|

市场调查报告书

商品编码

1686548

印尼黏合剂和密封剂:市场占有率分析、行业趋势和成长预测(2025-2030 年)Indonesia Adhesives And Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

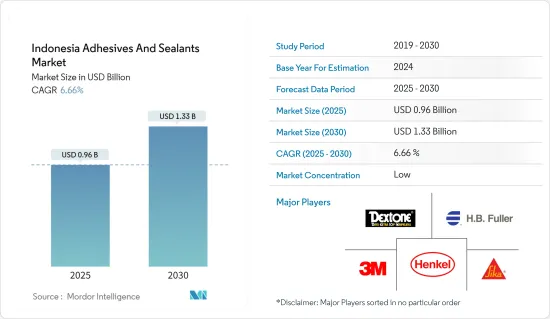

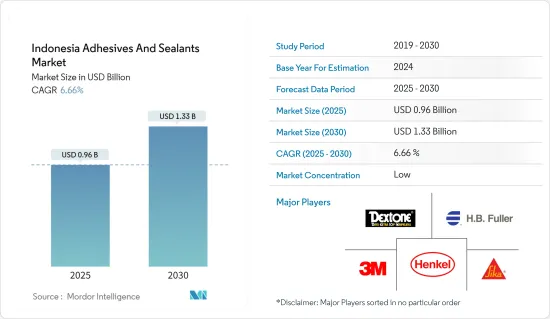

印尼黏合剂和密封剂市场规模预计在 2025 年为 9.6 亿美元,预计到 2030 年将达到 13.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.66%。

COVID-19疫情对印尼黏合剂和密封剂市场产生了负面影响。全国范围的封锁和严格的社交隔离措施导致航太、汽车、建筑、医疗保健、包装和鞋类行业关闭,从而影响了印尼的黏合剂和密封剂市场。然而,在新冠疫情爆发后,限制措施一旦解除,市场就恢復良好。由于航太、汽车、建筑、医疗保健、包装和鞋类等各个应用领域对黏合剂和密封剂的消费增加,市场出现强劲復苏。

主要亮点

- 预测期内,印尼的黏合剂和密封剂市场预计将受到建设产业需求成长和包装产业需求成长的推动。

- 另一方面,过度依赖进口原材料可能会阻碍市场成长。

- 生物基黏合剂的技术创新和发展以及向复合材料黏合的转变可能会成为预测期内探索市场的机会。

印尼黏合剂和密封剂市场趋势

市场主导的水性黏合剂技术

- 水性黏合剂使用水作为载体或稀释介质来分散树脂。透过让水蒸发或被基质吸收,它就会变硬。这些黏合剂以水作为稀释剂而不是挥发性有机溶剂配製而成,可以被视为低VOC黏合剂。

- 水性黏合剂由水溶性合成聚合物(纤维素醚、聚乙烯醇、甲基纤维素、羧甲基纤维素、聚乙烯吡咯烷酮等聚合物)或天然聚合物(植物基,如淀粉和糊精;蛋白质来源,如血液、鱼、乳清、大豆;以及动物基,如骨骼和皮革)製成。

- 在印尼,水性黏合剂技术比溶剂型黏合剂更受欢迎的主要原因是其环保特性,因为它通常产生较少的挥发性有机化合物(VOC),从而劣化。

- 根据 Mordor Intelligence 的分析,在印尼,水基黏合剂技术预计在 2024 年至 2029 年期间以 6.50% 的速度成长。水性黏合剂和丙烯酸水基黏合剂主要用于建设产业的各种应用。丙烯酸水性黏合剂主要用于建筑领域,作为标籤和胶带形式的压敏黏着剂,用于磁砖黏合和层压。

- 2024 年 5 月,汉高股份公司宣布其黏合剂和涂料创新将实现循环经济并减少其碳足迹。其中一个产品亮点是 Aquence PS 3017 RE,这是一种专为清洗宝特瓶上的烯烃薄膜标籤开发的水性丙烯酸黏合剂。 Aquence PS 3017 RE 是一种水性丙烯酸黏合剂,专为清洗宝特瓶上的烯烃薄膜标籤而开发,使从瓶子上去除标籤的过程更容易、更节能,同时提高回收宝特瓶的纯度和价值。

- 由于水溶性黏合剂具有上述所有优点,因此水溶性黏合剂技术可望主导国内黏合剂和密封剂市场。

包装产业占据市场主导地位

- 印尼黏合剂和密封剂市场的最大消费产业是包装产业。黏合剂和密封剂在造纸和包装行业中发挥着至关重要的作用。例如,黏合剂可用于层压纸张或纸板、黏贴标籤或内衬食品包装(例如饮料罐)。

- 包装黏合剂和密封剂对各种表面具有出色的黏附性和黏合性,并广泛应用于从纸盒到食品和饮料包装。

- 包装黏合剂和密封剂可实现更快的黏合和更可靠的密封,从而简化您的製造流程。此外,快速固化包装密封剂为各种包装材料提供了灵活可靠的解决方案。

- 根据 Moldo Intelligence 估计,印尼的包装量预计将从 2023 年的 168.34 吨增加到 2022 年的 160.55 吨。由于电子商务领域的兴起,包装行业预计未来将继续增长,电子商务领域在过去几年中为包装行业带来了巨大的推动力,因为运输货物需要专门的包装。

- 各公司正在包装领域进行各种投资。例如,2022年,中国包装公司Lamipak开始在印尼建造第二家工厂。该公司计划在2024年投资2亿美元,分两阶段扩大产能,达到每年180亿包。

- 最近,PT Sariguna Primatirta Tbk。生产 Cleo 品牌瓶装水的印尼公司 Tanobel 计划在 2023 年投入 3,000 亿印尼盾(1,988 万美元)的资本支出,用于建造工厂和扩大分销网络。

- 因此,推动包装产业成长的这种趋势可能会进一步促进该国黏合剂和密封剂的消费。

印尼黏合剂和密封剂产业概况

印尼的黏合剂和密封剂市场高度分散。市场的主要企业(不分先后顺序)包括 3M、HB Fuller Company、Henkel AG &Co.KGaA、Sika AG 和 DEXTONE INDONESIA。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 包装产业需求不断成长

- 建设产业需求增加

- 限制因素

- 过度依赖进口原料

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 树脂专用黏合剂

- 丙烯酸纤维

- 氰基丙烯酸酯

- 环氧树脂

- 聚氨酯

- 硅胶

- VAE・EVA

- 其他树脂专用黏合剂

- 黏合剂(按技术分类)

- 热熔胶

- 反应性

- 溶剂型

- UV固化型

- 水性

- 树脂专用密封胶

- 聚氨酯

- 环氧树脂

- 丙烯酸纤维

- 硅胶

- 其他树脂密封剂

- 最终用户产业

- 航太

- 车

- 建筑与施工

- 鞋类和皮革

- 卫生保健

- 包装

- 木製品和配件

- 其他最终用户产业

第六章竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- ALTECO co., ltd.

- ARKEMA

- DEXTONE INDONESIA

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Mapei Inc

- Pamolite Adhesive Industry

- Pidilite Industries Ltd.

- Sika AG

第七章 市场机会与未来趋势

- 生物基黏合剂的创新与发展

- 向复合黏合的转变

The Indonesia Adhesives And Sealants Market size is estimated at USD 0.96 billion in 2025, and is expected to reach USD 1.33 billion by 2030, at a CAGR of 6.66% during the forecast period (2025-2030).

The COVID-19 pandemic had a negative impact on the market for Indonesia adhesives and sealants. Nationwide lockdowns and strict social distancing measures led to the closure of aerospace, automotive, construction, healthcare, packaging, and footwear industries consequently affecting the Indonesia adhesives and sealants market. However, after the COVID-19 pandemic, the market recovered well following the lifting of restrictions. It rebounded significantly due to the increased consumption of adhesives and sealants in various applications such as aerospace, automotive, construction, healthcare, packaging, footwear, and others.

Key Highlights

- Growing demand from the construction industry and increasing demand from the packaging industry in the country are expected to drive the market for Indonesia's adhesives and sealants market during the forecast period.

- On the flip side, the over-reliance on the import of raw materials is likely to hinder the market's growth.

- The innovation and development of bio-based adhesives and shifting focus toward adhesive bonding for composite materials are likely to act as opportunities for the market studied over the forecast period.

Indonesia Adhesives and Sealants Market Trends

Water-borne Adhesives Technology to Dominate the Market

- Water-borne adhesives use water as a carrier or diluting medium to disperse a resin. They are set by allowing the water to evaporate or be absorbed by the substrate. These adhesives are compounded with water as a diluent rather than a volatile organic solvent, and they can be considered low-VOC adhesives.

- Water-borne adhesives are produced from either soluble synthetic polymers (from polymers such as cellulose ethers, polyvinyl alcohol, methylcellulose, carboxymethylcellulose, and polyvinylpyrrolidone) or natural polymers (from vegetable sources such as starches and dextrins, protein sources such as blood, fish, milk albumen, and soybean, and animal sources such as bones and hides).

- In Indonesia, the major reason for their preference for waterborne adhesive technology over solvent-borne is due to their eco-friendly nature, as it is generally lower in volatile organic compounds (VOCs), which degrade the environment.

- In Indonesia, the market for water born adhesive technology is growing at a a rate of 6.50% for the period of 2024 to 2029 as per the Mordor Intelligence analysis. The waterborne adhesives, and acrylic water-borne adhesives are majorly employed for different applications in the building and construction industry. Acrylic water-borne adhesives are majorly used as pressure-sensitive adhesives in the construction sector in the form of labels and tapes for tile bonding and laminating purposes.

- In May 2024, Henkel AG & Co. KGaA presented adhesive and coating innovations enable circularity and reduce carbon footprint. One of the product highlights is Aquence PS 3017 RE, a water-based acrylic adhesive that was developed for olefin-based film labels on washable PET bottles. It makes the process of removing the labels from the bottles easier and more energy efficient, while the purity and value of the recycled PET bottle are also increased.

- All the aforementioned benefits offered by water borne adhesives, the water borne adhesive technology is expected to dominate the market for adhesives and sealants in the country.

Packaging Industry to Dominate the Market

- The packaging industry is the largest consumer of the Indonesia adhesives and sealants market. Adhesives and sealants play a crucial role in the paper and packaging industries. Adhesives are used for example in laminating paper and cardboard, gluing labels, and lining food packages such as beverage cans.

- Packaging adhesives and sealants provide excellent adhesion and bonding to a wide variety of surfaces and are used in applications ranging from folding cartons to food and beverage packaging.

- Adhesives and sealants for packaging simplify manufacturing processes by enabling faster bonding and secure seals. Additionally, fast-curing packaging sealants provide flexible and reliable solutions for a wide range of packaging materials.

- According to the Mordor Intelligence estimates, the packaging volume of Indonesia has grown from 168.34 tons in 2023 to 160.55 tons in 2022. It is expected that the packaging industry will keep growing as there has been a rise in the e-commerce sector which has given a significant boost to the packaging industry in the past few years as special packaging is required for shipping goods.

- There are various investments done in the packaging sector by various companies. For instance, in 2022, China-based packaging company Lamipak kicked off the construction of its second factory in Indonesia. It plans to expand its capacity to up to 18 billion packs per year in two phases with an investment of USD 200 million by 2024.

- More recently, PT Sariguna Primatirta Tbk., also known as Tanobel, the Indonesian company behind the Cleo-branded bottled water, has set IDR 300 billion (USD 19.88 million) in capital expenditure in 2023 to build factories and expand its distribution network.

- Hence, such trends driving the growth of packaging industry is likely to further fuel the consumption of adhesives and sealants in the country.

Indonesia Adhesives and Sealants Industry Overview

Indonesia adhesives and sealants market is highly fragmented. Some of the major players (not in any particular order) in the market include 3M, H.B. Fuller Company, Henkel AG & Co. KGaA, Sika AG, and DEXTONE INDONESIA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from the Packaging Industry

- 4.1.2 Growing Demand from the Construction Industry

- 4.2 Restraints

- 4.2.1 Over-reliance on Import of Raw Materials

- 4.2.2 Other Restraints

- 4.3 Industry Value-chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Adhesives by Resin

- 5.1.1 Acrylic

- 5.1.2 Cyanoacrylate

- 5.1.3 Epoxy

- 5.1.4 Polyurethane

- 5.1.5 Silicone

- 5.1.6 VAE/EVA

- 5.1.7 Other Adhesives by Resin

- 5.2 Adhesives by Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-borne

- 5.2.4 UV Cured

- 5.2.5 Water-borne

- 5.3 Sealants by Resin

- 5.3.1 Polyurethane

- 5.3.2 Epoxy

- 5.3.3 Acrylic

- 5.3.4 Silicone

- 5.3.5 Other Sealants by Resin

- 5.4 End-user Industry

- 5.4.1 Aerospace

- 5.4.2 Automotive

- 5.4.3 Building and Construction

- 5.4.4 Footwear and Leather

- 5.4.5 Healthcare

- 5.4.6 Packaging

- 5.4.7 Woodworking and Joinery

- 5.4.8 Other End-user Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 ALTECO co., ltd.

- 6.4.3 ARKEMA

- 6.4.4 DEXTONE INDONESIA

- 6.4.5 H.B. Fuller Company

- 6.4.6 Henkel AG & Co. KGaA

- 6.4.7 Huntsman International LLC

- 6.4.8 Mapei Inc

- 6.4.9 Pamolite Adhesive Industry

- 6.4.10 Pidilite Industries Ltd.

- 6.4.11 Sika AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation and Development of Bio-based Adhesives

- 7.2 Shifting Focus Toward Adhesive Bonding for Composite Materials