|

市场调查报告书

商品编码

1687164

PVC 稳定剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)PVC Stabilizers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

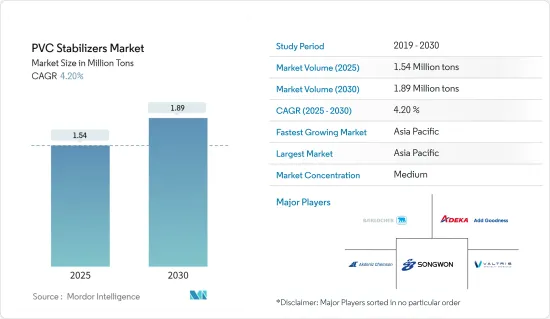

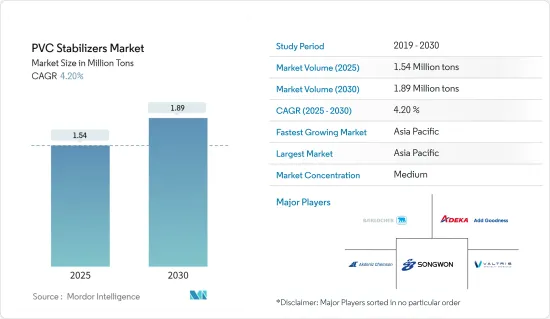

PVC 稳定剂市场规模预计在 2025 年为 154 万吨,预计到 2030 年将达到 189 万吨,预测期内(2025-2030 年)的复合年增长率为 4.2%。

COVID-19 疫情对 PVC 稳定剂市场产生了不利影响。全球停工和严格的政府监管迫使大多数製造工厂关闭,造成了毁灭性的挫折。儘管如此,预计市场将在 2021 年復苏,并在未来几年大幅成长。

主要亮点

- 短期内,PVC管路、管材和配件对稳定剂的需求增加以及汽车工业中稳定剂使用量的增加是推动PVC稳定剂需求的主要因素。

- 然而,健康危害和政府对使用铅基稳定剂的严格规定预计将阻碍市场成长。

- 然而,有机锡稳定剂作为环保选择的日益广泛使用预计将为市场研究创造新的机会。

- 亚太地区占据全球 PVC 稳定剂市场的主导地位。亚太市场的成长动力源自于该地区各国各类终端用户产业(包括建筑业)对 PVC 稳定剂日益增长的需求。中国和印度是该地区市场的主要贡献者。

PVC稳定剂市场趋势

建筑业占据市场主导地位

- 聚氯乙烯(PVC)是建设产业的主要塑胶。它坚固而轻便,能够抵抗天气、化学腐蚀和磨损。由 PVC 製成的常见产品包括管道、电缆、窗框、地板材料和屋顶。

- PVC 管在用水和污水系统中发挥着至关重要的作用。它们确保流畅、无摩擦的流动,并能防止积聚、结垢和腐蚀。特别是,PVC 管道被认为是输送饮用水的安全管道,安装在地下时的使用寿命可超过 100 年。此外,它还具有成本效益,可以回收8到10次。

- 牛津经济研究院预测全球建筑产出将呈现强劲成长轨迹,从目前的4.2兆美元增加到2037年的13.9兆美元以上。

- 中国占全球主导地位,生产了全球50-60%的PVC管道。特别是,它是聚氯乙烯聚合物製成的硬质管、管材和软管的最大出口国。

- 2023年,中国建筑业实际价值成长6.5%。国家统计局表示,今年前九个月,该产业对经济的贡献比去年同期成长了7.2%。

- 据投资印度称,都市化趋势表明,到 2030 年,超过 40% 的人口将居住在都市区,需要额外 2,500 万住宅中产阶级和经济适用住宅。此外,根据住宅和城市事务部的数据,在 AMRUT 计划下,约有 134,000 户家庭获得了供水,约有 102,000 户家庭获得了排污服务。

- 在美国,由于美国政府的目标是到 2030 年将排放在 2005 年的基础上减少 50-52%,以符合《巴黎协定》,因此未来几年 PVC 生产可能会受到影响。因此,美国PVC 产业正在准备采取重大措施抑制温室气体 (GHG)排放,并计划在 2050 年实现碳中和。

- 此外,2023 年 12 月,美国环保署 (EPA) 准备宣布监管 PVC 的计划,改变处置要求的性质。

- 据欧洲乙烯基製造商委员会称,窗户、管道、地板材料和屋顶薄膜等建筑产品占欧洲 PVC 的 70%。 PVC 是欧洲建设产业的主要塑胶。

- 德国强劲的经济正在引发对商业空间的需求激增。尤其是,人们对高品质、符合 ESG 标准的办公大楼的兴趣日益浓厚,主要租金的上涨就是明证。预计 2023 年第三季将有 246,000平方公尺的办公空间运作,到 2024 年总投入运营总合180 万平方公尺。

- 鑑于这些发展,全球建设产业的兴起预示着未来几年 PVC 稳定剂的前景看好。

亚太地区占市场主导地位

- 由于中国和印度等国家的建筑和汽车等行业的需求激增,亚太地区引领 PVC 稳定剂市场。

- PVC 管道和地板材料具有耐用、美观灵活、易于安装、易于清洁和可回收等优点。在建设产业,PVC 屋顶材料因其维护要求低、使用寿命超过 30 年而广受欢迎。

- 中国香港住宅委员会已推出多项措施推动廉价住宅建设。当局的目标是到 2030 年的 10 年内提供 301,000 套公共住宅。

- 此外,日本建设产业近年来也成为PVC稳定剂的主要消费者。日本正在进行一些引人注目的建设计划,包括三菱地所将在东京车站附近建设的日本高层建筑,该摩天大楼预计于 2027 年竣工,将包括 50 套豪华公寓,预计月租金将达到 43,000 美元。

- PVC 通常用于汽车工业,例如传统汽车和电动车的引擎盖下和内装。

- 中国是世界上最大的汽车製造国之一。根据OICA预测,2023年中国乘用车产量将达2,600万辆,较2022年成长10%以上。

- 此外,OICA表示,印度2023年的汽车产量将达585万辆,较2022年成长7%以上。该国的乘用车产量预计将达到478万辆,比2022年增长7.9%,从而支持市场成长。

- 根据通讯资料,受产量上升以及国内外需求復苏的推动,中国电子製造业在 2024 年前四个月表现良好。根据工业与资讯化部的报告,2024年1至4月,中国电子产业主要企业利润总额总合去年同期成长75.8%,达到人民币1,442亿元(约203亿美元)。

- 印度包装产业协会(PIAI)预测,预测期内印度包装产业将实现22%的强劲成长。此外,到 2025 年,印度包装市场规模将达到 2,048.1 亿美元,在此期间的复合年增长率高达 26.7%。这一激增证实了未来几年印度对 PVC 稳定剂的需求将持续成长。

- 鑑于这种动态和政府的推动,预测期内亚太地区 PVC 稳定剂市场的需求将会成长。

PVC 稳定剂产业概况

PVC 稳定剂市场因其性质而部分分散。主要企业(不分先后顺序)包括 Baerlocher GmbH、ADEKA Corporation、Akdeniz Chemson、SONGWON 和 Valtris Specialty Chemicals。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- PVC 管、管材和配件稳定剂的需求不断增加

- 在汽车产业的应用日益广泛

- 其他驱动因素

- 限制因素

- 健康危害和政府对使用铅基稳定剂的严格规定

- 其他阻碍因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 按类型

- 钙基

- 铅基

- 锡基

- 钡基

- 其他类型

- 按最终用户产业

- 建筑和施工

- 车

- 电气和电子

- 包装

- 鞋类

- 其他最终用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- Adeka Corporation

- Akdeniz Chemson

- Baerlocher GmbH

- Clariant

- Galata Chemicals

- Goldstab Organics Pvt. Ltd

- KD Chem Co. Ltd

- Kunshan Maijisen Composite Materials Co. Ltd

- Pau Tai Industrial Corp.

- PMC Group Inc.

- Ra Chemicals Pvt. Ltd

- Reagens SpA

- Shandong Jinchangshu New Material Technology Co. Ltd

- SONGWON

- Timah

- Valtris Specialty Chemicals

- Vikas Ecotech Ltd

第七章 市场机会与未来趋势

- 增加使用有机锡稳定剂作为环保选择

- 其他机会

The PVC Stabilizers Market size is estimated at 1.54 million tons in 2025, and is expected to reach 1.89 million tons by 2030, at a CAGR of 4.2% during the forecast period (2025-2030).

The COVID-19 pandemic adversely affected the PVC stabilizers market. Global lockdowns and severe government rules resulted in a catastrophic setback, as most production hubs were shut down. Nonetheless, the market recovered in 2021 and is expected to rise significantly in the coming years.

Key Highlights

- Over the short term, growing demand for stabilizers for PVC pipes, tubings, and fittings and increasing use in the automotive industry are the major factors driving demand for PVC stabilizers.

- However, health hazards and stringent government regulations regarding the use of lead-based stabilizers are expected to hinder the market's growth.

- Nevertheless, the rising usage of organo-tin stabilizers as an environmentally friendly option is expected to create new opportunities for the market studied.

- Asia-Pacific dominates the global PVC stabilizers market. Rising demand for PVC stabilizers in different end-user industries, including building and construction in the countries of this region, is driving the Asia-Pacific market. China and India are the major contributors to this regional market.

PVC Stabilizers Market Trends

The Building and Construction Segment to Dominate the Market

- Polyvinyl chloride (PVC) stands out as the predominant plastic in the building and construction industry. Its robust yet lightweight nature ensures durability against weathering, chemical corrosion, and abrasion. Common products crafted from PVC include pipes, cables, window profiles, flooring, and roofing.

- PVC pipes play a pivotal role in water, waste, and sewage systems. They resist build-up, scaling, and corrosion, ensuring a smooth, friction-free flow. Notably, PVC pipes are deemed safe for transporting drinking water, boasting a service life exceeding 100 years for underground installations. Additionally, they are cost-effective and can be recycled 8-10 times.

- Oxford Economics forecasts a robust growth trajectory for global construction output, projecting an increase from over USD 4.2 trillion currently to a staggering USD 13.9 trillion by 2037, predominantly fueled by the construction powerhouses of China, the United States, and India.

- China dominates the global landscape, producing 50-60% of the world's PVC pipes. Notably, it stands as the foremost exporter of rigid tubes, pipes, and hoses crafted from vinyl chloride polymers.

- In 2023, China's construction industry witnessed a 6.5% growth in actual value. The industry's economic contribution surged by 7.2% Y-o-Y during the initial nine months, as highlighted by the National Bureau of Statistics (NBS).

- As per Invest India, urbanization trends suggest that by 2030, over 40% of the population will reside in urban locales, driving the need for an additional 25 million mid-end and affordable housing units. Furthermore, according to the Ministry of Housing & Urban Affairs, around 134 lakh water tap connections and 102 lakh sewer/septage connections have been provided under the AMRUT scheme.

- PVC production in the United States is likely to be affected in the coming years due to the US government's target of reducing emissions by 50-52% from 2005 benchmarks by 2030, aligning with the Paris Agreement. Consequently, the US PVC industry is gearing up for substantial measures to curtail greenhouse gas (GHG) emissions, eyeing carbon neutrality by 2050.

- Furthermore, in December 2023, the US Environmental Protection Agency (EPA) unveiled plans to regulate PVC, a move poised to reshape disposal mandates.

- According to the European Council of Vinyl Manufacturers, windows, pipes, flooring, roofing membranes, and other building products use 70% of all European PVC. It is the leading plastic in the European building and construction industry.

- Germany's robust economy is driving a surge in demand for commercial spaces. Notably, there has been a growing interest in high-quality, ESG-compliant office buildings, evident from rising prime rents. In Q3 2023, 246,000 sq. m of office space came online, with forecasts suggesting a total of 1.8 million sq. m in 2024.

- Given these dynamics, the global construction industry's prominence suggests a bullish outlook for PVC stabilizers over the coming years.

Asia-Pacific to Dominate the Market

- Asia-Pacific leads the PVC stabilizers market, driven by surging demand from industries like construction and automotive in countries like China and India.

- PVC pipes and flooring offer benefits like durability, aesthetic flexibility, easy installation, simple cleaning, and recyclability. In the building and construction industry, PVC roofing is favored for its low maintenance and longevity, lasting over 30 years.

- The housing authorities of Hong Kong, China, have launched several measures to push the construction of low-cost housing. The officials aim to provide 301,000 public housing units in 10 years till 2030.

- In addition, Japan's construction industry has been another major consumer of PVC stabilizers in recent times. Japan is witnessing notable construction projects, including Mitsubishi State's endeavor of erecting the nation's tallest building near Tokyo station, featuring 50 luxury apartments projected to earn USD 43,000 monthly in rent, with a completion target of 2027.

- PVC is commonly used in under-the-hood applications, interiors, and other areas in conventional vehicles and electric vehicles in the automotive industry.

- China is one of the largest automotive manufacturers worldwide. According to OICA, in 2023, the production of passenger vehicles in China stood at 26 million units, an increase of more than 10% compared to 2022.

- Moreover, according to the OICA, in 2023, the total production of vehicles in India stood at 5.85 million units, registering an increase of more than 7% compared to 2022. The production of passenger vehicles in the country stood at 4.78 million units, registering an increase of 7.9% compared to the year 2022, thereby supporting the growth of the market.

- As per data from Xinhua News Agency, China's electronics manufacturing industry showcased robust performance in the initial four months of 2024, buoyed by rising production and a rebound in both domestic and global demand. Major companies in China's electronics industry, as reported by the Ministry of Industry and Information Technology, saw their combined profits surge by 75.8% Y-o-Y, reaching CNY 144.2 billion (~USD 20.3 billion) from January to April 2024.

- The Packaging Industry Association of India (PIAI) projects the Indian packaging industry to grow at a robust 22% during the forecast period. Furthermore, the Indian packaging market is on track to hit USD 204.81 billion by 2025, boasting an impressive CAGR of 26.7% until then. This surge underscores a rising demand for PVC stabilizers across India over the coming years.

- Given these dynamics and government backing, Asia-Pacific is poised to register heightened demand in the PVC stabilizers market during the forecast period.

PVC Stabilizers Industry Overview

The PVC stabilizers market is partially fragmented by nature. The major players (not in any particular order) include Baerlocher GmbH, Adeka Corporation, Akdeniz Chemson, SONGWON, and Valtris Specialty Chemicals.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Stabilizers for PVC Pipes, Tubings and Fittings

- 4.1.2 Increasing Use In the Automotive Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Health Hazards and Stringent Government Regulations Regarding the Use of Lead-based Stabilizers

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 By Type

- 5.1.1 Calcium-based

- 5.1.2 Lead-based

- 5.1.3 Tin-based

- 5.1.4 Barium-based

- 5.1.5 Other Types

- 5.2 By End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Automotive

- 5.2.3 Electrical and Electronics

- 5.2.4 Packaging

- 5.2.5 Footwear

- 5.2.6 Other End-user Industries

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Nigeria

- 5.3.5.5 Egypt

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Adeka Corporation

- 6.4.2 Akdeniz Chemson

- 6.4.3 Baerlocher GmbH

- 6.4.4 Clariant

- 6.4.5 Galata Chemicals

- 6.4.6 Goldstab Organics Pvt. Ltd

- 6.4.7 KD Chem Co. Ltd

- 6.4.8 Kunshan Maijisen Composite Materials Co. Ltd

- 6.4.9 Pau Tai Industrial Corp.

- 6.4.10 PMC Group Inc.

- 6.4.11 Ra Chemicals Pvt. Ltd

- 6.4.12 Reagens SpA

- 6.4.13 Shandong Jinchangshu New Material Technology Co. Ltd

- 6.4.14 SONGWON

- 6.4.15 Timah

- 6.4.16 Valtris Specialty Chemicals

- 6.4.17 Vikas Ecotech Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Usage of Organo-tin Stabilizers as an Environment-friendly Option

- 7.2 Other Opportunities