|

市场调查报告书

商品编码

1687201

仓库机器人-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Warehouse Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

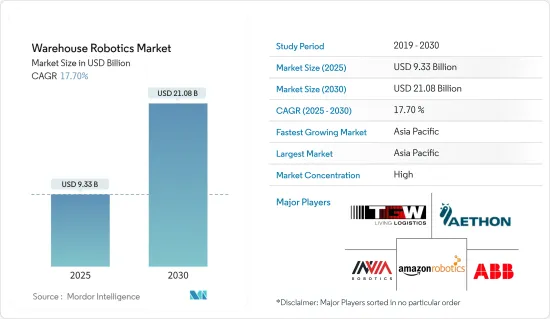

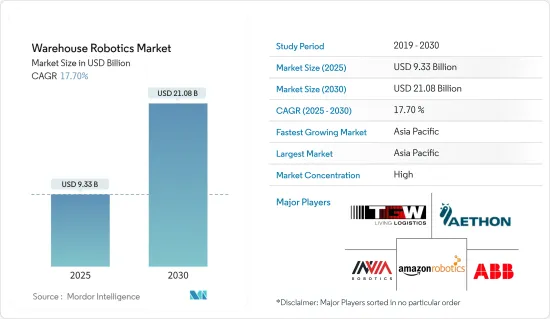

预计 2025 年仓库机器人市场规模为 93.3 亿美元,到 2030 年将达到 210.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 17.7%。

关键亮点

- SKU 多样性的增加推动了仓库自动化:受 SKU 多样性激增的推动,仓库机器人市场正在经历加速成长。预计超过 50% 的公司将增加 SKU 数量,以满足长尾消费者的需求。这一趋势正在重塑传统的仓储模式,而大容量托盘订购系统正在被小容量、多 SKU 订购系统所取代。为了应对这项挑战,自动化小批量储存/检索系统 (AS/RS) 至关重要。这些系统利用轻型起重机来管理手提箱、箱子和板条箱,从而优化储存并释放关键的劳动力和配送资源。

- 扩大仓库规模:为了适应 SKU 的增加,仓库面积从 2000 年的 65,000 平方英尺扩大到 2020 年的 20 万多平方英尺。

- 改变零售商与批发商之间的动态:即时订购和直接面向消费者的分销正在减少大托盘订单并加速对自动化的需求。

- 拣选机器人和 AGV:最新一代的拣选机器人和自动导引运输车(AGV) 非常适合处理大型仓库中大量 SKU 范围内的小订单。

- 投资激增推动技术进步:资本的涌入推动仓库自动化技术的发展。创业投资公司正积极投资机器人技术,2020 年第一季仓库机器人新兴企业的资金筹措达到 3.81 亿美元,年增 57%。

- Locus Robotics 扩张 2020 年 6 月,Locus Robotics 筹集了 4,000 万美元,用于加强研发并扩展到欧盟。

- 亚马逊创新中心:亚马逊投资 4,000 万美元在麻萨诸塞州开发最先进的机器人中心,旨在推动自动化进步。

- Shopify 的策略性收购:Shopify 于 2019 年以 4.5 亿美元收购了 6 River Systems,透过整合云端基础的软体和协作行动机器人来扩展履约能力。

- 电子商务热潮推动采用:电子商务的快速成长持续推动仓库机器人的采用。随着网路零售的爆炸性成长,高效的库存管理和履约业务变得至关重要。

- 市场规模预测:Cowen预测,2024年美国电商仓储与物流机器人市场规模将达到近80亿美元。

- 新的履约模式:Albertsons 和 Takeoff Technologies 正在试行城市履约中心,使用人工智慧和机器人技术来简化较小的都市区仓库业务。

- 克罗格扩张:克罗格正与 Ocado 合作,开设多达 20 个配备大型机器人设施的客户履约中心。

- 劳动力短缺和成本降低推动创新:仓库机器人越来越多地被用来解决劳动力短缺问题并降低营运成本。自动化透过减少不必要的劳动力流动和简化操作来提高效率。

- 浪费的运动成本:美国仓库每年因浪费的运动而损失 43 亿美元,凸显了机器人解决方案的重要性。

- 工业机器人的成长:预计运作中的工业机器人数量将从 2018 年的 240.8 万台增加到 2021 年的 378.8 万台。

- 阿里巴巴裁员:透过实施机器人劳动力,阿里巴巴将仓库劳动力减少了 70%,同时为技术纯熟劳工创造了更多机会。

仓库机器人市场趋势

移动机器人(AGV 和 AMR)是按类型分類的最大细分市场

移动机器人,尤其是自动导引运输车(AGV) 和自主移动机器人 (AMR),占据仓库机器人市场主导地位。到 2021 年,该领域将占全球销售额的 22.80%,成为自动化的重要动力。

- 强劲成长:移动机器人是成长最快的领域,预计复合年增长率为 16.64%,显示市场对适应性机器人解决方案的偏好。

- 收益预测:该部门 2021 年的销售额预计将达到 22.5 亿美元,到 2027 年将增长至 56.3 亿美元,这将支撑其在仓库中的日益普及。

- 技术进步:对感测器技术、人工智慧和电脑视觉的投资正在提高移动机器人的能力。亚马逊收购 Canvas 先进自主机器人技术就是一个显着的例子。

- 工业应用:移动机器人广泛应用于各行各业,尤其是零售业(2021 年市场占有率为 27.46%)和食品饮料产业,以提高产品处理和温控环境的效率。

亚太地区预计将占据主要市场占有率

亚太地区是仓库机器人市场占主导地位且成长最快的地区,2021 年占全球份额的 46.72%。

- 预测复合年增长率:受中国和印度等国家快速采用机器人技术的推动,该地区预计将以 16.06% 的复合年增长率保持领先地位。

- 市场规模:预计亚太地区仓库机器人市场 2021 年的收益将达到 46.2 亿美元,到 2027 年将成长至 112 亿美元。

- 电子商务扩张:印度和中国蓬勃发展的电子商务市场是主要驱动力,预计印度市场将从 2020 年的 462 亿美元成长到 2030 年的 3,500 亿美元。

- 製造业领导:亚太地区作为全球製造地的地位正在推动仓库自动化技术的应用,尤其是在中国、日本和韩国。

- 技术创新:亚洲公司正在投资人工智慧机器人解决方案。中国机器人公司 Geek+ 在人工智慧物流机器人领域取得了长足进步,与全球知名企业竞争。

仓库机器人产业概况

仓库机器人市场由全球参与企业主导,市场格局趋于巩固。现有的自动化和机器人纯粹公司处于行业前沿,利用研究、合作和收购来保持其市场地位。

霍尼韦尔机器人中心:霍尼韦尔向机器人创新中心投资 5,000 万美元,表明该公司致力于引领仓库自动化领域。

投资者信心:GreyOrange 和 Vecna Robotics 等新兴企业已经筹集了大量资金,显示出对仓库机器人的成长潜力充满信心。

技术领导者塑造市场动态:ABB 有限公司、发那科公司、霍尼韦尔国际公司、库卡股份公司和安川电机公司等主要企业正在引领市场。这些公司正在开发先进的解决方案,例如 AMR、AS/RS 和支援 AI 的系统。

Swisslog 的 KR SCARA机器人和 Locus Robotics 的 RaaS(机器人即服务)订阅模式等创新解决方案正在颠覆传统的市场方式,并提供经济高效、易于存取的自动化解决方案。

策略伙伴关係:与电子商务平台和物流供应商的合作是市场扩张的关键策略,例如波克夏‧格雷与全球履约达成的 2,300 万美元当日杂货配送协议。

未来市场驱动力:要想取得成功,企业需要专注于人工智慧和机器学习的进步,以增强机器人的能力。适应不同仓库配置的灵活解决方案、与零售商的伙伴关係以及可扩展的自动化平台将是关键。解决高昂的实施成本和监管挑战对于跨行业广泛采用也至关重要。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 工业影响评估

第五章市场动态

- 市场驱动因素

- SKU数量增加

- 增加对科技和机器人技术的投资

- 市场问题

- 严格的监管要求

- 高成本

第六章市场区隔

- 按类型

- 工业机器人

- 分类系统

- 输送机

- 堆垛机

- 自动储存和搜寻系统(ASRS)

- 移动机器人(AGV 和 AMR)

- 按功能

- 贮存

- 包装

- 转运

- 其他的

- 按最终用户产业

- 饮食

- 车

- 零售

- 电气和电子

- 製药

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 亚洲

- 中国

- 韩国

- 日本

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章竞争格局

- 公司简介

- ABB Limited

- Kiva Systems(Amazon Robotics LLC)

- TGW Logistics Group GMBH

- Singapore Technologies Engineering Ltd(Aethon Incorporation)

- InVia Robotics Inc.

- Fanuc Corporation

- Honeywell International Incorporation

- Toshiba Corporation

- Omron Adept Technologies

- Yaskawa Electric Corporation(Yaskawa Motoman)

- Kuka AG

- Fetch Robotics Inc.

- Geek+Inc.

- Grey Orange Pte Ltd

- Hangzhou Hikrobot Technology Co. Ltd

- Syrius Robotics

- Locus Robotics

第八章投资分析

第九章:市场的未来

The Warehouse Robotics Market size is estimated at USD 9.33 billion in 2025, and is expected to reach USD 21.08 billion by 2030, at a CAGR of 17.7% during the forecast period (2025-2030).

Key Highlights

- Expanding SKU Diversity Drives Warehouse Automation: The warehouse robotics market is witnessing accelerated growth driven by the surge in SKU diversity. Over 50% of businesses are expected to increase the number of SKUs to cater to long-tail consumer demands. This trend is reshaping traditional warehouse models, where large-pallet order systems are being replaced by small, multi-SKU orders. To meet this challenge, automated mini-load storage and retrieval systems (AS/RS) are becoming vital. These systems leverage lightweight cranes to manage totes, cases, and crates, optimizing storage and freeing up crucial labor and delivery resources.

- Increase in Warehouse Size: Warehouses have expanded from 65,000 sq. ft in 2000 to over 200,000 sq. ft in 2020 to accommodate the rising volume of SKUs.

- Shift in Retailer-Wholesaler Dynamics: Just-in-time ordering and direct-to-consumer distribution are reducing large-pallet orders, accelerating the need for automation.

- Picking Robots and AGVs: The latest generation of picking robots and Automated Guided Vehicles (AGVs) is ideal for handling small orders spread over vast SKU ranges in large warehouses.

- Surging Investments Fuel Technological Advancements: The influx of capital is propelling warehouse automation technologies forward. Venture capital firms have been actively investing in robotics, with funding for warehouse robotics startups reaching USD 381 million in Q1 2020, a 57% year-over-year increase.

- Locus Robotics' Expansion: In June 2020, Locus Robotics raised USD 40 million to enhance R&D and expand into the European Union.

- Amazon's Innovation Hub: Amazon's investment of USD 40 million to develop a cutting-edge robotics hub in Massachusetts is expected to boost automation advancements.

- Shopify's Strategic Acquisition: Shopify's USD 450 million acquisition of 6 River Systems in 2019 expanded its fulfillment capabilities, incorporating cloud-based software and collaborative mobile robots.

- E-commerce Boom Accelerates Adoption: The rapid growth of e-commerce continues to drive the adoption of warehouse robotics. Efficient inventory management and fulfillment operations are becoming critical as online retail surges.

- Projected Market Value: Cowen projects that the U.S. market for warehouse and logistics robots in e-commerce will reach nearly USD 8 billion by 2024.

- New Fulfillment Models: Albertsons and Takeoff Technologies have collaborated to pilot urban fulfillment centers powered by AI and robotics to streamline small urban warehouse operations.

- Kroger's Expansion: Kroger is planning to open up to 20 customer fulfillment centers in partnership with Ocado, featuring large-scale robot-driven facilities.

- Labor Shortages and Cost Reduction Drive Innovation: Warehouse robotics are being increasingly used to tackle labor shortages and reduce operational costs. Automation helps improve efficiency by reducing unnecessary labor movement and streamlining operations.

- Wasted Motion Costs: U.S. warehouses lose USD 4.3 billion annually due to wasted motion, emphasizing the importance of robotic solutions.

- Industrial Robots Growth: The operational stock of industrial robots is projected to grow from 2,408 thousand units in 2018 to 3,788 thousand units by 2021.

- Alibaba's Workforce Reduction: By deploying robotic labor, Alibaba reduced its warehouse workforce by 70%, while creating more opportunities for skilled labor.

Warehouse Robotics Market Trends

Mobile Robots (AGVs and AMRs) Largest Segment by Type

Mobile robots, particularly Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs), dominate the warehouse robotics market. This segment captured 22.80% of global revenue in 2021, making it a pivotal driver of automation.

- Strong Growth: Mobile robots are the fastest-growing segment, with a CAGR of 16.64% forecasted, indicating a clear market preference for adaptable robotic solutions.

- Revenue Projections: The segment generated USD 2.25 billion in revenue in 2021 and is expected to grow to USD 5.63 billion by 2027, underlining the increased adoption in warehouses.

- Technological Advancements: Investments in sensor technology, AI, and computer vision are enhancing the capabilities of mobile robots. Amazon's acquisition of Canvas Technology for advanced autonomous robots is a notable example.

- Industry Applications: Mobile robots are widely used across industries, particularly in retail (27.46% market share in 2021) and food and beverage sectors, where they enhance efficiency in product handling and temperature-controlled environments.

Asia Pacific is Expected to Hold Significant Market Share

Asia-Pacific is the dominant and fastest-growing region in the warehouse robotics market, capturing 46.72% of the global share in 2021.

- CAGR Projections: The region is expected to maintain its leadership with a CAGR of 16.06%, driven by the rapid adoption of robotics technologies in countries like China and India.

- Market Size: The Asia-Pacific warehouse robotics market generated USD 4.62 billion in revenue in 2021, with forecasts estimating growth to USD 11.20 billion by 2027.

- E-commerce Expansion: The booming e-commerce market in India and China is a significant driver, with India's market expected to grow from USD 46.2 billion in 2020 to USD 350 billion by 2030.

- Manufacturing Leadership: Asia-Pacific's status as a global manufacturing hub is propelling the adoption of warehouse automation technologies, especially in China, Japan, and South Korea.

- Technological Innovation: Companies in Asia are investing in AI-powered robotics solutions. Geek+, a Chinese robotics company, has made significant advancements with its AI-powered logistics robots, competing with established global players.

Warehouse Robotics Industry Overview

The warehouse robotics market is dominated by global players, with a consolidated market structure. Established automation companies and specialized robotics firms are at the forefront of the industry, leveraging research, partnerships, and acquisitions to maintain their market positions.

Honeywell's Robotics Hub: Honeywell's USD 50 million investment in a Robotics Innovation Hub showcases the company's commitment to leading the warehouse automation sector.

Investor Confidence: Emerging players such as GreyOrange and Vecna Robotics have raised substantial funds, indicating strong confidence in the growth potential of warehouse robotics.

Technology Leaders Shape Market Dynamics: Key players like ABB Limited, Fanuc Corporation, Honeywell International Inc., KUKA AG, and Yaskawa Electric Corporation lead the market. These companies are developing advanced solutions, including AMRs, AS/RS, and AI-powered systems.

Innovative Solutions: Swisslog's KR SCARA robots and Locus Robotics' RaaS (robots-as-a-service) subscription model are disrupting traditional market approaches, providing cost-effective and accessible automation solutions.

Strategic Partnerships: Collaboration with e-commerce platforms and logistics providers, such as Berkshire Grey's USD 23 million contract with a global retailer for same-day grocery fulfillment, is a key strategy for market expansion.

Factors Driving Future Success in the Market: To succeed, companies need to focus on AI and machine learning advancements to enhance robotic capabilities. Flexible solutions that adapt to various warehouse configurations, partnerships with retailers, and scalable automation platforms will be critical. Addressing high implementation costs and regulatory challenges will also be essential to ensure wider adoption across industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of SKUs

- 5.1.2 Increasing Investments in Technology and Robotics

- 5.2 Market Challenges

- 5.2.1 Stringent Regulatory Requirements

- 5.2.2 High Cost

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Industrial Robots

- 6.1.2 Sortation Systems

- 6.1.3 Conveyors

- 6.1.4 Palletizers

- 6.1.5 Automated Storage and Retrieval System (ASRS)

- 6.1.6 Mobile Robots (AGVs and AMRs)

- 6.2 By Function

- 6.2.1 Storage

- 6.2.2 Packaging

- 6.2.3 Trans-shipment

- 6.2.4 Other Functions

- 6.3 By End-user Industry

- 6.3.1 Food and Beverage

- 6.3.2 Automotive

- 6.3.3 Retail

- 6.3.4 Electrical and Electronics

- 6.3.5 Pharmaceutical

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 South Korea

- 6.4.3.3 Japan

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ABB Limited

- 7.1.2 Kiva Systems (Amazon Robotics LLC)

- 7.1.3 TGW Logistics Group GMBH

- 7.1.4 Singapore Technologies Engineering Ltd (Aethon Incorporation)

- 7.1.5 InVia Robotics Inc.

- 7.1.6 Fanuc Corporation

- 7.1.7 Honeywell International Incorporation

- 7.1.8 Toshiba Corporation

- 7.1.9 Omron Adept Technologies

- 7.1.10 Yaskawa Electric Corporation (Yaskawa Motoman)

- 7.1.11 Kuka AG

- 7.1.12 Fetch Robotics Inc.

- 7.1.13 Geek+ Inc.

- 7.1.14 Grey Orange Pte Ltd

- 7.1.15 Hangzhou Hikrobot Technology Co. Ltd

- 7.1.16 Syrius Robotics

- 7.1.17 Locus Robotics