|

市场调查报告书

商品编码

1692497

五氧化二铌-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Niobium Pentoxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

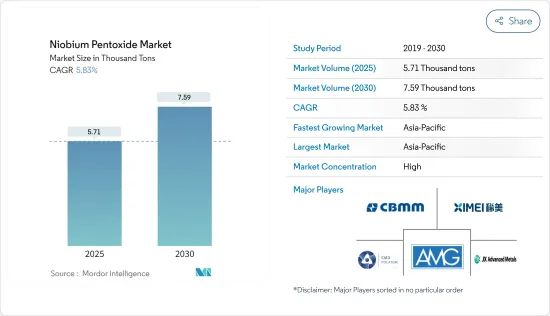

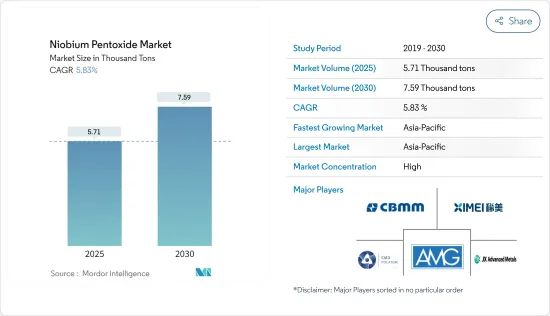

预计 2025 年五氧化二铌市场规模将达到 5,710 吨,2030 年将达到 7,590 吨,预测期内(2025-2030 年)的复合年增长率为 5.83%。

受新冠疫情影响,五氧化二铌市场遭遇挫折。全球停工和严格的政府监管导致大面积生产停工。然而,预计市场将在 2021 年復苏,并在未来几年经历显着成长。

主要亮点

- 短期内,光学产业对五氧化二铌的需求不断增长以及製造业对优质钢材的需求不断增加是推动研究市场需求的主要因素。

- 然而,由于急性接触五氧化二铌而导致的健康问题预计将阻碍市场成长。

- 然而,生物医药领域不断增长的需求预计将为市场带来新的机会。

- 预计亚太地区将主导全球市场,其中中国和印度的需求将占据大部分市场份额。

五氧化二铌市场趋势

製造业对优质钢材的需求不断增加

- 五氧化二铌的驱动力是製造业对优质钢材的需求激增。在钢铁生产中加入五氧化二铌可以提高强度、韧性和耐腐蚀性,巩固其作为各种钢铁应用中关键合金元素的作用。

- 五氧化二铌可提高高强度低合金钢(HSLA)的强度和韧性,这种钢广泛应用于建筑、运输和能源领域。

- 在不銹钢中,五氧化二铌可提高耐腐蚀性,使其可用于食品加工、化学加工和医疗设备等领域。

- 此外,它还能增强管道钢的强度,这对于石油和天然气运输至关重要。

- 根据世界钢铁协会(Worldsteel)的数据,全球粗钢产量将从2023年11月的1.449亿吨下降至2023年12月的1.357亿吨。然而,到 2024 年 7 月,产量回升至 1.528 亿吨。然而,与 2023 年 7 月相比下降了 4.7%,凸显了该行业面临的挑战。然而,随着新兴经济体加大基础设施开发和建设倡议,预计未来几年钢铁需求将会復苏。

- 此外,中国、日本和美国等国家的钢铁生产能力增强,进一步推动了全球钢铁产量,从而支持了研究市场的成长。

- 根据世界钢铁协会的数据,日本 2024 年 7 月钢铁产量为 710 万吨,较 2023 年同期下降 3.8%。累计产量49.8吨,较去年同期下降2.8%。

- 美国是世界第四大粗钢生产国,报告称,2024 年 7 月粗钢产量为 690 万吨,小幅增加 2.1%。不过,根据世界钢铁协会的数据,今年迄今的总产量为 4,690 万吨,下降了 1.8%。

- 德国呈现正面趋势,预计2024年7月产量将成长4.8%,达310万吨。根据世界钢铁协会的数据,德国年产量达2,250万吨,大幅增加4.5%。

- 巴西的增幅最高,2024年7月产量为3.1吨,增幅高达11.6%。世界钢铁协会报告称,巴西年产量增加3.3%,至19.4吨。

- 2023年南非粗钢产量将达到约487.10万吨,与前一年同期比较增约10.64%。国际钢铁协会(Worldsteel)报告称,产量激增凸显了该国的钢铁业和五氧化二铌市场。

- 钢铁对于建筑、铁路、汽车製造和消费品等许多行业都至关重要。过去十几年来,开发中国家特别是印度的工业化进程大幅拉动了钢铁需求。

- 鑑于这些动态,五氧化二铌市场在未来几年可能会显着成长。

亚太地区可望主导市场

- 亚太地区将主导五氧化二铌市场,并将成为预测期内成长最快的地区。这种成长是由于铌金属在光学玻璃、超级电容、高温合金和陶瓷等各种应用领域的需求增加,尤其是在中国、印度、韩国、日本和东南亚国家。

- 五氧化二铌及其衍生物在钢铁生产中扮演重要角色。铌的添加增加了钢的强度,使其更耐高温氧化和腐蚀。铌还能降低韧脆转变温度,提高焊接性和成形性。它在高级结构钢、高强度低合金钢(HSLA)和不銹钢的生产中尤其重要。

- 富含铌的 HSLA 钢主要用于汽车和建筑业。值得注意的是,大约 80% 的汽车钢板都添加了铌微合金,以确保车辆的燃油效率、安全性和耐用性。

- 根据印度汽车製造商工业(SIAM)的数据,2024年1月至3月,印度的乘用车、商用车、三轮车、两轮车和四轮车产量为739万辆。其中,乘用车114万辆,商用车26.8万辆。

- 到2024年,印度的经济适用住宅预计将成长70%。据投资印度 (Invest India) 称,预计到 2025 年,建筑业的估值将达到 1.4 兆美元。预计到 2030 年,超过 30% 的人口将成为居住者,因此迫切需要超过 2,500 万套中型和经济适用住宅。 《房地产法》、商品及服务税和房地产投资信託基金等近期改革旨在透过加速审批和加强建设产业来刺激市场成长。

- 中国是世界主要钢铁生产国之一,钢铁产品供应国内和国际市场。根据世界钢铁协会的数据,中国仍维持最大生产国地位,但 2024 年 7 月产量下降 9.0% 至总合万吨。全年中国产量为613.7吨,较2023年下降2.2%。

- BigMint 预计,到 2024/2025 财政年度结束(截至 2025 年 3 月),印度钢铁产量将与前一年同期比较增近 6%,达到 1.52 亿吨。预计大部分产量将来自使用高炉的钢厂。

- 铌合金在建筑中也极为重要,尤其是结构和承重部件。中国在全球建筑领域处于领先地位,占全球投资的20%,预计2030年将在建筑领域投资约13兆美元,市场前景看好。

- 根据塑胶出口促进委员会的数据,2023 年 12 月,印度的眼镜和护目镜月出口量创下新高。印度眼镜市场目前正面临低价竞争、依赖进口镜片以及快速变化的消费者偏好等挑战。 2023 年,印度隐形眼镜市场价值约为 1.643 亿美元。

- 根据波音公司的《商业展望(2023-2042)》,预计2042年中国将交付约8,560架新飞机。交付的激增预计将推动飞机零件(特别是引擎叶片)製造对五氧化二铌的需求。

- 五氧化二铌因其高表面积、优异的电导性、稳定性和耐用性而成为高性能超级超级电容开发的主要参与者。

- 根据中国国家能源局的数据,预计2023年将安装超过31吉瓦的新型能源储存系统,2024年将达到36吉瓦。这些包括锂离子电池、超级电容和液流电池在内的新型能源储存解决方案得到了中国领导层的支持。

- 考虑到这些动态,预计亚太地区五氧化二铌市场在预测期内将实现稳定成长。

五氧化二铌产业概况

五氧化二铌市场本质上呈现整合状态。主要企业(排名不分先后)包括 CBMM、Ximei Resources Holding Limited、JSC Solikamsk Magnesium Plant、AMG、JX Advanced Metals Corporation 等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 光学产业对五氧化二铌的需求不断增长

- 製造业对优质钢材的需求不断增加

- 其他驱动因素

- 限制因素

- 急性接触五氧化二铌的健康问题

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 年级

- 工业级(纯度99.0%至99.8%)

- 3N

- 4N

- 应用

- 铌金属

- 光学玻璃

- 超级电容

- 高温合金

- 陶瓷

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 合併、收购、合资、合作和协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- AMG

- CBMM

- Chengdu Huarui Industrial Co., Ltd.

- F&X Electro-Materials Limited

- Hebei Suoyi New Material Technology Co., Ltd.

- JSC Solikamsk Magnesium Plant

- JX Advanced Metals Corporation

- Kurt J. Lesker Company

- Merck KGaA

- Mitsui Mining & Smelting Co. Ltd.

- MPIL

- Taki Chemical Co., Ltd.

- XIMEI Resources Holding Limited

第七章 市场机会与未来趋势

- 生物医学领域的需求不断增长

- 其他机会

The Niobium Pentoxide Market size is estimated at 5.71 thousand tons in 2025, and is expected to reach 7.59 thousand tons by 2030, at a CAGR of 5.83% during the forecast period (2025-2030).

The niobium pentoxide market faced setbacks due to COVID-19. Global lockdowns and stringent government regulations led to widespread shutdowns of production hubs. However, the market rebounded in 2021 and is projected to see significant growth in the upcoming years.

Key Highlights

- Over the short term, the growing demand for niobium pentoxide in the optics industry and the increasing demand for high-quality steel from the manufacturing sector are the major factors driving the demand for the market studied.

- However, concerns about health issues caused by acute exposure to niobium pentoxide are expected to hinder the market's growth.

- Nevertheless, the growing demand from the biomedical sector is expected to create new opportunities for the market studied.

- Asia-Pacific region is expected to dominate the market across the world, with the majority of demand coming from China and India.

Niobium Pentoxide Market Trends

Increasing Demand for High-quality Steel from the Manufacturing Sector

- The manufacturing sector's surging demand for high-quality steel is driving the rising trend of niobium pentoxide. Its incorporation in steel production enhances strength, toughness, and corrosion resistance, solidifying its role as a vital alloying element across diverse steel applications.

- Niobium pentoxide bolsters the strength and toughness of high-strength, low-alloy (HSLA) steel, which is widely utilized in the construction, transportation, and energy sectors.

- In stainless steel, niobium pentoxide enhances corrosion resistance, benefiting sectors like food processing, chemical processing, and medical equipment.

- Additionally, it strengthens pipeline steel, which is crucial for oil and gas transportation.

- According to the World Steel Association (worldsteel), global crude steel production dipped to 135.7 million tonnes (Mt) in December 2023 from 144.9 million tonnes (Mt) in November 2023. However, July 2024 saw a rebound to 152.8 million tonnes (Mt). Despite this, it represented a 4.7% decline from July 2023, highlighting the industry's challenges. However, as emerging economies intensify their infrastructure and construction initiatives, steel demand is set to recover in the coming years.

- Additionally, bolstered steel production capacities in nations like China, Japan, and the United States have further fueled global steel output, thereby supporting the growth of the market studied.

- As per the World Steel Association, Japan's steel production in July 2024 stood at 7.1 Mt, marking a 3.8% decline from the same month in 2023. Year-to-date figures show a production of 49.8 Mt, reflecting a 2.8% year-on-year drop.

- The United States, ranked as the fourth-largest producer of crude steel globally, reported a production of 6.9 Mt in July 2024, witnessing a modest increase of 2.1%. However, the year-to-date production figures were at 46.9 Mt, indicating a decline of 1.8%, as per the World Steel Association.

- Germany showcased a positive trend, producing an estimated 3.1 Mt in July 2024, which is a 4.8% increase. Year-to-date, Germany's production reached 22.5 Mt, marking a notable 4.5% rise, according to data from the World Steel Association.

- Brazil led the pack with the highest growth, producing 3.1 Mt in July 2024, an impressive increase of 11.6%. Year-to-date, Brazil's production stood at 19.4 Mt, up by 3.3%, as reported by the World Steel Association.

- In 2023, South Africa's crude steel production reached approximately 4,871.0 kilotons, marking a growth rate of about 10.64% from the previous year. This surge in production, as reported by the World Steel Association (worldsteel), underscored the country's steel sector and niobium pentoxide market.

- Steel is integral to various sectors, from construction and railroads to automotive manufacturing and consumer goods. Over the last decade, industrialization in developing nations, especially India, has significantly boosted steel demand.

- Given these dynamics, the niobium pentoxide market is poised for substantial growth in the coming years.

Asia Pacific Region is Expected to Dominate the Market

- Asia-Pacific is set to dominate the niobium pentoxide market, emerging as the fastest-growing region during the forecast period. This growth is driven by rising demands across various applications, such as niobium metal, optical glass, supercapacitors, superalloys, and ceramics, especially in countries like China, India, South Korea, Japan, and several Southeast Asian nations.

- Niobium pentoxide and its derivatives play a crucial role in iron and steel production. Adding niobium enhances steel's strength and boosts its resistance to high-temperature oxidation and corrosion. Niobium also lowers the ductile-brittle transition temperature and enhances welding properties and formability. It's particularly vital in producing high-grade structural steel, high-strength low alloy (HSLA) steels, and stainless steel.

- HSLA steels, enriched with niobium, find primary applications in the automotive and construction sectors. Notably, around 80% of all automotive sheet steel grades are micro-alloyed with niobium, ensuring vehicles are fuel-efficient, safe, and durable.

- In India, data from the Society of Indian Automobile Manufacturers (SIAM) indicates that from January to March 2024, the production of passenger vehicles, commercial vehicles, three wheelers, two wheelers and quadricycle reached 7.39 million units. Specifically, sales for passenger and commercial vehicles were 1.14 million and 268 thousand units, respectively.

- In 2024, India is set to witness a 70% surge in the availability of affordable housing. According to Invest India, the construction sector is projected to attain a valuation of USD 1.4 trillion by 2025. With forecasts suggesting that over 30% of the population will be urban dwellers by 2030, there's a pressing need for 25 million more mid-end and affordable housing units. Recent reforms, such as the Real Estate Act, GST, and REITs, aim to expedite approvals and strengthen the construction industry, driving market growth.

- China stands as the globe's leading producer of iron and steel, with its output serving both domestic and international markets. As per the data from the World Steel Association, while China retained its title as the largest producer, it saw a 9.0% dip in output for July 2024, totaling 82.9 million tonnes (Mt). Year-to-date figures show China's production at 613.7 Mt, reflecting a 2.2% drop from 2023.

- According to BigMint, India's steel production is projected to grow by nearly 6% year-on-year, reaching 152 million tons by the close of FY2024/2025 (ending March 2025). The bulk of this projected output is anticipated to stem from steel mills utilizing blast furnaces.

- Niobium alloys are also pivotal in construction, especially for structural and load-bearing components. China, leading the global construction arena with 20% of worldwide investments, is set to spend nearly USD 13 trillion on buildings by 2030, signaling a robust market outlook.

- Data from the Plastics Export Promotion Council highlights that India achieved its highest monthly export of spectacles and goggles in December 2023, a milestone not seen in 60 months. The Indian optical market currently grapples with challenges like low-cost competition, reliance on imported lenses, and swiftly evolving consumer preferences. In 2023, the market for contact lenses in India was valued at approximately USD 164.30 million.

- According to the Boeing's Commercial Outlook (2023-2042) anticipates around 8,560 new aircraft deliveries in China by 2042. This surge in deliveries is expected to elevate the demand for niobium pentoxide in manufacturing aircraft components, particularly engine blades.

- Niobium pentoxide is emerging as a key player in developing high-performance supercapacitors, owing to its high surface area, excellent electrical conductivity, stability, and durability..

- Data from China's National Energy Administration indicates that in 2023, the country installed over 31 gigawatts of new energy storage systems, with projections reaching 36 gigawatts by 2024. Endorsed by Chinese leadership, these new energy storage solutions encompass lithium-ion batteries, supercapacitors, and flow batteries.

- Given these dynamics, the niobium pentoxide market in the Asia-Pacific region is poised for steady growth during the forecast period.

Niobium Pentoxide Industry Overview

The niobium pentoxide market is consolidated in nature. The major players (not in any particular order) include CBMM, Ximei Resources Holding Limited, JSC Solikamsk Magnesium Plant, AMG, and JX Advanced Metals Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Niobium Pentoxide in the Optics Industry

- 4.1.2 Increasing Demand for High-quality Steel from the Manufacturing Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Concerns about Health Issues Caused by Acute Exposure to Niobium Pentoxide

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Grade

- 5.1.1 Industrial Grade (purity: 99.0% to 99.8%)

- 5.1.2 3N

- 5.1.3 4N

- 5.2 Application

- 5.2.1 Niobium Metal

- 5.2.2 Optical Glass

- 5.2.3 Supercapacitors

- 5.2.4 Superalloys

- 5.2.5 Ceramics

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMG

- 6.4.2 CBMM

- 6.4.3 Chengdu Huarui Industrial Co., Ltd.

- 6.4.4 F&X Electro-Materials Limited

- 6.4.5 Hebei Suoyi New Material Technology Co., Ltd.

- 6.4.6 JSC Solikamsk Magnesium Plant

- 6.4.7 JX Advanced Metals Corporation

- 6.4.8 Kurt J. Lesker Company

- 6.4.9 Merck KGaA

- 6.4.10 Mitsui Mining & Smelting Co. Ltd.

- 6.4.11 MPIL

- 6.4.12 Taki Chemical Co., Ltd.

- 6.4.13 XIMEI Resources Holding Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Demand from the Biomedical Sector

- 7.2 Other Opportunities