|

市场调查报告书

商品编码

1686259

影像感测器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Image Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

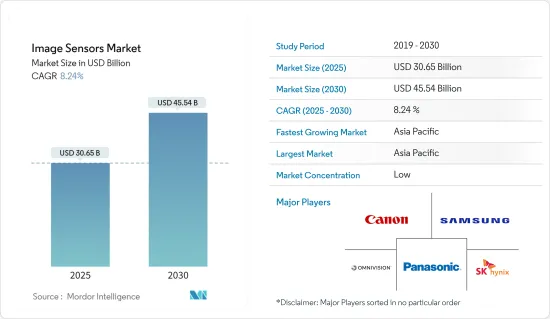

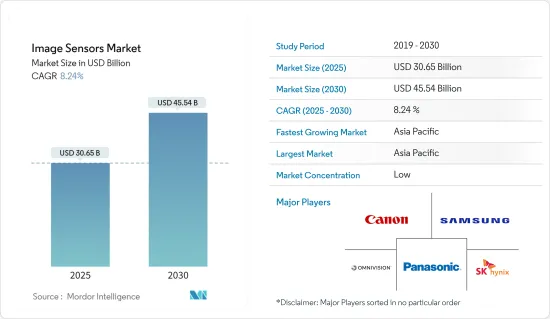

影像感测器市场规模在 2025 年预估为 306.5 亿美元,预计到 2030 年将达到 455.4 亿美元,在市场预估和预测期(2025-2030 年)内复合年增长率为 8.24%。

影像感测器主要用于许多成像设备和数位相机,以增强和储存工业、媒体、医疗和消费应用中的影像。因此,影像感测器的广泛应用领域正在推动各个终端使用者垂直领域的需求。

主要亮点

- 汽车和运输行业的视讯监控整合是各地区观察到的主要趋势之一。例如,加拿大每天有数百万人出行,为了提高公共交通的安全性,政府正在安装具有整合摄影机的综合监控系统。预计这将进一步推动对影像感测器的需求。

- 近年来,智慧型手机已成为消费性电子产品中的主要摄影设备,超越了相机和数位单眼相机。由于智慧型手机的需求不断增加,预计影像感测器市场在预测期内将实现高成长率。全球厂商都在努力提升解析度、性能、像素尺寸等关键参数,这也推动着影像感测器市场的创新。例如,三星最近为其旗舰系列智慧型手机发布了最新的 200 兆像素 (MP) 影像感测器。三星全新 ISOCELL HP2 影像感测器采用改进的像素技术和满阱容量,可提供高品质的行动影像。

- 智慧型手錶和 AR/ VR头戴装置等创新家用电子电器的日益普及正在推动对影像感测器的需求。例如,根据消费科技协会(CTA)的数据,美国穿戴式装置销售额预计将在 2023 年达到 1,380 万美元。

- 此外,所研究的市场因产品创新而得到认可,这鼓励了具有创新功能的新型影像感测器的推出。例如,ams Osram 于 2023 年 1 月扩展了其 Mira 系列高灵敏度全域百叶窗CMOS 影像感测器,推出了 2.3mm x 2.8mm、0.5Mpixel Mira050。 Mira050 对可见光和近红外线(NIR) 光均敏感,适用于眼动追踪、AR/VR/MR 耳机中的上下文识别、手势追踪、智慧门锁中的脸部辨识的 3D 深度感应以及机器人中的物体检测等应用。

- 然而,随着感测器和电子产业小型化趋势的盛行,研究市场设计和製造的复杂性不断大幅增加,对研究市场的成长构成了挑战。此外,高品质影像感测器的高成本仍然是令使用者头痛的问题,特别是在价格分布设备/设备领域。

- 宏观经济因素的影响也对研究市场的成长构成了挑战,因为消费者的经济状况显着影响着他们购买消费性电子产品的能力。例如,最近的经济放缓也导緻美国消费电子产业发展放缓,消费科技零售将从 2022 年的 5,050 亿美元下降到 2023 年的 4,850 亿美元。

影像感测器市场趋势

CMOS 影像感测器显着成长

- CMOS 影像感测器技术在多家供应商中占有重要地位,并且逐渐转向低成本相机设计。儘管 CMOS 感测器经常与以类似价格分布提供更优质影像的 CCD(电荷耦合元件)感测器进行比较,但它透过提供更多的晶片功能来简化相机设计,在低成本消费市场中占据了重要地位。

- 家用电子电器、安全性、汽车和监控都是采用 CMOS 技术的影像感测器的成长市场。近年来,内建相机的智慧型手机的普及刺激了家用电子电器产业的成长。因此,智慧型手机的广泛普及正在推动这一成长。例如,根据爱立信预测,到2028年全球智慧型手机用户数量将达到77.4亿。

- 随着 ADAS 提高驾驶员安全性以及自动驾驶汽车技术的进步,CMOS 影像感测器的车载应用不断扩展。由于政府和汽车监管机构强制采用 ADAS 和其他车载安全解决方案,预计预测期内汽车领域对 CMOS 影像感测器的需求将会成长。

- 此外,由于CMOS影像感测器能够在黑暗、昏暗和照度等各种光照条件下工作,因此在安全应用中的使用也在增加,从而加强了安全和监控领域CMOS影像感测器市场。因此,预测期内智慧安全和监控解决方案的不断普及将推动研究市场的成长。

亚太地区市场将显着成长

- 在亚太地区,受汽车和消费性电子产业显着增长的推动,影像感测器的需求多年来一直是主要驱动力。由于汽车应用和智慧型手机等家用电子电器继续采用影像感测器,预计亚太地区的影像感测器市场将在预测期内大幅扩张。

- 中国的影像感测器产量也大幅成长,国内已涌现多家影像感测器製造商,并专注于开发新产品以巩固其市场地位。例如,2023 年 4 月,Gpixel 发布了 GL3516,这是一款具有 3.5 um 像素的 16K 解析度线扫描 CMOS 影像感测器。 GL3516 非常适合需要高速扫描和 16K 解析度的工业检测应用,包括锂电池检测、平板检测、PCB 检测、标籤检测和铁路检测,并且与 Gpixel 目前的 GL7008 8K 线扫描感测器引脚和封装相容。

- 此外,印度是该地区最大和成长最快的经济体之一,其购买力的提升和数位技术的普及预计将推动该国电子市场的发展。此外,在政府的主导下,智慧城市也在印度蓬勃发展。

- 过去几十年来,印度的工业部门也取得了令人瞩目的成长,尤其是在中国和日本等国家。 「工业4.0」等趋势正在推动自动化和机器人等先进解决方案的采用,从而推动对影像感测器的需求。例如,根据国际机器人联合会的数据,中国最近在采用工业机器人方面超过了美国。

影像感测器产业竞争格局

影像感测器市场较为分散,国内外多家厂商参与,竞争较为激烈。对于任何一家市场主导企业来说,市场渗透率都不算高。高市场成长率创造了巨大的投资机会,从而引发了一系列新进者的涌入。主要参与者包括Canon、三星电子、Omnivision Technologies Inc.和Sk Hynix。

- 2023 年 3 月-Panasonic控股公司宣布开发有机光电导薄膜 (OPF) CMOS 影像感测器技术,可在各种光源照明下提供出色的色彩还原。此技术将执行光电转换的OPF部分与电路部分分离。这减少了色彩串扰并提供出色的光谱特性。

- 2023 年 1 月 - Teledyne Technologies 旗下公司 Teledyne e2v 宣布推出 Hydra3D+,这是一款新型飞行时间 (ToF) CMOS 影像感测器,解析度为 832 x 600 像素。此外,它能够有效处理各种反射并管理照明功率,使其成为中远距和户外应用的理想选择,例如监控、自动导引车、ITS 和建筑施工。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 汽车产业需求不断成长

- 垂直应用对手势姿态辨识/控制的需求

- 市场挑战

- CCD 技术市场萎缩为OEM带来挑战

第六章 市场细分

- 按类型

- CMOS

- CCD

- 按最终用户产业

- 家电

- 卫生保健

- 产业

- 安全与监控

- 汽车与运输

- 航太和国防

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 世界其他地区

- 北美洲

第七章 竞争格局

- 公司简介

- Canon Inc.

- Ams AG

- Omnivision Technologies Inc.

- Panasonic Corporation

- Samsung Electronics Co. Ltd

- Sony Corporation

- STMicroelectronics NV

- Teledyne DALSA Inc.

- SK Hynix Inc.

- GalaxyCore Inc.

- Hamamatsu Photonics KK

第八章投资分析

第九章 市场机会与未来趋势

The Image Sensors Market size is estimated at USD 30.65 billion in 2025, and is expected to reach USD 45.54 billion by 2030, at a CAGR of 8.24% during the forecast period (2025-2030).

The image sensors are used primarily in many imaging devices and digital cameras to enhance the image's quality of picturization and storage with its applications in industrial, media, medical, and consumer applications. Hence, the wide application area of image sensors drives their demand across various end-user verticals.

Key Highlights

- The integration of video surveillance in the automotive and transportation industry is one of the significant trends observed across various regions. For instance, to enhance security for the Canadian Public Transportation System, with the country having millions of daily traffic, the government has deployed a unified surveillance System with integrated cameras. This is further expected to surge the demand for image sensors.

- In recent years, the smartphone has become the primary camera device in consumer electronics, dominating still cameras and DSLRs. Due to the growing demand for smartphones, the image sensors market is expected to record a high growth rate during the forecast period. Manufacturers worldwide have been striving to improve major parameters, such as resolution, performance, and pixel size, which are also driving innovations in the image sensors market. For example, Samsung has recently introduced its latest 200-megapixel (MP) image sensor for its flagship series of smartphones. Samsung's new ISOCELL HP2 image sensors feature improved pixel technology and full-well capacity for high-quality mobile images.

- The growing popularity of innovative consumer electronic devices, such as smartwatches, AR/VR headsets, etc., is driving the demand for image sensors. For instance, according to the Consumer Technology Association (CTA), the sales revenue of wearables in the United States is anticipated to reach USD 13.8 million in 2023.

- Also, the companies are recognized for their product innovation in the studied market, which is encouraging them to launch new image sensors with innovative features. For instance, in January 2023, ams OSRAM extended its Mira family of high-sensitivity, global shutter CMOS image sensors with the introduction of the 2.3mm x 2.8mm, 0.5Mpixel Mira050, a highly sensitive sensor that enables engineering designers to save power and space in wearable and mobile devices. Its sensitivity to both visible and near-infrared (NIR) light makes Mira050 suitable for applications such as eye tracking, contextual awareness in AR/VR/MR headsets, gesture tracking, 3D depth sensing for face recognition in smart door locks, and object detection in robots.

- However, with the miniaturization trend prevailing in the sensor and electronic device industry, the design and manufacturing complexity in the studied market continues to grow significantly, which continues to challenge the studied market's growth. Additionally, the high cost of quality image sensors also continues to remain a major pain point for users, especially in the lower and mid-range device/equipment segment.

- The impact of macroeconomic factors is also a challenging factor for the studied market's growth as the economic condition of consumers largely impacts their buying capability of consumer electronic products. For instance, owing to the recent economic slowdown, the consumer electronics industry in the United States has also been witnessing a slowdown, with consumer technology retail revenue taking a dip to reach USD 485 billion in 2023, compared to USD 505 billion in 2022.

Image Sensors Market Trends

CMOS Image Sensor to Witnesses a Significant Growth

- CMOS image sensor technology, with several vendors marking their presence, is sustaining its vigorous shift into low-cost camera designs. Although often compared to CCD (charge-coupled device) sensors with superior image quality in a similar price range, CMOS sensors are establishing a strong foothold at the low-cost end of the consumer device market by offering more functions on-chip for simplified camera design.

- Consumer electronics, security, automotive, and surveillance are all growing markets for image sensors utilizing CMOS technology. Over the years, the rise of the consumer electronics sector has been spurred by the growing popularity of smartphones with built-in cameras. Hence, the growing adoption of smartphones is aiding this growth. For instance, according to Ericsson, global smartphone subscriptions are anticipated to reach 7,740 million by 2028,

- The expansion of the automotive applications of CMOS image sensors is spurred by the advancements in driver safety with the help of ADAS and the innovation of self-driving automobiles. With government and automotive industry regulatory authorities mandating the adoption of ADAS and other automotive security solutions, the demand for CMOS image sensors is anticipated to grow in the automotive domain during the forecast period.

- Furthermore, the capacity of CMOS image sensors to work in different lighting conditions, including darkness, dim light, and low light, has also raised the use of CMOS image sensors for security applications, bolstering the CMOS image sensor market for security and surveillance. Hence, the growing penetration of smart security and surveillance solutions will continue to drive the studied market's growth during the forecast period.

Asia-Pacific to Witness Significant Market Growth

- Over the years, the demand for image sensors has gained significant traction in the Asia Pacific region, owing to the remarkable growth of the automotive and consumer electronics industry. Due to the continued uptake of image sensors for automotive applications and applications in smartphones and other consumer electronic devices, the Asia Pacific image sensors market is anticipated to expand significantly over the projected period.

- China is also showing significant growth in image sensor production owing to the emergence of several image sensor manufacturers in the country who are majorly focusing on inventing new products to strengthen their market positions. For instance, in April 2023, Gpixel introduced the GL3516 16K resolution line scan CMOS image sensor with 3.5 um pixels, producing an image diagonal of 57.3 mm and a line rate of 120 kHz. With features that make it perfect for industrial inspection applications requiring high-speed scanning and 16K resolution, such as lithium battery testing, flat panel inspection, PCB inspection, label inspection, and railway inspection, the GL3516 is pin and footprint compatible with Gpixel's current GL7008 8K line scan sensor.

- Moreover, India is one of the largest and fastest-growing economies in the region; the growing purchasing power and the rising penetration of digital technologies are expected to drive the market for electronic goods in the country. Furthermore, the country is also seeing growth in smart cities due to government initiatives.

- Over the past few decades, the industrial sector in India has also witnessed remarkable growth, especially in countries such as China, Japan, etc. With trends such as "Industry 4.0," which governs a higher adoption of advanced solutions such as automation and robotics, the demand for image sensors is also growing. For instance, according to IFR, recently, China overtook the United States in terms of the adoption of industrial robots.

Image Sensors Industry Competitive Landscape

The Image Sensors Market is fragmented in nature due to the presence of several local and global players, which also makes the competitive rivalry intense. Levels of market penetration are not massive for any of the prevailing players in the market. Due to the high market growth rate, it is a significant investment opportunity; therefore, new entrants are entering the market. Key players are Canon Inc., Samsung Electronics Co. Ltd., Omnivision Technologies Inc., Sk Hynix, etc.

- March 2023 - Panasonic Holdings Corporation announced the development of an Organic Photoconductive Film (OPF) CMOS Image Sensor Technology that can achieve excellent color reproducibility under various light source irradiation. According to the company, the new technology separates the OPF part that performs photoelectric conversion from the circuit part. Allowing it to reduce color crosstalk and obtain excellent spectral characteristics.

- January 2023 - Teledyne e2v, a part of Teledyne Technologies, released its Hydra3D+, a new Time-of-Flight (ToF) CMOS image sensor that incorporates 832 x 600-pixel resolution, making it tailored for versatile 3D detection and measurement. Furthermore, its ability to effectively handle a wide range of reflectivity and manage lighting power makes it ideal for mid/long-range distances and outdoor applications such as surveillance, automated guided vehicles, ITS, and building construction.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment on the Impact of COVID-19 on the market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand in Automotive Sector

- 5.1.2 Demand for Gesture Recognition/Control in Vertical Applications

- 5.2 Market Challenges

- 5.2.1 Diminishing CCD technology market would pose a challenge to OEMs

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 CMOS

- 6.1.2 CCD

- 6.2 By End-user Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Healthcare

- 6.2.3 Industrial

- 6.2.4 Security and Surveillance

- 6.2.5 Automotive and Transportation

- 6.2.6 Aerospace and Defense

- 6.2.7 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Rest of the World

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Canon Inc.

- 7.1.2 Ams AG

- 7.1.3 Omnivision Technologies Inc.

- 7.1.4 Panasonic Corporation

- 7.1.5 Samsung Electronics Co. Ltd

- 7.1.6 Sony Corporation

- 7.1.7 STMicroelectronics NV

- 7.1.8 Teledyne DALSA Inc.

- 7.1.9 SK Hynix Inc.

- 7.1.10 GalaxyCore Inc.

- 7.1.11 Hamamatsu Photonics K.K.