|

市场调查报告书

商品编码

1687081

泰国黏合剂和密封剂:市场占有率分析、行业趋势和成长预测(2025-2030 年)Thailand Adhesives and Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

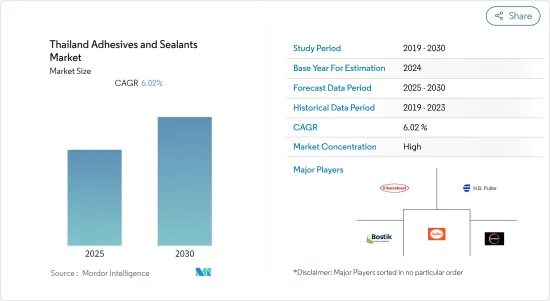

预计泰国黏合剂和密封剂市场在预测期内的复合年增长率将达到 6.02%。

由于该地区长期停工和原材料短缺,COVID-19 疫情的蔓延影响了该国的汽车产业。

关键亮点

- 短期内,国内包装产业需求的增加和向复合材料黏合的转变是推动市场发展的关键因素。

- 另一方面,有关 VOC排放的严格环境法规和 COVID-19 的不利影响正在阻碍市场成长。

- 预计生物基黏合剂需求的不断增长将为整个预测期内的市场成长提供各种机会。

泰国胶黏剂和密封剂市场趋势

纸张、纸板和包装领域占据市场主导地位

- 包装行业是黏合剂最大的终端用户之一。应用包括袋子、香烟、过滤器、纸箱侧缝和封口、复合容器和管、一次性用品、信封、软包装、产品、标籤/标誌/贴纸、特殊包装和瓦楞纸板。纸板印表机使用书本黏合剂。

- 泰国约有2000家印刷公司,其中大多数是中小型公司。大型企业占比不足1%。有数千家企业参与包装产业。

- 食品加工产业是软包装的最大用户,占总需求的50%以上。

- 该国对瓦楞包装的需求不断增长,主要是由于对包装食品和饮料产品的需求持续增加。

- 根据export.gov通报,泰国美容及个人保健产品市场规模预计到2022年将达80亿美元。根据export.gov通报,泰国美容及个人保健产品市场规模预计到2022年将达80亿美元。美容和化妆品行业对高价值包装中使用的黏合剂的需求成长正在推动研究市场的发展。

- 总体而言,预计预测期内包装产业对黏合剂的需求将以中等至高速成长。

硅胶占据密封剂市场的主导地位

- 硅胶是一种用途广泛的聚合物。它们旨在为玻璃、金属和石头等表面提供永久和临时的黏合。硅胶密封胶需要使用底漆才能达到最佳黏合效果,但在许多情况下,底漆并不是必需的。

- 硅胶密封胶可在恶劣环境、较大温度范围、磨蚀条件和气候变迁下有效运作。这使得它表现出优异的性能,具有优异的耐水性、耐化学性、耐热性和柔韧性。

- 这些密封剂的主要终端用户产业是电子电气、汽车、航太和建筑施工。硅胶黏合剂最常见的用途之一是用于家庭周围的基本维修。

- 硅胶指定密封电缆和感测器,由于其能够承受极端温度,预计电子汽车、建筑和电子领域对这些密封剂的需求将会上升。此外,在建筑领域,硅胶密封胶的使用量正在增加,因为它们甚至可以在极端天气条件下使用。

- 因此,由于上述因素,预计预测期内对硅胶密封胶的需求将会成长。

泰国黏合剂和密封剂产业概况

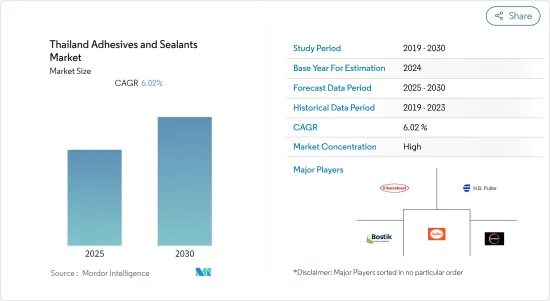

泰国的黏合剂和密封剂市场在收益方面是巩固的。前五家公司的市占率总合约为70%,市场竞争非常激烈。然而,其他本地参与者的存在也为市场创造了竞争环境。主要企业包括汉高(泰国)有限公司、Selic Corp Public Company Limited、科思创股份公司、波士胶(阿肯集团)和 HB Fuller(泰国)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 包装产业需求不断成长

- 向复合黏合的转变

- 限制因素

- 有关VOC排放的严格环境法规

- COVID-19的影响

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 胶水

- 技术部门

- 水性

- 丙烯酸纤维

- 聚醋酸乙烯酯(PVA)乳液

- 乙烯醋酸乙烯(EVA)乳液

- 其他水性胶黏剂

- 溶剂型

- 苯乙烯-丁二烯橡胶(SBR)

- 氯丁橡胶

- 聚丙烯酸酯(PA)

- 其他溶剂型胶黏剂

- 反应性

- 环氧树脂

- 氰基丙烯酸酯

- 硅胶

- 聚氨酯

- 其他反应性黏合剂

- 热熔胶

- 热塑性聚氨酯

- 乙烯醋酸乙烯酯

- 苯乙烯-丁二烯共聚物

- 其他热熔胶

- 其他黏合剂技术

- 最终用户产业

- 建筑与施工

- 纸和纸板包装

- 运输

- 鞋类和皮革

- 医疗保健

- 电气和电子

- 其他的

- 技术部门

- 密封胶

- 产品类型

- 硅胶

- 聚氨酯

- 丙烯酸纤维

- 其他密封胶产品类型

- 最终用户产业

- 建筑与施工

- 运输

- 医疗保健

- 电气和电子

- 其他的

- 产品类型

第六章 竞争格局

- 併购、合资、合作与协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Anabond Limited

- AVERY DENNISON CORPORATION

- Beardow Adams

- Bond Chemicals Company Limited

- Bostik

- CEMEDINE Co. Ltd

- Covestro AG

- Dow

- DUNLOP ADHESIVES(THAILAND)CO. LTD

- HB Fuller(Thailand)Co. Ltd

- Henkel(Thailand)Ltd

- Huntsman International LLC

- Jowat(Thailand)Co. Ltd

- Lord Corporation(Parker Hannifin Corp)

- MORESCO(THAILAND)CO. LTD

- Selic Corp. Public Company Limited

- Siam Industry Adhesive Tapes Co. Ltd

- Sika Thailand

- Star Bond(Thailand)Company Limited

- Thai Mitsui Specialty Chemicals Co. Ltd

- TOAGOSEI(THAILAND)CO. LTD

- Wacker Chemie AG

第七章 市场机会与未来趋势

- 生物基黏合剂的需求不断增加

The Thailand Adhesives and Sealants Market is expected to register a CAGR of 6.02% during the forecast period.

The spread of covid-19 in the region impacted the automotive sector of the country due to long lockdowns and the shortage of raw materials in the country.

Key Highlights

- Over the short term, major factors driving the market studied are increasing demand from the packaging industry and shifting focus towards adhesive bonding for composite materials in the country.

- On the flip side, stringent environmental regulations regarding VOC emissions and the negative impact of COVID-19 are hindering the market's growth.

- Increasing demand for bio-based adhesives is expected to offer various opportunities for the market's growth over the forecast period.

Thailand Adhesives and Sealants Market Trends

Paper, Board, and Packaging Segment to Dominate the Market

- The packaging industry is one of the largest end-users of adhesives. Some of the applications include bags, cigarettes and filters, cartons' side seams and closures, composite containers and tubes, disposables, envelopes, flexible packaging, products, labels/signs/decals, specialty packaging, and corrugated boards, among others. Paper board printing houses use adhesives for books.

- There are around 2,000 printing houses in Thailand, most of which are small- to medium-scale. Large-scale establishments account for less than 1% of the total number. Thousands of establishments are involved in the packaging industry.

- The food processing sector is the largest user of flexible packaging, accounting for more than 50% of the total demand.

- The growing demand for corrugated packaging in the country is mainly due to the continued and increasing demand for packaged food and beverages.

- Additionally, there is a considerable increase in the demand for small-scale folding cartons and packaging from the beauty and personal care industry.According to export.gov, Thailand's beauty and personal care products market is expected to reach USD 8.0 billion by 2022. Such growth in the demand for adhesives used in expensive packaging, from beauty and cosmetics industry, is driving the studied market.

- Overall, the demand growth for adhesives from the packaging industry is expected to be moderate to high during the forecast period

Silicone Segment to Dominate the Sealants Market

- Silicones are versatile polymers. These are designed to provide permanent and temporary bonding to surfaces, such as glass, metal, and stone. Primers are required for the optimal adhesion of silicone sealants, although primers are often not necessary.

- The silicone sealants work effectively in harsh environments, across a wide temperature range, in situations involving abrasion, and under climatic changes. Hence, they are water-, chemical-, and temperature-resistant, flexible, and deliver outstanding performance.

- The major end-user industries for these sealants are electronics and electrical, automotive, aerospace, and building and construction. Some of the most common uses of silicone adhesives are for basic repairs around the house.

- The demand for these sealants is expected to increase in the electronic automotive sector, construction, and electronic devices, as silicone is used to seal cables and sensors into place, and due to its property to withstand extreme temperatures. Furthermore, in the building and construction sector, its usage is increasing as silicone sealants can be used even in extreme weather conditions.

- Thus, from the factors mentioned above, the demand for silicone sealants are expected to grow over the forecast period.

Thailand Adhesives and Sealants Industry Overview

Thailand adhesives and sealants market is consolidated in terms of revenue. The top five players account for a combined share of around 70%, making the market highly competitive. However, the presence of other local players is creating a competitive environment in the market. The major companies include Henkel (Thailand) Ltd, Selic Corp Public Company Limited, Covestro AG, Bostik (Arkem Group), and H.B. Fuller (Thailand) Co. Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand from Packaging Industry

- 4.1.2 Shifting Focus Towards Adhesive Bonding for Composite Materials

- 4.2 Restraints

- 4.2.1 Stringent Environmental Regulations Regarding VOC Emissions

- 4.2.2 COVID-19 Impact

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION

- 5.1 Adhesives

- 5.1.1 Technology

- 5.1.1.1 Water-borne

- 5.1.1.1.1 Acrylics

- 5.1.1.1.2 Polyvinyl Acetate (PVA) Emulsion

- 5.1.1.1.3 Ethylene Vinyl Acetate (EVA) Emulsion

- 5.1.1.1.4 Other Water-borne Adhesives

- 5.1.1.2 Solvent-borne

- 5.1.1.2.1 Styrene-butadiene Rubber (SBR)

- 5.1.1.2.2 Chloroprene Rubber

- 5.1.1.2.3 Poly Acrylate (PA)

- 5.1.1.2.4 Other Solvent-borne Adhesives

- 5.1.1.3 Reactive

- 5.1.1.3.1 Epoxy

- 5.1.1.3.2 Cyanoacrylate

- 5.1.1.3.3 Silicone

- 5.1.1.3.4 Polyurethane

- 5.1.1.3.5 Other Reactive Adhesives

- 5.1.1.4 Hot-Melt

- 5.1.1.4.1 Thermoplastic Polyurethane

- 5.1.1.4.2 Ethylene Vinyl Acetate

- 5.1.1.4.3 Styrenic-butadiene Copolymers

- 5.1.1.4.4 Other Hot-melt Adhesives

- 5.1.1.5 Other Adhesive Technologies

- 5.1.2 End-user Industry

- 5.1.2.1 Buildings and Construction

- 5.1.2.2 Paper, Board, and Packaging

- 5.1.2.3 Transportation

- 5.1.2.4 Footwear and Leather

- 5.1.2.5 Healthcare

- 5.1.2.6 Electrical and Electronics

- 5.1.2.7 Other End-user Industries

- 5.1.1 Technology

- 5.2 Sealants

- 5.2.1 Product Type

- 5.2.1.1 Silicone

- 5.2.1.2 Polyurethane

- 5.2.1.3 Acrylic

- 5.2.1.4 Other Sealant Product Types

- 5.2.2 End-user Industry

- 5.2.2.1 Buildings and Construction

- 5.2.2.2 Transportation

- 5.2.2.3 Healthcare

- 5.2.2.4 Electrical and Electronics

- 5.2.2.5 Other End-user Industries

- 5.2.1 Product Type

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Anabond Limited

- 6.4.3 AVERY DENNISON CORPORATION

- 6.4.4 Beardow Adams

- 6.4.5 Bond Chemicals Company Limited

- 6.4.6 Bostik

- 6.4.7 CEMEDINE Co. Ltd

- 6.4.8 Covestro AG

- 6.4.9 Dow

- 6.4.10 DUNLOP ADHESIVES (THAILAND) CO. LTD

- 6.4.11 H.B. Fuller (Thailand) Co. Ltd

- 6.4.12 Henkel (Thailand) Ltd

- 6.4.13 Huntsman International LLC

- 6.4.14 Jowat (Thailand) Co. Ltd

- 6.4.15 Lord Corporation (Parker Hannifin Corp)

- 6.4.16 MORESCO (THAILAND) CO. LTD

- 6.4.17 Selic Corp. Public Company Limited

- 6.4.18 Siam Industry Adhesive Tapes Co. Ltd

- 6.4.19 Sika Thailand

- 6.4.20 Star Bond (Thailand) Company Limited

- 6.4.21 Thai Mitsui Specialty Chemicals Co. Ltd

- 6.4.22 TOAGOSEI (THAILAND) CO. LTD

- 6.4.23 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing demand for Bio-based Adhesives