|

市场调查报告书

商品编码

1686531

拉丁美洲电池:市场占有率分析、行业趋势和成长预测(2025-2030 年)South and Central America Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

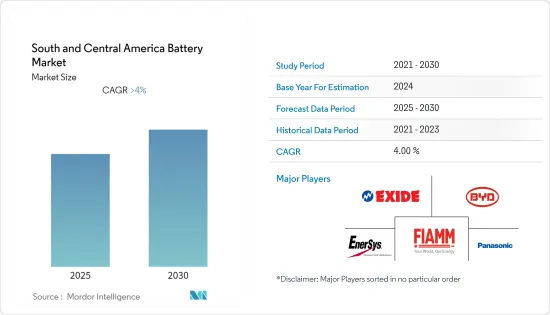

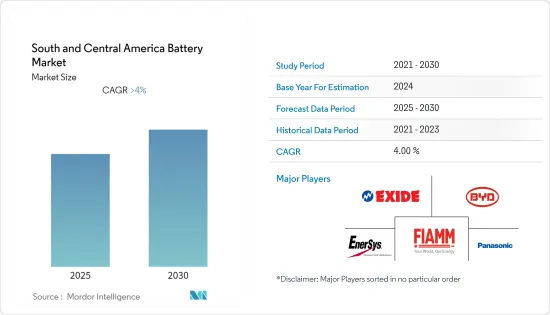

预计预测期内拉丁美洲电池市场的复合年增长率将超过 4%。

2020年,新冠疫情对市场产生了负面影响。目前市场已恢復至疫情前的水准。

主要亮点

- 从长远来看,推动拉丁美洲电池市场发展的主要因素包括锂离子电池价格下降、电动车的普及以及可再生能源领域的扩张。此外,随着资料中心正在发展其用于云端服务的数位基础设施,资料中心不断增长的需求也可能推动市场的发展。下一代云端服务可能会采用区块链网路。

- 另一方面,原材料供需不匹配可能会阻碍市场成长。

- 巴西和阿根廷等国家的资料中心的增长以及商业基础设施的经济发展日益加快预计将为拉丁美洲电池市场创造巨大的机会。

- 由于消费品需求不断增长以及投资不断增加,巴西可望主导拉丁美洲市场。

拉丁美洲电池市场趋势

锂离子电池占市场主导地位

- 在锂离子电池产业发展的早期阶段,消费性电子领域是电池的主要消费者。然而,近年来,随着电动车(EV)销量的成长,电动车(EV)製造商已成为锂离子电池的最大消费者。

- 电动车不会排放二氧化碳或氮氧化物等温室气体,因此对环境的影响比传统内燃机汽车 (ICE) 更小。由于这些优势,许多国家正在推出补贴和政府计划来鼓励使用电动车。

- 2022年7月,巴西政府发布行政命令,放宽锂出口限制。目前,巴西占全球锂离子产量的1.5%,由两家公司营运:CBL和AMG Brasil。

- 2022年11月,阿根廷宣布计划在必要设备从中国运抵拉普拉塔市后开始营运该国第一家锂电池工厂。该工厂将由拉普拉塔国立大学(UNLP)、YPF-Tecnologia(Y-TEC)和国家科学技术研究委员会(CONICET)在科技创新部的支持下建造。

- 由于这些因素,预计锂离子电池将在预测期内主导拉丁美洲电池市场。

巴西占市场主导地位

- 巴西是消费电池最大的市场之一,这主要是因为消费品需求量大。巴西对消费性电子产品的需求正在增加,这可能会大大促进市场的发展。

- 在巴西,一次电池的主要供应国是中国、美国、德国等,巴西一次电池的进口额远超过其出口额,显示巴西对进口的依赖程度很高,以满足一次电池的需求。巴西对一次电池的需求由海外製造商的经销商网路和通路合作伙伴满足。

- 巴西的电池需求将受到电力需求的推动,预计2014年至2024年间电力需求将以约2.7%的成长率成长,进而导致备用电力源的需求增加。

- Rota 2030计画旨在提高交通运输领域的能源效率,为巴西的电动车市场提供重大推动力。预计在预测期内,电动车普及率的激增将为巴西电池市场提供显着推动力。

- 截至2022年2月,荷兰先进冶金集团(AMG)巴西子公司AMG Mineracao在巴西的锂精矿年产能为13万吨。同时,加拿大 Sigma Lithium Resources 旗下子公司 Sigma Mineração 计划在其位于 Grota do Cirilo 的综合设施中实现 220,000 吨精矿产能。

- 2022年4月,巴西矿业公司CBMM宣布计画开始为快速充电电动机车供应铌电池单元,采用与东芝共同开发的技术。东芝计划生产 4,000 个电池单元,以便与最终用户进行技术检验。

- 因此,预计预测期内巴西将对拉丁美洲电池市场产生正面影响。

拉丁美洲电池产业概况

拉丁美洲电池市场相当分散。主要企业(不分先后顺序)包括 Exide Industries Ltd、比亚迪股份有限公司、FIAMM Energy Technology SpA、Panasonic Corporation和 EnerSys。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概述

- 介绍

- 2027 年市场规模与需求预测

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章市场区隔

- 类型

- 一次电池

- 二次电池

- 科技

- 铅酸电池

- 锂离子电池

- 其他技术

- 应用

- 汽车领域

- 工业电池(动力、固定(电信、UPS、能源储存系统(ESS) 等))

- 消费性电子产品

- 其他用途

- 地区

- 巴西

- 阿根廷

- 哥伦比亚

- 其他拉丁美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 市场占有率分析

- 公司简介

- BYD Company Ltd

- Duracell Inc.

- EnerSys

- Panasonic Corporation

- Saft Groupe SA

- Exide Industries Ltd

- Clarios

- FIAMM Energy Technology SpA

第七章 市场机会与未来趋势

简介目录

Product Code: 52300

The South and Central America Battery Market is expected to register a CAGR of greater than 4% during the forecast period.

The COVID-19 outbreak negatively impacted the market in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, major factors driving the South and Central American battery market include declining lithium-ion battery prices, increasing adoption of electric vehicles, and the growing renewable energy sector. Increasing demand from data centers is also likely to drive the market as data centers are evolving digital infrastructures for cloud services. The next generation of cloud service may be adopted to incorporate a blockchain network.

- On the other hand, the demand-supply mismatch of raw materials is likely to hinder the market's growth.

- Increasing the growth in data centers and economic development in countries like Brazil and Argentina for commercial infrastructure are expected to create immense opportunities for the South and Central American battery market.

- Brazil is expected to dominate the market in South and Central America due to the rising demand for consumer goods and increasing investments in the country.

South and Central America Battery Market Trends

Lithium-ion Batteries to Dominate the Market

- In the early stages of the lithium-ion battery industry, the consumer electronics sector was the major consumer of batteries. However, in recent years, electric vehicle (EV) manufacturers have become the biggest consumers of lithium-ion batteries due to the growing sales of EVs.

- EVs do not emit CO2, NOX, or any other greenhouse gases and, hence, have a lower environmental impact compared to conventional internal combustion engine (ICE) vehicles. Due to this advantage, many countries are encouraging the use of EVs by introducing subsidies and government programs.

- In July 2022, the Brazilian government issued an executive order to relax the rules on lithium export. Currently, Brazil accounts for 1.5% of global production of lithium-ion, and two companies are operational in the region, i.e., CBL and AMG Brazil.

- In November 2022, Argentina announced its plans to begin operations at its first lithium battery plant after the necessary equipment arrived in the city of La Plata from China. The plant will be constructed by Universidad Nacional de La Plata (UNLP), YPF-Tecnologia (Y-TEC), and the National Scientific and Technical Research Council (CONICET), with the support of the Ministry of Science, Technology, and Innovation.

- Owing to such factors, lithium-ion batteries are expected to dominate the South and Central American battery market during the forecast period.

Brazil to Dominate the Market

- Brazil is one of the largest markets for consumer batteries, mainly due to the high demand for consumer goods. The demand for consumer electronics in Brazil is increasing, which may offer a significant boost for the market studied.

- In Brazil, the major supplier countries for primary batteries include China, the United States, and Germany. The import value of primary batteries in Brazil is way higher than the export, which signifies the high dependency on imports to meet the requirements of primary batteries. Distributor networks and channel partners of overseas manufacturing firms cater to the demand for primary batteries in Brazil.

- The battery demand in Brazil is boosted by the demand for electricity, which is anticipated to register a growth rate of about 2.7% during 2014-2024, leading to an increasing requirement of standby sources of electricity.

- The Rota 2030 program is aimed at improving energy efficiency in the transportation sector, which is a major boost for the Brazilian electric vehicle market. The surge in the deployment of electric vehicles is likely to provide a significant impetus to the Brazilian battery market during the forecast period.

- As of February 2022, AMG Mineracao, a Brazilian subsidiary of Dutch Advanced Metallurgical Group (AMG), had an annual lithium production capacity of 130 thousand metric ton of concentrate in Brazil. Meanwhile, Sigma Mineracao, part of Canada-based Sigma Lithium Resources, had planned a capacity of 220 thousand ton of concentrate in its complex at Grota do Cirilo.

- In April 2022, Brazilian mining company CBMM announced its plans to start using technology it developed with Toshiba to supply niobium battery cells for fast-charging electric motorcycles. Toshiba is planning to produce 4,000 battery cells to validate the technology with the end user.

- Therefore, due to such factors, Brazil is expected to have a positive impact on the battery market in South and Central America during the forecast period.

South and Central America Battery Industry Overview

The South and Central American battery market is moderately fragmented. Some of the major players (in particular order) include Exide Industries Ltd, BYD Company Ltd, FIAMM Energy Technology SpA, Panasonic Corporation, and EnerSys.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Primary Battery

- 5.1.2 Secondary Battery

- 5.2 Technology

- 5.2.1 Lead-acid Battery

- 5.2.2 Lithium-ion Battery

- 5.2.3 Other Technologies

- 5.3 Application

- 5.3.1 Automotive

- 5.3.2 Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- 5.3.3 Consumer Electronics

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Colombia

- 5.4.4 Rest of South and Central America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 BYD Company Ltd

- 6.4.2 Duracell Inc.

- 6.4.3 EnerSys

- 6.4.4 Panasonic Corporation

- 6.4.5 Saft Groupe SA

- 6.4.6 Exide Industries Ltd

- 6.4.7 Clarios

- 6.4.8 FIAMM Energy Technology SpA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219