|

市场调查报告书

商品编码

1686620

菲律宾太阳能:市场占有率分析、行业趋势和成长预测(2025-2030年)Philippines Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

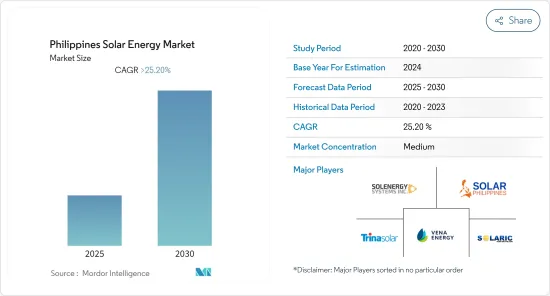

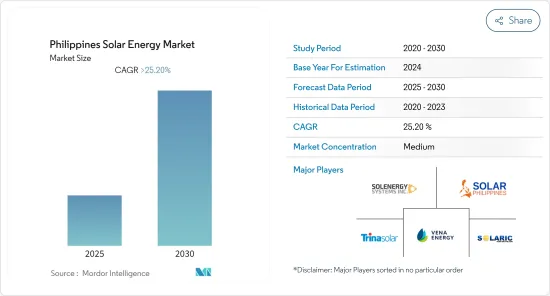

预计预测期内菲律宾太阳能市场的复合年增长率将超过 25.2%。

主要亮点

- 从中期来看,预计快速的经济发展和人口成长等因素将在预测期内推动市场发展。预计在预测期内,利用太阳能发电的需求不断增加以及太阳能发电系统价格的下降将推动市场发展。

- 然而,该国低效率的电网基础设施预计将在未来几年阻碍市场成长。

- 然而,据估计,透过用太阳能等可再生能源取代或整合柴油发电机,该国每年可节省超过 2 亿美元。菲律宾的小岛由以发电机为基础的微电网供电,燃料为进口柴油和船用油。由于电网不稳定、发电能力不足以及补贴燃料短缺,这些岛屿经常遭遇停电和意外停电。因此,利用太阳能和其他可再生能源的离网电气化有望成为未来的一大商机。

菲律宾太阳能市场趋势

光伏发电(PV)显着成长

- 太阳能为菲律宾日益增长的能源需求提供了直接的解决方案。随着太阳能光电设备成本的稳定下降以及安装和试运行太阳能发电工程所需时间的缩短,太阳能光电系统在菲律宾各地的消费者和产业中越来越受欢迎。

- 由于全国范围内太阳能发电装置的不断增加,预计预测期内小规模太阳能发电的采用将会增加,从而导致太阳能发电行业显着增长。菲律宾能源部(DOE)发布了《2020-2040 年菲律宾能源计画》,设定了该国可再生能源占总发电结构比重到 2030 年达到 35% 、到 2040 年达到 50% 的目标。这一发展将加速菲律宾对太阳能的采用。

- 根据国际可再生能源机构(IEA)的数据显示,截至2022年,该国太阳能发电装置容量为162.5万千瓦,与前一年同期比较增18%。在菲律宾,工业和商业部门对太阳能的需求不断增加,这可能会对太阳能市场的成长产生正面影响。

- 小型太阳能光伏(PV)已在菲律宾住宅领域广泛应用,这主要是由于光伏技术成本的下降和净计量的引入。

- 然而,儘管有净计量政策,自 2013 年以来,住宅和商业领域 100kW 以下的光伏装置成长有限。成长缓慢主要是由于行政、财务和监管障碍,阻碍了中小型业主安装屋顶太阳能。

- 因此,随着全国太阳能光电站安装量的不断增加,预测期内太阳能发电产业很可能主导菲律宾太阳能市场。

太阳能成本下降推动市场

- 在过去六年里,太阳能产业透过规模经济大幅降低了成本。设备充斥市场,价格暴跌。 2011年,太阳能板价格下跌了48.4%,自2008年以来,太阳能发电系统的成本已下降了30%以上。截至2022年,太阳能光电(PV)组件比2011年便宜80%以上,全国太阳能发电装置的数量不断增加,推动了市场的成长。

- 2010年至2022年间,太阳能发电成本下降了近四分之三,并且还会持续下降。不断的技术改进,例如提高太阳能电池组件的效率,正在推动成本的降低。这些高度模组化技术的工业化带来了规模经济带来的巨大效益,并加剧了改善製造流程和竞争性供应链的竞争。

- 截至2021年,全球组件价格已跌至0.24美元/瓦。随着太阳能板价格的下降,消费者对安装太阳能电池板以享受税收优惠和减少电费表现出兴趣,从而影响了菲律宾太阳能市场的成长。

- 因此,预计太阳能发电系统价格的下降将增加菲律宾太阳能光电的采用率,并在预测期内推动市场发展。

菲律宾太阳能产业概况

菲律宾太阳能市场较分散。主要企业包括(排名不分先后)Solar Philippines Power Project Holdings、Solenergy Systems Inc.、Vena Energy、Solaric Corp. 和 Trina Solar Ltd.。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 菲律宾太阳能市场的发展

- 可再生能源结构(2022年)

- 太阳能装置容量及2028年预测

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 太阳能发电需求不断成长

- 太阳能发电系统价格下降

- 限制因素

- 电网基础设施效率低下

- 驱动程式

- PESTLE分析

第五章 按技术细分的市场

- 光伏(PV)

- 聚光型太阳光电(CSP)

第六章竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 市场占有率分析

- 主要企业简介

- Solar Philippines Power Project Holdings

- Solenergy Systems Inc.

- Vena Energy

- Solaric Corp.

- Trina Solar Ltd.

- AC Energy

- Cleantech Global

- Citicore Power Inc.

- Aboitiz Power Corporation

- Helios Solar Energy Corporation(HSEC)

第七章 市场机会与未来趋势

- 利用可再生能源实现离网电气化

简介目录

Product Code: 53322

The Philippines Solar Energy Market is expected to register a CAGR of greater than 25.2% during the forecast period.

Key Highlights

- Over the medium period, factors such as rapid economic development and a growing population are expected to drive the market during the forecast period. The growing demand for solar energy-based power generation and declining photovoltaic system prices are expected to drive the market during the forecast period.

- On the other hand, the country's inefficient electricity grid infrastructure is expected to hinder the market's growth in the coming years.

- Nevertheless, it is estimated that replacing/integrating diesel generators with renewable energy, like solar, can save the country over USD 200 million per year. Small islands in the Philippines are powered by generator-based mini-grids fueled by imported diesel and bunker (freighter) oil. These islands suffer from blackouts and unplanned power outages due to grid instability, inadequate generation capacity, and lack of subsidized fuel. Therefore, off-grid electrification through renewable energy sources, such as solar, is expected to create a significant opportunity in the future.

Philippines Solar Energy Market Trends

Solar Photovoltaic (PV) to Register Significant Growth

- Solar energy provides an immediate solution to the country's growing energy needs. With steadily falling solar power equipment costs and the short time needed to install and commission solar power projects, solar photovoltaic systems are increasingly becoming popular among consumers and industries across the Philippines.

- With the increased solar PV installations across the country, the solar PV segment is expected to grow significantly due to increasing small-scale solar PV deployment during the forecast period. The Department of Energy (DOE) released the Philippine Energy Plan 2020-2040, establishing the country's goal for renewable energy to reach 35% of its power generation mix by 2030 and 50% by 2040. This development, in turn, will culminate in the increasing deployment of solar PV across the country.

- According to International Renewable Energy Agency, as of 2022, the country witnessed 1,625 MW of solar PV installations with an annual growth rate of 18% compared to the previous year. It is observing growing demand for solar PV from industrial and commercial segments, which may positively impact the growth of the solar energy market in the Philippines.

- Small-scale solar photovoltaic (PV) has been widely adopted by the residential sector in the Philippines, mainly due to the declining cost of PV technology and the introduction of net metering.

- However, despite the net metering policy, the residential and commercial sector has witnessed limited growth for PV installation of up to 100 kW in size since 2013. The slow growth has been mainly due to administrative, financial, and regulatory hurdles, preventing small owners and medium-sized enterprises from installing rooftop solar.

- Hence, due to the increasing solar photovoltaic installations across the country, the solar PV segment will likely dominate the Philippine solar energy market during the forecast period.

Declining Costs of Solar PV to Drive the Market

- The solar industry has cut costs dramatically through economies of scale in the past six years. As the market was flooded with equipment, prices plummeted. In 2011, the price of solar panels declined by 48.4%, while the PV system costs dropped by more than 30% since 2008. As of 2022, solar photovoltaic (PV) modules were more than 80% cheaper than in 2011, culminating in an increase in solar installations across the country and favoring the market's growth.

- The cost of electricity from solar PV declined by almost three-fourths during 2010-2022 and continues to decline. Continuous technological improvements, including higher solar PV module efficiencies, drive cost reductions. The industrialization of these highly modular technologies yielded impressive benefits from economies of scale and greater competition to improved manufacturing processes and competitive supply chains.

- As of 2021, global module prices dipped as low as USD 0.24/W. As the prices of solar panels are declining, consumers are showing interest in installing solar panels to incur tax benefits and low electricity bills, which impacts the growth of the solar energy market in the Philippines.

- Thus, the declining photovoltaic system prices are expected to increase the adoption of solar power in the Philippines and drive the market during the forecast period.

Philippines Solar Energy Industry Overview

The Philippines Solar Energy Market is moderately fragmented. Some of the major companies include (in no particular order) Solar Philippines Power Project Holdings, Solenergy Systems Inc., Vena Energy, Solaric Corp., and Trina Solar Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Evolution of Solar Power Market in the Philippines

- 4.3 Renewable Energy Mix, 2022

- 4.4 Solar Energy Installed Capacity and Forecast, in GW, till 2028

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.1.1 The Growing Demand for Solar Energy-Based Power Generation

- 4.7.1.2 Declining Photovoltaic System Prices

- 4.7.2 Restraints

- 4.7.2.1 The Country's Inefficient Electricity Grid Infrastructure

- 4.7.1 Drivers

- 4.8 PESTLE Analysis

5 MARKET SEGMENTATION - BY TECHNOLOGY

- 5.1 Solar Photovoltaic (PV)

- 5.2 Concentrated Solar Photovoltaic (CSP)

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Market Share Analysis

- 6.4 Key Company Profiles

- 6.4.1 Solar Philippines Power Project Holdings

- 6.4.2 Solenergy Systems Inc.

- 6.4.3 Vena Energy

- 6.4.4 Solaric Corp.

- 6.4.5 Trina Solar Ltd.

- 6.4.6 AC Energy

- 6.4.7 Cleantech Global

- 6.4.8 Citicore Power Inc.

- 6.4.9 Aboitiz Power Corporation

- 6.4.10 Helios Solar Energy Corporation (HSEC)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Off-Grid Electrification Through Renewable Energy Sources

02-2729-4219

+886-2-2729-4219