|

市场调查报告书

商品编码

1685819

汽车转向感测器:市场占有率分析、行业趋势和成长预测(2025-2030 年)Automotive Steering Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

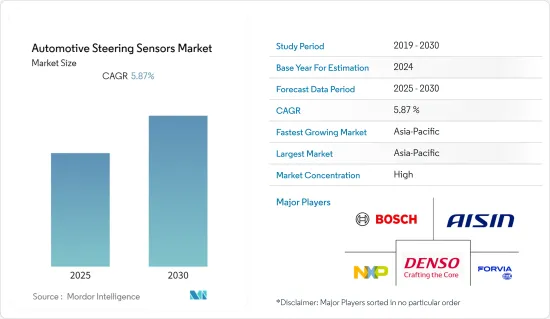

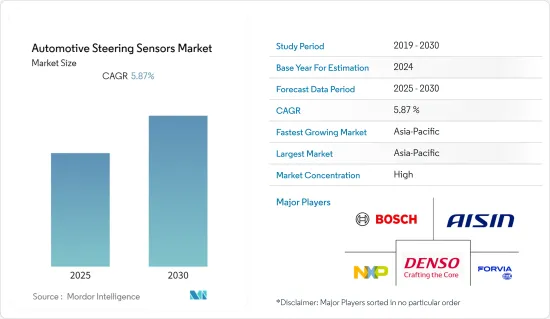

预计预测期内汽车转向感测器市场的复合年增长率将达到 5.87%

COVID-19 几乎影响了汽车产业的每个领域,包括汽车转向感测器市场。此外,由于封锁和停产,汽车转向感测器的需求大幅下降。然而,预计 2021 年汽车产业的产量将显着增长,这可能会在预测期内增加对转向感测器的需求。随着情况恢復正常,重型商用车领域正在成长,这可能会在预测期内推动汽车转向感测器市场的成长。

随着汽车行业关注电气化和自动驾驶等最新技术趋势,对转向感测器的需求正在增加。同时,製造商倾向于在车辆中加入位置感测器,这表明市场将持续成长。配备自动驾驶系统的自动驾驶汽车(尤其是 4 级和 5 级汽车)通常会处理大量资料并向转向系统提供反馈,以实现平稳驾驶、避开障碍物并绕过交通标誌。这就需要在这类车辆中加入更多的感测器,预计这将推动该领域的市场发展。

消费者对新安全系统和技术的需求正在成长。对乘客安全的日益关注促使汽车製造商为其车辆配备驾驶辅助系统,尤其是转向辅助系统。这些因素正在推动对转向感测器的需求。

此外,政府采取严格的燃油经济性标准和国际安全措施也是先进转向系统扩展和发展的主要驱动力。电动方向盘(EPS) 系统中的多个转向感测器为驾驶提供了额外的安全保障。

由于上述因素,汽车转向感测器市场预计在预测期内将大幅成长。

汽车转向感测器市场趋势

扭力感测器需求量最大

扭矩感测器测量驾驶员施加的转向扭矩。车辆的电控系统接收来自扭矩感测器的输入,然后马达或泵浦将所需的扭矩提供迴转向柱或辅助装置。

扭矩感测器用于汽车电子和液压动力方向盘系统。如今,所有汽车都配备了动力方向盘或电子动力方向盘。因此,由于全球对动力方向盘系统的需求不断增加,预计扭矩和角度感测器市场将在预测期内蓬勃发展。

随着技术的进步,汽车产业也不断升级和改进其感测器产品。为了跟上市场步伐,许多OEM和其他公司都在投资研发。例如

- 2022 年 5 月,耐世特汽车与大陆集团合作扩展了两项新的软体功能,为所有类型的电动方向盘和线控转向系统以及所有驾驶自动化(1-5 级)提供备用安全层。

- 2021 年 10 月,耐世特汽车宣布在其电动方向盘(EPS) 产品组合中增加一款新型模组化管柱辅助 EPS 系统 (mCEPS),旨在满足广泛OEM的需求。耐世特的高性能扭矩感测器和旋转角度感测器是自订为卓越的噪音、振动和声振粗糙度 (NVH) 性能以及平稳、精确的转向感觉而开发的,让驾驶员感觉与道路更加紧密地联繫在一起。

- 2021年7月,UD卡车公司宣布将在日本的重型旗舰车型Quon上采用其突破性技术UD主动转向系统,该技术可显着提高转向精度和驾驶舒适度。 UD 主动转向系统在液压转向装置顶部使用马达,在需要时提供额外的扭矩。安装在马达中的电控系统(ECU) 每 2,000 秒接收来自卡车各处感测器的输入,监控驾驶环境和驾驶行为。

预计在预测期内,这种改进的扭矩感测器产品将得到汽车製造商的更多采用。

亚太地区占很大份额

亚太地区预计将成为製造这些系统的主要市场,其中印度、日本和中国将成为汽车零件的製造地,并向美国和德国等国家供应汽车零件。

近年来,由于中产阶级人均收入的提高和目的地设备製造商(OEM)的成本优势,亚太汽车产业蓬勃发展。该地区以生产紧凑、经济高效的汽车而闻名,并由中国和印度等世界上增长最快的经济体组成。

中国在亚太汽车转向感测器市场占据主导地位。中国是亚太地区重要的汽车市场。此外,该国在亚太汽车感测器产业占据主导地位。这是因为人们越来越接受汽车安全措施和先进的安全技术,例如 ESC(电子稳定控制)和 ADAS(高级驾驶辅助系统)。 2022年4月,中国新冠疫情爆发频率增加,对市场相关人员带来挑战,并对中国经济造成负面压力。在此期间,汽车产业和供应链面临终极挑战。此外,一些大型汽车製造商停产并面临巨大的物流挑战,导致交付能力崩坏。

影响印度汽车转向感测器市场成长的关键因素包括由于消费者可支配收入的增加以及对省油汽车的需求的增加而导致的全国汽车需求的增加。预计在预测期内对市场产生重大影响的其他因素包括客户对轻鬆灵活驾驶的需求不断增加、动力方向盘系统高成本以及线传技术。

从事转向感测器供应和销售的公司期待在其他潜在市场实现广泛扩张。一些OEM正在与汽车製造商合作改进他们的产品。随着技术的进步,感测器产品也不断升级。例如

- 2022 年 1 月,作为印度市场业务整合的一部分,采埃孚收购了与 Lane 集团合资的 Lane TRW Steering Systems 的多数股权。新合资企业将以 ZF Rane Automotive India 的名义运营,生产商用车转向系统。

汽车转向感光元件产业概况

汽车转向感测器市场包括罗伯特博世有限公司、大陆集团、电装株式会社、海拉有限公司、恩智浦半导体等。该地区的汽车转向感测器市场出现了大量的併购活动,其中五家主要企业对转向感测器市场做出了重大贡献。

- 2022年1月,博世与大众汽车集团旗下的Cariad公司同意联手并建立广泛的伙伴关係,以实现这一目标。两家公司希望使部分和高度自动驾驶适合大规模生产,让广大消费者能够享受。大众集团旗下品牌销售的汽车旨在提供允许驾驶员暂时将手从方向盘上移开的功能。

- 2021年8月,总部位于北美奥本山的全球汽车零件供应商佛吉亚(Faurecia)与总部位于德国、专注于汽车工程创新的同类公司海拉集团(Hella KGaA Hück GmbH)达成策略性合併,成为全球第七大汽车零件供应商。此次合併将以海拉的能源管理、感测器和致动器以及佛吉亚的氢系统解决方案和混合动力系统产品组合为基础。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 波特五力分析

- 新进入者的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 感测器类型

- 健康监测系统

- 扭力感测器

- 智慧型多功能感测器系统

- 位置感测器/角度感测器

- 其他感测器类型

- 车辆类型

- 搭乘用车

- 轻型商用车

- 重型商用车

- 科技

- 接触类型

- 磁的

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 印度

- 中国

- 日本

- 韩国

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 北美洲

第六章竞争格局

- 供应商市场占有率

- 公司简介

- Robert Bosch GmbH

- DENSO Corporation

- HELLA GmbH & Co. KgaA

- Methode Electronics Inc.

- Continental AG

- Honeywell Inc.

- Infineon Technology

- NXP Semiconductors NV

- Sensata Technologies

- Hitachi Metals

第七章 市场机会与未来趋势

The Automotive Steering Sensors Market is expected to register a CAGR of 5.87% during the forecast period.

COVID-19 hurt almost all segments of the automotive industry, including the automotive steering sensors market. In addition, due to lockdowns and halts in production, the demand for automotive steering sensors plummeted. However, the automotive industry witnessed significant growth in terms of production in 2021, which is likely to increase the demand for steering sensors over the forecast period. With the situation returning to normalcy, the heavy commercial vehicle segment is growing, which will likely help the automotive steering sensor market grow during the forecast period.

The automotive industry's recent shift in attention to technical developments such as electrification and autonomous driving has raised the demand for steering sensors. At the same time, the manufacturers' preference for integrating position sensors into vehicles suggests that the market will continue to grow. Autonomous vehicles (especially level 4 and level 5 vehicles) that feature self-driving systems generally process huge amounts of data to give feedback to the steering system and drive smoothly, clear obstacles, and perform turning maneuvers according to traffic signs. Due to this, it is expected that a larger number of sensors need to be incorporated into these types of vehicles, which is expected to drive the market for this segment.

There is growing consumer demand for new safety systems and technologies. Automotive manufacturers have been prompted to equip their vehicles with driver assistance systems, particularly steering assistance systems, as passenger safety concerns have grown. Such factors are driving the demand for steering sensors.

Furthermore, the adoption of stringent fuel efficiency standards by the government and international safety measures are seen as major drivers for the expansion and development of advanced steering systems. The presence of multiple steering sensors in electric power steering (EPS) systems provides the driver with extra safety benefits.

Owing to the aforementioned factors, the automotive steering sensor market is expected to grow significantly during the forecast period.

Automotive Steering Sensor Market Trends

Torque Sensors Experience the Highest Demand

Torque sensors measure the steering torque applied by the driver. The vehicle's electronic control units receive the input from the torque sensor and the motor, or the pump applies the required torque back or assistance on the steering column.

The torque sensor is utilized in automobiles' electronic and hydraulic power steering systems. Nowadays, all cars come with either hydraulic power steering or electronic power steering. As a result, the torque and angle sensor market is expected to flourish in the forecast period due to an increase in global demand for power steering systems.

With growing advancements in technology, sensor products have also been consistently upgraded and improved in the automotive industry. To cater to the market, many OEMs and others are investing in research and development. For instance,

- In May 2022, Nexteer Automotive and Continental AG jointly expanded their two new software functions that provide backup safety layers for all variants of Electric Power Steering and Steer-by-Wire systems and across all driving automation (levels 1 - 5).

- In October 2021, Nexteer Automotive announced the addition of its new modular column-assist EPS system (mCEPS) to its electric power steering (EPS) portfolio, which is designed to fulfill the needs of a wide range of OEMs. Nexteer's high-performance torque and rotation angle sensors are custom-developed to deliver superior noise, vibration, and harshness (NVH) performance and a smooth and precise steering feel, allowing drivers to feel more connected to the road.

- In July 2021, UD Trucks Corp. announced that UD Active Steering, a groundbreaking technology that dramatically enhances steering precision and driver comfort, will be offered in Japan on heavy-duty flagship Quon models. An electric motor is installed above the hydraulic steering gear in UD Active Steering to give additional torque when needed. The electronic control unit (ECU) on the electric motor gets input from sensors all over the truck every 2,000 seconds, monitoring the driving environment and the driver's actions.

Such improved sensor products for torque sensors are expected to witness increasing adoption by automakers during the forecast period.

Asia-Pacific Holds a Significant Share

The Asia-Pacific region is expected to become the major market for the manufacture of these systems, with India, Japan, and China moving toward becoming manufacturing hubs for automotive components and sourcing the same to countries such as the United States and Germany.

The automotive industry in Asia-Pacific has been very dynamic over the past few years, owing to the increasing per capita income of the middle-class population and cost advantages for original equipment manufacturers (OEMs). The region is known for producing compact and cost-effective cars and comprises some of the fastest-developing economies of the world, including China and India.

China is dominating the Asia-Pacific automotive steering sensors market in the Asia-Pacific region. China is a significant vehicle market in the Asia-Pacific region. Furthermore, the country dominates the Asia-Pacific automotive sensors industry. This is due to increased acceptance of car safety measures as well as a rise in advanced technology for safety such as ESC, Advanced Driver Assistance Systems (ADAS), etc. In April 2022, the increased frequency of COVID incidences in China created challenges for market players and put negative pressure on the Chinese economy. During this time, the automobile industry and supply chain were pushed to the ultimate challenge. Furthermore, some of the major automakers shut down production and faced enormous logistical challenges, resulting in a collapse in delivery capacity.

The main factors influencing the growth of the Indian automotive steering sensors market include an increase in demand for motor vehicles across the country due to an increase in consumer disposable income and an increase in demand for fuel-efficient automobiles. Other factors that are expected to have a significant influence on the market over the forecast period include an increase in customer desire for easy driving and agility, the high cost of power steering systems, and drive-by-wire technology.

Companies involved in the supply and distribution of steering sensors are looking forward to widespread expansion in other potential markets. Several OEMs are collaborating with automakers to improve their goods. Sensor items have also been continually upgraded as technology has advanced. For instance,

- In January 2022, as a part of the consolidation of its operations in the Indian market, ZF acquired a majority stake in the Rane TRW Steering Systems joint venture with the Rane Group. The new joint venture will operate under the name of ZF Rane Automotive India and produce steering systems for commercial vehicles.

Automotive Steering Sensor Industry Overview

The automotive steering sensors market is dominated by several players, such as Robert Bosch GmbH, Continental AG, DENSO Corporation, HELLA GmbH & Co. KgaA, and NXP Semiconductor. The automotive steering sensors market in the region has undergone a lot of mergers and acquisitions, making the top-five players significant contributors to the steering sensors market.

- In January 2022, Bosch and the Volkswagen Group subsidiary Cariad are collaborating to achieve this objective and have agreed to form an extensive partnership. The companies want to make partially and highly automated driving suitable for volume production and thus available to the broad mass of consumers. For the vehicles sold under the Volkswagen Group brands, the alliance aims to make functions available that will allow drivers to temporarily take their hands off the steering wheel.

- In August 2021, Faurecia, a global automotive supplier headquartered in Auburn Hills, North America, and Hella KGaA Hueck & Co, a German-based company with a similar focus on automotive engineering innovation, came together under a strategic merger to become the seventh-largest automotive supplier across the world. This combination builds on Hella's energy management, sensors, and actuators and Faurecia's portfolio of hydrogen system solutions and hybrid systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 Sensor Type

- 5.1.1 Health Monitoring Systems

- 5.1.2 Torque Sensors

- 5.1.3 Intelligent Multi-functional Sensor Systems

- 5.1.4 Position Sensors/Angle Sensors

- 5.1.5 Other Sensor Types

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Light Commercial Vehicles

- 5.2.3 Heavy Commercial Vehicles

- 5.3 Technology

- 5.3.1 Contacting

- 5.3.2 Magnetic

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Robert Bosch GmbH

- 6.2.2 DENSO Corporation

- 6.2.3 HELLA GmbH & Co. KgaA

- 6.2.4 Methode Electronics Inc.

- 6.2.5 Continental AG

- 6.2.6 Honeywell Inc.

- 6.2.7 Infineon Technology

- 6.2.8 NXP Semiconductors N.V.

- 6.2.9 Sensata Technologies

- 6.2.10 Hitachi Metals