|

市场调查报告书

商品编码

1685923

智慧交通:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Smart Transportation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

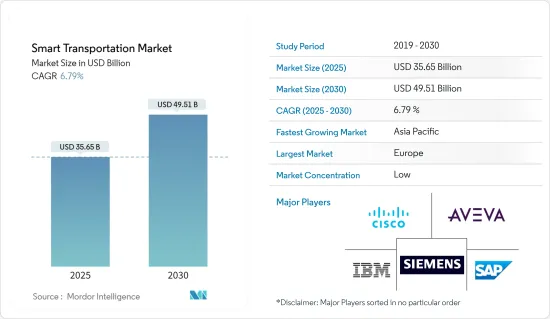

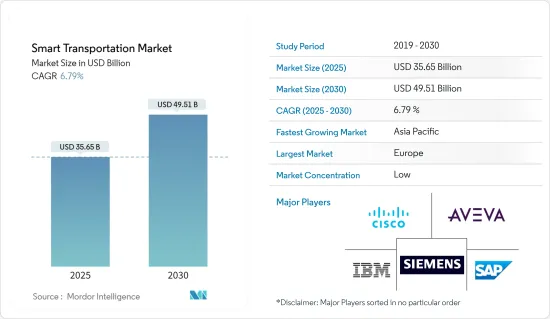

预计 2025 年智慧交通市场价值为 356.5 亿美元,到 2030 年将达到 495.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.79%。

推动市场成长的因素包括交通量的增加、政府减少温室气体影响的措施、城市计划的增加、特大城市的兴起、都市化和人口成长。根据联合国估计和预测,到2030年,全球70%以上的人口将实现城市化,其中印度将有7亿人居住在城市。这些预测为规划、设计和建立一个生态学和经济永续的新印度提供了独特的机会。此外,都市化正在推动世界各国经济发展,全球75%的经济产出发生在城市。

主要亮点

- 都市化的加速反映出世界城市日益复杂,包括其交通需求。运输市场面临的主要挑战之一是应对这种复杂性。在预测期内,物联网和连接设备的成长趋势将与智慧城市计划一起持续下去。特别是,使用物联网相互通讯的互联产品(例如智慧家庭、智慧电錶、智慧交通和智慧照明)的使用增加预计将成为市场扩张的驱动力。此外,预计2025年将建立超过26个智慧城市,其中大多数位于北美和欧洲,这为智慧城市采用人工智慧和物联网技术提供了主要驱动力。

- 创新城市发展的主要目标之一是智慧运输,包括交通运输。建构高效、灵活、一体化的交通网络对于智慧运输至关重要。智慧运输是现代城市中心发展的关键驱动力,具有改善游客和居民日常生活的潜力。到 2040 年,城市预计将容纳全球 65% 的人口。

- 城市交通管理优先考虑步行和骑自行车等健康的交通途径。移动性管理还可以最大限度地减少碳排放,并为社区提供最佳的交通流量分析。

- 人口从郊区和农村快速迁移到城市,以及大城市中心的人口集中度提高,加剧了交通拥堵。随着城市人口密度不断增加,道路设计不良和城市规划不充分也导致城市拥挤问题日益严重。例如,2022 年,美国驾驶者平均在交通拥堵中浪费了 51 个小时,即每週约一小时。根据行动分析公司 Inrix 发布的 2022 年全球交通记分卡,这比以前多了 15 个小时,而交通拥堵所浪费的每一分钟都会让美国驾驶者损失 869 美元。

- 此外,2022 年 4 月,电子与资讯科技部 (MeitY) 在 InTranSE-II 计画下推出了智慧型运输系统(ITS) 下的几项应用程序,以改善印度的交通状况。印度本土的 ADAS(高级驾驶辅助系统)、公车讯号优先系统和 CoSMiC(通用智慧物联网连接)软体是由印度先进运算发展中心 (CDAC) 和印度理工学院马德拉斯分校 (IIT-M) 共同设计的。 Mahindra & Mahindra 是该计划的工业合作伙伴。政府已宣布 ODAWS 的目的是为了改善公路基础设施。

- 但由于智慧交通需要标准化策略,软体、硬体、行动网路组件等方面较为混杂,且由多家厂商生产,相容性问题令人担忧。此外,各国的通讯协定差异很大,这给製造商带来了挑战,即他们的产品是否会被全球接受。

智慧交通市场趋势

都市化和人口成长推动市场

- 人口成长、都市化上升、特大城市数量增加是推动市场发展的主要因素。此外,随着人口成长和都市化,许多城市将面临交通挑战,从而增加对智慧交通的需求。例如,根据美国国家人口问题研究所的预测,2022年全球都市化将达到57%。北美洲是都市化最高的地区,超过五分之四的人口居住在都市区。

- 全球超过一半的城市人口居住在亚洲,印度和中国等一些国家,光在都市区就已有约10亿人口。其他城市人口相对较多的地区是北美、欧洲和非洲。都市化的加速意味着世界各地的城市交通变得更加复杂。解决这些复杂问题是这些地区运输市场面临的主要挑战之一。例如,根据联合国的预测,到2050年,预计68%的人口将居住在都市区。

- 城市人口成长对公共交通基础设施带来巨大压力。大城市居民期望公共交通快速、有效率、实惠、安全且环保。提供这样的交通基础设施是未来城市面临的主要挑战之一。此外,快速的都市化导致严重的交通拥堵、严重的安全问题以及城乡差距的扩大。为了克服这些挑战,透过灵活的网路控制提供即时出行和交通资讯的智慧交通解决方案近年来在许多高度都市化的城市获得了大力支持。

- 此外,都市区和特大城市面临日益严重的交通拥堵以及其他与交通相关的问题,如污染物排放增加和燃料资源枯竭,这些问题对大都市的整体福祉产生了负面影响。为了使交通管理更有效,世界各地的许多城市正在采用智慧交通系统,使现有系统变得智慧。

- 此外,城市交通对于改善任何城市居民的生活品质至关重要。如今,世界各地的城市规模已发展到令人难以置信的程度。全球特大城市的日益成熟以及交通技术领域的多项创新进一步推动了市场的成长。

亚太地区预计将创下最快成长

- 中国最近在其「十四五」规划(2021-2025年)中概述了综合交通运输体系。报告指出,2025年,中国将大力推动交通运输智慧化、绿色化,交通运输业整体能力、服务品质、效率显着提升。该计划旨在改善运输业的道路、铁路、港口和水路,以及相关技能和人才。这反过来又支持了都市化、消费需求和要素供应动态的成长。

- 随着以物联网(IoT)为代表的智慧交通网路的引入,日本的智慧交通正在迅速扩张。智慧交通网路需要包含云端、感测器、资料通讯和其他技术的物联网架构。近年来的快速进步使得增强设备通讯变得可行。

- 澳洲正在开发与驾驶员和基础设施营运商互动的交通管理技术,以减少交通拥堵并改善安全和道路状况。该国拥有多样化和复杂的交通基础设施网络,对智慧交通技术日益增长的需求正在为该国的市场相关人员创造商机。

- 亚太其他地区由新加坡、印度和韩国等许多新兴国家组成。这些国家正在兴起智慧城市,交通领域越来越多地采用智慧技术来提高交通效率,为技术供应商创造市场机会。

- 亚太国家之间也在市场进入、投资和合作等方面互相帮助。例如,印度和韩国于2022年12月同意从韩国经济发展合作基金(EDCF)获得149.5亿印度卢比(1.8314亿美元)的贷款,用于在那格浦尔-孟买高速公路上建造智慧交通系统。

智慧交通产业概览

由于智慧交通产业的市场渗透率相对较低,企业准备透过提供针对特定细分市场的产品和解决方案,甚至为单一客户客製化产品来增强差异化和价格实现。思科、SAP SE、IBM等智慧交通和商业领域的主要参与企业正致力于拓展新的领域。这些公司在开发新的创意以扩大其在智慧交通领域的产品线方面有着良好的记录。总体而言,预测期内产业竞争对手之间的敌意预计会增加。

- 2023 年 8 月 - 日立铁路全球首个数位交通应用程式全面投入商业服务,连接热那亚整个公共运输基础设施。该服务与该市的公共和私人交通系统相连,使居住或访问热那亚的任何人都可以以廉价规划、预订和付款交通途径旅行。热那亚公共和私人交通的整合将允许乘客规划、预订和支付他们的多式联运交通途径。其 663 辆公车、2,500 个公车站和地铁每年服务 1,500 万名乘客。

- 2022 年 10 月——西门子与 16 个合作伙伴启动计划,该项目计划持续到 2024 年底。该计划预算为 2,300 万欧元(2,500 万美元),属于德国政府资助的「safe.trAIn」计划的一部分。在这种高度控制和标准化的环境中满足要求可以显着提高区域铁路运输的效率和永续性。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业价值链分析

- 宏观经济趋势对市场的影响

- 技术简介

第五章市场动态

- 市场驱动因素

- 都市化进程、特大城市增加、人口成长

- 政府加强交通基础设施的倡议

- 市场限制

- 实施资金要求高

第六章市场区隔

- 按应用

- 交通管理

- 道路安全和保障

- 停车管理

- 公共运输

- 车用通讯系统

- 货物

- 其他用途

- 依产品类型

- 高阶旅行者资讯系统(ATIS)

- 先进运输管理系统(ATMS)

- 智慧型运输定价系统(ATPS)

- 先进公共运输系统(APTS)

- 协作车辆系统

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚洲

- 中国

- 日本

- 澳洲和纽西兰

- 拉丁美洲

- 墨西哥

- 巴西

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 沙乌地阿拉伯

- 北美洲

第七章竞争格局

- 公司简介

- Cisco Systems Inc.

- SAP SE

- IBM Corporation

- AVEVA Group PLC

- Siemens Corporation

- Oracle Corporation

- Alstom

- Advantech Co. Ltd

- Orange SA

- Huawei Technologies Co. Ltd

- Hitachi Ltd

第八章投资分析

第九章:市场的未来

The Smart Transportation Market size is estimated at USD 35.65 billion in 2025, and is expected to reach USD 49.51 billion by 2030, at a CAGR of 6.79% during the forecast period (2025-2030).

Increasing traffic volume, government initiatives aimed at decreasing the effects of greenhouse emissions, rising city projects, and the rise of megacities, urbanization, and population are some factors driving the market growth. The UN forecasts estimate that more than 70% of the world population will be urbanized by 2030, wherein 700 million people will reside in cities in India. These predictions serve as a unique opportunity to plan, design, and build an ecologically and economically sustainable new India. Additionally, urbanization has boosted national economies across the globe, as 75% of global economic production takes place in the cities.

Key Highlights

- Increasing urbanization reflects the growing complexities in cities worldwide, with transportation needs being one of them. One of the primary issues the transportation market faces is resolving this complexity. The trend of a rising number of IoT and linked devices will continue with smart city projects during the projection period. The increased use of linked products like smart homes, smart meters, smart transportation, and smart lighting, among others that use IoT to communicate with one another, is expected to drive market expansion. In addition, it is predicted that by 2025, there will be more than 26 smart cities, with the majority existing in North America and Europe, delivering a significant drive to AI and IoT technology for adoption in smart cities.

- One of the primary objectives of innovative city development is smart mobility, which includes transportation. Creating efficient, flexible, and integrated transportation networks is vital to smart mobility. Smart mobility is a significant development driver in modern urban centers and may improve tourists' and inhabitants' everyday lives. By 2040, cities are expected to accommodate 65% of the world's population.

- Healthy modes of transportation, such as walking and cycling, are prioritized in urban mobility management. Mobility management also minimizes carbon emissions and provides communities with optimal traffic flow analysis.

- Traffic congestion is increasing due to exponential growth in suburban and rural populations relocating to cities and an equivalent increase in population concentration around metropolitan centers. Vehicle congestion in cities has increased as cities have grown in density, assisted by insufficient roadway designs and bad urban planning. For example, in 2022, the average American motorist wasted 51 hours in traffic congestion, or approximately an hour each week. This is 15 hours longer lost to traffic than previously, and all that time squandered in traffic jams costs the typical American motorist USD 869 in lost time, according to the mobility analytics firm Inrix's 2022 Global Traffic Scorecard.

- Further, in April 2022, the Ministry of Electronics and Information Technology (MeitY) launched several applications under the Intelligent Transportation System (ITS) as part of the InTranSE- II program to improve India's traffic scenario. An indigenous Onboard Driver Assistance and Warning System (ODAWS), Bus Signal Priority System, and Common SMart IoT Connectiv (CoSMiC) software were designed as a joint enterprise by the Centre for Development of Advanced Computing (CDAC) and the Indian Institute of Technology Madras (IIT-M). Mahindra and Mahindra was the industrial collaborator for the project. The government declared that ODAWS aims to improve the highway infrastructure as the number of vehicles and road speed has increased, exacerbating safety concerns.

- However, due to the need for a standardized strategy, smart transportation mixed with numerous aspects, such as software, hardware, and mobile network components, are produced by multiple manufacturers, resulting in compatibility concerns. Furthermore, communication protocols range significantly among nations, posing challenges for manufacturers in terms of worldwide acceptance of their products.

Smart Transportation Market Trends

Rise of Urbanization, and Population would Drive the Market

- The population growth, coupled with the increasing urbanization rate and megacities, is the primary factor driving the market. Moreover, as the population grows and urbanizes, many cities will face transportation challenges, thus driving the demand for smart transportation. For instance, according to the Population Reference Bureau, in 2022, the degree of urbanization worldwide was 57%. North America was the region with the highest level of urbanization, with over four-fifths of the population residing in urban areas.

- More than half the world's urban population resides in Asia, where some countries, like India and China, already have about a billion people living in cities alone. The other regions with relatively high urban populations are North America, Europe, and Africa. Increasing urbanization indicates the rising complexities in the transportation of cities worldwide. Resolving these complexities is one of the significant challenges faced by the transport markets across these areas. For instance, according to the United Nations, people living in urban areas are expected to reach 68% by 2050.

- Urban population growth will significantly pressure public transport infrastructure. Residents of big cities will expect public transport that is fast, efficient, affordable, safe, and environmentally friendly. Delivering such transportation infrastructure will be one of the critical challenges confronting future cities. Furthermore, rapid urbanization has brought heavy traffic congestion, serious safety issues, and growing urban inequality. Smart transportation solutions have gained significant traction in the past few years across many highly urbanized cities to overcome such challenges by delivering real-time travel and traffic information with resilient network control.

- Furthermore, besides increasing traffic congestion, the urban areas and megacities face several other transport-related problems, such as growing emissions of pollutants and depleting fuel resources that adversely impact the overall well-being of any major city. To make transport management more effective, several cities worldwide are trying to create intelligence into existing systems by adopting smart transportation systems, which is expected to drive the market's growth at a rapid pace.

- Moreover, urban transportation is becoming crucial for a better quality of life for citizens in any city. Today cities worldwide are expanding to incredible sizes. The rising maturation rate of megacities worldwide and multiple innovations taking place in the technology field for the transportation sector are further driving the market's growth.

Asia Pacific is Expected to Register Fastest Growth

- China outlined a recent comprehensive transportation system in the 14th Five-Year Plan (2021-2025). According to the circular, by 2025, China will have made achievements in pursuing intelligent and green transportation, as well as significant advances in overall competence, service quality, and efficiency of the transportation industry. This plan aims to improve the transportation industry's roads, trains, ports, and waterways and the technology and human resources involved. As a result, this will support growth in urbanization, consumer demand, and factor supply movements.

- Smart transportation is quickly expanding in Japan with the introduction of smart transportation networks, such as the Internet of Things (IoT). Smart transportation networks require IoT architecture, which includes technologies such as the cloud, sensors, and data communication. Rapid improvements in recent years have made it feasible to enhance device communication.

- Australia has been developing traffic management technologies interacting with drivers and infrastructure operators to reduce traffic congestion and enhance safety and traffic conditions. The country has a diverse and complex transportation infrastructure network, creating an opportunity for the market players in the country due to the increasing demand for smart transportation technologies.

- The rest of Asia-Pacific consists of many emerging countries, including Singapore, India, and South Korea. The emergence of smart cities in these countries is increasing the adoption of intelligent technologies in transportation to enhance traffic efficiencies, creating a market opportunity for technology providers.

- Countries in the region are also helping each other by investing and partnering in the market adoption in Asia-Pacific. For instance, in December 2022, India and South Korea agreed to a loan of INR 1,495 crore (USD 183.14 million) from the Economic Development Cooperation Fund (EDCF) of the Republic of Korea to construct an intelligent transport system on the Nagpur-Mumbai Expressway.

Smart Transportation Industry Overview

As the market penetration of the smart transportation industry is relatively low, firms are poised to offer products and solutions that are tailor-made to specific segments and even customize products for individual customers, enhancing differentiation and price realization. The major participants in the smart transportation business, like Cisco, SAP SE, IBM, etc., are focusing on growing their operations in new areas. These companies have a track history of developing novel and inventive ideas to expand their product lines in the smart transportation sector. Overall, the industry's intensity of competitive rivalry is expected to be high during the forecast period.

- August 2023 - Hitachi Rail's world-first digital transport app enters full commercial service to connect Genoa's entire public transport infrastructure, The service, in conjunction with the city's public and private transport systems, allows any person living or visiting Genoa to plan, book and pay for multimodal journeys at a reduced price. By integrating the city's public and private transport systems, the service provides users with the possibility to plan, book and pay for multimodal journeys. 663 buses, 2500 bus stops and the metro line uses 15 million passengers per annum.

- October 2022 - Siemens and 16 partners started a project likely to last through the end of 2024 to enhance artificial intelligence in the autonomous operation of regional trains. A budget of EUR 23 million (USD 25 million) within the German government-funded "safe.trAIn" project is available for this project. Meeting the requirements in this highly governed and standardized environment can significantly improve the efficiency and sustainability of regional railway transportation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macroeconomic Trends on the Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise of Urbanization and Increasing Mega Cities and Increasing Population

- 5.1.2 Government Initiatives to Enhance the Transportation Infrastructure

- 5.2 Market Restraints

- 5.2.1 High Capital Required for Deployment

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Traffic Management

- 6.1.2 Road Safety and Security

- 6.1.3 Parking Management

- 6.1.4 Public Transport

- 6.1.5 Automotive Telematics

- 6.1.6 Freight

- 6.1.7 Other Applications

- 6.2 By Product Type

- 6.2.1 Advanced Traveler Information Systems (ATIS)

- 6.2.2 Advanced Transportation Management Systems (ATMS)

- 6.2.3 Advanced Transportation Pricing Systems (ATPS)

- 6.2.4 Advanced Public Transportation Systems (APTS)

- 6.2.5 Cooperative Vehicle Systems

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.5.1 Mexico

- 6.3.5.2 Brazil

- 6.3.6 Middle East and Africa

- 6.3.6.1 United Arab Emirates

- 6.3.6.2 South Africa

- 6.3.6.3 Saudi Arabia

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 SAP SE

- 7.1.3 IBM Corporation

- 7.1.4 AVEVA Group PLC

- 7.1.5 Siemens Corporation

- 7.1.6 Oracle Corporation

- 7.1.7 Alstom

- 7.1.8 Advantech Co. Ltd

- 7.1.9 Orange SA

- 7.1.10 Huawei Technologies Co. Ltd

- 7.1.11 Hitachi Ltd