|

市场调查报告书

商品编码

1685695

微球-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Microspheres - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

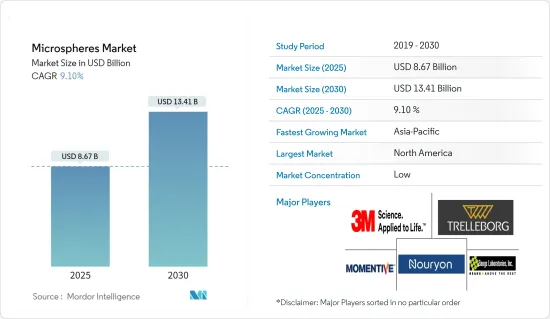

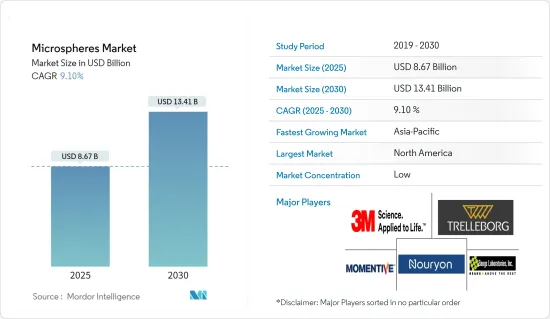

微球市场规模估计并预测在 2025 年将达到 86.7 亿美元,预计到 2030 年将达到 134.1 亿美元,在预测期内(2025-2030 年)的复合年增长率为 9.1%。

2020 年,COVID-19 疫情对市场产生了轻微的负面影响。然而,预计市场将在 2021 年復苏,并在预测期内实现稳步成长。

主要亮点

- 短期内,医疗产业应用的扩大和进步以及化妆品行业需求的增加是推动市场成长的因素。

- 预计高昂的生产和研发成本将在预测期内阻碍市场成长。

- 中空玻璃微球(HGM)在癌症治疗药物中的应用日益增多以及作为储氢介质的使用可能会在未来几年为市场提供机会。

- 北美占据全球市场主导地位,其中美国占最大的消费量。然而,亚太地区在 FOECAST 期间可能以最高的复合年增长率成长。

微球市场趋势

医疗技术的应用日益广泛

- 在医疗技术中,微球被用作美容手术、重组手术和泌尿系统的可注射生物材料。它也用于近距离放射治疗。

- 聚合物、玻璃和陶瓷基微球通常用于医疗设备的製造和测试。

- 直径 50 微米或更大的微球具有多种颜色,包括红色、蓝色、黑色、黄色和绿色,通常用作医疗设备中的挑战粒子和示踪剂。

- 彩色微球通常用于测试管瓶和容器的清洗评估、过滤介质和系统、离心和沈降过程、流动追踪和流体动态、污染控制和药物製造。

- 萤光色微球用于微循环和生物学研究、成像和流式细胞技术等医学应用,它们利用紫外线产生特征颜色,为使用显微镜、雷射和其他分析方法观察提供额外的灵敏度。

- 由于近年来品质和功能的改进,微球被广泛应用于医学诊断,作为可注射生物材料、组织填充剂、诊断设备试剂和药物传输载体。

- 2022年9月,Sirtex Medical核准,巴西国家补充健康局(ANS)已批准SIR-Spheres Y-90树脂微球用于治疗巴西的晚期肝细胞癌(HCC)。

- 2022 年 9 月,ABK Biomedical Inc. 宣布其 Easi-Vue 栓塞微球已获得 FDA 510(k) 批准,用于治疗动静脉畸形和富血管肿瘤患者。

- 根据经合组织的数据,2021年医疗保健支出占美国国内生产总值)的比例将达到17.8%,而2020年为18.8%。

- 持续的创新、技术发展和各种多功能应用以及上述事实可能会推动医疗技术产业应用对微球的需求。

北美占据市场主导地位

- 预计北美地区将占据市场主导地位。以国内生产毛额计算,美国是该地区最大的经济体。

- 美国是仅次于中国的世界第二大汽车製造国。根据 OICA 统计,2021 年汽车产量为 9,167,214 辆,较上年的 8,822,399 辆成长 4%。美国全国汽车经销商协会(NADA)预测,2022年美国新轻型汽车销售量可能成长3.4%,达到1,550万辆。由于汽车的普及和价格的上涨,预计未来汽车产量将会增加。

- 航太零件向法国、英国、中国和德国等国的强劲出口,以及美国的强劲支出,也推动了航太製造业的活动。包括日本、台湾和比利时在内的多个国家和地区都从美国购买国防飞机和设备。例如,日本计划从洛克希德·马丁公司购买105架F-35联合攻击战斗机,美国政府已于2020年7月核准。

- 美国是北美最大的化妆品消费国之一。它是目前世界上最大的美容市场。预计2021年美国化妆品市场价值将达到172.171亿美元,到2025年将达到210.031亿美元。欧莱雅、新雅芳、科蒂、雅诗兰黛、露华浓等美国主要化妆品品牌的存在预计将有利于该国的行业增长并推动微球市场的发展。

- 美国医疗保健产业是该国最先进的产业之一。根据美国医疗保险和医疗补助服务中心的数据,2020年美国医疗保健支出成长9.7%,达到4.1兆美元,即每人12,530美元。此外,2021年至2028年间,中国的医疗保健支出预计将以平均超过5.5%的速度成长,到2028年将达到约6.192兆美元。

- 根据加拿大汽车工业协会统计,汽车产业为加拿大GDP贡献超过190亿美元。此外,预计到 2024 年该国汽车产业规模将成长至 401 亿美元,为市场提供成长机会。

- 在全球范围内,加拿大在民用飞行模拟领域排名第一,在民用引擎生产领域排名第三,在民航机生产领域排名第四。加拿大航太航太业70%以上的产品出口到六大洲190多个国家。

微球行业概况

微球市场较为分散。市场的主要企业包括(不分先后顺序)3M、Nouryon、Momentive、Trelleborg AB 和 Bangs Laboratories Inc.

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 医疗产业的应用和进步日益增多

- 化妆品产业需求增加

- 限制因素

- 生产和研发成本高

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 原料

- 玻璃

- 聚合物

- 陶瓷製品

- 飞灰

- 金属

- 其他成分

- 类型

- 中空的

- 柔软的

- 应用

- 车

- 航太

- 化妆品

- 石油和天然气

- 油漆和涂料

- 医疗技术

- 复合材料

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- 3M

- Bangs Laboratories Inc.

- Chase Corporation

- Cospheric LLC

- Kureha Corporation

- Luminex Corporation(Diasorin Spa)

- Matsumoto Yushi-seiyaku Co. Ltd

- Merit Medical Systems

- Momentive

- Mo-sci Corporation(Heraeus Holdings)

- Nouryon

- Potters Industries LLC

- Siemens Healthineers AG

- Trelleborg AB

第七章 市场机会与未来趋势

- 扩大应用于癌症治疗药物

- 其他机会

The Microspheres Market size is estimated at USD 8.67 billion in 2025, and is expected to reach USD 13.41 billion by 2030, at a CAGR of 9.1% during the forecast period (2025-2030).

The COVID-19 outbreak had a minor negative impact on the market in 2020. However, the market rebounded in 2021 and is expected to grow steadily during the forecast period.

Key Highlights

- Over the short term, increasing applications and advancements in the medical industry and rising demand from the cosmetics industry are the factors driving the market's growth.

- High production and research and development costs are expected to hinder the market's growth during the forecast period.

- Increasing application in cancer treatment drugs and the usage of hollow glass microspheres (HGM) as a hydrogen storage medium are likely to create opportunities for the market in the future.

- North America dominates the global market, with the United States accounting for the largest consumption. However, the Asia-Pacific is likley to grow with the highest CAGR during the foecast period.

Microspheres Market Trends

Increasing Usage in the Medical Technology

- Medical Technology utilizes microspheres for applications as an injectable biomaterial in cosmetic surgery, reconstructive surgery, and urology. It is also used in brachytherapy.

- Polymer, glass, and ceramic-based microspheres are generally used microspheres in medical technology for the manufacturing and testing of medical devices.

- Microspheres are often used as challenge particles and tracers in medical devices, having diameters of more than 50 microns in different colors, such as red, blue, black, yellow, and green.

- Colored microspheres are typically used in the testing of vial and container cleaning evaluations, filtration media and systems, centrifugation and sedimentation processes, flow tracing and fluid mechanics, controlling contamination, and manufacturing of pharmaceuticals.

- Fluorescent-colored microspheres are used for applications that use UV light to produce distinctive colors and offer additional sensitivity for observation under microscopes, lasers, and other analytical methods, for medical applications, such as microcirculation and biological research, imaging, and flow cytometry.

- With recent improvements in quality and functionality, microspheres are widely used in medical diagnostics as injectable biomaterial, tissue filler, reagents for diagnostic devices, and drug delivery vehicles.

- In September 2022, Sirtex Medical announced that the Brazilian National Agency of Supplementary Health (ANS) approved SIR-Spheres Y-90 resin microspheres will be used to treat intermediate and advanced stage hepatocellular carcinoma (HCC) in Brazil.

- In September 2022, ABK Biomedical Inc. announced that the company had received FDA 510(k) clearance for Easi-Vue embolic microspheres to treat patients suffering from arteriovenous malformations or hypervascular tumors.

- According to the OECD, the healthcare expenditure accounted for 17.8% of United States' gross domestic product (GDP) in 2021, compared to 18.8% in 2020.

- Continuous innovation, technological development, and various versatile applications, along with the facts mentioned above, may boost the demand for microspheres in the application of the medical technology industry.

North America to Dominate the Market

- The North American region is expected to dominate the market. In the region, the United States is the largest economy in terms of GDP.

- The United States is the second-largest automotive manufacturing country globally, falling only behind China. According to OICA, automotive production in 2021 accounted for 9,167,214 units, an increase of 4% from the previous year, which was reported to be 8,822,399 units. The National Automobile Dealers Association (NADA) predicted that new United States light-vehicle sales would likely increase by 3.4% to 15.5 million units in 2022. The production of automobiles is anticipated to ascend in the future owing to the rising popularity and affordability of vehicles.

- Strong exports of aerospace components to countries, such as France, the United Kingdom, China, and Germany, along with robust spending in the United States, are driving manufacturing activities in the aerospace industry. Several countries, like Japan, Taiwan, and Belgium, have purchased defense aircraft and equipment from the United States. For instance, Japan planned to buy 105 F-35 joint strike fighters from Lockheed Martin, with the US government approving the same in July 2020.

- The United States is one of the largest cosmetics consumers in the North American region. It is currently the largest beauty market globally. The US cosmetic products market was valued at USD 17,217.1 million in 2021, and it is expected to reach USD 21,003.1 million by 2025. The presence of major cosmetics brands in the United States, including L'Oreal, New Avon, Coty, Estee Lauder, Revlon, and others, is likely to benefit the industry growth in the country, propelling the microspheres market.

- The healthcare sector in the United States is one of the most advanced in the country. According to the Centers for Medicare and Medicaid Services, in 2020, the country's health care expenditure increased by 9.7 % and reached USD 4.1 trillion or USD 12,530 per person. Moreover, for the 2021-2028 period, national healthcare spending is projected to grow at an average of more than 5.5% and reach approximately USD 6.192 trillion by 2028.

- According to the Automotive Industries Association of Canada, the automotive industry contributes over USD 19 billion to the Canadian GDP. Also, the automotive industry in the country is expected to rise to USD 40.1 billion by 2024, giving growth opportunities to the market studied.

- Globally, Canada ranks first in civil flight simulation, third in civil engine production, and fourth in civil aircraft production. It is the only nation ranked in the top five of all the key categories-the Canadian aerospace industry exports over 70% of its products to over 190 countries across six continents.

Microspheres Industry Overview

The microspheres market is fragmented. A few major players in the market include 3M, Nouryon, Momentive, Trelleborg AB, and Bangs Laboratories Inc., among others (not in any particular order).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Application and Advancements in Medical Industry

- 4.1.2 Increasing Demand from Cosmetics Industry

- 4.2 Restraints

- 4.2.1 High Production and Research and Development Cost

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Raw Material

- 5.1.1 Glass

- 5.1.2 Polymer

- 5.1.3 Ceramic

- 5.1.4 Fly Ash

- 5.1.5 Metallic

- 5.1.6 Other Raw Materials

- 5.2 Type

- 5.2.1 Hollow

- 5.2.2 Soild

- 5.3 Application

- 5.3.1 Automotive

- 5.3.2 Aerospace

- 5.3.3 Cosmetics

- 5.3.4 Oil and Gas

- 5.3.5 Paints and Coatings

- 5.3.6 Medical Technology

- 5.3.7 Composites

- 5.3.8 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Bangs Laboratories Inc.

- 6.4.3 Chase Corporation

- 6.4.4 Cospheric LLC

- 6.4.5 Kureha Corporation

- 6.4.6 Luminex Corporation (Diasorin Spa)

- 6.4.7 Matsumoto Yushi-seiyaku Co. Ltd

- 6.4.8 Merit Medical Systems

- 6.4.9 Momentive

- 6.4.10 Mo-sci Corporation (Heraeus Holdings)

- 6.4.11 Nouryon

- 6.4.12 Potters Industries LLC

- 6.4.13 Siemens Healthineers AG

- 6.4.14 Trelleborg AB

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Application in Cancer Treatment Drugs

- 7.2 Other Opportunities