|

市场调查报告书

商品编码

1685781

美国农业机械:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030 年)United States Agricultural Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

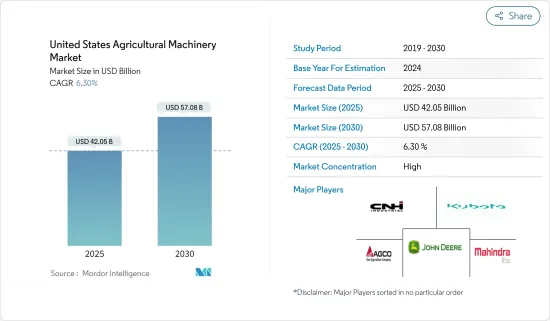

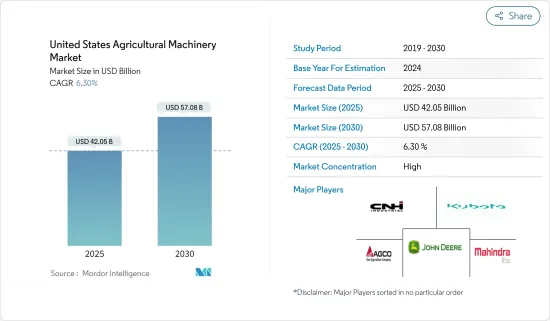

预计2025年美国农业机械市场规模为420.5亿美元,2030年将达570.8亿美元,预测期间(2025-2030年)的复合年增长率为6.3%。

主要亮点

- 农业在支撑美国经济方面发挥着至关重要的作用。美国约有 40% 的土地用于农业,包括牲畜放牧。如此广大的农业用地促使人们越来越依赖机械来完成复杂的农业任务。此外,农场经营规模扩大、劳动力减少以及机械化程度提高等因素正在推动美国农业机械的销售。

- 此外,自动化农业机械需求的激增源自于全国对机器取代传统体力劳动的青睐。越来越多的人开始将自动化机器引入农业,不仅可以减少对人力的依赖,还可以提高效率、产量和产品品质。为了因应这些趋势,製造商正争相引进先进的农业机械。一个值得注意的例子是 8R,这是约翰迪尔于 2022 年在拉斯维加斯推出的全自动拖拉机,旨在帮助农民应对技术劳动力市场紧张的局面。

- 然而,机械化带来的成本上升给农民的生产成本带来了压力。针对这种情况,政府实施了各种制度和补贴,旨在透过提高机械化程度来提高农业生产力。为强调政府的承诺,美国农业部 (USDA) 已于 2022 年拨款 3 亿美元用于新的有机农业转型计画。正如农业部长明确表示的那样,该倡议旨在改善农民的市场和收入管道。除了市场准入之外,该倡议还为机械采购提供即时财政援助、透过作物保险增加支援以及提供包括同侪指导在内的全面技术培训。

美国农业机械市场趋势

拖拉机领域占据市场主导地位

在美国,拖拉机占农业机械的大多数。美国拖拉机市场已经发展到优先考虑动力、精度和效率,尤其是与联合收割机等大型机器相比。例如,根据美国机械工业协会的资料,美国自走式联合收割机的零售落后,2024年前五个月售出农用拖拉机91,987台,而去年同期仅2,205台。此外,美国农民也享有了购买农用拖拉机的及时补贴。补贴鼓励小农户投资拖拉机,增加了销售量。

此外,随着全球自动化技术的进步,美国的自动拖拉机市场也蓬勃发展。这一趋势使美国成为全球领先的自动拖拉机市场,从而推动了拖拉机的整体销售。国内企业积极投入研发,推出突破界限的先进拖拉机。例如,CLAAS 于 2023 年推出了改进的 XERION 拖拉机系列,具有经过精细调校的动力传动系统、增强的液压流量和更高的多功能性。这些升级功能在 Xerion 5000 和 4500 型号上得到体现,可用于 TRAC 或 TRAC VC 配置。因此,在补贴、蓬勃发展的自动拖拉机市场以及主要企业推出的新车型的推动下,美国拖拉机市场将在未来几年内实现成长。

农场整合促进机械化

在美国,农业生产日益集约化。进入21世纪,少数大型专业农场开始主导农业生产,这些农场主要位置美国不到四分之一人口居住的农村地区。美国近一半的农场都是家庭所有,这导致了农场平均规模的扩大。根据美国农业部的资料,平均农场规模将从 2019 年的 446 英亩增长到 2023 年的 464 英亩。盈利是推动这项整合的动力。农场越大,盈利往往越高。

农场规模扩大的趋势导緻美国农场总数减少。根据美国农业部的资料,这一数字将从 2022 年的 190 万个农场下降到 2023 年的 180 万个农场。因此,这种下降减少了农业部门的机会。机会的减少加上劳动力的迁移正在刺激农业机械化程度的提高和现代设备的采用,从而推动市场成长。

随着人事费用的上升以及农场规模的扩大需要更多的劳动力,利润的很大一部分都用于支付劳动力费用,从而挤压了盈利。此外,对于农场管理者来说,单纯依靠劳动力非常耗时,而且效率低。因此,农业机械的引进出现了明显的转变。因此,劳动成本的上升加上农场规模的扩大正在推动农业机械的采用,从而促进未来几年的市场成长。

美国农业机械产业概况

美国农业机械市场是一个集中的市场,少数几家主要企业占据主导地位。市场的主要企业包括迪尔公司、久保田公司、美国爱科集团、凯斯纽荷兰工业公司、马恆达农业北美公司等。併购、伙伴关係、业务扩张和产品发布是市场主要企业采用的一些商业策略。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 技术进步

- 农业劳动力短缺日益严重

- 政府加强农业机械化的支持

- 市场限制

- 农业机械初期投资维护成本高

- 现代农业机械的安全问题

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 联结机

- 耕作机械

- 犁

- 光环

- 耕耘机和耕耘机

- 其他的

- 种植机

- 播种机

- 播种机

- 吊具

- 其他的

- 收割机

- 联合收割机

- 青贮收割机

- 其他收割机

- 牧草和饲料机械

- 草坪修剪机

- 打包机

- 其他的

- 灌溉机械

- 喷水灌溉

- 滴灌

- 其他的

- 其他农业机械

第六章 竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- Deere and Company

- CNH Industrial

- Mahindra Agriculture North America

- AGCO Corporation

- KUBOTA Corporation

- Farmtrac Tractor Europe

- Deutz-Fahr

- Claas KGaA mbH

- Kuhn Group Inc.

- Kverneland Group

第七章 市场机会与未来趋势

The United States Agricultural Machinery Market size is estimated at USD 42.05 billion in 2025, and is expected to reach USD 57.08 billion by 2030, at a CAGR of 6.3% during the forecast period (2025-2030).

Key Highlights

- Agriculture plays a pivotal role in bolstering the United States economy. Roughly 40% of U.S. land is dedicated to agricultural pursuits, encompassing livestock grazing. This extensive agricultural land use has spurred a heightened reliance on machinery for intricate farming tasks. Furthermore, factors such as expansive farming operations, dwindling labor availability, and an uptick in mechanization are propelling the sales of agricultural machinery nationwide.

- Additionally, the surge in demand for automated agricultural equipment stems from a nationwide shift favoring machinery over traditional manual labor. The trend of integrating autonomous machinery into farming is gaining traction, not only to lessen dependence on human labor but also to boost efficiency, yield, and product quality. In response to this growing trend, manufacturers are eager to introduce advanced agricultural machinery. A notable example is John Deere's 2022 unveiling of its fully autonomous 8R tractor in Las Vegas, designed to assist farmers amidst a tightening skilled labor market.

- However, the rising costs associated with mechanization have strained farmers' production expenses. In light of this, the government is rolling out various schemes and subsidies aimed at bolstering farm productivity through enhanced mechanization. Highlighting the government's commitment, the U.S. Department of Agriculture (USDA) allocated a substantial USD 300 million in 2022 to a new organic transition initiative. As articulated by the Agriculture Secretary, this initiative aims to forge improved markets and income avenues for farmers. Beyond market access, the initiative extends immediate financial assistance for machinery purchases, augmented crop insurance support, and comprehensive technical guidance, including mentorship from fellow farmers.

US Agricultural Machinery Market Trends

Tractors Segment dominates the Market

In the United States, tractors dominate the agricultural machinery landscape. The nation's tractor market has evolved, prioritizing power, precision, and efficiency, especially when compared to larger machines like combines. For example, data from the Association of Equipment Manufacturers reveals that from January to May 2024, U.S. retail sales saw 91,987 farm tractors sold, while self-propelled combines lagged with only 2,205 units. Furthermore, U.S. farmers have benefited from timely subsidies on agricultural tractor purchases. These subsidies have empowered even small-scale farmers to invest in tractors, driving up sales numbers.

Moreover, the U.S. has witnessed a surge in the autonomous tractor market, paralleling global advancements in automation technology. This trend positions the U.S. as a leading global market for autonomous tractors, bolstering overall tractor sales. Domestic players are actively engaging in R&D, pushing the envelope with advanced tractor launches. For instance, CLAAS unveiled its modified XERION tractor line in 2023, boasting powertrain tweaks, enhanced hydraulic flow, and greater versatility. These upgrades are featured on the Xerion 5000 and 4500 models, available in TRAC or TRAC VC configurations. Thus, with subsidies, a booming autonomous tractor market, and major companies rolling out new models, the U.S. tractor segment is poised for growth in the coming years.

Consolidation of Farms is driving the Mechanization

In the United States, agricultural production has increasingly consolidated. In the 21st century, a smaller number of large, specialized farms dominate agricultural output, primarily located in rural areas home to less than a quarter of the United States population. Nearly half of the nation's farms are family-operated, contributing to a rise in the average farm size. Data from the United States Department of Agriculture indicates that the average farm size grew from 446 acres in 2019 to 464 acres in 2023. Profitability drives this consolidation: larger farms tend to be more profitable.

This trend towards larger farms has led to a decrease in the total number of farms across the United States. USDA data shows a drop from 1.9 million farms in 2022 to 1.8 million in 2023. Consequently, this decline has reduced opportunities within the agricultural sector. Coupled with labor migration, this reduction in opportunities has spurred a rise in farm mechanization and the adoption of modern equipment, fueling market growth.

As labor costs rise and larger farms demand more manpower, a significant chunk of profits is now funneled into labor payments, squeezing profitability. Moreover, relying solely on labor is time-intensive, often proving inefficient for farm owners. Consequently, there's a marked shift towards agricultural machinery adoption. Thus, the interplay of rising labor costs and expanding farm sizes is propelling this machinery adoption, bolstering market growth in the coming years.

US Agricultural Machinery Industry Overview

The United States Agricultural Machinery Market is a consolidated market, with few major players dominating the market. The major players in the market are Deere & Company, Kubota Corporation, AGCO Corporation, CNH Industrial, and Mahindra Agriculture North America, among others. Mergers & acquisitions, partnerships, expansion, and product launches are the business strategies adopted by the major players in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Technological Advancements

- 4.2.2 Rising Farm Labour Shortage

- 4.2.3 Increasing Government Support to Enhance Farm Mechanization

- 4.3 Market Restraints

- 4.3.1 High Initial Investments and Maintenance Cost Of Farm Machinery

- 4.3.2 Security Concerns in Modern Farming Equipment

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Tractors

- 5.2 Plowing and Cultivating Machinery

- 5.2.1 Ploughs

- 5.2.2 Harrows

- 5.2.3 Cultivators & Tillers

- 5.2.4 Others

- 5.3 Planting Machinery

- 5.3.1 Seed Drills

- 5.3.2 Planters

- 5.3.3 Spreaders

- 5.3.4 Others

- 5.4 Harvesting Machiney

- 5.4.1 Combine Harvesters

- 5.4.2 Forage Harvesters

- 5.4.3 Other Harvesters

- 5.5 Haying and Forage Machinery

- 5.5.1 Mowers

- 5.5.2 Balers

- 5.5.3 Others

- 5.6 Irrigation Machinery

- 5.6.1 Sprinkler Irrigation

- 5.6.2 Drip Irrigation

- 5.6.3 Others

- 5.7 Other Agricultural Machinery

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Deere and Company

- 6.3.2 CNH Industrial

- 6.3.3 Mahindra Agriculture North America

- 6.3.4 AGCO Corporation

- 6.3.5 KUBOTA Corporation

- 6.3.6 Farmtrac Tractor Europe

- 6.3.7 Deutz-Fahr

- 6.3.8 Claas KGaA mbH

- 6.3.9 Kuhn Group Inc.

- 6.3.10 Kverneland Group