|

市场调查报告书

商品编码

1685844

气体感测器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Gas Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

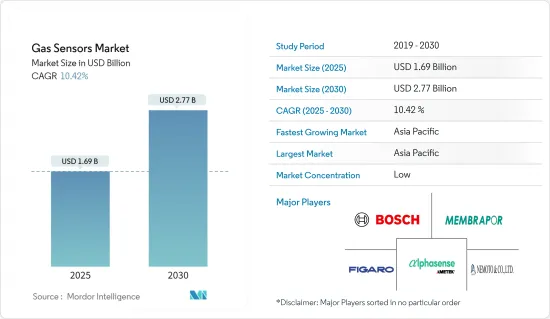

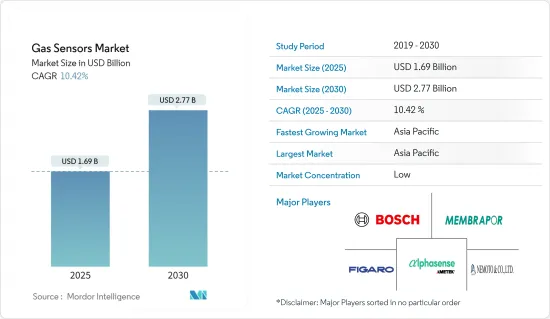

预计 2025 年气体感测器市场规模为 16.9 亿美元,到 2030 年将达到 27.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.42%。

主要亮点

- 在智慧城市中,气体感测器正在应用于环境监测,例如气象站、公共区域和大楼自动化系统中的空气品质检查。预计这种广泛的采用将在整个预测期内推动市场成长。

- 此外,暖气、通风和空调 (HVAC) 系统对于建筑物、监测环境和调节气体浓度至关重要。这两个特点正在刺激巨大的需求并进一步支持市场成长。

- 气体检测在全球石油和天然气领域至关重要。该行业的海上钻井和探勘活动会产生危险、可燃性气体和有毒的气体。虽然某些气体在少量时是无害的,但在高浓度时它们会带走氧气并造成严重风险,包括窒息。随着石油产量预计增加,对气体感测器的需求也将增加。这些感测器对于快速识别设施、管道和储存槽的气体洩漏至关重要。

- 人们对与有毒有害气体相关的职场危害的认识不断提高,推动了气体感测器的采用,特别是在石油和天然气、化学、石化、金属和采矿等领域。鑑于潜在的风险,化学工业通常依靠气体感测器在气体浓度超过安全限值时启动紧急系统。

- 气体感测器的製造成本正在上升,这主要是由于技术进步。现在,许多感测器都采用了电子机械系统 (MEMS) 和奈米技术等最尖端科技,这些技术在提高性能的同时,也增加了製造过程的复杂性和成本。开发这种先进的感测器技术需要大量的研发投入,进一步加剧成本结构。虽然现有製造商正在适应这些变化,但新进业者和中型製造商面临巨大的障碍。

- 由于俄罗斯-乌克兰衝突和随之而来的经济放缓,气体感测器市场面临明显的混乱。通货膨胀和利率上升抑制了消费者支出,从而抑制了对气体感测器的需求。美国和中国的贸易紧张局势加剧了全球供应链的中断。尤其是美国半导体製造设备出口的严格管制,对中国电力、汽车等产业的生产造成了阻碍。

气体感测器市场趋势

一氧化碳(CO)领域占据很大市场占有率

- 一氧化碳 (CO) 构成重大威胁,因为它会引起中毒,并且是不可预测的发病率和死亡率的主要原因。因此,找到检测这种危险气体的最佳材料和技术至关重要。金属氧化物半导体(MOS)感测器的应用越来越受到关注,尤其是在微米或奈米薄膜格式中。

- 一氧化碳本质上具有毒性,但在工业和冶金作业中却是重要的可燃且环保的能源来源。一氧化碳在氧化还原反应中起着至关重要的作用,并有助于金属的精製。一氧化碳尤其易燃、易爆。鑑于潜在的危险,一氧化碳感测器的采用越来越多。日益严格的政府法规,特别是针对工人安全的法规进一步推动了这一趋势。

- 一氧化碳侦测仪因其能够检测这种无色、无味、无臭的气体而成为各行各业的必需品。这种感测器对于避免一氧化碳中毒至关重要。如果不及时治疗,一氧化碳中毒可能会导致严重后果,包括失去意识、癫痫发作甚至死亡。光是在美国,这种无声杀手每年就会导致超过 20,000 人次急诊就诊,是许多国家最常见的致命中毒原因。

- 一氧化碳 (CO) 会减少身体器官和组织的氧气供应,从而危害您的健康。即使在较低的 CO 浓度下,患有心臟病的人也会面临更大的风险,并且可能会出现胸痛和运动能力下降等症状,反覆接触可能会导致心血管併发症。道路上车辆数量的增加会产生大量的二氧化碳,对用于分析和检测环境中气体的气体感测器的需求庞大。 CO(一氧化碳)气体感测器是气体检测仪器的关键组成部分,旨在识别各种环境中(从家庭、汽车到工业环境)的一氧化碳。

- 根据美国环保署估计,不包括野火排放,美国2023年将排放约4,230万吨一氧化碳(CO)。二氧化碳排放的增加将为该领域的成长创造新的市场机会。

亚太地区可望大幅成长

- 甲烷是继二氧化碳之后对全球暖化影响最大的温室气体。中国是石化燃料活动甲烷排放量最大的国家之一,面临控制排放的压力。

- 中国生态环境部最近发布的《甲烷控制规划》概述了这些努力,但仍面临控制甲烷排放的压力。控制甲烷排放面临资料收集不足、税收和监管标准以及持续的技术和管理障碍。

- 由于地缘政治衝突导致能源价格上涨,人们对氢等替代能源的兴趣日益浓厚。氢气有潜力成为工业和住宅用途的初级能源能源。由于二氧化碳测量仪和呼吸分析仪等设备中加入了气体感测器,医疗产业预计将保持强劲成长。

- 气体感测器对于检测氢气洩漏以及确保氢气的安全生产、储存和使用至关重要。日本正大力投资氢能作为清洁能源来源,并致力于开发用于汽车和发电的氢燃料电池。气体感测器对于检测氢气洩漏以及确保氢气的安全生产、储存和使用至关重要。

- 例如,日本最着名的发电公司JERA打算在2035年到氨和氢燃料供应方面投资超过60亿美元,该公司的主要重点是蓝氢氢和绿氢。蓝氢由天然气产生并排放二氧化碳,但可以捕获和储存以最大限度地减少对温室气体的影响。另一方面,绿色氢是利用水力发电解从太阳能和风力发电可再生能源产生的。

气体感测器产业概况

气体感测器市场分散,参与者多。提供各种类型气体感测器的公司根据技术优势来区分其产品。因此,他们与竞争对手采取价格战策略来抢占市场占有率。主要参与者包括 Membrapor AG、AlphaSense Inc.、Nemoto Industries、Figaro Engineering Inc. 和 Robert Bosch GmbH。

2023 年 10 月-Figaro Engineering 宣布在德国诺伊斯开设 Figaro 欧洲办事处。这项策略性倡议旨在透过向客户和当地经销商提供专门的技术支援来加强费加罗在欧洲的影响力。预计该办公室将带头进行有针对性的行销工作,并凸显费加洛扩大其在欧洲市场立足点的决心。

2023 年 10 月-MEMBRAPOR AG 增强了其 NO2/CA-2 感测器,灵敏度几乎提高了一倍。这项改进使得检测 ppb 范围内的低浓度成为可能。该感测器具有完善的催化 O3 过滤器,可有效减轻电化学 NO2 感测器中常见的 O3 交叉敏感性。推出了 NO2/CA-20 感测器,将测量能力扩展到 20 ppm 范围。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 为满足政府法规,汽车对气体感测器的需求增加

- 提高对主要行业职业事故的认识

- 市场挑战

- 成本上升和产品缺乏差异化

第六章 市场细分

- 按类型

- 氧

- 一氧化碳(CO)

- 二氧化碳 (CO2)

- 氮氧化物

- 碳氢化合物

- 其他类型

- 依技术分类

- 电化学公式

- 光电离检测器(PID)

- 固体/金属氧化物半导体

- 催化

- 红外线的

- 半导体

- 按应用

- 医疗

- 建筑自动化

- 产业

- 饮食

- 车

- 运输和物流

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 亚洲

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 北美洲

第七章 竞争格局

- 公司简介

- Figaro Engineering Inc.

- Membrapor AG

- AlphaSense Inc.

- Nemoto & Co. Ltd

- Robert Bosch GmbH

- Delphi Technologies

- SGX Sensortech Ltd(Amphenol Corporation)

- Zhengzhou Winsen Electronics Technology Co., Ltd.

- Niterra Co. Ltd.(NGK-NTK)

- Senseair(Asahi Kesai)

- Drgerwerk AG & Co. KGaA

第八章投资分析

第九章市场机会与未来成长

The Gas Sensors Market size is estimated at USD 1.69 billion in 2025, and is expected to reach USD 2.77 billion by 2030, at a CAGR of 10.42% during the forecast period (2025-2030).

Key Highlights

- In smart cities, gas sensors find applications in environmental monitoring, including air quality checks at weather stations, public areas, and within building automation systems. This widespread adoption is expected to drive the market's growth through the forecast period.

- Additionally, heating, ventilation, and air conditioning (HVAC) systems are integral to buildings, monitoring environments and regulating gas concentrations. This dual functionality has spurred significant demand, further fueling market growth.

- Gas detection is paramount in the global oil and gas sector. This industry's offshore drilling and exploration activities produce a spectrum of hazardous, flammable, and toxic gases. While some gases are benign in small quantities, they can deplete oxygen in high concentrations, leading to severe risks like suffocation. As oil production is projected to rise, so is the demand for gas sensors. These sensors are crucial for swiftly identifying gas leaks from equipment, pipelines, and storage tanks.

- Increasing awareness of workplace hazards related to toxic and hazardous gases is propelling the adoption of gas sensors, especially in sectors like oil and gas, chemicals, petrochemicals, metals, and mining. Given the potential risks, chemical industries often rely on gas sensors to trigger emergency systems when gas concentrations exceed safe limits.

- Production costs for gas sensors have increased, primarily due to technological advancements. Many sensors now incorporate cutting-edge technologies like microelectromechanical systems (MEMS) or nanotech, which, while enhancing performance, also complicate the fabrication process, thereby increasing costs. Developing these advanced sensor technologies necessitates substantial investments in research and development, further adding to the cost structure. While established players have adapted to these changes, newcomers and mid-tier manufacturers face significant hurdles.

- The gas sensors market faced notable disruptions due to the Russia-Ukraine conflict and subsequent economic slowdown. Rising inflation and interest rates curtailed consumer spending, dampening the demand for gas sensors. The trade tensions between the United States and China exacerbated global supply chain disruptions. Notably, the United States' stringent controls on semiconductor manufacturing equipment exports to China have hampered production in China's consumer electronics and automotive sectors.

Gas Sensors Market Trends

Carbon Monoxide (CO) Segment to Hold Significant Market Share

- Carbon monoxide (CO) poses a significant threat as it can cause intoxication, a leading factor in unpredictable morbidity and mortality, which is often linked to inhalation injuries from combustion. This underscores the critical need to identify optimal materials and technologies for detecting this hazardous gas. Metal oxide semiconductor (MOS) sensors have garnered attention, especially for their application in micro- or nano-thin film formats.

- While carbon monoxide is inherently toxic, it serves as a crucial, combustible, and eco-friendly energy source in industrial and metallurgical operations. It plays a pivotal role in redox reactions, aiding in metal purification. Notably, carbon monoxide is both highly flammable and prone to explosions. Given the potential dangers, the adoption of carbon monoxide sensors is on the rise. This trend is further propelled by increasingly stringent government regulations, particularly those emphasizing worker safety.

- Carbon monoxide detectors are indispensable in various industries, primarily for their ability to detect this colorless, odorless, and tasteless gas, which is otherwise imperceptible to human senses. Such sensors are pivotal in averting carbon monoxide poisoning, a condition that, when left unchecked, can lead to severe consequences, including loss of consciousness, seizures, or even death. In the United States alone, this silent killer prompts over 20,000 emergency room visits annually and stands as the most common fatal poisoning in many nations.

- Carbon monoxide (CO) can harm health by impeding oxygen delivery to the body's organs and tissues. Individuals with heart disease face heightened risks even at lower CO levels, experiencing symptoms like chest pain, reduced exercise capacity, and potentially additional cardiovascular complications with repeated exposure. The growing number of vehicles on the road generates a huge amount of CO, which creates a significant demand for gas sensors to analyze and detect gases in the environment. CO (Carbon Monoxide) gas sensors are crucial components in gas detection equipment, designed to identify carbon monoxide in various settings, from homes and automotive to industrial environments.

- According to the Environmental Protection Agency, the United States saw emissions of around 42.3 million tons of carbon monoxide (CO) in 2023, excluding those from wildfires. Such increased CO emissions create new market opportunities for segment growth.

Asia-Pacific Expected to Witness Major Growth

- After CO2, methane is the second most impactful greenhouse gas, significantly contributing to global warming. China is one of the top methane emitters from fossil fuel activities, and the nation is under pressure to rein in its methane output.

- Despite efforts outlined in China's recent methane plan issued by the Ministry of Ecology and Environment. These include inadequate data collection, tax regulatory standards, and ongoing technical and managerial hurdles in controlling methane emissions.

- The increase in energy prices due to geopolitical conflicts has caused a growing interest in alternative energy sources like Hydrogen. Hydrogen can potentially be a primary energy source for industrial and residential uses. The medical industry is projected to stay steady, with gas sensors in devices like capnography and breath analyzers.

- Gas sensors are crucial for detecting hydrogen leaks and ensuring Hydrogen's safe production, storage, and utilization. Japan invests heavily in Hydrogen as a clean energy source, with initiatives to develop hydrogen fuel cells for vehicles and power generation. Gas sensors are crucial for detecting hydrogen leaks, ensuring the safe production, storage, and utilization

- For instance, Japan's most prominent power generation company, JERA, intends to invest over USD 6 billion in ammonia and hydrogen fuel supplies by 2035. The company's primary focus will be on blue and green Hydrogen. Blue Hydrogen is generated from natural gas, which produces carbon emissions that are then captured and stored to minimize its greenhouse gas impact. In contrast, green Hydrogen is produced through water electrolysis-powered solar and wind energy renewable resources.

Gas Sensors Industry Overview

The gas sensors market is fragmented because of the presence of many players. The companies offering various types of gas sensors have technological product differentiation. Hence, they are adopting competitive pricing strategies to gain market share. Some of the key players include Membrapor AG, AlphaSense Inc., Nemoto & Co. Ltd, Figaro Engineering Inc., and Robert Bosch GmbH

October 2023-Figaro Engineering announced the opening of the Figaro Europe Office in Neuss, Germany. This strategic move aimed to bolster Figaro's presence in Europe by offering dedicated technical support to customers and local distributors. The office was expected to spearhead targeted marketing initiatives, underscoring Figaro's commitment to expanding its foothold in the European market.

October 2023 - MEMBRAPOR AG enhanced its NO2/CA-2 sensor, boosting its sensitivity to nearly double its capability. This advancement enabled the sensor to detect lower concentrations in the ppb range. The sensor features its established catalytic O3 filter, effectively mitigating the common O3 cross-sensitivity in electrochemical NO2 sensors. It introduced the NO2/CA-20 sensor, extending its measurement capabilities to ranges of up to 20 ppm.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Gas Sensors in Automobiles for Compliance with Governmental Regulations

- 5.1.2 Growing Awareness on Occupational Hazards across Major Industries

- 5.2 Market Challenges

- 5.2.1 Rising Costs and Lack of Product Differentiation

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Oxygen

- 6.1.2 Carbon Monoxide (CO)

- 6.1.3 Carbon Dioxide (CO2)

- 6.1.4 Nitrogen Oxide

- 6.1.5 Hydrocarbon

- 6.1.6 Other Types

- 6.2 By Technology

- 6.2.1 Electrochemical

- 6.2.2 Photoionization Detectors (PID)

- 6.2.3 Solid State/Metal Oxide Semiconductor

- 6.2.4 Catalytic

- 6.2.5 Infrared

- 6.2.6 Semiconductor

- 6.3 By Application

- 6.3.1 Medical

- 6.3.2 Building Automation

- 6.3.3 Industrial

- 6.3.4 Food and Beverages

- 6.3.5 Automotive

- 6.3.6 Transportation and Logistics

- 6.3.7 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.5.1 Brazil

- 6.4.5.2 Argentina

- 6.4.5.3 Mexico

- 6.4.6 Middle East and Africa

- 6.4.6.1 United Arab Emirates

- 6.4.6.2 Saudi Arabia

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Figaro Engineering Inc.

- 7.1.2 Membrapor AG

- 7.1.3 AlphaSense Inc.

- 7.1.4 Nemoto & Co. Ltd

- 7.1.5 Robert Bosch GmbH

- 7.1.6 Delphi Technologies

- 7.1.7 SGX Sensortech Ltd (Amphenol Corporation)

- 7.1.8 Zhengzhou Winsen Electronics Technology Co., Ltd.

- 7.1.9 Niterra Co. Ltd. (NGK-NTK)

- 7.1.10 Senseair (Asahi Kesai)

- 7.1.11 Drgerwerk AG & Co. KGaA