经济的坚定承诺。 HTWO 凭藉其在现代 FCEV 中采用的成熟燃料电池技术,正在将其燃料电池技术产品扩展到其他汽车OEM和非汽车领域,从而实现氢气在所有领域的使用。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 政府措施支持市场成长

- 市场限制

- 缺乏基础设施对市场成长构成挑战

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 电解质类型

- 聚合物电子膜燃料电池

- 直接甲醇燃料电池

- 碱性燃料电池

- 磷酸燃料电池

- 车辆类型

- 搭乘用车

- 商用车

- 燃料类型

- 氢

- 甲醇

- 输出

- 小于100KW

- 100~200KW

- 200KW以上

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 北美洲

第六章竞争格局

- 供应商市场占有率

- 公司简介

- BorgWarner Inc.

- Nuvera Fuel Cells LLC

- Ballard Power Systems Inc.

- Hydrogenics(Cummins Inc.)

- Nedstack Fuel Cell Technology BV

- Oorja Corporation

- Plug Power Inc.

- SFC Energy AG

- Watt Fuel Cell Corporation

- Doosan Fuel Cell Co. Ltd

第七章 市场机会与未来趋势

- 提高可再生能源整合度

简介目录

Product Code: 46343

The Automotive Fuel Cell System Market size is estimated at USD 7.21 billion in 2025, and is expected to reach USD 39.68 billion by 2030, at a CAGR of 40.63% during the forecast period (2025-2030).

Key Highlights

- The COVID-19 pandemic did not impact the market as severely as it had affected other automotive segments. While the demand experienced a decline during the lockdown, it was expected that the market would gain momentum in 2021, with high growth continuing throughout the forecast period.

- With the growing environmental concerns, governments and environmental agencies are enacting stringent emission norms and laws, which are expected to increase the manufacturing cost of fuel-efficient diesel engines in the coming years. As a result, the new commercial vehicle diesel engines segment is expected to register a sluggish growth rate during the short term.

- Additionally, conventional fossil fuel-powered commercial vehicles, especially trucks, and buses, are responsible for increasing transportation emissions. The advent of fuel-cell commercial vehicles, which are considered low or zero-emission vehicles, is anticipated to reduce vehicular emissions emitted by heavy commercial vehicles.

- Moreover, initiatives by government bodies around the world to opt for green energy mobility in order to curtail and curb transportation pollution is a key factor that is projected to drive the fuel cell system market in the near future.

Automotive Fuel Cell System Market Trends

Government Initiatives for Clean Energy is Driving the Hydrogen Fuel Demand

- Government initiatives throughout the world to choose green energy mobility in order to restrict and reduce transportation pollution is a crucial driver that is expected to boost the fuel cell commercial vehicle market in the near future. Several governments are already laying out plans throughout the world to encourage fuel-cell electric vehicles (FCEVs) on the road will also help the automotive fuel-cell industry grow.

- In February 2022, Japan's Ministry of the Environment announced that it would support local governments and companies in the establishment of a hydrogen business consortium. The ministry has been jointly implementing a hydrogen supply chain platform that generates low-carbon hydrogen and utilizes it in the region with certain companies and local governments. It aims to realize the hydrogen supply chain platform after conducting demonstrations across Japan by around 2030.

- In February 2022, the Indian Ministry of New and Renewable Energy announced that it implemented the 'Renewable Energy Research and Technology Development' program to support research in various aspects of renewable energy, including inter-alia hydrogen-based transportation and fuel cell development. The ministry listed some of its major development. The Indian Institute of Science (IISc) established a production plant for high-purity hydrogen generation through biomass gasification. International Advanced Research Centre for Powder Metallurgy and New Materials (ARCI) Center for Fuel Cell Technologies is setting up an integrated automated manufacturing line for producing 20 kW PEM fuel cell stacks.

- In January 2022, the German government announced support for the CryoTRUCK project for hydrogen trucks. The testing specialist IABG and the Technical University of Munich are jointly developing a CRYOGAS hydrogen gas tank with a refueling system for hydrogen trucks in long-distance transport. The three-and-a-half-year CryoTRUCK project, with a total budget of more than EUR 25 million, will develop and validate a first-generation technology for cryogenic compressed hydrogen gas (CRYOGAS) storage and refueling systems in heavy-duty fuel cell trucks.

- Such initiatives are driving the market forward by increasing the adoption of fuel-cell transportation. However, the major obstacle to the introduction of a wide range of fuel cell vehicles in the global market is the lack of hydrogen infrastructure. Factors for fewer hydrogen refueling stations around the world are the involvement of high investment and conventional production methods of hydrogen, which is leading to high emission levels and making it difficult to be in line with the stringent Energy Policy Act.

- Establishing a new hydrogen refueling infrastructure is extremely costly (but not any costlier than establishing a methanol or ethanol infrastructure). Hydrogen that is produced from natural gas can be cheaper than gasoline. Hydrogen produced from water and electricity via hydrolysis is more expensive than gasoline using conventional methods unless low-cost off-peak electricity is used or solar panels are employed.

Europe Expected to Witness High Growth Rate

- The European Union plans to reduce greenhouse gas (GHG) emissions from the transportation sector significantly. As a result, several countries in Europe have identified the implementation of innovative technologies, such as fuel cells (primarily PEMFC), as a way to meet these objectives. This, in turn, is expected to provide a significant opportunity for the fuel cell manufacturers involved in the market in the near future.

- Europe is home to over 30% of proposed hydrogen investments globally (about USD 76 billion), with nearly 314 project proposals in total and 268 aiming for full or partial commissioning through 2030.

- The European Union (EU) has proposed some of the most stringent emission standards in the world in order to reduce the usage of conventional fuel vehicles and encourage the use of alternative fuel vehicles in the region. These emission standards are projected to push the market and vehicle manufacturers toward zero-emission vehicles.

- Several projects have been initiated to explore and develop acceptable solutions to the problem of automobile emissions. For instance, ongoing EC-supported initiatives include the H2BusEurope scheme that involves the deployment of 1,000 hydrogen buses and infrastructure and the JIVE and JIVE 2 projects that involve putting into operation nearly 300 fuel cell electric buses (FCEBs) in 22 cities across Europe and will be supported in part by a 32 million euro grant from the FCH JU (Fuel Cells and Hydrogen Joint Undertaking) within the European Union's Horizon 2020 framework program for research and innovation. The project consortium consists of 22 members from seven different countries.

- Furthermore, companies operating in the market are adopting strategies such as new product developments, collaborations, contracts, and agreements to sustain their market position. For instance,

- In September 2022, Hyundai Motor Company and Iveco Group at IAA Transportation 2022 in Hannover unveiled the first IVECO eDAILYFuel Cell Electric Vehicle. The two companies announced hydrogen-powered IVECO BUS vehicles with Hyundai's fuel cell system earlier in July. The eDAILYFuel Cell Electric Vehicle (FCEV) exemplifies IVECO's best-selling and longest-running large van's future potential.

- In addition, the development of hydrogen technology in the region will help in the expansion of the market.

- For instance, in March 2022, Cummins Inc. announced the successful operation of its new Hydrogen fuel cell systems production center in Herten, Germany. This significant development is expected to bolster the company's efforts in scaling up alternative power solutions and promote the widespread adoption of hydrogen technologies throughout Europe. The facility boasts an initial production capacity of 10MW per year for fuel cell system engineering and assembly.

- The companies active in the region are constantly working on new materials and new fuel cell technologies. They are also spending on the expansion of their facilities. These trends are expected to continue in the coming years, as some companies have indicated their focus on fuel cell technology by announcing their upcoming investments.

Automotive Fuel Cell System Industry Overview

- The automotive fuel cell system market is dominated by players such as Ballard Power Systems Inc., Doosan Fuel Cell Co. Ltd, Hydrogenics, and Nedstack Fuel Cell Technology BV. These companies have been expanding their businesses using new and innovative technologies to have an advantage over their competitors.

- In February 2023, Doosan Fuel Cell signed a statement of cooperation with the South Australian government and HyAxiom, a subsidiary of Doosan Corporation. In accordance with the agreement, South Australia and Doosan Fuel Cell committed to "exchange equipment and experience for the production of eco-friendly hydrogen and derivatives, to "create strategies and alliances to achieve worldwide competitiveness in hydrogen exports," and to "share best practices for hydrogen production.

- In July 2022, Iveco Group, through its brand IVECO BUS, announced that it would partner with HTWO to equip its future European hydrogen-powered buses with world-leading fuel cell systems. HTWO, as a fuel cell system-based hydrogen business brand of Hyundai Motor Group, was first released in December 2020 with Hyundai's strong commitment to a hydrogen economy. With its proven fuel cell technology utilized in Hyundai FCEVs, HTWO is expanding the provision of fuel cell technology to other automobile OEMs and non-automobile sectors to make hydrogen available for everything.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Government Initiatives to Support The Market Growth

- 4.2 Market Restraints

- 4.2.1 Lack of Infrastructure poses a Challenge For The Growth of The Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Electrolyte Type

- 5.1.1 Polymer Electronic Membrane Fuel Cell

- 5.1.2 Direct Methanol Fuel Cell

- 5.1.3 Alkaline Fuel Cell

- 5.1.4 Phosphoric Acid Fuel Cell

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Fuel Type

- 5.3.1 Hydrogen

- 5.3.2 Methanol

- 5.4 Power Output

- 5.4.1 Below 100 KW

- 5.4.2 100-200 KW

- 5.4.3 Above 200 KW

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Russia

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 India

- 5.5.3.2 China

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 BorgWarner Inc.

- 6.2.2 Nuvera Fuel Cells LLC

- 6.2.3 Ballard Power Systems Inc.

- 6.2.4 Hydrogenics (Cummins Inc.)

- 6.2.5 Nedstack Fuel Cell Technology BV

- 6.2.6 Oorja Corporation

- 6.2.7 Plug Power Inc.

- 6.2.8 SFC Energy AG

- 6.2.9 Watt Fuel Cell Corporation

- 6.2.10 Doosan Fuel Cell Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Renewable Energy Integration

02-2729-4219

+886-2-2729-4219