|

市场调查报告书

商品编码

1687118

合约包装:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Contract Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

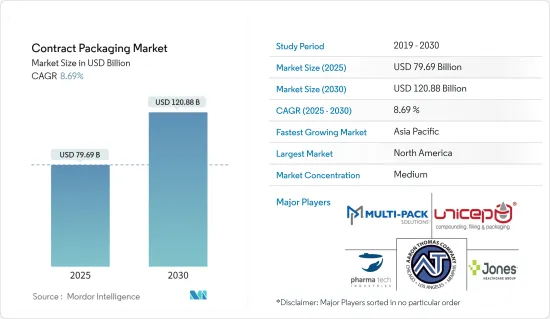

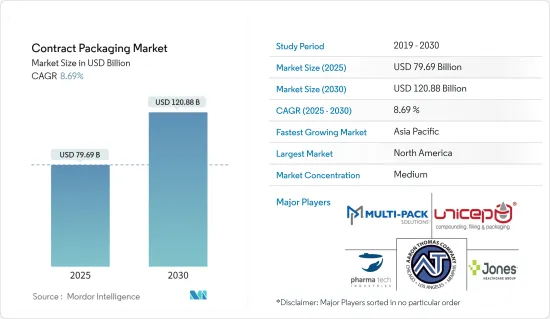

合约包装市场规模预计在 2025 年为 796.9 亿美元,预计到 2030 年将达到 1208.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.69%。

主要亮点

- 合约包装市场是供应链不可或缺的一部分,可以提高企业生产力。随着越来越多的製造商将包装需求外包,以便能够专注于自己的核心竞争力,全球对合约包装的需求正在蓬勃发展。

- 合约包装服务提供许多好处,并确保您的产品及其包装始终符合行业标准和政府法规。此外,这些服务还能帮助製造商降低营运成本。凭藉合适的设备、专业知识和材料,合约包装公司可以大幅降低製造商的成本,从而刺激市场扩张。

- 全球製药和化妆品行业的成长正在推动对综合合约包装服务的需求。要遵守严格的规定,就需要进行严格的测试和品质检查。将这些包装作业外包允许製造商将合规责任(通常称为军用规格包装)转移给合约包装商,使合约包装成为比内部解决方案更具吸引力的选择。

- 消费者对环境议题的意识不断增强,加上製造商对经济高效包装的需求不断增加,促使包装承包商采用永续的、环保的包装设计。此外,永续性和客製化趋势将在整个预测期内加强合约包装市场,特别是对于个人护理用品、食品和饮料等消费包装商品。

- 2024 年 4 月,美国合约包装供应商 Orlandi 推出了其最新产品 EcoPro 纸质包装。该产品满足了日益增长的环保包装需求。 EcoPro 是一种可回收、阻隔性、可热封的纸包装,是传统塑胶薄膜和铝箔袋的永续替代品。

- 大型公司越来越多地将收购和扩大其地理覆盖范围作为其成长策略的一部分。例如,2024年4月,美国专门从事加值包装的经销商Veritiv Corporation宣布收购美国合约套装服务供应商Ameripac LLC。此举旨在加强 Veritiv 的市场影响力并扩大其合约包装基本客群。

- 随着包装领域的快速发展,许多合约包装供应商都在努力跟上这些变化,但这可能会阻碍市场成长。为了保持竞争力,这些供应商必须适应不断变化的消费者偏好和需求。

合约包装市场趋势

具有巨大成长潜力的药品

- 医疗领域的进步正在推动製药业的快速成长。研究方法的演变正在导致患者健康的创新治疗方法的显着改善,从而推动了主要市场对合约包装服务的需求。

- 专门从事製药和医疗产业的合约包装公司优先考虑法规遵循和安全性,确保产品符合最高品质标准。外包包装服务可使製药公司降低包装、标籤、消毒和仓储等方面的成本,从而推动市场成长。製药公司越来越多地将最终产品的包装外包给专业公司,凸显了药品包装对病患安全至关重要。

- 随着对复杂和专业化药物的关注度不断提高,合约包装正成为医药市场的首选。受託製造厂商(CDMO) 正在介入提供全面的包装服务,使製药公司能够简化业务并专注于其核心竞争力。 CDMO 凭藉其先进的基础设施,促进了药物开发、製造和包装步骤,进一步推动了市场成长。

- 合约包装服务为製药公司提供了灵活性和扩充性,以满足不断变化的市场需求和生产量。这些服务涵盖了各种包装形式,从泡壳包装和瓶子到管瓶和小袋,以满足不同药物和剂量的多样化需求。

- 此外,许多合约包装公司已经投资了尖端设备和技术。这不仅简化了包装流程、减少了错误,而且提高了整体效率。这些投资使製药公司能够扩大生产规模以满足日益增长的需求。

- Pharmapack Europe 2024 调查的结果表明,未来一年合约包装将呈现良好的成长轨迹。随着特种药品和生物製药变得越来越普遍,对客製化包装解决方案的需求日益增长,推动製造商转向合约包装服务。这些公司擅长创建客製化包装解决方案,使製药商脱颖而出并满足特种药物的独特需求。

预计北美将占据最大市场占有率

- 北美合约包装市场正在经历多个行业的快速扩张,包括製药、化妆品、个人护理和饮料。在製药领域,药品製造投资的增加以及各地区包装法规的严格化,推动了合约包装服务需求的激增。

- 合约包装公司专门提供客製化解决方案以满足药品的特定要求,提供从泡壳包装到单位剂量包装的所有产品。我们在法规遵循和品质保证方面的专业知识可确保药品安全包装并符合行业标准,从而进一步增加了北美对这些服务的需求。

- 在化妆品行业,合约包装使品牌能够灵活地快速将产品推向市场。合约包装公司与化妆品公司密切合作,创造出创新的设计,不仅增强了产品的美感,也增强了其对消费者的吸引力。从填充、贴标到组装和运输,我们提供从护肤到化妆的全方位服务。

- 为了满足对化妆品永续解决方案日益增长的需求,合约包装公司正在投资尖端技术。这包括关注环保材料和可回收选择,有助于推动市场成长。

- 包装技术的进步推动了化妆品个人化包装趋势的激增,增加了北美的需求。像 Cosmopak USA LLC 这样的公司处于领先地位,提供客製化服务来提升您的品牌形象。

合约包装行业概况

合约包装市场相当分散,国内外都有许多公司。在市场上运营的公司正在透过合作和合併不断扩大其地理覆盖范围。随着各类外包企业的扩张,市场在提供可靠、及时的服务上的竞争愈加激烈。

- 2024 年 2 月,软包装解决方案领导者美国包装公司 (APC) 宣布了其最新的 RE Design for Recycle 技术。这种创新的包装是专为冷冻食品(包括水果和蔬菜)设计的。随着这项技术的推出,APC 的 RE永续包装产品组合现在拥有多样化的技术,不仅包括新的回收设计,还包括堆肥设计、循环内容、可再生内容和各种其他回收设计选项。

- 2024 年 7 月,永续包装技术公司宣布将优先考虑生物基包装,并利用 2M 集团旗下材料科学公司 Banner Chemicals 的专业知识。目标是建立一系列生医材料技术和解决方案,以便无缝整合到当前的包装製造流程中。 Innovate UK 和 SSPP 政府基金的策略伙伴关係和投资支持了永续包装技术的努力。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 寻求透过外包非核心业务来获得竞争优势的公司

- 电子商务产业需求增加

- 对尖端技术和创新包装的需求日益增加

- 市场限制

- 严格的政府法规

- 与内部包装的竞争

- 行业法规和标准

- 合约包装的演变

第六章 市场细分

- 按包装

- 初级包装

- 二次包装

- 三级包装

- 按最终用户产业

- 食物

- 饮料

- 药品

- 家庭和个人护理

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 荷兰

- 义大利

- 西班牙

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Aaron Thomas Company

- Multipack Solutions LLC

- Pharma Tech Industries Inc.

- Reed Lane Inc.

- Sharp Packaging Services

- UNICEP Packaging LLC

- Green Packaging Asia

- Jones Healthcare Group

- Stamar Packaging Inc.

- Budelpack Poortvliet BV

- Complete Co-Packing Services Ltd

第八章投资分析

第九章:未来展望

The Contract Packaging Market size is estimated at USD 79.69 billion in 2025, and is expected to reach USD 120.88 billion by 2030, at a CAGR of 8.69% during the forecast period (2025-2030).

Key Highlights

- The contract packaging market is integral to the supply chain, enhancing business productivity. Many manufacturers are increasingly outsourcing their packaging needs, allowing them to concentrate on their core competencies and driving a global surge in demand for contract packaging.

- Contract packaging services offer numerous benefits, ensuring products and their packaging consistently meet industry standards and government regulations. Moreover, these services help manufacturers cut operational costs. With the right equipment, expertise, and materials, contract packaging companies can significantly lower these costs for manufacturers, fueling the market's expansion.

- The growing pharmaceutical and cosmetic industries worldwide are boosting the demand for comprehensive contract packaging services. Adhering to stringent regulations necessitates rigorous inspections and quality checks. By outsourcing these packaging tasks, manufacturers can transfer the responsibility of compliance (often termed mil-spec packaging) to contract packaging agencies, making contract packaging a more attractive option than in-house solutions.

- Heightened consumer awareness regarding environmental issues, coupled with manufacturers' growing demand for cost-effective packaging, is prompting contract packagers to embrace sustainable and eco-friendly packaging designs. Additionally, the trends of sustainability and customization are set to bolster the contract packaging market, especially in consumer-packaged goods like personal care items and food and beverages, throughout the forecast period.

- In April 2024, Orlandi, a contract packer based in the United States, unveiled its latest offering, the EcoPro Paper Wrap. This product addresses the surging demand for eco-conscious packaging. EcoPro is a recyclable, high-barrier, heat-sealable paper wrap, presenting a sustainable alternative to traditional plastic films and foil pouches.

- Major players, as part of their growth strategy, are increasingly turning to acquisitions and expanding their geographical reach. For instance, in April 2024, Veritiv Corporation, a US-based distributor specializing in value-added packaging, announced its acquisition of Ameripac LLC, a contract packaging service provider in the United States. This move is aimed at bolstering Veritiv's market presence and expanding its customer base in contract packaging.

- As the packaging landscape evolves rapidly, many contract packaging providers find it challenging to stay abreast of these shifts, potentially hindering market growth. To maintain competitiveness, these providers must adapt to changing consumer preferences and demands.

Contract Packaging Market Trends

Pharmaceuticals Expected to Experience Significant Growth

- Advancements in the medical field are driving the rapid growth of the pharmaceutical industry. Evolving research methods are leading to significant improvements in innovative treatments for patient well-being, subsequently boosting the demand for contract packaging services in major markets.

- Specializing in the pharmaceutical and medical industries, contract packaging companies ensure products meet the highest quality standards, prioritizing regulatory compliance and safety. By outsourcing packaging services, pharmaceutical companies can reduce costs in areas like packaging, labeling, sterilization, and warehousing, fueling market growth. Pharmaceutical firms are increasingly turning to specialized companies for the packaging of their end products, underscoring the critical nature of drug packaging for patient safety.

- As complex medications and specialty drugs rise in prominence, contract packaging is becoming a favored choice in the pharmaceutical market. Contract development and manufacturing organizations (CDMOs) are stepping in, offering holistic packaging services that allow pharmaceutical firms to streamline operations and concentrate on their core strengths. With their advanced infrastructure, CDMOs are facilitating stages from drug development to manufacturing and packaging, further propelling market growth.

- Contract packaging services grant pharmaceutical firms the flexibility and scalability to adjust to evolving market demands and production volumes. These services cater to a wide array of packaging formats, from blister packs and bottles to vials and sachets, addressing the diverse needs of various medications and dosages.

- Moreover, many contract packaging providers are investing in cutting-edge equipment and technology. This not only streamlines packaging processes and reduces errors but also boosts overall efficiency. Such investments empower pharmaceutical companies to scale production in line with rising demand.

- Insights from the Pharmapack Europe 2024 survey indicate a promising growth trajectory for contract packaging in the next year. The increasing prevalence of specialty and biologic medicines has heightened the demand for tailored packaging solutions, prompting manufacturers to turn to contract packaging services. These companies excel in crafting bespoke packaging solutions, allowing pharmaceutical manufacturers to stand out and cater to the distinct needs of specialty medications.

North America Expected to Account for the Largest Market Share

- The North American contract packaging market is witnessing rapid expansion across diverse industries, notably pharmaceuticals, cosmetics, personal care, and beverages. In pharmaceuticals, heightened investments in drug manufacturing and stringent regional packaging regulations are driving a surge in demand for contract packaging services.

- Specializing in bespoke solutions, contract packaging firms cater to the distinct requirements of pharmaceuticals, offering everything from blister packs to unit-dose packaging. Their expertise in abiding by regulatory compliance and quality assurance ensures medications are packaged safely and to industry standards, further fueling the demand for these services in North America.

- In the cosmetics industry, contract packaging empowers brands with the flexibility to swiftly introduce products to the market. Collaborating closely with cosmetics firms, contract packagers craft innovative designs that not only elevate product aesthetics but also boost consumer appeal. Their comprehensive services span from filling and labeling to assembling and transportation, catering to everything from skincare to makeup.

- To address the rising demand for sustainable solutions in cosmetics, contract packaging firms are investing in cutting-edge technologies. This includes a focus on eco-friendly materials and recyclable options, propelling the market's growth.

- Advancements in packaging technologies are fueling a surge in personalized packaging trends within cosmetics, amplifying demand in North America. Companies like Cosmopak USA LLC are at the forefront, offering tailored services to bolster their brand image.

Contract Packaging Industry Overview

The contract packaging market is moderately fragmented, with the presence of many domestic and international companies. The companies in the market are continually expanding their geographical footprint with the help of partnerships and mergers. With the growth of outsourcing activities among various established players, the market has been witnessing significant competition in terms of providing reliable and quick services, making it competitive.

- February 2024: American Packaging Corporation (APC), a frontrunner in flexible packaging solutions, launched its latest RE Design for Recycle technology. This innovative packaging is specifically designed for frozen food items, including fruits and vegetables. With this addition, APC's RE sustainable packaging portfolio now boasts a diverse range of technologies, encompassing not only the new Design for Recycle but also the Design for Compost, Circular Content, Renewable Content, and various other Design for Recycle options.

- July 2024: Sustainable Packaging Technologies, drawing on the expertise of Banner Chemicals, a materials sciences company under the 2M Group, announced that it was set to prioritize bio-based packaging. Its goal is to curate a portfolio of biomaterial technologies and solutions that seamlessly integrate into current packaging manufacturing processes. Strategic partnerships and investments from Innovate UK and SSPP government funds have bolstered the efforts of Sustainable Packaging Technologies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Companies Looking to Gain a Competitive Advantage by Outsourcing Non-core Operations

- 5.1.2 Increasing Demand from the E-commerce Industry

- 5.1.3 Increasing Need for Latest Technologies and Innovative Packaging

- 5.2 Market Restraints

- 5.2.1 Stringent Government Regulations

- 5.2.2 Competition from In-house Packaging

- 5.3 Industry Regulations and Standards

- 5.4 Evolution of Contract Packaging

6 MARKET SEGMENTATION

- 6.1 By Packaging

- 6.1.1 Primary

- 6.1.2 Secondary

- 6.1.3 Tertiary

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Pharmaceutical

- 6.2.4 Household and Personal Care

- 6.2.5 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.2.4 Netherlands

- 6.3.2.5 Italy

- 6.3.2.6 Spain

- 6.3.2.7 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Aaron Thomas Company

- 7.1.2 Multipack Solutions LLC

- 7.1.3 Pharma Tech Industries Inc.

- 7.1.4 Reed Lane Inc.

- 7.1.5 Sharp Packaging Services

- 7.1.6 UNICEP Packaging LLC

- 7.1.7 Green Packaging Asia

- 7.1.8 Jones Healthcare Group

- 7.1.9 Stamar Packaging Inc.

- 7.1.10 Budelpack Poortvliet BV

- 7.1.11 Complete Co-Packing Services Ltd