|

市场调查报告书

商品编码

1685803

屋顶瓦片:市场占有率分析、行业趋势和成长预测(2025-2030 年)Roofing Tiles - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

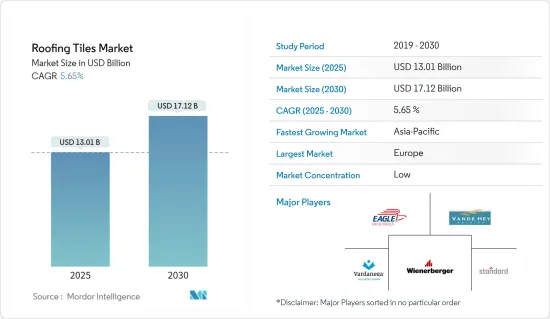

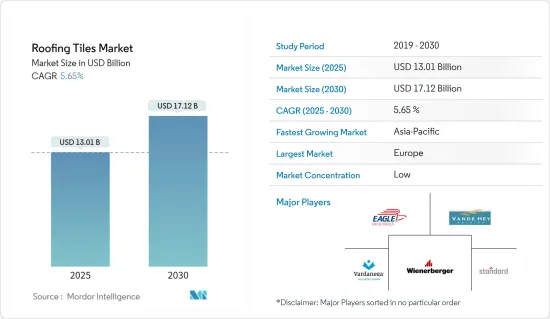

预计 2025 年屋顶瓦市场规模为 130.1 亿美元,到 2030 年将达到 171.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.65%。

市场成长受到新冠疫情的阻碍,封锁、维持社交距离措施和贸易制裁导致全球供应链网路严重中断。各国采取的封锁措施导致大多数行业暂时停顿,对建筑业造成了影响。然而,建设产业在 2021 年实现了成长,使得所研究的市场在预测期内得以反弹。

主要亮点

- 未来五到十年,随着亚太地区建设产业建造更多的住宅,以及政府也简化了建造绿色建筑的程序,屋顶瓦市场可能会成长。

- 原材料价格的变化、屋顶瓦片的高价格以及高昂的安装成本可能会减缓屋顶瓦片市场的成长。

- 在预测期内,市场可能会因太阳能屋顶瓦的发展而获得机会。

- 亚太地区是世界上最大的屋顶瓦市场,这得益于印度、中国、菲律宾和印尼等国家建设业的强劲成长。

屋顶瓦市场趋势

住宅建设显着成长

- 与沥青瓦屋顶相比,在住宅应用中使用屋顶瓦可以减少向阁楼的热量传递约 70%。屋顶瓦适用于多种类型的住宅,包括独栋住宅、联排别墅、公寓和公寓。

- 根据联合国的数据,全球约有 50% 的人口居住在都市区,预计到 2030 年将达到 60%。经济和人口成长的速度必须与居住活动的需求相符。到2030年,全球约40%的人口需要住宅,预计每天将超过96,150套。

- 主要受都市化推动,公寓、平房和别墅等住宅在新兴经济体中越来越受欢迎。

- 2021年欧洲建筑总投资成长5.2%,凸显了该地区的韧性。欧洲建筑业联合会(FIEC)预测,2022年建筑业将成长2.4%。

- 在美国,2022 年住宅建筑价值为 9,104.16 亿美元,而 2021 年为 8,029.33 亿美元。

- 中国、印度、巴西和阿根廷等经济体的主要城市正在扩张,需要更多的住宅来容纳从全国各地迁移的人口。

- 因此,所有上述趋势都可能影响预测期内所研究市场的需求。

亚太地区占市场主导地位

随着印度、中国、菲律宾、越南和印尼等国家对住宅和商业建筑的投资不断增加,预计未来几年屋顶瓦市场将会扩大。

- 中国的建筑业是世界上最大的产业,从业人员超过5,300万人。根据国家统计局的数据,预计2022年中国建筑业总产值将达到31.2兆元人民币(约4.57兆美元),而2021年为29.31兆元人民币(约4.29兆美元),成长6%。 2022年中国建筑业对GDP的贡献率将达到约6.9%。

- 此外,中国政府于2022年1月发布了一项五年计划,重点是使建筑业更加永续和品质主导。中国计划增加预製建筑,以减少建筑工地的污染和废弃物。

- 此外,建筑业将向现代化方式转型,建立低碳生产方式,提高建筑质量,进而增加对屋瓦产品的需求。

- 根据印度品牌股权基金会(IBEF)的报告,印度拥有庞大的建筑业,预计到2025年将成为全球第三大建筑市场。印度政府实施的智慧城市计划和全民住宅等各种政策预计将为印度建设产业提供急需的动力。

- 日本也正在兴建许多豪华公寓和多用户住宅。根据经济合作暨发展组织(OECD)的报告,2022年日本颁发的住宅和多用户住宅许可证数量约为71,627张,而2021年约为71,373张。

- 因此,预计这些因素将在预测期内推动亚太市场的成长。

屋瓦业概况

屋顶瓦市场本质上是分散的。市场的主要企业(不分先后顺序)包括 Wienerberger AG、VandeHey Raleigh、Fornace Laterizi Vardanega Isidoro、Eagle Roofing Products 和 Standard Industries Inc.(BMI Group)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 绿建筑对天然环保屋顶材料的需求不断增加

- 主要国家都市化

- 限制因素

- 全球市场上屋顶材料的现有使用情况

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 类型

- 黏土砖

- 混凝土屋顶瓦

- 其他类型

- 最终用途

- 住宅

- 非住宅

- 商业的

- 基础设施

- 工业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- Crown Roof Tiles

- Eagle Roofing Products

- Fornace Laterizi Vardanega Isidoro SRL

- Ludowici Roof Tiles

- Mca Clay Roof Tile

- Standard Industries Inc.(BMI Group)

- Vande Hey Raleigh

- Verea Clay Tile

- VORTEX HYDRA SRL ITALY

- Wienerberger AG

第七章 市场机会与未来趋势

- 太阳能屋顶意识不断增强

The Roofing Tiles Market size is estimated at USD 13.01 billion in 2025, and is expected to reach USD 17.12 billion by 2030, at a CAGR of 5.65% during the forecast period (2025-2030).

The market's growth was hampered by the COVID-19 pandemic, as lockdowns, social distancing measures, and trade sanctions triggered massive disruptions to global supply chain networks. Due to lockdowns in various countries, most industries were temporarily shut down, which impacted the building and construction sectors. But the construction industry grew in 2021, which helped the market studied during the forecast period get back on its feet.

Key Highlights

- Over the next five to ten years, the market for roofing tiles is likely to grow because the construction industry in the Asia-Pacific region is building more homes and the government is making it easier to build green buildings.

- Changes in the prices of raw materials, the high prices of roofing tiles, and the high costs of installing them are likely to slow the growth of the roofing tile market.

- During the time frame of the forecast, the market is likely to have opportunities due to the development of solar roof tiles.

- The Asia-Pacific region was the world's biggest market for roofing tiles, thanks to strong growth in construction in places like India, China, the Philippines, and Indonesia.

Roofing Tiles Market Trends

Residential Construction to Witness Noticeable Growth

- The use of roof tiles in residential applications can reduce overall heat transfer to the attic by approximately 70% compared to an asphalt shingle roof. Roofing tiles are available for single-family homes, townhomes, condos, and apartment buildings, among other types of homes.

- According to the United Nations (UN), around 50% of the global population resides in urban cities, which is projected to reach 60% by 2030. The pace of economic and demographic growth must be in harmony with the demand for residential activities. By 2030, around 40% of the global population will likely need housing, at over 96,150 houses per day.

- Residential properties such as apartments, bungalows, and villas are gaining popularity in emerging nations and are mainly driven by urbanization.

- The total investment in construction in Europe grew by 5.2% in 2021, highlighting the region's resilience. The Federation of the European Construction Industry (FIEC) estimates that the construction sector grew by 2.4% in 2022.

- In the United States, the annual value of residential construction in the year 2022 was USD 9,10,416 million, while in the year 2021 the value was USD 8,02,933 million.

- Major cities in economies, including China, India, Brazil, Argentina, and others, are expanding and require additional housing to accommodate people migrating from various regions of the country.

- Hence, all such trends mentioned above are likely to impact the demand for the market studied during the forecast period.

Asia-Pacific to Dominate the Market

With growing investments in residential and commercial construction in countries such as India, China, the Philippines, Vietnam, and Indonesia, the market for roofing tiles is expected to increase in the coming years.

- China's construction sector is the largest industry in the world, employing more than 53 million people. According to the National Bureau of Statistics, China's construction sector output was CNY 31.20 trillion (~USD 4.57 trillion) in 2022, compared to CNY 29.31 trillion (~USD 4.29 trillion) in 2021, registering a 6% growth. China's construction industry contributed around 6.9% to its GDP in 2022.

- Moreover, the Chinese government unveiled a five-year plan in January 2022 focused on making the construction sector more sustainable and quality-driven. China is planning to increase prefabricated building construction to reduce pollution and waste from construction sites.

- Further, the construction industry will transition to modernized practices which will enable the establishment of low carbon-production modes and improvement in the quality of buildings, consequently increasing demand for roofing tiles products.

- India has a huge construction sector and is expected to become the world's third-largest construction market by 2025, as per the report of IBEF (Indian Brand Equity Foundation). Various policies implemented by the Indian government, such as the Smart Cities project, Housing for all, etc., are expected to bring the needed impetus to the Indian construction industry.

- Many luxury apartments and residential complexes are under construction in Japan. As per the report of the Organization for Economic Co-operation and Development (OECD), the total permit issued to dwellings and residential buildings in Japan was around 71,627 in 2022, as compared to about 71,373 in 2021.

- Hence, such factors will drive the market growth in the Asia-Pacific during the forecast period.

Roofing Tiles Industry Overview

The roofing tile market is fragmented by nature. Some of the major players in the market (not in any particular order) include WienerbergerAG, VandeHey Raleigh, Fornace LateriziVardanega Isidoro, Eagle Roofing Products, and Standard Industries Inc. (BMI Group), among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Natural and Eco-friendly Roof Materials in Green Buildings

- 4.1.2 Growing Urbanization in Major Economies

- 4.2 Restraints

- 4.2.1 Existing Usage of Roofing Shingles in the Global Market

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Clay Tiles

- 5.1.2 Concrete Tiles

- 5.1.3 Other Types

- 5.2 End-use Sector

- 5.2.1 Residential

- 5.2.2 Non-residential

- 5.2.2.1 Commercial

- 5.2.2.2 Infrastructure

- 5.2.2.3 Industrial

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Crown Roof Tiles

- 6.4.2 Eagle Roofing Products

- 6.4.3 Fornace Laterizi Vardanega Isidoro SRL

- 6.4.4 Ludowici Roof Tiles

- 6.4.5 Mca Clay Roof Tile

- 6.4.6 Standard Industries Inc.(BMI Group)

- 6.4.7 Vande Hey Raleigh

- 6.4.8 Verea Clay Tile

- 6.4.9 VORTEX HYDRA S.R.L. ITALY

- 6.4.10 Wienerberger AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Awareness of Solar Roofing