|

市场调查报告书

商品编码

1686539

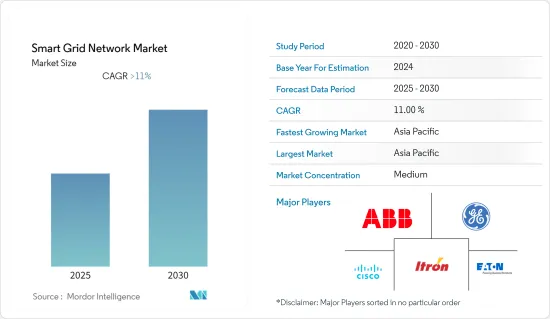

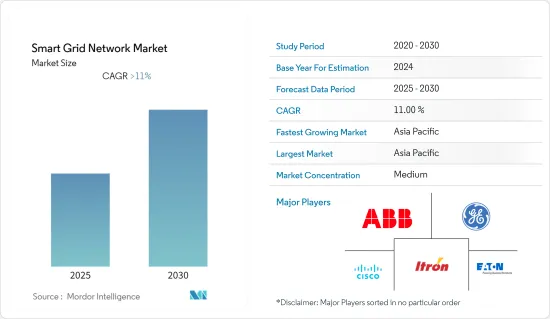

智慧电网-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Smart Grid Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预计预测期内智慧电网市场复合年增长率将超过 11%。

主要亮点

- 由于全球已开发经济体和新兴经济体越来越多地采用智慧电网技术,预计高级计量基础设施 (AMI) 在预测期内将显着增长。

- 世界各国新兴低度开发国家的政府越来越多地将智慧电网技术视为维持长期经济繁荣并有助于实现碳排放目标的战略性基础设施投资。预计这将在不久的将来为参与智慧电网网路市场的公司创造充足的商机。

- 预计亚太地区将在预测期内占据市场主导地位,大部分需求来自中国、印度和日本。

智慧电网市场趋势

先进测量基础设施 (AMI) 将实现显着成长

- 先进计量基础设施 (AMI) 或智慧计量是智慧电錶、通讯网路和资料管理系统的整合系统。它实现了公用事业公司和客户之间的双向通讯。

- 近年来,计量行业取得了快速发展,从自动抄表(AMR)过渡到使用双向通讯的智慧电錶,为配电公司(DISCOM)、客户和社会带来了更大的利益。

- AMI 提供了显着的营运优势,为公用事业节省了成本并为客户提供了更多便利。 AMI 可以透过远端读取仪表、连接和断开服务、识别中断、更快地产生更准确的帐单以及允许公用事业公司为客户提供使用资讯的数位访问,显着降低公用事业营运成本。

- 随着电网现代化和减少输配电损耗的力度不断加大,世界各国政府都在投资先进的计量基础设施。预计这将在预测期内推动 AMI 市场的发展。

亚太地区占市场主导地位

- 预计亚太地区将在2021年主导智慧电网市场。在中国、印度和日本等国家的支持下,预计未来这种主导地位将持续下去。

- 中国的目标是到2025年成为全球电力设备领导者。这是《中国製造2025》计画技术蓝图(2017年)中提出的国家战略。创新和技术是国家计划的重点。已拨出大量资金支持发展。

- 2015年,国家发展改革委、国家能源局强调,大力发展智慧电网,提高电网承载能力和优化能源资源配置能力,促进清洁能源和分散式能源利用,建构安全、高效、清洁的现代化能源系统。

- 同样,2020年,印度成为世界第三大发电国。这种电力来自传统能源和可再生能源。该国透过政府主导的各项「全民用电」计划,在改善城乡都市区的电力供应方面取得了巨大进展。

- 国家智慧电网计画(NSGM)于 2015 年 5 月宣布,预算为 98 亿印度卢比,支出为 33.8 亿印度卢比,标誌着电力产业现代化的第一步。

- 2019 年 8 月,印度联邦电力部下属四家公共部门企业的合资企业能源效率服务有限公司 (EESL) 为印度北方邦的一个智慧电錶计划投资了 270 亿印度卢比。在这个雄心勃勃的计划下,EESL 计划在三年内(2019-2022 年)在该州电力消耗处安装 400 万个电錶。

- 因此,越来越重视解决传统电网中普遍存在的问题、越来越关注环境保护、越来越多地采用智慧电网技术来节约能源和提高消费效率,正在推动该地区智慧电网市场的成长。

智慧电网产业概况

智慧电网网路市场中等程度分散。该市场的主要企业包括 ABB 有限公司、思科系统公司、伊顿公司、通用电气公司和 Itron 公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概述

- 介绍

- 2027 年市场规模与需求预测

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 科技应用领域

- 传播

- 需量反应

- 先进测量基础设施 (AMI)

- 其他技术应用

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 南美洲

- 中东和非洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- ABB Ltd

- Cisco Systems Inc.

- Eaton Corporation PLC

- General Electric Company

- Itron Inc.

- Osaki Electric Co. Ltd

- Hitachi Ltd

- Schneider Electric SE

- Siemens AG

- Honeywell International Inc.

第七章 市场机会与未来趋势

简介目录

Product Code: 52426

The Smart Grid Network Market is expected to register a CAGR of greater than 11% during the forecast period.

Key Highlights

- Advanced Metering Infrastructure (AMI) is expected to witness significant growth during the forecast period due to the increasing deployment of smart grid technologies across the world's developed and emerging economies.

- Governments of both emerging and underdeveloped nations worldwide are increasingly viewing smart grid technology as a strategic infrastructural investment that will sustain their long-term economic prosperity and help them achieve their carbon emission reduction targets. This, in turn, is expected to provide an ample amount of opportunities to the companies involved in the smart grid network market in the near future.

- Asia-Pacific is expected to dominate the market during the forecast period, with the majority of the demand coming from China, India, and Japan.

Smart Grid Market Trends

Advanced Metering Infrastructure (AMI) to Witness Significant Growth

- Advanced metering infrastructure (AMI) or smart metering is an integrated system of smart meters, communications networks, and data management systems. It enables two-way communication between utilities and customers.

- The metering industry has taken rapid strides in the recent past few years by traversing from automated meter reading (AMR) to smart metering, using bi-directional communication, thereby enabling greater benefits to electricity distribution companies (DISCOMs), customers, and society.

- AMI provides significant operational benefits, which leads to cost savings for utility companies and convenience for customers. AMI can significantly reduce operating costs of utility companies by remotely reading meters, connecting/disconnecting service, identifying outages, generating more accurate bills in a faster manner, and enabling utilities to provide customers digital access to their usage information.

- With the increasing efforts to modernize the electricity grid and reduce T&D losses, governments across the world are investing in advanced metering infrastructure. This, in turn, is expected to drive the AMI market during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the smart grid network market in 2021. It is expected to continue its dominance in the coming years, backed up by countries like China, India, and Japan.

- China has the ambition to become a world leader in electrical power equipment by 2025. This is a national strategy outlined in the Technology Roadmap (2017) of the Made in China 2025 program. Innovation and technology are heavily focused on the national program. Large amounts of funding are being allocated to support the development.

- In 2015, the National Development and Reform Commission and National Energy Administration stressed the significance of smart grid development to improve the ability of the grid to allow for and optimize the allocation of energy resources and promote the utilization of clean energy and distributed energy with the purpose to create a safe, efficient, clean, and modern energy system.

- Similarly, in 2020, India was the third-largest electricity-generating nation in the world. This power is generated from both conventional and renewable sources. The country has made major strides in improving access to power among both rural and urban communities through various government-led schemes focused on Power for All.

- The country made its first move to modernize its power utility sector, with the National Smart Grid Mission (NSGM) announced in May 2015, with an outlay of INR 980 crore and a budgetary support of INR 338 crore.

- In August 2019, Energy Efficiency Services Limited (EESL), a joint venture of four public sector enterprises under the Union Ministry of Power of India, lined up investments worth INR 2,700 crore for the smart meter project in Uttar Pradesh, India. Under the ambitious project, EESL is expected to install four million electricity meters on the premises of state power consumers in three years (2019-2022).

- Therefore, increasing focus on dealing with issues prevailing to conventional electric networks, rising concerns about environmental protection, and growth in the adoption of smart grid technology to improve efficiency in energy conservation and consumption are fueling the growth of the smart grid network market in the region.

Smart Grid Industry Overview

The smart grid network market is moderately fragmented. Some of the key players in this market include ABB Ltd, Cisco Systems Inc., Eaton Corporation PLC, General Electric Company, and Itron Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology Application Area

- 5.1.1 Transmission

- 5.1.2 Demand Response

- 5.1.3 Advanced Metering Infrastructure (AMI)

- 5.1.4 Other Technology Application Areas

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 South America

- 5.2.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 ABB Ltd

- 6.3.2 Cisco Systems Inc.

- 6.3.3 Eaton Corporation PLC

- 6.3.4 General Electric Company

- 6.3.5 Itron Inc.

- 6.3.6 Osaki Electric Co. Ltd

- 6.3.7 Hitachi Ltd

- 6.3.8 Schneider Electric SE

- 6.3.9 Siemens AG

- 6.3.10 Honeywell International Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219