|

市场调查报告书

商品编码

1687209

紫外线稳定剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)UV Stabilizers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

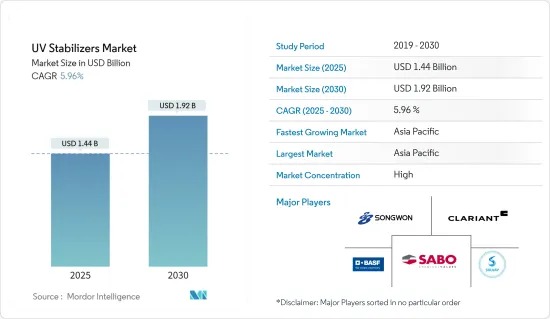

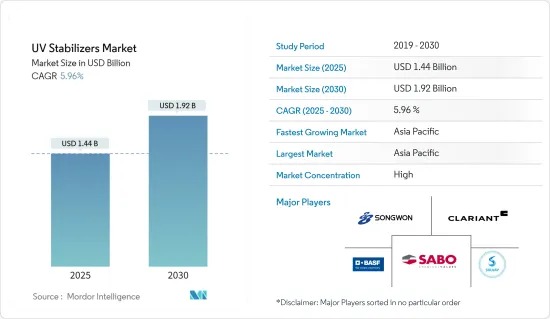

紫外线稳定剂市场规模预计在 2025 年为 14.4 亿美元,预计到 2030 年将达到 19.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.96%。

2020 年,COVID-19 疫情对市场产生了负面影响。这是因为製造设施和工厂因封锁和限製而关闭。供应链和运输中断进一步扰乱了市场。不过,2021年,产业復苏,市场需求回归。

主要亮点

- 推动市场成长的关键因素包括聚合物产业对紫外线稳定剂的消费量增加以及木材涂料对紫外线稳定剂的需求不断增长。

- 然而,预计 COVID-19 的负面经济影响将阻碍市场成长。

- 在产品类型中,受阻胺光稳定剂(HALS)在预测期内占据最高的市场占有率。

紫外线稳定剂的市场趋势

汽车产业占市场主导地位

- 紫外线稳定剂在汽车中的主要应用领域包括内装件(车门覆层、装饰条、窗框、中央控制台等)和外部部件(保险桿、支架、侧面装饰条等)。

- 根据国际汽车工业组织(OICA)的数据,2022 年全球汽车及车辆总产量将达到 8,501 万辆,而 2021 年为 8,014 万辆。

- 此外,根据标普世界行动通讯公司的数据,2022年全球乘用车产量将达6,816万辆,较去年同期成长7.9%。

- 2021年汽车产量亚洲及大洋洲为4,673万辆,美洲为1,615万辆,分别比2020年增加6%及3%。不过,2021年欧洲产量为1,634万辆,较2020年产量下降4%。

- 阿根廷、印尼、摩洛哥、乌克兰、泰国等新兴经济体汽车产量较去年与前一年同期比较成长均超过10%。

- 《华尔街日誌》引述汽车研究集团 LMC Automotive 和 EV-Volumes 的初步研究结果称,2022 年全球电动车销量将达到 780 万辆,较 2021 年成长 68%。根据这些报告,到2022年电动车将占全球汽车销量的10%。一些研究人员预测,到2030年电动车产业的市场占有率将增加一倍甚至四倍。

- 因此,未来几年汽车产业的这些因素可能会对所研究市场的需求产生重大影响。

亚太地区占市场主导地位

- 由于建筑、包装和汽车领域的显着增长,预计亚太地区将主导市场。

- 自疫情爆发以来,中国汽车产业持续成长。预计汽车产量将从 2021 年的 2,608 万辆增加到 2022 年的 2,702 万辆,2022 年增长率为 3%。

- 此外,根据工业和资讯化部预测,到2025年,国内汽车产量预计将达到3,500万辆,进一步巩固中国作为世界领先汽车製造国之一的地位。

- 在印度,随着大量人口从农村迁移到都市区,食品服务业也随之成长,食品包装产业也经历快速成长。印度每年消费200亿包食品和饮料。

- 预计2030年全球包装消费量将达500亿个左右,其中饮料包装增加8%。预测期内,该国食品包装的成长预计将增加对紫外线稳定剂的需求。

- 由于木工和细木工应用的增加,黏合剂和密封剂成为韩国的主要市场之一。此外,家具需求的不断增长也加速了对黏合剂的需求,从而支撑了整个行业的成长。随着製造商产能的扩大,黏合剂在电子产业的需求也呈现上升趋势。

- 例如,汉高韩国宣布其鬆岛工厂将于2022年8月在仁川松岛高科技产业丛集内完工。该工厂预计将成为黏合剂技术部门在亚太地区高衝击电子解决方案的生产中心。

- 预计这些因素将在预测期内推动亚太地区紫外线稳定剂市场的发展。

紫外线稳定剂产业概况

全球紫外线稳定剂市场正在整合。市场的主要企业(不分先后顺序)包括BASF SE、SONGWON、Solvay、CLARIANT 和 SABO SpA。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 聚合物产业消费量增加

- 木器涂料需求不断成长

- 限制因素

- 原物料价格波动

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 类型

- 紫外线吸收剂

- 受阻胺光稳定剂 (HALS)

- 猝灭剂

- 抗氧化剂

- 最终用户产业

- 包装

- 车

- 农业

- 建筑和施工

- 黏合剂和密封剂

- 其他最终用户产业

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场排名分析

- 主要企业策略

- 公司简介

- ADEKA CORPORATION

- ALTANA AG

- BASF SE

- Chitec Technology Co., Ltd.

- CLARIANT

- Eastman Chemical Company

- Everlight Chemical Industrial Co.

- Lycus Ltd., LLC.

- Mayzo, Inc.

- Rianlon Corporation

- SABO SpA

- SI Group Inc.(SK Capital Partners)

- Solvay

- SONGWON

- UniteChem Group

第七章 市场机会与未来趋势

- 紫外线稳定剂奈米复合材料

- 扩大在製药业的应用

The UV Stabilizers Market size is estimated at USD 1.44 billion in 2025, and is expected to reach USD 1.92 billion by 2030, at a CAGR of 5.96% during the forecast period (2025-2030).

The COVID-19 pandemic negatively impacted the market in 2020. This was because of the shutdown of the manufacturing facilities and plants due to the lockdown and restrictions. Supply chain and transportation disruptions further created hindrances for the market. However, the industry witnessed a recovery in 2021, thus rebounding the demand for the market studied.

Key Highlights

- The major factors driving the growth of the market include the rising consumption of UV stabilizers in the polymer industry and increasing demand for UV stabilizers from wood coatings.

- On the flip side, the negative economic effects of COVID-19 are expected to hinder the growth of the studied market.

- Among the product types, Hindered Amine Light Stabilizers (HALS) accounted for the highest market share during the forecast period.

UV Stabilizers Market Trends

Automotive Sector to Dominate the Market

- Some of the major application areas of UV stabilizers in automobiles include interior parts (door cladding, trim, window frame, center console, etc.) and exterior parts (bumper, bracket, side molding, etc.).

- According to the International Organization of Motor Vehicle Manufacturers (OICA), the total production of cars and vehicles globally in 2022 was 85.01 million units, compared to 80.14 million units in 2021.

- Additionally, according to S&P Global Mobility, global passenger car production reached 68.16 million units in 2022, an increase of 7.9% from the same period in the previous year.

- The Asia-Oceania and Americas regions recorded automotive production of 46.73 million and 16.15 million units in 2021, respectively, registering an increase of 6% and 3% compared to 2020. However, Europe recorded a production of 16.34 million units in 2021, a decrease of 4% from the production achieved in 2020.

- Emerging countries like Argentina, Indonesia, Morocco, Ukraine, and Thailand saw an increase in automotive production of over 10% over the previous year.

- There were 7.8 million electric vehicles sold worldwide in 2022, a 68% increase from 2021, the Wall Street Journal reported, citing preliminary research from the automotive research groups LMC Automotive and EV-Volumes. According to these reports, electric vehicles accounted for 10% of global auto sales in 2022. Some researchers predict the EV industry's market share are expected to double or even quadruple by 2030.

- Hence, such factors from the automotive sector are likely to significantly impact the demand for the market studied in the coming years.

Asia-Pacific region to Dominate the Market

- Asia-Pacific is anticipated to dominate the market owing to its massive growth in the construction, packaging, and automotive sectors.

- The automotive industry in China increased post-pandemic. Automotive production increased from 26.08 million units in 2021 to 27.02 million units in 2022 and registered a 3% growth in 2022.

- Additionally, according to China's Ministry of Industry and Information Technology, domestic vehicle production will reach 35 million by 2025, further solidifying its position as the world's leading automobile manufacturer.

- In India, the food packaging industry is witnessing sharp growth as most of the population shifts from rural to urban areas, increasing food services, among others. India consumes 20 billion food and beverage packages annually.

- By 2030, the country is expected to consume around 50 billion packages, with a growth rate of 8% in beverage packaging. Food packaging growth in the country is anticipated to increase UV stabilizer demand over the forecast period.

- Adhesives and sealants are one of the major markets in South Korea, owing to increasing woodworking and joinery applications. Additionally, the rising demand for furniture is also accelerating the demand for adhesives, propelling overall industry growth. Adhesives are also increasing in the electronics industry, and manufacturers are expanding their business capabilities.

- For instance, in August 2022, Henkel Korea announced the completion of its Songdo Plant within the Songdo High-Tech Industrial Cluster in Incheon. This was expected to become the Asia-Pacific production hub for high-impact electronics solutions for the Adhesive Technologies business unit.

- Hence, such factors will help boost the UV stabilizer market in the Asia-Pacific region over the forecast period.

UV Stabilizers Industry Overview

The global UV Stabilizers market is consolidated in nature. Some of the major players in the market (not in any particular order) include BASF SE, SONGWON, Solvay, CLARIANT, and SABO S.p.A., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Consumption in Polymer Industry

- 4.1.2 Increasing Demand for Wood Coatings

- 4.2 Restraints

- 4.2.1 Fluctuations in Raw Material Prices

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 UV Absorbers

- 5.1.2 Hindered Amine Light Stabilizers (HALS)

- 5.1.3 Quenchers

- 5.1.4 Antioxidants

- 5.2 End-User Industry

- 5.2.1 Packaging

- 5.2.2 Automotive

- 5.2.3 Agriculture

- 5.2.4 Building and Construction

- 5.2.5 Adhesives and Sealants

- 5.2.6 Other End-User Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ADEKA CORPORATION

- 6.4.2 ALTANA AG

- 6.4.3 BASF SE

- 6.4.4 Chitec Technology Co., Ltd.

- 6.4.5 CLARIANT

- 6.4.6 Eastman Chemical Company

- 6.4.7 Everlight Chemical Industrial Co.

- 6.4.8 Lycus Ltd., LLC.

- 6.4.9 Mayzo, Inc.

- 6.4.10 Rianlon Corporation

- 6.4.11 SABO S.p.A.

- 6.4.12 SI Group Inc. (SK Capital Partners)

- 6.4.13 Solvay

- 6.4.14 SONGWON

- 6.4.15 UniteChem Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Nano-composites in UV Stabilizers

- 7.2 Increasing Application in the Pharmaceutical Industry