|

市场调查报告书

商品编码

1686272

蒸发冷却:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Evaporative Cooling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

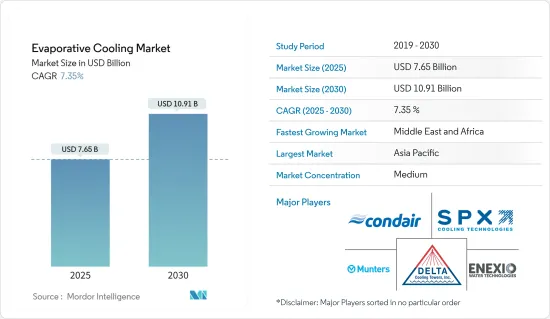

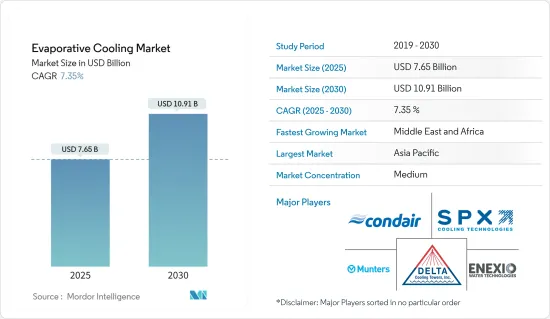

2025 年蒸发冷却市场规模预估为 76.5 亿美元,预计到 2030 年将达到 109.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.35%。

主要亮点

- 气候变迁导致热浪更加频繁,数百万人面临致命高温的威胁。气温升高影响着全世界的人们,迫切需要在不减少碳排放的情况下解决冷气需求。

- 与空调系统相比,蒸发冷却器使用更少的部件来冷却房间,包括风扇、泵浦和水,因此它们可以以极低的成本和最低的营业成本冷却各种空间。这种蒸发冷却系统的拥有低成本是其主要优点之一。

- 此外,世界各国政府都在提供节能计画来推广节能技术。例如,蒸发冷却已被证明是一种永续的冷却技术,因此这些系统有资格获得荷兰的能源投资补贴(EIA),这可以导致总投资的净回报超过 11%。

- 此外,这些系统使用零件少、节能,使得蒸发冷却成为市场上最经济的冷却选择之一。例如,Canstar Blue 估计典型的逆循环分离式空调每小时的运作约为 0.60 美元。然而,只要额外增加0.02美元的水费,蒸发冷却系统的成本就会降至每小时不到0.10美元。

- 这些蒸发冷却系统的主要缺点之一是它们高度依赖周围空气的品质。蒸发冷却过程是由周围空气的干球温度和湿球温度之间的温差驱动的,在中高湿度地区,这种温差可以忽略不计,从而导致冷却能力有限。

- 同时,印度暖气、冷冻与空调工程师学会(ISHRAE)和其他全球监管机构也敦促在当前疫情情况下增加新鲜空气的吸入和通风。这迫使最终用户考虑安装蒸发冷却系统。蒸发冷却系统可以显着改善室内空气品质,并以更少的能源消耗提供更安全的工作空间。

蒸发冷却的市场趋势

直接蒸发冷却占很大份额

- 直接蒸发冷却利用汽化潜热将液态水转化为水蒸气,从而降低温度并增加空气湿度。这是最基本、最传统的蒸发冷却类型,被广泛使用。预计这些蒸发冷却剂在美国南部将拥有有限的利基市场,因为那里七月中午的相对湿度超过 40%。

- 直接蒸发冷却系统也适用于需要大量替换热负荷并且不介意为此使用外部空气的应用。其应用广泛应用于舒适度标准宽鬆的建筑物、仓库、商务用厨房和住宅。因此,系统要求取决于最终使用者和既定的操作性能标准。大多数建筑物使用自然蒸发冷却系统,但也会使用间接冷却。

- 在所有终端用户应用中,工业领域占据了最大的市场占有率,这得益于直接蒸发冷却器的大规模部署。直接蒸发冷却器的工业应用包括建筑物、仓库、工厂、製造单位、发电、石油和天然气、建筑等等。

- 此外,工业部门正在部署先进的蒸发冷却系统,以便在问题出现之前预测维护需求。采用物联网 (IoT) 技术的现代化冷却技术包括感测器、连接、软体和其他允许系统与其他连接设备通讯的组件。物联网解决方案透过收集设备状态和空气品质资讯来增强预防性保养。

- 因此,许多公司都专注于直接蒸发冷却(DEC),这是冷却资料中心最节能的方式。例如,Munters 于 2021 年 4 月将其维吉尼亚的员工迁移至新工厂,以扩大其资料中心冷却部门,其中包括自然蒸发冷却。该工厂占地 365,000 平方英尺,用于製造、研发和销售,该公司的投资目标为 3,600 万美元。

亚太地区占较大市场占有率

- 随着气温升高和收益增加,东南亚地区的空调销售需求将大幅成长,预计到 2040 年将达到 3 亿台,其中印尼预计将供应全球一半的空调。

- 此外,根据国际能源总署的调查,中国、美国和日本占据空调销售的主导地位,其中印度和印尼的增幅最为显着。过去10年,中国空调销量已超过5亿台,但印度和印尼的空调需求成长更为迅速,两国空调安装台数年均增幅均超过15%。 (印度)

- 南亚地区空调需求成长迅速,需要经济、简单的冷冻技术。考虑到这些国家的二氧化碳排放目标,蒸发冷却是最好的解决方案之一。东南亚是亚太地区成长最快的资料中心市场之一。

- 然而,随着微软、谷歌和苹果等全球主要企业制定碳中和和零可持续发展目标的标准,并开发出尖端节能技术,永续性预计将在未来几年成为亚洲资料中心提供商之间的关键差异化因素。

- 资料中心冷却是亚洲永续性的一大障碍,占总能源需求的 35% 至 40%。目前,亚洲的大多数资料中心都采用风冷,这是一种效率极低且昂贵的解决方案。

- 该地区的公司越来越多地转向蒸发冷却技术。例如,蒸发冷却等冷却技术使资料中心永续。随着资料中心变得更加动态以满足数位化的需求,这些技术使企业能够采用间接蒸发、直接蒸发、混合系统和液体冷却来降低电源使用效率 (PUE) 和整体能源使用量。

蒸发冷却产业概况

蒸发冷却市场竞争适中,由几家大公司组成。从市场占有率来看,目前少数几家大公司占据着市场主导地位。这些大公司凭藉其主导的市场占有率,正专注于扩大海外基本客群。主要企业包括 Delta Cooling Towers Inc.、Condair Group AG 和 SPX Cooling Technologies。预计竞争和快速的技术进步将在预测期内对公司的成长构成威胁。

2023年5月,小米有品推出米家智慧蒸发冷风扇,提供消费者清爽舒适的室内环境。该公司的智慧风扇设计集通风、降温、加湿三种功能于一体。配备循环水冷系统,透过添加水、结晶可提供多种冷却效果。创新无线水箱专利设计,随时可将水箱从主机上拆下清洗,卫生又方便。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 产业影响评估

- 蒸发冷却热点分析

- 住宅和商业领域部署的替代/替代冷却技术的比较分析

第五章 市场动态

- 市场驱动因素

- 对经济高效的冷却解决方案的需求

- 市场限制

- 对外部气候的依赖

第六章 市场细分

- 按冷却类型

- 直接蒸发冷却

- 间接蒸发冷却

- 两级蒸发冷却

- 按应用

- 住宅用途

- 商业用途

- 工业应用

- 月子农场

- 其他用途

- 按分销管道

- 大型零售商店

- 暖通空调承包商和经销商

- 其他分销管道

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- Delta Cooling Towers Inc.

- Condair Group AG

- SPX Cooling Technologies

- Baltimore Aircoil Company Inc.

- Munters Group AB

- Colt Group Limited

- Phoenix Manufacturing Inc.

- Bonaire

- ENEXIO Water Technologies GmbH

- CFW Evapcool

- Celsius Design Limited

第八章投资分析

第 9 章:未来趋势

The Evaporative Cooling Market size is estimated at USD 7.65 billion in 2025, and is expected to reach USD 10.91 billion by 2030, at a CAGR of 7.35% during the forecast period (2025-2030).

Key Highlights

- As heat waves happen more frequently owing to climate change, millions of people are in danger of exposure to temperatures that could be fatal. People worldwide have been impacted by rising temperatures, making it imperative to address the need for cooling without having a negative carbon footprint, which has been a significant element driving the industry.

- Because evaporative coolers employ fewer parts than air conditioning systems, such as a fan, pump, and water, to chill the room, they can cool various spaces for a meager cost and with minimal operational costs. These evaporative cooling systems' low ownership costs are one of their main benefits.

- Additionally, various governments worldwide have been offering saving programs to promote energy-efficient technologies. For example, as evaporative cooling has been a proven sustainable cooling technology, these systems have been made eligible for the Energy Investment Deduction (EIA) in the Netherlands, which could result in more than 11% net benefit on the entire investment.

- Furthermore, because these systems use fewer components and are, therefore, more energy efficient, evaporative cooling has been one of the most affordable cooling options on the market. For instance, Canstar Blue estimates that the typical reverse cycle split system air conditioner may run at about USD 0.60 per hour. However, with an additional USD 0.02 for water, an evaporative cooling system may cost less than USD 0.10 per hour.

- These evaporative cooling systems' high reliance on the surrounding air quality has been one of their main disadvantages. Since the evaporative cooling process is driven by the temperature difference between the ambient air's dry and wet bulb temperatures, this difference is negligible for moderate and highly humid regions, which results in a constrained cooling capacity.

- On the other hand, the Indian Society of Heating, Refrigerating and Air Conditioning Engineers (ISHRAE), among other regulating authorities globally, has urged more fresh air intake and ventilation in the current pandemic scenario. Due to this, end users are now compelled to consider integrating evaporative cooling systems, which might significantly improve indoor air quality and offer secure workspaces with less energy use.

Evaporative Cooling Market Trends

Direct Evaporative Cooling to Hold a Major Share

- By utilizing the latent heat of evaporation, which transforms liquid water into water vapor, direct evaporative cooling reduces the temperature and raises air humidity. It is the most basic, traditional, and widely utilized form of evaporative cooling. These evaporative coolants are anticipated to have a limited niche market in the United States, mainly in the south, where the relative humidity at noon in July is above 40%.

- The direct evaporative cooling systems are also appropriate for applications that require significant heat-load replacement and are willing to use outside air to do it. Their applications are widely used in buildings, warehouses, commercial kitchens, and residential settings with laxer comfort standards. The system requirements, therefore, depend on the end users and the established operational performance criteria. Most buildings' evaporative coolers are natural systems, while some indirect ones are also employed.

- The industrial sector accounts for the largest market share among all end-user applications, driven by the large-scale deployment of direct evaporative coolers. The industrial applications for direct evaporative coolers include Buildings, warehouses, factories, manufacturing units, power generation, oil and gas, construction, and many more.

- Additionally, the industrial sectors implement advanced evaporative cooling systems to foresee the need for maintenance before a problem arises. The most recent cooling technologies, which employ Internet of Things (IoT) techniques, contain sensors, connections, software, and other components that let the system communicate with other connected devices. IoT solutions enhance preventative maintenance by collecting information on equipment status and air quality.

- As a result, many businesses concentrate on direct evaporative cooling (DEC), frequently the most energy-efficient method of cooling a data center. To grow its data center cooling sector, which includes natural evaporative cooling, Munters, for instance, shifted its Virginia staff to the new facility in April 2021. A 365,000-square-foot facility for manufacturing, R&D, and sales was the company's USD 36 million investment target.

The Asia-Pacific Region to Hold Significant Market Share

- The Southeast Asian region is anticipated to experience a significant demand for AC sales, driven by rising temperatures and rising earnings, expected to reach 300 million units by 2040; it is anticipated that Indonesia will supply half of the world's air conditioning units.

- In addition, research from the International Energy Agency states that cooling equipment sales are dominated by China, the United States, and Japan, with India and Indonesia experiencing the most significant rise. Although China sold over 500 million units in the past ten years, India and Indonesia had a relative increase in demand for air conditioning that was more rapid, with average yearly installations expanding at a pace of over 15% in both countries. (India)

- South Asia is experiencing exponential growth in the demand for air conditioning, driving the need for economic and simple cooling techniques. When considering these nations' targets for reducing carbon emissions, evaporative cooling is one of the finest solutions. Southeast Asia boasts among the Asia-Pacific region's fastest-growing data center marketplaces, although the sustainability of these facilities is still a problem for the area.

- Nevertheless, it is anticipated that in the upcoming years, sustainability will become a key differentiator in Asia between data center providers, particularly as leading tech companies around the world, like Microsoft, Google, and Apple, set standards with carbon neutral and zero sustainability goals and as cutting-edge energy-efficient technology is developed.

- Since data center cooling accounts for between 35% and 40% of overall energy demand, it represents a significant hurdle to sustainability in Asia. Most data centers in the area currently employ air-based cooling, a very ineffective and expensive solution.

- Companies in the area are switching more and more to evaporative cooling techniques. For instance, data centers can be sustainable thanks to cooling technology like evaporative cooling. As data centers become more prominent to accommodate the demands of digitalization, these technologies enable businesses to employ indirect evaporative, direct evaporative, hybrid systems, and liquid cooling to reduce Power Usage Effectiveness (PUE) and overall energy usage.

Evaporative Cooling Industry Overview

The Evaporative Cooling Market is moderately competitive and consists of several major players. In terms of market share, few of the major players currently dominate the market. With a prominent share in the market, these major players are focusing on expanding their customer base across foreign countries. The major players include companies like Delta Cooling Towers Inc., Condair Group AG, SPX Cooling Technologies, etc. The competition and rapid technological advancements are expected to pose a threat to the growth of the companies during the forecast period.

In May 2023, Xiaomi Youpin launched the MIJIA Smart Evaporative Cooling Fan, which provides its customers with a refreshing and comfortable indoor environment. The smart fan launched by the company has been designed to provide three effects in one - blowing, cooling, and humidifying. It would be equipped with a circulating water cooling system, which allows the addition of water and ice crystals to bring different cooling effects. The innovative wireless water tank patent design allows the tank to be removed from the body for cleaning at any time, ensuring hygiene and convenience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes Products

- 4.4 An Assessment of the Impact of COVID-19 on the industry

- 4.5 Analysis of the Evaporative Cooling Hotspot

- 4.6 Comparative Analysis of Alternative/Substitute Cooling Technologies Deployed in the Residential and Commercial Sectors

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Cost-effective Cooling Solution

- 5.2 Market Restraints

- 5.2.1 Dependency on External Climate

6 MARKET SEGMENTATION

- 6.1 By Type of Cooling

- 6.1.1 Direct Evaporative Cooling

- 6.1.2 Indirect Evaporative Cooling

- 6.1.3 Two-stage Evaporative Cooling

- 6.2 By Application

- 6.2.1 Residential Applications

- 6.2.2 Commercial Applications

- 6.2.3 Industrial Applications

- 6.2.4 Confinement Farming

- 6.2.5 Other Applications

- 6.3 By Distribution Channel

- 6.3.1 Big-box Retailers

- 6.3.2 HVAC Contractors and Distributors

- 6.3.3 Other Distribution Channels

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Delta Cooling Towers Inc.

- 7.1.2 Condair Group AG

- 7.1.3 SPX Cooling Technologies

- 7.1.4 Baltimore Aircoil Company Inc.

- 7.1.5 Munters Group AB

- 7.1.6 Colt Group Limited

- 7.1.7 Phoenix Manufacturing Inc.

- 7.1.8 Bonaire

- 7.1.9 ENEXIO Water Technologies GmbH

- 7.1.10 CFW Evapcool

- 7.1.11 Celsius Design Limited