|

市场调查报告书

商品编码

1687148

铌:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Niobium - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

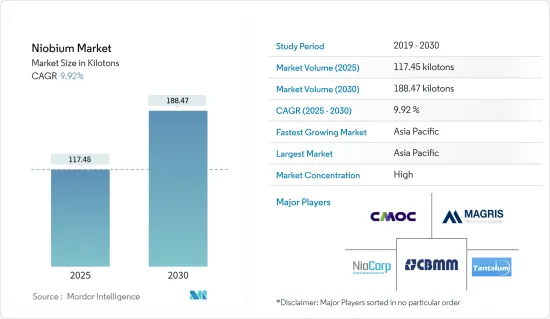

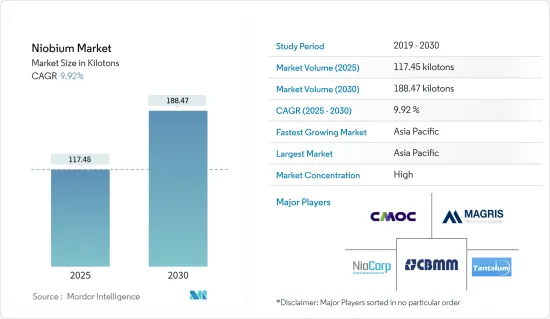

铌市场规模预计在 2025 年为 117.45 千吨,预计在 2030 年达到 188.47 千吨,预测期内(2025-2030 年)的复合年增长率为 9.92%。

2020 年,COVID-19 疫情对市场产生了负面影响。这是因为製造设施和工厂因封锁而关闭。供应链和运输中断进一步扰乱了市场。不过,2021年,产业復苏,市场需求回归。

主要亮点

- 从中期来看,结构钢的加速使用和对更轻、更省油的汽车的需求不断增长正在推动市场成长。

- 然而,有限的供应来源和对急性暴露导致的健康问题的担忧预计会阻碍市场的成长。

- 然而,铌在下一代锂离子电池中的良好应用,加上创新技术和矿山设计,预计将在预测期内提供大量机会。

- 亚太地区占市场主导地位,其中消费量最高的国家是中国和日本。

铌市场趋势

建设产业占据市场主导地位

- 建筑业是全球最大的铌消费产业。在建设产业中,高强度细合金铌板产品用于桥樑、高架桥和高层建筑的建造。重型机械和压力容器也用于精细合金板。结构材料广泛应用于土木工程和建筑、输电塔等,在这些领域铌与钒形成竞争。

- 同样地,钢筋也用于大型水泥建筑物中以增加其抵抗拉伸载荷的能力。透过添加铌和钒,可以生产出直径更大、强度更高的钢材,但一些较新的钢厂正在使用水淬技术,因此无需进行细合金化。

- 目前,建设产业正在推动对高强度低合金 (HSLA) 钢的需求,这使得更轻的建筑物能够降低成本并防止基础设施故障。

- 近年来,建筑业获得了大量投资。根据牛津经济研究院预测,2020年至2030年间,全球建筑业规模将成长4.5兆美元(42%),达到15.2兆美元。此外,预计2020年至2030年间,中国、印度、美国和印尼将占全球建设业成长的58.3%。

- 人口增长、从家乡向服务业中心的迁移以及核心家庭的趋势是推动世界各地住宅建设的一些因素。主要经济体快速迁移到都市区、政府在房地产市场住宅方面的支出增加、以及对豪华住宅的需求不断增长等因素都可能有利于所研究市场的成长。

- 此外,建筑业是印度经济成长的重要支柱。印度政府正在积极推动住宅建设,目标是为约13亿人提供住宅。

- 投资 3000 万美元的 Arkade Aspire 住宅综合体计划将在印度孟买建造一个面积为 35,366平方公尺的住宅综合体,其中包含两栋 18 层的住宅楼。预计建设将于2022年第二季开始,并于2025年第一季完工。在北美,美国在建设产业占有重要份额。除美国外,加拿大和墨西哥对建筑业的投资也贡献巨大。

- 根据美国人口普查局的数据,2022 年 12 月美国新建设产值为 17,929 亿美元。 2023年3月,非住宅部门价值为9,971.4亿美元,年增18.8%。

- 此外,加拿大政府的各种计划,如经济适用住房倡议(AHI)、新建筑加拿大计划(NBCP)和加拿大製造将支持该行业的扩张。 2022年8月,加拿大政府宣布将在三项关键倡议上投资超过20亿美元:三项倡议将支持在全国范围内开发约17,000套家庭住宅,其中包括数千套经济适用住宅。

- 此外,由于欧盟復苏基金的新投资,欧洲建筑业在 2022 年成长了 2.5%。儘管大多数欧盟建设公司面临价格压力,但预计景气将在 2022 年初回升并达到新冠疫情之前的水平。此外,随着新冠疫情危机消退,建筑商对投资新公司大楼和维修现有房产的积极性降低,非住宅建筑预计也将增加。预计非住宅建筑将加速发展,以支撑整体建筑市场的成长。 2022年主要建筑计划为非住宅建筑(办公室、医院、饭店、学校和工业建筑),占总数的31.3%。

- 因此,全球建筑业的强劲成长可能会在预测期内推动铌的消费需求。

亚太地区占市场主导地位

- 亚太地区占据全球市场主导地位。由于铌在结构钢中的应用加速,以及在中国、印度和日本等国的汽车和航太工业中的应用增加,该地区的铌消费量正在增长。

- 在一些新兴国家(例如中国和印度)的钢铁製造和建筑业中,铌的消费量以铌铁的形式显着增加。例如,根据世界钢铁协会的数据,中国 2023 年 4 月钢铁产量估计为 9,260 万吨,2023 年 1 月至 4 月总产量为 3.544 亿吨,比 2022 年同期增加 4.1%。

- 此外,中国钢铁协会表示,随着国家疫情应对力道放缓和经济復苏力道加大,作为经济风向标的中国钢铁业需求增加,该产业也因此受到提振。此外,受房地产市场稳定以及汽车、航运和建筑等其他钢铁消费产业復苏的推动,钢铁业在 2023 年也将呈现上升趋势。反过来,预计这将对市场产生积极影响。

- 中国是最大的乘用车生产国之一,背后还有其他因素推动了该国乘用车市场产量的成长,包括物流和供应链的改善、商业活动的活性化以及促进该国消费的政策。这增加了该国乘用车市场对铌市场的需求。例如,根据OICA的预测,2022年中国乘用车产量将达23,836,083辆,较2021年成长11%。

- 此外,该国的汽车产业正在经历趋势的转变,消费者越来越倾向于电池驱动的汽车。此外,中国政府预测,到 2025 年,电动车产量将达到 20%。这反映在该国的电动车销售趋势上,2022 年电动车销售将创下历史新高。

- 基础建设部门是印度经济的重要支柱。该国政府正在采取各种倡议,确保及时发展良好的基础设施。政府重点关注铁路、公路建设、住宅、城市发展和机场建设。

- 印度的住宅产业正在崛起,政府的支持和倡议进一步刺激了需求。据印度品牌股权基金会(IBEF)称,住房与城市发展部(MoHUA)在其 2022-2023 年预算中拨款 98.5 亿美元用于资助住宅建设和停滞计划的完成。

- 印尼还计划在第二季开始建造价值 27 亿美元的公寓,以供数千名公务员迁往婆罗洲岛的新首都。此外,印尼政府希望该计画的80%资金来自外国投资。预计住宅建设将推动该国铌消费市场需求增加。

- 日本是世界第三大粗钢生产国,也是铌市场的主要终端用户。受全球经济放缓影响,汽车製造业復苏缓慢、出口需求低迷,日本2022年粗钢产量与前一年同期比较下降约7.4%。日本钢铁联合会的资料显示,2022年日本粗钢产量将达8,920万吨,而2021年为9,630万吨。

- 考虑到上述因素,预测期内亚太地区铌市场预计将稳定上升。

铌行业概况

铌市场趋于整合。该市场的主要企业(不分先后顺序)包括 CBMM、洛阳钼业、Magris Performance Materials、NioCorp Development Ltd、长沙南方钽铌等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 加速结构钢的使用

- 对轻型、省油车的需求不断增加

- 限制因素

- 供应来源有限

- 担心急性暴露导致的健康问题

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 技术简介/生产分析

- 价格趋势

第五章 市场区隔

- 生产

- 碳酸盐岩及碳酸盐岩相关

- 铌铁矿-钽铁矿

- 类型

- 铌铁

- 氧化铌

- 铌金属

- 真空级铌合金

- 应用

- 钢

- 高温合金

- 超导磁铁和电容器

- 电池

- 其他用途

- 最终用户产业

- 建造

- 汽车和造船

- 航太和国防

- 石油和天然气

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 俄罗斯

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Admat Inc.

- Australian Strategic Materials Ltd

- CBMM

- Changsha South Tantalum Niobium Co.,Ltd

- CMOC

- Grandview Materials

- Magris Performance Materials

- NioCorp Development Ltd.

- Titanex GmbH

第七章 市场机会与未来趋势

- 铌在下一代锂离子电池中的预期用途

- 创新技术与矿山设计

The Niobium Market size is estimated at 117.45 kilotons in 2025, and is expected to reach 188.47 kilotons by 2030, at a CAGR of 9.92% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market in 2020. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- Over the medium term, accelerating usage of structural steel and increasing demand for lighter-weight and more fuel-efficient vehicles are some of the factors driving the growth of the market studied.

- On the flip side, limited supply sources and concerns about health issues on acute exposure is expected to hinder the growth of the market.

- However, the expected usage of niobium in next-generation lithium-ion batteries and innovative techniques and mine design are anticipated to provide numerous opportunities over the forecast period.

- Asia-Pacific dominated the market with the largest consumption from countries, such as China and Japan.

Niobium Market Trends

Construction Sector to Dominate the Market

- The construction industry is the largest consumer of niobium across the world. In the construction industry, high-strength niobium micro-alloyed plate products are used to construct bridges, viaducts, high-rise buildings, etc. Heavy machinery, pressure vessels, etc., represent additional applications of micro-alloyed plates. Structural sections are widely used in civil construction, transmission towers, etc., where niobium competes with vanadium.

- Similarly, steel reinforcing bar is used in large concrete structures to increase their resistance to tensile loads. Larger diameter, high-strength grades are produced via the addition of niobium and vanadium, although some modern steel mills also use water cooling, which negates the need for microalloying.

- Furthermore, niobium has also found application in high-strength and wear-resistant rails for railway tracks operating under high axle loads.The building and construction industry is currently driving the demand for High Strength Low Alloys (HSLA) steel, which provides cost savings through weight reduction in buildings and prevents infrastructure failures.

- The construction sector has witnessed major investments in recent years. According to Oxford Economics, the global construction industry is expected to grow by USD 4.5 trillion, or 42%, between 2020 and 2030 to reach USD 15.2 trillion. Also, China, India, the United States, and Indonesia are expected to account for 58.3% of global growth in construction between 2020 and 2030.

- Growth in population, migration from hometowns to service sector clusters, and the growing trend of nuclear families are some of the factors which have been driving residential construction across the world. Factors such as rapid urban migration in major economies, increased government spending in the real estate market for residential construction, along with the growing demand for high-class residential homes are likely to benefit the growth of the market studied.

- Moreover, the construction sector is an important pillar for the growth of the Indian economy. The Indian government has been actively boosting housing construction, aiming to provide houses to about 1.3 billion people.

- The USD 30 million Arkade Aspire Residential Complex project entails the construction of a 35,366 sq. m. residential complex with two 18-story residential towers in Mumbai, India. Construction began in Q2 2022 and is expected to be completed in Q1 2025. In North America, the United States has a major share in the construction industry. Besides the United States, Canada and Mexico contribute significantly to the investments in the construction sector.

- According to the U.S. Census Bureau, the value of new construction output in the United States amounted to USD 1,792.9 billion in December 2022. The non-residential sector accounted for USD 997.14 billion in March 2023, registering a growth of 18.8% compared to the same period the previous year.

- Furthermore, in Canada, various government projects, including the Affordable Housing Initiative (AHI), New Building Canada Plan (NBCP), and Made in Canada, are set to support the sector's expansion. In August 2022, the Canadian government announced a significant investment of more than USD 2 billion to fund three important initiatives that may collectively help develop approximately 17,000 houses for families across the nation, including thousands of affordable housing units.

- Additionally, the European construction sector grew by 2.5% in 2022 due to new investments from the EU Recovery Fund. Business confidence picked up in early 2022, despite price pressures at most EU construction firms, and is expected to reach pre-COVID-19 levels. Moreover, as the crisis due to COVID-19 abates and builders become less reluctant to invest in new corporate buildings and renovate existing properties. Non-residential construction is expected to pick up the pace, thus supporting overall growth in the construction market. The major construction projects in 2022 accounted for non-residential construction (offices, hospitals, hotels, schools, and industrial buildings), accounting for 31.3% of total activity.

- Therefore, such robust growth in construction across the world is likely to boost the demand for the consumption of niobium during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the global market. With accelerating usage in structural steel and growing usage in the automobile and aerospace industry in countries such as China, India, and Japan, the consumption of niobium is increasing in the region.

- The consumption of niobium is very high in steel manufacturing in the form of ferroniobium, and the construction industry is thriving in several emerging economies, such as China and India, among others. For instance, according to the World Steel Association, China produced an estimated 92.6 million tonnes of steel in April 2023 and a total of 354.4 million tonnes from January to April 2023, a 4.1% increase compared to the same period in 2022.

- Moreover, according to the China Iron and Steel Association, the economy's benchmark China's steel industry was buoyed by increased demand after the country's declining response to the pandemic and efforts to support the economy. In addition, the steel sector is on an upward trend in 2023, supported by a stable real estate market and a recovery in other steel-consuming industries such as automobiles, ships, and construction. This, in turn, is expected to impact the market positively.

- China is one of the largest producers of passenger cars, due to the improving logistics and supply chains, increased business activity, and the country's raft of pro-consumption measures, among other factors contributing to the passenger car market products in the country. Therefore, this has increased demand for niobium market from the country's passenger car segment. For instance, according to OICA, in 2022, the passenger car production in China amounted to 2,38,36,083 units, which showed an increase of 11% compared to 2021.

- Further, the automobile industry in the country is witnessing switching trends as the consumer inclination toward battery-operated vehicles is on the higher side. Moreover, the government of China estimates a 20% penetration rate of electric vehicle production by 2025. This is reflected in the electric vehicle sales trend in the country, which went record-breaking high in 2022.

- The infrastructure sector is an important pillar of the Indian economy. The government is taking various initiatives to ensure the timely creation of excellent infrastructure in the country. The government is focusing on railways, road development, housing, urban development, and airport development.

- The residential sector in India is on an increasing trend, with government support and initiatives further boosting the demand. According to the India Brand Equity Foundation (IBEF), the Ministry of Housing and Urban Development (MoHUA) allocated USD 9.85 billion in the 2022-2023 budget to construct houses and create funds to complete the halted projects.

- Furthermore, Indonesia expects to begin construction in the second quarter on apartments worth USD 2.7 billion for thousands of civil servants due to move to its new capital city on Borneo island. Moreover, tndonesian government intends to finance it for 80% through foreign investments. Therefore, this is expected to create an upside demand for the consumption for niobium market from the contry's residential construction.

- Japan is the third-biggest producer of crude steel worldwide, which is a major end-user for the Niobium Market. The crude steel output in Japan fell by around 7.4% in 2022 from the previous year owing to a slow recovery in automobile manufacturing and weaker export demand amid a slowdown in the global economy. As per the data of the Japan Iron and Steel Federation, the crude steel production in the country reached 89.2 million tons in 2022, as compared to 96.3 million tons in 2021.

- Considering the aforementioned factors, the Asia-Pacific niobium market is anticipated to rise steadily over the forecast period.

Niobium Industry Overview

The Niobium Market is consolidated in nature. The major players in this market (not in any particular order) include CBMM, CMOC, Magris Performance Materials, NioCorp Development Ltd, and Changsha South Tantalum Niobium Co.,Ltd., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Accelerating Usage in Structural Steel

- 4.1.2 Growing Demand for Lighter-Weight and More Fuel-Efficient Vehicles

- 4.2 Restraints

- 4.2.1 Limited Supply Sources

- 4.2.2 Concerns About Health Issues on Acute Exposure

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Technological Snapshot/ Production Analysis

- 4.6 Price Trends

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Occurrence

- 5.1.1 Carbonatites and Associates

- 5.1.2 Columbite-Tantalite

- 5.2 Type

- 5.2.1 Ferroniobium

- 5.2.2 Niobium Oxide

- 5.2.3 Niobium Metal

- 5.2.4 Vacuum-Grade Niobium Alloys

- 5.3 Application

- 5.3.1 Steel

- 5.3.2 Super Alloys

- 5.3.3 Superconducting Magnets and Capacitors

- 5.3.4 Batteries

- 5.3.5 Other Applications

- 5.4 End-user Industry

- 5.4.1 Construction

- 5.4.2 Automotive and Shipbuilding

- 5.4.3 Aerospace and Defense

- 5.4.4 Oil and Gas

- 5.4.5 Other End-user Industries

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Russia

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Admat Inc.

- 6.4.2 Australian Strategic Materials Ltd

- 6.4.3 CBMM

- 6.4.4 Changsha South Tantalum Niobium Co.,Ltd

- 6.4.5 CMOC

- 6.4.6 Grandview Materials

- 6.4.7 Magris Performance Materials

- 6.4.8 NioCorp Development Ltd.

- 6.4.9 Titanex GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Expected Usage of Niobium in Next-Generation Lithium Ion Battery

- 7.2 Innovative Techniques and Mine Designing