|

市场调查报告书

商品编码

1693664

亚太燃料电池汽车:市场占有率分析、行业趋势和成长预测(2025-2030 年)Asia-Pacific Fuel Cell Vehicles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

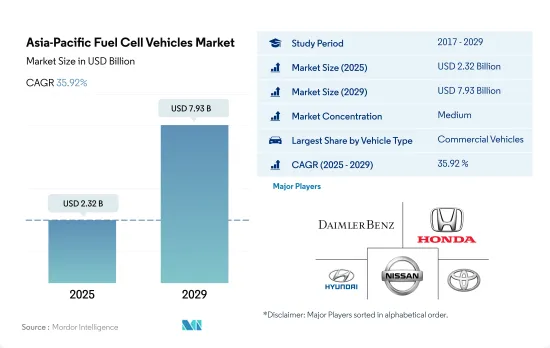

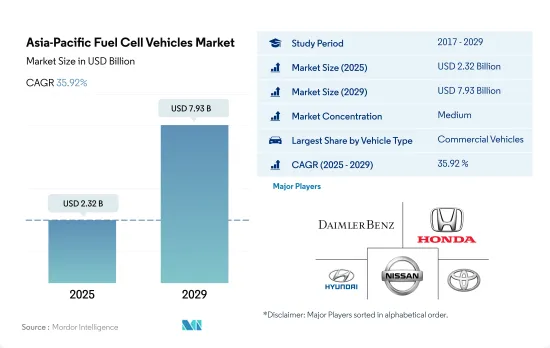

亚太地区燃料电池汽车市场规模预计在 2025 年为 23.2 亿美元,预计到 2029 年将达到 79.3 亿美元,预测期内(2025-2029 年)的复合年增长率为 35.92%。

展示该地区将燃料电池技术引入各类车辆的领先方法,并强调氢能作为交通运输清洁能源来源的巨大潜力

- 亚太地区永续交通运输正蓬勃发展,各领域的强劲成长就是明证。从乘用车到轻型商用车、货车、中型和重型卡车以及公共汽车,该地区正在稳步拥抱绿色交通。尤其值得注意的是乘用车领域燃料电池电动车(FCEV)销量的成长,凸显了该地区在采用清洁交通方面的领导地位。预计 2017 年至 2023 年间销售额将大幅成长,这一趋势预计将持续到 2030 年。

- 在商用车领域,对氢燃料电池技术的战略重点有望推动轻型和重型商用车领域的显着成长。轻型商用车皮卡和货车的销量正在显着增长,这表明物流和运输行业正在向零排放汽车转变。这项转变是由氢能基础设施投资和政府旨在抑制二氧化碳排放的奖励所推动的。

- 除了燃料电池公车外,中型和重型商用卡车也呈现快速成长态势,预计到 2030 年销售量将大幅成长。亚太地区对燃料电池电动车的乐观情绪凸显了向氢能经济迈出的重大一步,为全球采用清洁能源树立了先例。政府措施、技术进步和绿氢生产成本下降是这项转变的关键因素,使得 FCEV 对商业和客运的吸引力越来越大。

亚太地区的燃料电池汽车市场正在蓬勃发展,一些国家率先采用氢燃料技术。

- 世界各国政府为抑制和控制交通污染而采取的绿色能源旅行倡议是预计在不久的将来推动燃料电池商用车市场发展的关键因素之一。 2019 年 11 月,中国政府支持的卡车和巴士製造商北汽福田汽车表示,将投资 26 亿美元用于替代能源汽车,包括燃料电池引擎。该公司计划在2025年投放20万辆新能源商用车。

- 几家主要的OEM正在大力投资研发,并建立了战略伙伴关係,以增强其商用车技术。 2020年1月,日本本田汽车工业与五十铃汽车公司宣布将共同进行氢燃料电池动力来源重型卡车的研究,希望透过将零排放技术应用于重型车辆来扩大燃料电池的使用范围。预计此类发展将促进亚太地区电动商用车市场的发展。

- 2020年,韩国将电动车购买补贴延长至2024年(乘用车)、2025年(公车和卡车)。奖金与价格上限挂钩。售价低于6,000万韩元的电动车可以获得全额补贴,但售价在6,000万韩元至9,000万韩元之间的电动车只能获得全额补贴的50%。此前,每辆车最高可获得800万韩元的补贴。

亚太燃料电池汽车市场趋势

亚太地区的汽车贷款利率反映了每个国家的经济策略,一些国家优先采取奖励策略,而其他国家则采取更保守的立场。

- 过去几年,这些数字发生了显着变化。印尼和印度已大幅下调汽车贷款利率,显示两国在汽车销售数据波动的情况下可能采取措施提振汽车产业。日本坚持传统,维持名目利率,这是其超宽鬆货币政策延续的指标。马来西亚在 2021 年经历了急剧下滑,但在 2022 年重新站稳了脚跟,标誌着经济实现了适应性再平衡。同时,纽西兰和菲律宾则呈下降趋势。泰国在 2020 年急剧下降,但在 2022 年开始再次上升。澳洲的历程很有趣,每年都在稳步上升,这或许显示了经济韧性和策略超脱的结合。

- 2017年至2023年,亚太地区汽车贷款利率波动全景图。印尼的利率最高,在 10% 至 11% 之间波动,这清楚地表明了其经济状况。相较之下,日本的利率一直维持在1%以下,反映了多年来为刺激经济活动而实施的低利率。预计澳洲和纽西兰将呈现更稳定的趋势,到2019年将略有成长。同时,菲律宾在2017年以适度基数起步后,呈现大幅成长,在2019年达到7%以上的高峰。印度保持了稳定的节奏,保持在9-10%的范围内,而马来西亚则略有增长。相反,泰国却呈现逐渐下滑的趋势。

亚洲对电动车(EV)的需求激增,促使全球汽车製造商推出新产品,扩大了电动车和电池组的市场。

- 随着亚太地区对电动车 (EV) 的需求不断增长,许多汽车製造商正在采取策略推出适合这个快速成长的市场的创新产品。斯柯达于 2023 年 1 月宣布计划将一款尖端电动 SUV 引入印度就是一个重要的例子。该车配备强大的82kWh电池,一次充电续航里程超过500公里。斯柯达计划于 2023 年下半年推出这项倡议,象征着席捲该地区的更广泛趋势。这些措施的推出不仅将刺激电动车的需求,还将推动亚太国家广泛采用电池组。

- 随着公共运输成为亚太地区城市生活中越来越不可或缺的一部分,它激励新一代製造商推出创新、环保的车型。 2022 年 4 月,印度先锋新创新兴企业Greencell Mobility 推出了其电动行动巴士服务品牌 NueGo。 GreenCell 计划在印度南部、北部和西部三大地区部署 750 辆优质电动公车,以彻底改变城际通勤方式。最初的计划是在 24 个城市推出 250 辆公车,但长期愿景强调了该公司对加强环保公共交通的承诺。这些倡议预示着电动大众运输解决方案的蓬勃发展,未来几年电动大众运输解决方案很可能在亚太地区得到更广泛的应用。

亚太地区燃料电池汽车产业概况

亚太地区燃料电池汽车市场适度整合,前五大企业占60%的市场。该市场的主要企业包括戴姆勒股份公司(梅赛德斯-奔驰股份公司)、本田汽车公司、现代汽车公司、日产汽车公司、丰田汽车公司等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 人口

- 人均GDP

- 消费者汽车支出(cvp)

- 通货膨胀率

- 汽车贷款利率

- 共乘

- 电气化的影响

- 电动车充电站

- 电池组价格

- 新款 Xev 车型发布

- 物流绩效指数

- 二手车销售

- 燃油价格

- OEM生产统计

- 法规结构

- 价值炼和通路分析

第五章市场区隔

- 汽车模型

- 商用车

- 公车

- 大型商用卡车

- 轻型商用皮卡车

- 轻型商用厢型车

- 中型商用卡车

- 商用车

- 国家

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 马来西亚

- 韩国

- 泰国

- 其他亚太地区

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Ballard Power Systems

- Daihatsu Motor Co. Ltd.

- Daimler AG(Mercedes-Benz AG)

- Dongfeng Motor Corporation

- Honda Motor Co. Ltd.

- Hyundai Motor Company

- Mazda Motor Corporation

- Nissan Motor Co. Ltd.

- Toyota Motor Corporation

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 93064

The Asia-Pacific Fuel Cell Vehicles Market size is estimated at 2.32 billion USD in 2025, and is expected to reach 7.93 billion USD by 2029, growing at a CAGR of 35.92% during the forecast period (2025-2029).

Demonstrates the region's advanced approach to implementing fuel cell technology in various vehicle types, indicating strong potential for hydrogen as a clean energy source in transportation

- The Asia-Pacific region is witnessing a surge in sustainable transportation, evident in its robust growth across diverse segments. From passenger cars to commercial vehicles, spanning light commercial pick-up trucks, vans, medium to heavy-duty trucks, and buses, the region is steadfastly embracing green mobility. Notably, the rising sales of fuel cell electric vehicles (FCEVs) in the passenger car segment highlight the region's leadership in adopting clean transportation. These sales saw a significant increase from 2017 to 2023, and the trend is projected to persist till 2030.

- In the commercial vehicle arena, both light and heavy-duty segments are poised for substantial growth, driven by a strategic emphasis on hydrogen fuel cell technology. Sales of light commercial pick-up trucks and vans have witnessed a remarkable surge, signaling a shift toward zero-emission vehicles tailored for the logistics and transportation sectors. This transition is bolstered by investments in hydrogen infrastructure and government incentives aimed at curbing carbon emissions.

- Medium and heavy-duty commercial trucks, alongside FCEV-powered buses, are also on a rapid growth trajectory, with sales volumes set to soar by 2030. The optimism surrounding FCEVs in the Asia-Pacific region underscores a significant move toward a hydrogen-based economy, setting a global precedent for clean energy adoption. Government initiatives, technological advancements, and the declining cost of green hydrogen production are pivotal factors in this transition, rendering FCEVs increasingly attractive for both commercial and passenger transportation.

The Asia-Pacific fuel cell vehicles market is gaining momentum, with specific countries leading the charge toward hydrogen fuel technology adoption

- These initiatives taken by governments across the world to adopt green energy mobility in order to curtail and curb transportation pollution are among the key factors that are projected to drive the fuel cell commercial vehicle market in the near future. In November 2019, the government-backed Chinese business, Beiqi Foton Motor, a truck and bus manufacturer, announced that it would invest USD 2.6 billion in alternative energy vehicles, including fuel cell engines. The company plans to deploy 200,000 new energy commercial vehicles by 2025.

- Several major OEM players are investing heavily in research and development, and they are entering strategic partnerships to enhance their technologies for commercial vehicles. In January 2020, Japan's Honda Motor and Isuzu Motors announced that they would jointly conduct research on the use of hydrogen fuel cells to power heavy-duty trucks, looking forward to expanding fuel-cell usage by applying zero-emission technology to larger vehicles. Such developments are expected to enhance the electric commercial vehicles market across Asia-Pacific.

- In 2020, South Korea extended the purchase subsidy for electric vehicles for passenger cars until 2024, and for buses and trucks, it was extended until 2025. The bonus is tied to a price cap. EVs priced below KRW 60 million are eligible for full subsidies, but vehicles priced between KRW 60 million and 90 million may receive only 50% of the full amount. Previously, up to KRW 8 million in subsidies were available per vehicle.

Asia-Pacific Fuel Cell Vehicles Market Trends

Asia-Pacific's auto loan interest rates reflected varying national economic strategies, with some countries emphasizing stimulation while others took a more conservative stance

- Over the past few years, there have been noticeable changes in these figures. Indonesia and India notably reduced their auto loan rates, signaling potential efforts to bolster the automotive sector in the face of fluctuating sales. Japan, adhering to its legacy, sustained its nominal rates, an indicator of its persistent ultra-loose monetary policy. Malaysia, after a sharp dip in 2021, seemed to regain its footing in 2022, hinting at an adaptive economic recalibration. New Zealand and the Philippines, meanwhile, navigated a descending path. Thailand, with a plunge in 2020, retraced some steps upward by 2022. Australia's journey was intriguing, with a steady climb each year, possibly indicating a blend of economic resilience and strategic divergence from its regional peers.

- During 2017-2023 period, Asia-Pacific showcased a panorama of fluctuating interest rates for auto loans. Indonesia stood out with the steepest rates oscillating between 10% and11%, clearly underlining its economic landscape. In stark contrast, Japan's rates remained consistently below 1%, reflecting its long-standing policy of low-interest rates to boost economic activity. Australia and New Zealand moved along a more stable trend with a slight increase by 2019. Meanwhile, the Philippines, though starting from a moderate base in 2017, marked a dramatic ascent, peaking over 7% in 2019. India maintained a steady rhythm, keeping within the 9-10% bracket, while Malaysia's course was slightly upward. Conversely, Thailand embraced a gentle downward slope.

The surging demand for electric vehicles (EVs) in Asia is prompting global automakers to introduce new offerings, thereby expanding the EV and battery pack market

- In response to the escalating demand for electric vehicles (EVs) in the Asia-Pacific region, numerous automakers are aligning their strategies to unveil innovative products tailored to this burgeoning market. One important instance is the announcement made by Skoda in January 2023, where it shared plans to introduce a cutting-edge electric SUV in India. This vehicle stands out due to its formidable 82-kWh battery, boasting an impressive range exceeding 500 kilometers on a singular charge. With its launch slated for late 2023, Skoda's move is emblematic of the broader trend sweeping across the region. Such introductions are poised to not only fuel the EV demand but also drive the proliferation of battery packs in various Asia-Pacific countries.

- As public transportation becomes increasingly integral to urban life in the Asia-Pacific, it is inspiring a new generation of manufacturers to debut novel, eco-friendly models. In a significant move in April 2022, the pioneering India-based startup, GreenCell Mobility, unveiled its electric mobility bus service brand, NueGo. GreenCell has plans to revolutionize intercity commutes by deploying 750 premium electric buses across three key regions in India, encompassing the South, North, and West. While the initial phase will witness the rollout of 250 buses across 24 cities, the long-term vision underscores the company's commitment to enhancing green public transportation. Such initiatives signal a promising surge in electric public transit solutions, setting the pace for broader adoption across Asia-Pacific in the coming years.

Asia-Pacific Fuel Cell Vehicles Industry Overview

The Asia-Pacific Fuel Cell Vehicles Market is moderately consolidated, with the top five companies occupying 60%. The major players in this market are Daimler AG (Mercedes-Benz AG), Honda Motor Co. Ltd., Hyundai Motor Company, Nissan Motor Co. Ltd. and Toyota Motor Corporation (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Population

- 4.2 GDP Per Capita

- 4.3 Consumer Spending For Vehicle Purchase (cvp)

- 4.4 Inflation

- 4.5 Interest Rate For Auto Loans

- 4.6 Shared Rides

- 4.7 Impact Of Electrification

- 4.8 EV Charging Station

- 4.9 Battery Pack Price

- 4.10 New Xev Models Announced

- 4.11 Logistics Performance Index

- 4.12 Used Car Sales

- 4.13 Fuel Price

- 4.14 Oem-wise Production Statistics

- 4.15 Regulatory Framework

- 4.16 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 Vehicle Type

- 5.1.1 Commercial Vehicles

- 5.1.1.1 Buses

- 5.1.1.2 Heavy-duty Commercial Trucks

- 5.1.1.3 Light Commercial Pick-up Trucks

- 5.1.1.4 Light Commercial Vans

- 5.1.1.5 Medium-duty Commercial Trucks

- 5.1.1 Commercial Vehicles

- 5.2 Country

- 5.2.1 Australia

- 5.2.2 China

- 5.2.3 India

- 5.2.4 Indonesia

- 5.2.5 Japan

- 5.2.6 Malaysia

- 5.2.7 South Korea

- 5.2.8 Thailand

- 5.2.9 Rest-of-APAC

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Ballard Power Systems

- 6.4.2 Daihatsu Motor Co. Ltd.

- 6.4.3 Daimler AG (Mercedes-Benz AG)

- 6.4.4 Dongfeng Motor Corporation

- 6.4.5 Honda Motor Co. Ltd.

- 6.4.6 Hyundai Motor Company

- 6.4.7 Mazda Motor Corporation

- 6.4.8 Nissan Motor Co. Ltd.

- 6.4.9 Toyota Motor Corporation

7 KEY STRATEGIC QUESTIONS FOR VEHICLES CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219