|

市场调查报告书

商品编码

1686217

北美作物保护化学品-市场占有率分析、产业趋势与统计、成长预测(2025-2030)North America Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

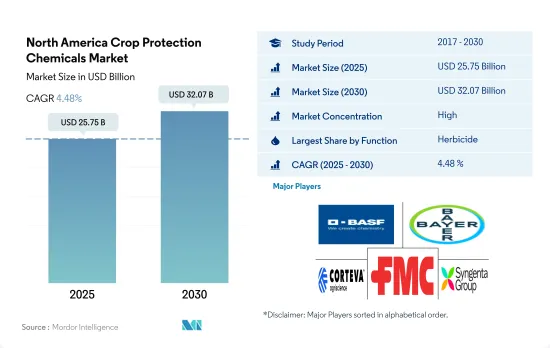

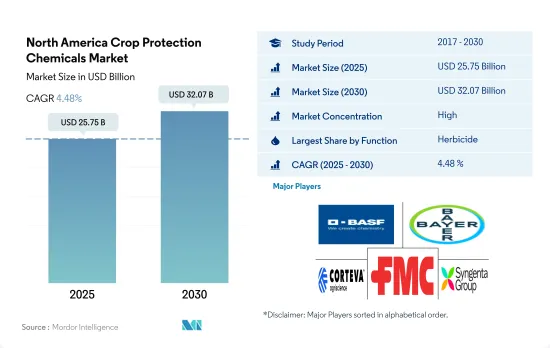

北美作物保护化学品市场规模预计在 2025 年为 257.5 亿美元,预计到 2030 年将达到 320.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.48%。

除草剂占据市场主导地位

- 农业在包括北美在内的所有国家都发挥着至关重要的作用,对GDP的贡献巨大。该地区气候多样、土壤肥沃,适合种植多种作物,包括小麦、玉米、大豆、菜籽以及各种水果和蔬菜。然而,农作物中各种病虫害的侵袭正成为农民日益严重的问题。采用各种害虫防治方法被认为是有效的解决方案。以金额为准,2022 年北美在整个作物保护化学品市场中占有第二高的份额,为 25.2%。

- 杂草对作物的侵害是该地区最常见的现象。田旋花、田旋花和马尾草都是常见的杂草,被认为会破坏作物。随着国内外对玉米和小麦的需求增加,杂草控制变得至关重要。因此,除草剂的需求不断上升,到 2022 年将占到以金额为准的 52.5% 左右。

- 油籽和作物作物的虫害对该地区的农业生产力构成了重大威胁。常见的害虫有甲虫、葡萄蛀虫、叶蝉和蚜虫。最好的解决方法是直接用新烟碱类杀虫剂喷洒种子,例如Imidacloprid或Thiamethoxam。 2022 年,杀虫剂市场以金额为准份额位居第二,为 34.3%。

- 人们对粮食安全的日益关注和各种发展正在促进更有效的种植实践,以最大限度地减少害虫对作物的影响。这推动了市场的发展,预计预测期内(2023-2029 年)的复合年增长率将达到 4.8%。

美国在作物防治需求成长中占据市场主导地位

- 北美洲的农业多样性程度很高,不同国家种植许多不同的作物。该地区气候多样,土壤肥沃,适合种植小麦、玉米、大豆、菜籽等作物以及各种水果和蔬菜。以价值计算,该地区在 2022 年整体作物保护化学品市场的份额位居第二,为 24.6%。

- 以 2022 年的以金额为准,美国占有最高份额,为 82.0%。美国农业多种多样,种植多种作物,包括小麦、玉米和大豆。它是小麦和玉米的主要生产国和出口国。然而,杂草和害虫造成的产量损失对该国的生产和农民的经济福祉构成了重大威胁。 2022年,除草剂在全国的份额最高,为53.3%。

- 同时,加拿大和墨西哥在2022年的以金额为准将分别为7.8%和5.1%。近年来,加拿大豆类产量成长迅速,农民平均每年播种350万公顷豆类。同样,加拿大油籽总产量比上一年增长了约 6%,这主要是由于油菜种植面积增加以及 2021产量反弹。高产量归功于该国采取了适当的病虫害管理措施。

- 预计该市场在 2023-2029 年预测期内的复合年增长率将达到 4.8%,这主要是由于该地区主要作物生产国病虫害的侵扰日益严重,以及农民对作物保护和有效防治病虫害的更好管理实践的认识不断提高。

北美作物保护化学品市场趋势

提高作物产量的需求是农药使用的主要动力。

- 2022年,北美每公顷农地的平均农药消费量为9.2公斤/公顷。 2022 年除草剂施用量最高,为每公顷 5.7 公斤。犁地和犁地保护性耕作方式在北美越来越受欢迎,因为它们对环境和土壤健康产生了积极影响。 2012年至2017年间,美国、加拿大和墨西哥实施密集耕作的农场数量下降了35%。然而,这种变化导致人们越来越依赖除草剂作为控制杂草的有效手段。

- 2022年每公顷杀菌剂平均消费量为1.8公斤。 2016年至2019年,美国和加拿大因真菌病害导致的玉米产量损失平均每公顷造成138.13美元的经济损失。如此严重的经济损失迫使农民使用更多的化学杀菌剂来保护作物并减少对其收益的影响。这导致对用于控制和抑制疾病爆发的杀菌剂的需求增加,从而导致农业化学投入增加。

- 2022年,每公顷农药消费量为1.5公斤。根据粮农组织统计部提供的资料,由于农药消费量减少,墨西哥种植面积最大的作物之一茄子的产量从2019年的每公顷793.0公斤下降到2021年的每公顷785.0公斤。提高农作物产量是该地区使用农药的主要驱动力。同样,随着农场虫害和产量损失的增加,杀线虫剂和杀软体动物剂的使用也增加。

由于原物料价格上涨和需求增加,预计未来几年农药价格将会上涨。

- 2022 年,Cypermethrin的价格为每吨 21,100 美元。Cypermethrin在农业中的广泛使用是因为它能够控制多种昆虫,例如蚜虫、介壳虫、斑甲虫、粉红甲虫、早斑蝽和毛虫。其有效性已被证实,因此越来越受到希望保护作物免受病虫害并确保丰收的农民的欢迎。

- Atrazine是氯化三嗪类系统性除草剂,用于在一年生禾本科植物和阔叶杂草出现之前专门针对并控制其生长。含有Atrazine的除草剂配方已被核准用于多种作物,包括玉米、甜玉米、高粱、甘蔗、小麦、澳洲坚果和番石榴。 2022年,Atrazine的价格为每吨13,800美元。

- Malathion是一种有机磷杀虫剂,用于多种作物和饲料作物,以控制多种害虫,包括蚜虫、跳甲、叶蝉和粉蚝。在美国广泛种植且经常用Malathion处理的五种作物是樱桃番茄、绿花椰菜、桑葚、蔓越莓和无花果。 2022 年Malathion的价格为每吨 12,600 美元。

- Mancozeb是一种广谱接触性杀菌剂,在美国被广泛用于多种水果、蔬菜和田间作物。预防多种真菌疾病,包括马铃薯枯萎病、叶斑病、疮痂病和銹病。它可用作马铃薯、玉米、高粱、番茄和谷物等作物的种子处理剂。 2022年的市场价格为每吨7800美元。

北美作物保护化学品产业概况

北美作物保护化学品市场相当集中,前五大公司占了74.93%的市场。市场的主要企业有:BASF公司、拜耳公司、科迪华农业科技公司、富美实公司和先正达集团。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 活性成分价格分析

- 法律规范

- 加拿大

- 墨西哥

- 美国

- 价值炼和通路分析

第五章市场区隔

- 功能

- 杀菌剂

- 除草剂

- 杀虫剂

- 杀软体动物剂

- 杀线虫剂

- 执行模式

- 化学处理

- 叶面喷布

- 熏蒸

- 种子处理

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

- 原产地

- 加拿大

- 墨西哥

- 美国

- 北美其他地区

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- ADAMA Agricultural Solutions Ltd

- American Vanguard Corporation

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 50678

The North America Crop Protection Chemicals Market size is estimated at 25.75 billion USD in 2025, and is expected to reach 32.07 billion USD by 2030, growing at a CAGR of 4.48% during the forecast period (2025-2030).

There is a dominance of herbicides in the market

- Agriculture plays a vital role in all the countries that encompass North America, as it contributes significantly to the country's GDP. The region's diverse climate and fertile land enable the cultivation of various crops, including wheat, corn, soybean, canola, and various fruits and vegetables. However, infestation of various diseases and insects on the crops has become a growing concern to the farmers. The adoption of various pest control practices has been considered an effective solution. North America occupied the second-highest share of 25.2% by value of the overall crop protection chemicals market in 2022.

- Weed attacks on crops are the most common across the region. Catchweed bedstraw, field bindweed, and horsetail are some common weeds that are considered crop-devastating. With the growing demand for maize and wheat domestically as well as internationally, the management of weeds has become imperative. This, in turn, has increased the demand for herbicides, which occupied the highest share of 52.5% by value in 2022.

- Pest infestation in oilseed and ornamental crops poses a major threat to agricultural productivity in the region. The common insect species are the bean leaf beetle, grape colaspis, leafhopper, and aphid. The optimum solution is to apply neonicotinoid pesticides on seeds directly, and application of imidacloprid or thiamethoxam. The insecticide market occupied the second-highest share of 34.3% by value in 2022.

- Increased concerns for food security and various developments have facilitated efficient methods of cultivation minimizing the impact of pests on their crops. This has driven the market, which is anticipated to register a CAGR of 4.8% during the forecast period (2023-2029).

The United States dominated the market due to the increased demand to protect crops from pests and diseases

- North America is diverse in terms of agriculture, as a wide range of crops are cultivated across different countries. The region's diverse climate and fertile land enable the cultivation of crops such as wheat, corn, soybean, canola, and various fruits and vegetables. The region occupied the second-highest share of 24.6% by value of the overall crop protection chemicals market value in 2022.

- The United States occupied the highest share of 82.0% by value in 2022. Agriculture in the United States is highly diverse, and a wide range of crops, such as wheat, maize, and soybean, are grown in the region. It is a major producer and exporter of wheat and corn. However, yield losses due to weeds and pests are a major threat to the production and the economic well-being of farmers in the country. In 2022, herbicides occupied the highest share of 53.3% in the country.

- At the same time, Canada and Mexico occupied shares of 7.8% and 5.1% by value in 2022. Pulse production in Canada has grown rapidly in recent years, where farmers seed an average of 3.5 million hectares of pulses per year. Similarly, Canada's total oilseed production rose by approximately 6% from the previous year, mainly due to the increased plantation area of Canola and yield recovery in 2021. The high yields are attributed to proper pest management practices adopted in the country.

- The market is anticipated to witness a CAGR of 4.8% during the forecast period 2023-2029, mainly due to increasing pest and disease infestation in major crop-producing countries of the region and the subsequent awareness of farmers about crop protection and better management practices for effective pest control.

North America Crop Protection Chemicals Market Trends

The need to increase the yield of the crops is majorly driving the usage of pesticides

- In 2022, the average pesticide consumption per hectare of agricultural land in North America was recorded at 9.2 kg per hectare. Herbicides recorded the highest rate of application, with 5.7 kg per hectare in 2022. Conservation tillage practices like no-till and reduced-till farming have become increasingly popular in North America due to their positive impact on the environment and soil health. Between 2012 and 2017, the United States, Canada, and Mexico witnessed a 35% decline in farms practicing intensive tillage. However, this shift has led to a greater dependence on herbicides as a means of effectively controlling weeds.

- The average per-hectare consumption of fungicides was 1.8 kg in 2022. From 2016 to 2019, the United States and Canada experienced an average economic loss of USD 138.13 per hectare due to decreased corn yields caused by fungal diseases. These substantial financial losses have driven farmers to use more chemical fungicides to safeguard their crops and mitigate the impact on their earnings. Consequently, the higher demand for fungicides to manage and control disease outbreaks has led to increased chemical inputs in agriculture.

- The per-hectare consumption of insecticides was recorded at 1.5 kg in 2022. According to the data provided by the FAO Statistics, the yield of eggplant, which is one of the most grown crops in Mexico, decreased from 793.0 kg per hectare in 2019 to 785.0 kg per hectare in 2021, the years where the insecticide consumption was reduced. The aim to increase the yield of the crops is majorly driving the usage of insecticides in the region. Similarly, the usage of nematicides and molluscicides increases with the increasing infestation and yield losses in agricultural farms.

The prices of pesticides are expected to grow in the coming years owing to the increasing raw material prices and growing demand

- In 2022, cypermethrin was valued at USD 21.1 thousand per metric ton. Its widespread utilization in agriculture owes to its proficiency in managing diverse insect varieties, such as aphids, beetles, spotted ball worms, pink ball worms, early spot borers, and hairy caterpillars. Its proven efficacy has elevated its popularity among farmers aiming to protect their crops from pests and secure a fruitful yield.

- Atrazine, a systemic herbicide classified under the chlorinated triazine group, is employed to specifically target and manage annual grasses and broadleaf weeds before they sprout. Herbicide formulations containing atrazine are approved for application on a range of crops, like corn, sweet corn, sorghum, sugarcane, wheat, macadamia nuts, and guava. In 2022, atrazine was recorded at USD 13.8 thousand per metric ton.

- Malathion is an organophosphate insecticide used to control a wide variety of food and feed crops to control many types of insects, such as aphids, fleas, leafhoppers, Japanese beetles, and other insect pests on several crops. Five crops that are extensively grown in the United States that use malathion frequently are cherry tomato, broccoli, mulberry, cranberry, and fig. Malathion was valued at USD 12.6 thousand per metric ton in 2022.

- Mancozeb is a broad-spectrum contact fungicide, which is labeled for application on numerous fruit, vegetable, and field crops within the United States. It protects against a wide spectrum of fungal diseases, including potato blight, leaf spot, scab, and rust. It fulfills the role of seed treatment for crops like potatoes, corn, sorghum, tomatoes, and cereal grains. Its market price for 2022 achieved a value of USD 7.8 thousand per metric ton.

North America Crop Protection Chemicals Industry Overview

The North America Crop Protection Chemicals Market is fairly consolidated, with the top five companies occupying 74.93%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, FMC Corporation and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Canada

- 4.3.2 Mexico

- 4.3.3 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits & Vegetables

- 5.3.3 Grains & Cereals

- 5.3.4 Pulses & Oilseeds

- 5.3.5 Turf & Ornamental

- 5.4 Country

- 5.4.1 Canada

- 5.4.2 Mexico

- 5.4.3 United States

- 5.4.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 American Vanguard Corporation

- 6.4.3 BASF SE

- 6.4.4 Bayer AG

- 6.4.5 Corteva Agriscience

- 6.4.6 FMC Corporation

- 6.4.7 Nufarm Ltd

- 6.4.8 Sumitomo Chemical Co. Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219