|

市场调查报告书

商品编码

1685888

工业淀粉:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Industrial Starches - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

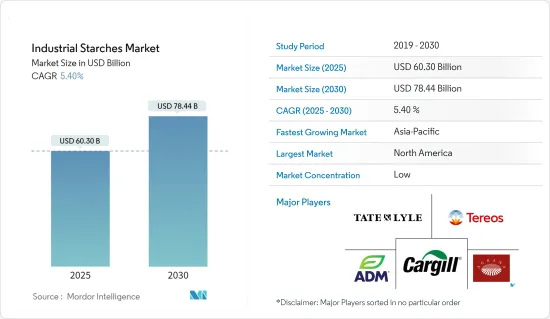

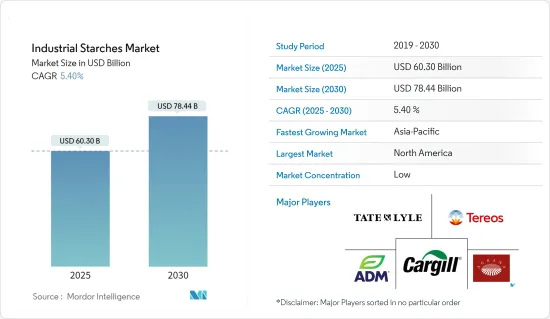

工业淀粉市场规模在 2025 年预计为 603 亿美元,预计到 2030 年将达到 784.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.4%。

淀粉是从农业原料中提取的碳水化合物,具有许多常见的食品和非食品应用。工业淀粉来自多种来源,包括玉米、马铃薯和小麦。随着全球经济逐渐好转,加工食品和方便食品的摄取量增加,在这些食品应用中具有广泛应用的工业淀粉市场需求正在增加,从而带动整体市场的发展。

随着食品工业的快速发展,对改性淀粉的需求也日益增加。改性淀粉为各种食品提供许多功能性益处,包括烘焙食品、点心、食品和饮料以及营养产品。目前,市面上有各种类型的淀粉,并以原料淀粉、改性淀粉、麦芽糊精、淀粉基糖等形式进行研究。这些淀粉的用途十分广泛,主要用于饮料和糖果零食行业,以及製药和发酵行业,并推动市场的发展。

工业淀粉市场趋势

玉米作为工业淀粉的潜在来源

玉米淀粉因其质地特性而备受青睐,尤其是作为乳製品和饮料等行业的增稠剂。这种成分在无麸质产品的开发中也具有优势。对于小麦淀粉来说,这是一个挑战,因为在萃取过程中可能会残留一些痕迹。清洁标籤成分和产品趋势对全球食品和饮料产业产生重大影响。此外,食品加工产业的快速扩张为原料製造商采取策略措施满足日益增长的需求提供了巨大的机会。在非食品应用方面,造纸业利用玉米粉作为填充物和上浆材料。它还可应用于纺织、洗衣、铸造、气浮和黏合剂行业。玉米粉在各行业的广泛应用推动了市场的成长。

北美占工业淀粉市场主要份额

北美食品工业高度发达,原料使用范围广泛,在区域工业淀粉市场中占据领先地位。在全球范围内,美国是最大的玉米生产国,2021-2022年产量为3.8394亿吨,用于包括淀粉生产在内的多种用途。在政府对无麸质成分产品标籤的严格监管下,市场严重倾向于无麸质食品的消费。因此,在美国,大多数改性食品淀粉都不含麸质,并且来自玉米、糯玉米和马铃薯。因此,小麦淀粉的市场占有率较低。由于消费者对更健康、更清洁成分的需求不断增加,加拿大的工业淀粉市场正在快速成长。浅色且具有微妙风味的应用尤其推动了该国对传统淀粉的需求。当地製造商在加工食品中使用它,帮助他们保持产品的吸引力。

工业淀粉产业概况

工业淀粉市场高度分散,许多本地、地区和国际参与者争夺市场占有率。市场的主要参与者包括阿彻丹尼尔斯米德兰公司、嘉吉公司、泰特莱尔公司和 Tereos 集团。为了加强业务,公司正在采取业务扩张、新产品推出和创新等关键策略。与当地企业签订新合约和伙伴关係的策略帮助该公司扩大了海外影响力,根据行业需求偏好推出新产品,并利用这些地区小型企业的专业知识。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 波特五力分析

- 新进入者的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 按类型

- 本国的

- 淀粉衍生物和甜味剂

- 按原料

- 玉米

- 小麦

- 木薯

- 马铃薯

- 其他的

- 按应用

- 食物

- 餵食

- 造纸工业

- 製药业

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 西班牙

- 英国

- 德国

- 俄罗斯

- 法国

- 义大利

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- Cargill Incorporated

- Archer Daniels Midland Company

- Ingredion Incorporated

- Tate & Lyle PLC

- Agrana Beteiligungs AG

- Kent Nutrition Group Inc.(Grain Processing Corp.)

- The Tereos Group

- Cooperatie Koninklijke Cosun UA

- Altia PLC

- Angel Starch and Food Pvt. Ltd

- Manildra Group

- Japan Corn Starch Co. Ltd

第七章 市场机会与未来趋势

第八章 免责声明

The Industrial Starches Market size is estimated at USD 60.30 billion in 2025, and is expected to reach USD 78.44 billion by 2030, at a CAGR of 5.4% during the forecast period (2025-2030).

Starch is a carbohydrate extracted from agricultural raw materials, which finds applications in many everyday food and non-food products. Industrial starches are derived from various sources, including corn, potato, wheat, and other sources. With the global economy gradually improving and resulting in an increased intake of processed and convenience foods, the market for industrial starch, which finds substantial usage in these food applications, is finding increased demand, thereby driving the overall market.

The demand for modified starches is increasing in parallel with the rapid development of the food industry. Modified starches offer many functional benefits to various foods, such as bakeries, snacks, beverages, and nutritional foods. Currently, a wide range of starches are available in the market, studied in the form of native starches, modified starches, malt dextrin, starch-based sugars, and others. These starches have expanding applications, primarily in the beverage and confectionery industries and the pharmaceutical and fermentation industries, among others, driving the market.

Industrial Starch Market Trends

Corn as one of the Prominent Source of Industrial Starch

Starch derived from corn is in high demand because of its textural properties, especially as a thickening agent in industries such as dairy and beverages. The ingredient also gains an edge in the development of gluten-free products, which is a challenge for starch sourced from wheat, considering the potential remains of traces during extraction. The trend of clean-label ingredients and products is drastically impacting the global food and beverage industry. Moreover, the rapid expansion of the food processing industry offers a significant opportunity for ingredient manufacturers to adopt strategic measures to cater to the growing demand. When it comes to non-food applications, the paper industry utilizes corn starch as a filler and sizing material. It also finds applications in the textile, laundry, foundry, air flotation, and adhesive industries. The wide applications of corn starch in various industries drive market growth.

North America Holds a Major Share in the Industrial Starches Market

With a highly developed food industry utilizing all ingredients, North America occupies the pole position in the Industrial Starches Market by region. Globally, the United States is the largest producer of corn, with a production of 383.94 million metric tons in 2021-2022, which is utilized in various application areas, including starch production. The market is significantly inclined toward the consumption of gluten-free food, supported by the country's government with its stringent regulations regarding product labeling of gluten-free ingredients. Thus, most modified food starches in the United States are gluten-free and derived from corn, waxy maize, and potatoes. Consequently, the wheat-sourced starches amount to a lower share of the market. The Canadian industrial starches market is growing rapidly, owing to rising consumer demand for healthy and cleaner ingredients. Light-colored applications with subtle flavors especially drive the demand for native starches in the country. Local manufacturers are using it in processed food products, aiding in maintaining the product's appeal.

Industrial Starch Industry Overview

The industrial starch market is highly fragmented, with many local, regional, and international players competing for market share. Some of the major players in the market are Archer Daniels Midland Company, Cargill Incorporated, Tate & Lyle PLC, and The Tereos Group. Companies adopt major strategies for expansion, new product launches, and innovations to strengthen their business. The strategy of forming new agreements and partnerships with local players helped the companies increase their footprint in foreign countries and release new products according to the industrial requirements preferences and leverage the expertise of these small regional companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Native

- 5.1.2 Starch Derivatives & Sweeteners

- 5.2 By Source

- 5.2.1 Corn

- 5.2.2 Wheat

- 5.2.3 Cassava

- 5.2.4 Potato

- 5.2.5 Other Sources

- 5.3 By Application

- 5.3.1 Food

- 5.3.2 Feed

- 5.3.3 Paper Industry

- 5.3.4 Pharmaceutical Industry

- 5.3.5 Other Applications

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Spain

- 5.4.2.2 United Kingdom

- 5.4.2.3 Germany

- 5.4.2.4 Russia

- 5.4.2.5 France

- 5.4.2.6 Italy

- 5.4.2.7 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Cargill Incorporated

- 6.3.2 Archer Daniels Midland Company

- 6.3.3 Ingredion Incorporated

- 6.3.4 Tate & Lyle PLC

- 6.3.5 Agrana Beteiligungs AG

- 6.3.6 Kent Nutrition Group Inc. (Grain Processing Corp.)

- 6.3.7 The Tereos Group

- 6.3.8 Cooperatie Koninklijke Cosun UA

- 6.3.9 Altia PLC

- 6.3.10 Angel Starch and Food Pvt. Ltd

- 6.3.11 Manildra Group

- 6.3.12 Japan Corn Starch Co. Ltd