|

市场调查报告书

商品编码

1685936

越南生物农药:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Vietnam Biopesticides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

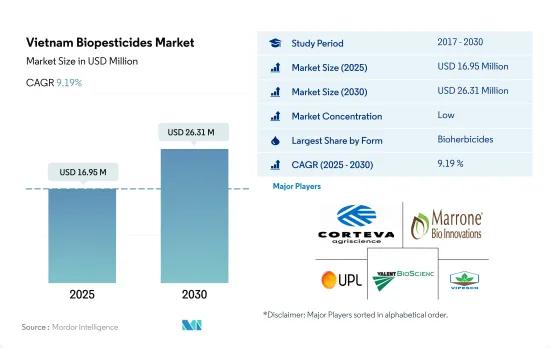

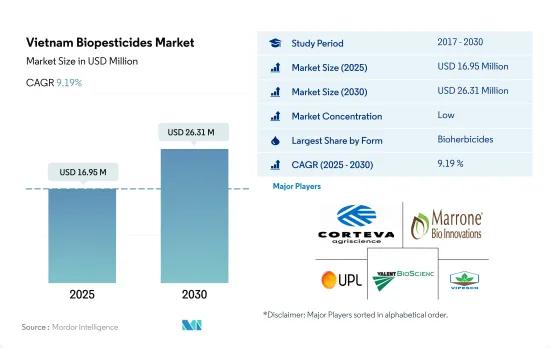

越南生物农药市场规模预计在 2025 年为 1,695 万美元,预计在 2030 年将达到 2,631 万美元,在市场估计和预测期(2025-2030 年)内以 9.19% 的复合年增长率增长。

- 生物农药是基于微生物、植物抽取物和其他天然化合物的安全农作物保护产品。它对于综合虫害管理(IPM)来说具有许多有吸引力的特性。生物防治促进有益微生物的生长,同时消灭有害害虫。根据粮农组织统计,农业病虫害造成的作物损失每年达40.0%。

- 生物农药在越南生物农药市场占据主导地位,2022 年占 31.5% 的份额。在越南,用作生物除草剂的菌属包括炭疽菌、镰刀菌、炼格孢菌、尾孢菌、柄銹菌、根腐菌、壳斗菌和核盘菌。越南制定了农业生态政策来促进特定的农业生态,如农林业、综合病虫害管理(IPM)、综合作物管理(ICM)、农业实践标准化、有机生产、食品安全病虫害防治以及保护和景观农业政策。

- IPM 和 ICM 旨在帮助农民了解他们的田间生态系统,使用适当的农业技术,有效地管理他们的生产系统,种植健康的作物,并减少田间农药和化肥的使用。这些政策预计将促进该国生物农药市场的发展。

- 农药行动网络(PAN)亚太区(PANAP)是一个致力于消除农药使用对人类和环境造成的危害并促进基于生物多样性的生态农业的全球性组织。该计画也提高了人们对农药不良影响的认识,预计将推动2023年至2029年间生物农药国内市场价值成长68.0%。

越南生物农药市场趋势

该国计划扩大有机农业,由于需求不断增长,水果和蔬菜将成为首要任务。

- 2022年,越南有机作物种植面积将达38,000公顷,约占亚太地区有机农地总面积的1%。越南目前拥有约17,000家有机生产商、555家加工商和60家出口商。

- 随着消费者的健康意识增强,全球有机农产品需求预计将激增,越南正寻求扩大有机农产品的出口。有机水果蔬菜种植是该国有机农业的主导,2022 年占 58.8%,其次是经济作物(35.7%)和连续作物(5.5%)。

- 随着2017年以来国家政策的出台以及《促进越南有机农业发展的国家有机标准》、《有机农业法令》、《2020-2030年国家有机农业计划》等政府计划的出台,越来越多的省市正在积极制定地方计划和计划,发展有机农业。

- 有机农业在越南蓬勃发展,许多计划由政府、国际合作伙伴和私营部门资助。参与式保障体系(PGS)越来越受欢迎,并正在许多社区实施。越南有机农业协会(VOAA)目前在13个省份拥有17个PGS小组,其中5个已投入运营,其余处于规划阶段。这些PGS集团产品包括蔬菜、米、柳橙、柚子等。

- 越南有机产品销往180个国家。越南已设定目标,2030年将有机农业面积扩大到总农地面积的2.5-3%。

约 88% 的河内消费者愿意购买有机农产品,导致人均消费量增加。

- 越南民众逐渐重视产品的品质和健康。健康和健身是越南消费者最关心的五大议题之一。越南的人均收入不断增加,鼓励人们在营养食品上花费更多。

- 蔬菜中高浓度的农药和化肥一直对越南人民来说是危险的。河内约30%的蔬菜产区由政府管理,并认证为安全。根据对河内四家大型超级市场185名受访者进行的调查的说明统计和分析结果显示,约有15%的消费者已经有过购买有机蔬菜的经验。然而,如果市场上有有机产品,88% 的人愿意购买。

- 有机食品消费有限的主要原因是缺乏有关有机市场的资讯以及购买有机产品的不便。有机蔬菜的平均价格比常规蔬菜高出约70%。此外,高所得的顾客更关心蔬菜的安全性,以前消费过有机产品的顾客更有可能为有机蔬菜支付更高的价格。这些结果表明应该向消费者广泛传播有关有机蔬菜的讯息。

- 越南有机食品消费量的增加将导致国内需求的增加。因此,需要鼓励将土地转变为有机农业,以生产所需的产品。因此,需要增加对有机保护和营养产品的需求以确保产品质量,从而决定该国生物农药市场的潜在成长。

越南生物农药产业概况

越南生物农药市场较为分散,前五大企业市占率合计为3.46%。市场的主要企业有:Corteva Agriscience、Marrone Bio Innovations Inc.、UPL、Valent BioSciences LLC 和 Vipesco。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 有机种植区

- 有机产品人均支出

- 法律规范

- 越南

- 价值炼和通路分析

第五章市场区隔

- 形式

- 生物真菌剂

- 生物除草剂

- 生物杀虫剂

- 其他生物防治剂

- 作物类型

- 经济作物

- 园艺作物

- 耕地作物

第六章 竞争格局

- 重大策略倡议

- 市场占有率分析

- 商业状况

- 公司简介.

- Biotech Bio-Agriculture

- Corteva Agriscience

- Marrone Bio Innovations Inc.

- UPL

- Valent BioSciences LLC

- Vipesco

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 49580

The Vietnam Biopesticides Market size is estimated at 16.95 million USD in 2025, and is expected to reach 26.31 million USD by 2030, growing at a CAGR of 9.19% during the forecast period (2025-2030).

- Biopesticides are crop protection products that are safe to use and are based on microorganisms, plant extracts, and other natural compounds. They have a variety of appealing properties for Integrated Pest Management (IPM). Biopesticides encourage the growth of beneficial microorganisms while controlling harmful pests. According to FAO, agricultural pests cause up to 40.0% of crop loss annually.

- Bioherbicides dominate the biopesticides market in the country, and they accounted for a share of 31.5% in 2022. In Vietnam, some genera used as bioherbicides are Colletotrichum, Fusarium, Alternaria, Cercospora, Puccinia, Entyloma, Ascochyta, and Sclerotinia, Agroecology policies are developed in Vietnam in order to promote particular agroecological practices like agroforestry, Integrated Pest Management (IPM), Integrated Crop Management (ICM), standardization of agricultural practices organic production, food safety control, and conservation and landscape agriculture policies.

- IPM and ICM are intended to assist farmers in understanding the field ecology, using suitable farming techniques, managing the production system effectively, growing healthy crops, and using fewer pesticides and fertilizers in fields. These policies are expected to propel the biopesticides market in the country.

- Pesticide Action Network (PAN) Asia Pacific (PANAP) is a global organization working to eliminate the harm that pesticide usage causes to people and the environment and advance ecological agriculture based on biodiversity. This program also raises awareness about the negative consequences of pesticides, which is expected to increase the domestic market value of biopesticides between 2023 and 2029 by 68.0%.

Vietnam Biopesticides Market Trends

The country plans to expand organic farming, with fruits and vegetables as the top priority due to increasing demand

- The area under organic crop cultivation in Vietnam was recorded at 38.0 thousand hectares in 2022, around 1% of the overall Asia-Pacific organic agricultural land. In Vietnam, there are currently approximately 17,000 organic agriculture producers, 555 processors, and 60 exporters.

- Vietnam has been trying to increase the export of organic farm produce as global demand is expected to rise rapidly as consumers become more health conscious. Organic cultivation in the fruit and vegetable crops is dominating the country's organic farming, and it accounted for 58.8% in 2022, followed by cash crops and row crops, accounting for 35.7% and 5.5% in the same year, respectively.

- With national policies issued since 2017 and government programs such as the National Organic Standard, the Decree on Organic Agriculture, and the National Organic Agriculture Project 2020-2030 to promote organic agriculture in Vietnam, more provinces and cities have actively developed local programs and projects to develop organic agriculture.

- Organic agriculture is thriving in Vietnam, with numerous projects funded by the government, international partners, and the private sector. Participatory Guarantee Systems (PGS) are becoming more popular and are being replicated in an increasing number of communities. The Vietnam Organic Agriculture Association (VOAA) currently has 17 PGS groups in 13 provinces, five of which are operational and the rest in the planning stages. These PGS groups' products include vegetables, rice, oranges, and grapefruits.

- Organic products from Vietnam are available in 180 countries. Vietnam has set a target of increasing the total organic land area to 2.5-3% of the total agricultural land area by 2030.

Approximately 88% of the Hanoi consumers are willing to by organic produce, leads to increase in per capita spending.

- People in Vietnam have gradually begun to pay more attention to product quality and health than they had previously. Health and fitness are still among Vietnamese consumers' top five concerns. Vietnam's per capita income has continuously increased, encouraging people to spend more on nutritious food.

- High levels of pesticides and chemical fertilizers inside vegetables are always risky for Vietnamese people. Around 30% of the area for vegetable production in Hanoi is controlled and safely certified by the government. Descriptive statistics and the results analyzed a sample of 185 respondents surveyed at four big supermarkets in Hanoi concluded that about 15% of the consumers already had the experience of using organic vegetables. However, 88% wanted to try and buy organic products if they were available in the market.

- Major reasons for the limitation in the consumption of organic foods were the lack of information about the organic market and the inconvenience of buying organic products. The average price for organic vegetables was about 70% higher than that of conventional ones. High-income customers were also concerned about the safety of vegetables, and those who previously consumed organic products were likely to pay more for organic vegetables. These findings suggest that information about organic vegetables should be widely publicized to consumers.

- The rising organic food consumption in Vietnam leads to increasing domestic demand. This requires a higher land conversion to organic farming to produce the desired product. A subsequent increase in the demand for organic protection and nutrition products is needed to ensure the quality of the product, thus determining potential growth in the biofertilizers market in the country.

Vietnam Biopesticides Industry Overview

The Vietnam Biopesticides Market is fragmented, with the top five companies occupying 3.46%. The major players in this market are Corteva Agriscience, Marrone Bio Innovations Inc., UPL, Valent BioSciences LLC and Vipesco (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 Vietnam

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Form

- 5.1.1 Biofungicides

- 5.1.2 Bioherbicides

- 5.1.3 Bioinsecticides

- 5.1.4 Other Biopesticides

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Biotech Bio-Agriculture

- 6.4.2 Corteva Agriscience

- 6.4.3 Marrone Bio Innovations Inc.

- 6.4.4 UPL

- 6.4.5 Valent BioSciences LLC

- 6.4.6 Vipesco

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219