|

市场调查报告书

商品编码

1686660

生质乙醇:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Bioethanol - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

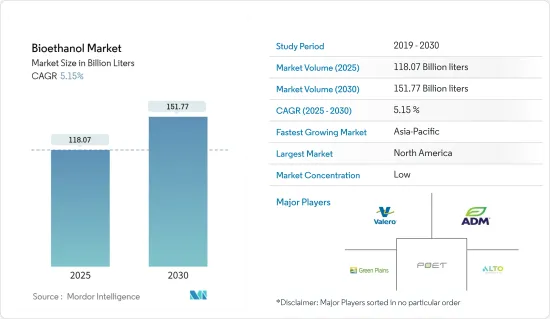

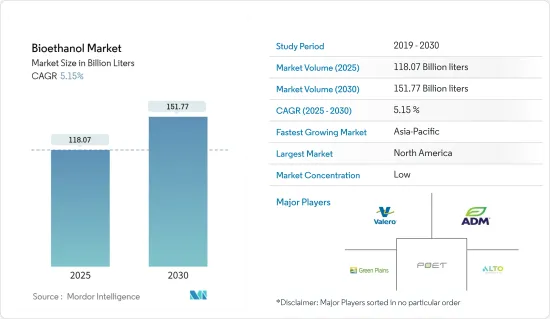

预计 2025 年生质乙醇市场规模为 1,180.7 亿公升,到 2030 年将达到 1,517.7 亿公升,预测期内(2025-2030 年)的复合年增长率为 5.15%。

由于供应链中断,生质乙醇市场受到了 COVID-19 的不利影响。然而,2021年市场復苏。推动市场发展的关键因素是美国政府加强倡议,并加强对美国高乙醇含量汽油销售的监管。

主要亮点

- 短期内,越来越多的有利倡议、监管机构的混合要求以及对使用石化燃料和生质燃料需求日益增长的环境担忧正在推动市场成长。

- 由于电动车需求不断增长,燃料汽车的逐步淘汰和向生物丁醇的转变阻碍因素了市场的成长。

- 第二代生质乙醇生产的发展以及航空工业对生质乙醇等生质燃料的消费增加可能为未来的市场提供机会。

- 北美占据全球市场主导地位,其中美国占消费量最大。

生质乙醇市场趋势

扩大汽车和交通运输领域的应用

- 生质乙醇最广泛的用途是作为汽车和运输业的燃料和燃料添加剂。生质乙醇将与传统汽油一起用作汽车汽油引擎的燃料。它还可以生产 ETBE(乙基叔丁基醚),一种用于多种汽油的辛烷值增强剂。

- 将生质乙醇与传统燃料混合可增加可再生潜力。 E10能量饮料因含有10%的乙醇而得名。生质乙醇是一种低碳燃料,有潜力促进运输业的脱碳。

- 过去 30 年来,美国的汽油经销商在使用生质乙醇作为辛烷值增强剂或汽油增量剂时都享受到税收优惠。这促进了该领域生质乙醇的使用。

- 美国生质燃料生产商受益于最近的立法,其中包括对生产低碳燃料的资金援助和大量税额扣抵抵免。已拨款 5 亿美元用于生质燃料基础设施建设,以建立乙醇和生物柴油混合物的储存槽和相关设施。

- 根据OICA资料,2022年汽车产量较2021年成长6%。 2022年全球汽车产量约8,502万辆。

- 预计2022年亚洲及大洋洲汽车产量为5,002万辆,美洲为1,775万辆,分别较2020年成长近7%及近10%。不过,2022年欧洲产量为1,621万辆,较2021年产量下降1%。

- 此外,2021年,美国能源局宣布拨款6,470万美国用于研发计划,重点生产低成本生质燃料作为航空等大型运输工具的石化燃料替代品,加强美国到2050年实现排放零排放的承诺。

- 随着各经济体宣布增加生质乙醇燃料消费量的计划,预测期内对生质乙醇的需求可能会激增。

北美占据市场主导地位

- 北美地区占据生质乙醇市场占有率。美国是世界上最大的生质乙醇生产国,其次是巴西、中国、印度和加拿大。中国也是最大的生质乙醇消费国。

- 近年来,随着可再生燃料标准(RFS)目标的提高和国内汽油消费量的增加,生质乙醇产量增加,目前几乎所有生物乙醇都含有 10% 的乙醇。

- 2022 年北美汽车产量约 1,479 万辆,而 2021 年为 1,346 万辆。

- 在该国 2.63 亿辆註册车辆中,约有 93% 能够在 E15 上行驶。此外,美国约有 2,200 万辆灵活燃料汽车 (FFV) 可以使用最高可达 E85 的乙醇混合物。

- 加拿大无污染燃料标准要求液体燃料供应商(汽油、柴油和家用暖气油)逐步降低其在加拿大生产和销售的燃料的碳强度,从而到2030年将加拿大使用的液体燃料的碳强度降低约13%(从2016年的水平)。

- 加拿大政府最近向低碳和零排放燃料基金投资15亿美元,也可能为氢和生质燃料等低碳燃料的本地生产和采用提供更多支持。

- 由于上述因素,北美被调查市场的需求预计会增加。

生质乙醇产业概况

生质乙醇市场中等程度分散。该市场的主要企业(不分先后顺序)包括 POET LLC、Valero、ADM、Green Plains Inc. 和 Alto Ingredients Inc.

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 监管偏袒和日益严格的混合要求

- 石化燃料的使用和生质燃料的需求所导致的环境问题日益严重

- 限制因素

- 电动车需求不断成长,燃料汽车将被淘汰

- 转向生物丁醇

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 原料类型

- 甘蔗

- 玉米

- 小麦

- 其他原料类型

- 应用

- 汽车和运输

- 饮食

- 药品

- 化妆品和个人护理

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Abengoa

- ADM

- Alto Ingredients Inc.

- Blue Bio Fuels Inc.

- Cenovus Inc.

- Cristalco

- Cropenergies AG

- Ethanol Technologies

- Granbio Investimentos SA

- Green Plains Inc

- Henan Tianguan Group Co. Ltd

- Jilin Fuel Ethanol Co. Ltd

- KWST

- Lantmannen

- Poet LLC

- Raizen

- Sekab

- Suncor Energy Inc.

- Tereos

- Valero

- Verbio Vereinigte Bioenergie AG

第七章 市场机会与未来趋势

- 第二代生质乙醇生产的发展

- 航空业生质燃料消耗量增加

The Bioethanol Market size is estimated at 118.07 billion liters in 2025, and is expected to reach 151.77 billion liters by 2030, at a CAGR of 5.15% during the forecast period (2025-2030).

The Bioethanol Market was adversely affected by COVID-19 due to disruptions in the supply chain. However, the market rebounded in 2021. The major factors driving the market were the increasing government initiatives and the increased restrictions on marketing gasoline containing a higher percentage of ethanol in the United States.

Key Highlights

- Over the short term, increasing favorable initiatives, blending mandates by regulatory bodies, and rising environmental concerns about the use of fossil fuels and the need for biofuels are the factors driving the market's growth.

- Phasing out of fuel-based vehicles due to rising demand for electric cars and shifting focus to bio-butanol are the factors hindering the market's growth.

- Developing second-generation bio-ethanol production and increasing consumption of biofuels like bioethanol in the aviation industry is likely to create opportunities for the market in the future.

- North America dominated the global market, with the United States having the most significant consumption.

Bioethanol Market Trends

Increasing Usage in the Automotive and Transportation Sector

- The most extensive bioethanol applications are fuel and fuel additives in the automotive and transportation industries. It is used alongside conventional petrol to fuel petrol engines in road vehicles. It can also produce ETBE (ethyl-tertiary-butyl-ether), an octane booster used in many types of petrol.

- Blending bioethanol with conventional fuels improves its renewability. E10 energy is so named because it contains 10% ethanol. Bioethanol is a low-carbon fuel that may help to decarbonize the transport industry.

- In the United States, tax incentives have been provided to gasoline marketers for using bio-ethanol as an octane enhancer and gas extender over the past three decades. This has driven boosted the usage of bio-ethanol in this sector.

- Biofuel producers in the United States received a boost from the latest legislation, which encompasses funding and critical tax credits for producing low-carbon fuels. Funding of USD 500 million was allocated for biofuel infrastructure improvements by installing storage tanks and related equipment for ethanol-biodiesel blends.

- In 2022, according to OICA data, the overall production of automobiles increased by 6% compared to 2021. The global automotive production in 2022 was around 85.02 million units.

- The Asia-Oceania and Americas regions recorded automotive production of 50.02 million and 17.75 million units in 2022, registering an increase of nearly 7% and 10%, respectively, compared to 2020. However, Europe recorded a production of 16.21 million units in 2022, a decrease of 1% from the production achieved in 2021.

- Furthermore, in 2021, the United States Department of Energy announced to provide USD 64.7 million in funds for research and development projects dedicated to producing low-cost biofuels as fossil-fuel replacements for heavy-duty transportation like airplanes to bolster America's commitment to reaching net-zero emissions by 2050.

- With various economies announcing their plans to increase bio-ethanol consumption in fuels, the demand for bio-ethanol will likely surge during the forecast period.

North America Region to Dominate the Market

- The North American region is dominating the bioethanol market share. The United States is the largest producer of bioethanol globally, followed by Brazil, China, India, and Canada. It is also the largest consumer of bioethanol.

- In recent years, bioethanol production has increased due to higher renewable fuel standard (RFS) targets and growth in domestic motor gasoline consumption, almost all of which is now blended with 10% ethanol by volume.

- In 2022, the overall production of automobiles in North America was around 14.79 million units compared to 13.46 million units in 2021.

- Around 93% of the country's 263 million registered automobiles may operate on E15. Furthermore, around 22 million flex-fuel vehicles (FFVs) in the United States can run on ethanol blends up to E85.

- The Canadian Clean Fuel Standard requires liquid fuel (gasoline, diesel, and home heating oil) suppliers to gradually reduce the carbon intensity of the fuels they produce and sell for use in Canada over time, resulting in a reduction in the carbon intensity of liquid fuels used in Canada of approximately 13% (below 2016 levels) by 2030.

- Some initiatives include the Canadian government's recent USD 1.5 billion investment in a Low-carbon and Zero-Emissions Fuels Fund, which may enhance support for local production and adoption of low-carbon fuels like hydrogen and biofuels.

- Due to all the factors mentioned above, the demand in the market studied is expected to increase in the North American region.

Bioethanol Industry Overview

The Bioethanol Market is moderately fragmented. Some major players in the market (not in any particular order) include POET LLC, Valero, ADM, Green Plains Inc., and Alto Ingredients Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Favorable Initiatives and Blending Mandates by Regulatory Bodies

- 4.1.2 Rising Environmental Concerns by the Use of Fossil Fuels and Need for the Bio-fuels

- 4.2 Restraints

- 4.2.1 Phasing out of Fuel-based Vehicles Due to Rising Demand for Electric Vehicles

- 4.2.2 Shifting Focus to Bio-butanol

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Feedstock Type

- 5.1.1 Sugarcane

- 5.1.2 Corn

- 5.1.3 Wheat

- 5.1.4 Other Feedstock Types

- 5.2 Application

- 5.2.1 Automotive and Transportation

- 5.2.2 Food and Beverage

- 5.2.3 Pharmaceutical

- 5.2.4 Cosmetics and Personal Care

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Abengoa

- 6.4.2 ADM

- 6.4.3 Alto Ingredients Inc.

- 6.4.4 Blue Bio Fuels Inc.

- 6.4.5 Cenovus Inc.

- 6.4.6 Cristalco

- 6.4.7 Cropenergies AG

- 6.4.8 Ethanol Technologies

- 6.4.9 Granbio Investimentos SA

- 6.4.10 Green Plains Inc

- 6.4.11 Henan Tianguan Group Co. Ltd

- 6.4.12 Jilin Fuel Ethanol Co. Ltd

- 6.4.13 KWST

- 6.4.14 Lantmannen

- 6.4.15 Poet LLC

- 6.4.16 Raizen

- 6.4.17 Sekab

- 6.4.18 Suncor Energy Inc.

- 6.4.19 Tereos

- 6.4.20 Valero

- 6.4.21 Verbio Vereinigte Bioenergie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Development of Second-generation Bio-ethanol Production

- 7.2 Increasing Consumption of Bio-fuels in the Aviation Industry