|

市场调查报告书

商品编码

1851589

数位转型(DX):市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Digital Transformation (DX) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

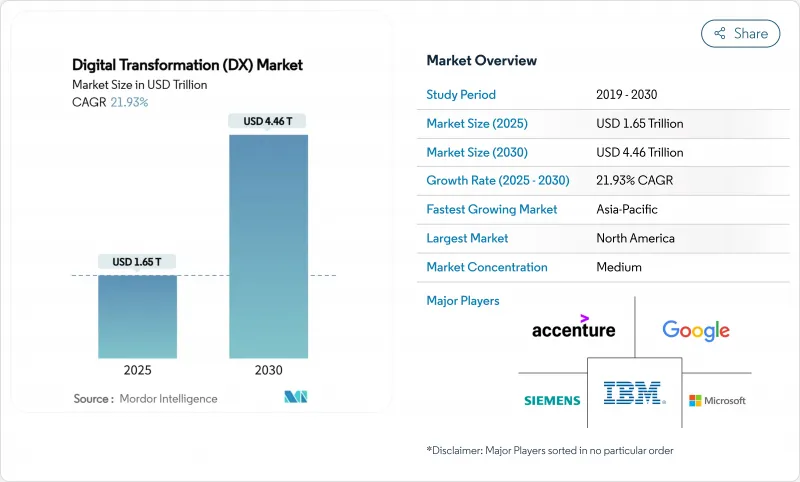

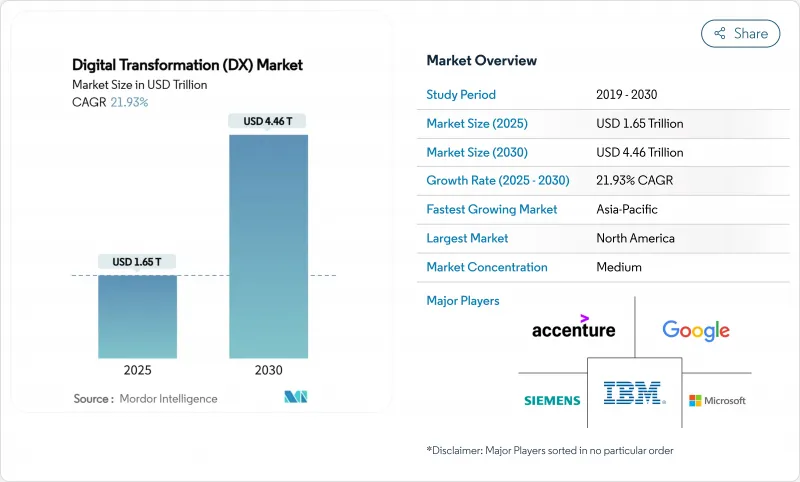

预计到 2025 年,数位转型市场价值将达到 1.65 兆美元,到 2030 年将达到 4.46 兆美元,年复合成长率为 21.93%。

企业人工智慧的普及、优先考虑云端服务的支出策略以及监管要求迫使企业实现营运数位化,共同推动了强劲成长。各国自主制定的人工智慧政策鼓励企业将运算资源在地化,而5G网路则为製造业和医疗保健领域的即时应用开闢了新的应用场景。低程式码平台将应用开发扩展到IT部门之外,而ESG(环境、社会和治理)报告规则则加速了资料主导合规投资。随着企业在创新目标和旧有系统成本压力之间寻求平衡,渐进式现代化策略正日益普及。儘管企业为了避免被单一供应商锁定而采取多供应商云端和人工智慧策略,市场竞争强度仍然适中,但超大规模云端服务供应商的资本支出正在重新定义数位转型市场的规模经济。

全球数位转型(DX)市场趋势与洞察

云端优先企业IT支出激增

企业正将预算从本地硬体重新分配到支援人工智慧工作负载和混合工作模式的云端原生平台。例如,亚马逊网路服务 (AWS) 的人工智慧助理 Amazon Q 已解答了超过 100 万个内部开发人员的问题,节省了 45 万小时的人力工作。云端运算经济缩短了采购週期,将支出从资本预算转移到营运预算,并加快了实验速度。微软与可口可乐的伙伴关係等策略性交易表明,生成式人工智慧服务将建构在可扩展的云端基础上。随着企业将云端基础设施视为必不可少的组成部分,供应商正在扩展区域资料中心,以符合主权资料规则。

加强人工智慧/机器学习在各业务职能中的集成

人工智慧正从试点阶段迈向大规模生产阶段。高盛已在多个部门部署了人工智慧助手,联合健康集团正在管理超过1000个人工智慧应用案例,用于自动化保险理赔和临床决策。国防、工业和零售业的领导者也正在效仿这一模式,将生成模型融入设计、维护和客户体验工作流程。同时,员工技能提升和资料管治架构也不断完善,使人工智慧成为一项核心竞争力,而非实验性的附加功能。

修復遗留技术债

企业仍然将高达 80% 的 IT 预算用于维护使用了数十年的系统,这挤占了创新资金。 ServiceNow 的一项研究表明,老旧应用程式每年每个系统会对员工造成 4 万美元的损失,每週还会占用 17 个小时的工作时间。政府机构尤其反映了这个问题,它们每年 1000 亿美元的 IT 支出中,大部分都用于维护遗留资产。由此产生的技术债增加了网路安全风险,因为过时的软体缺乏现代化的管理。

细分市场分析

2024年,人工智慧和机器学习将占据数位转型市场份额的27.8%,预计该细分市场将以24.5%的复合年增长率成长,进一步巩固数据主导自动化作为策略差异化优势的地位。推动这一数位转型市场规模成长的,是那些正在扩展聊天机器人、建议引擎和预测性维护模型的企业。高盛和洛克希德·马丁的运作部署标誌着这些系统正从试点阶段迈向关键任务阶段。扩增实境(XR)工具已将工业工人的培训保留率提高了275%,而沃尔玛的食品溯源网路等区块链解决方案已将验证产品来源所需的时间从7天缩短至2.2秒。

并行部署的边缘运算丛集在感测器附近处理数据,从而避免云端延迟带来的损失。工业机器人与数位孪生技术同步,实现了汽车和电子工厂的持续流程最佳化。增材製造生产线利用模具零件的即时列印来减少停机时间。这些技术的结合,进一步深化了重工业数位转型的市场渗透。

至2024年,云端解决方案将占据数位转型市场63.4%的份额,并在2030年之前以22.8%的复合年增长率成长。这一市场份额的成长与超大规模资料中心业者资料中心营运商斥资数十亿美元建设资料中心密切相关。 AWS的「雷尼尔计画」(丛集 Rainier)将Trainium 2晶片集群化,打造出全球最强大的AI训练电脑。微软800亿美元的基础建设投资也印证了投资週期的不断攀升。Oracle与Google云端合作,实现了双向低延迟连接,且不收取退出费用。

云端运算的经济模式对没有伺服器资本预算的中小型企业也极具吸引力。计量收费模式使成本与使用量挂钩,而区域可用区则符合资料居住法规的要求。随着时间的推移,对平台锁定的担忧促使许多公司将微服务分布在多个云端平台上,从而催生了对跨平台编配工具的需求。

数位转型市场按技术(人工智慧和机器学习、扩增实境(VR/AR)等)、部署模式(云端、本地部署、混合部署)、组织规模(大型企业、中小企业)、垂直产业(银行、金融服务和保险、医疗保健和生命科学、製造和工业等)以及地区进行细分。市场预测以美元计价。

区域分析

北美将在2024年占据32.3%的数位转型市场份额,这主要得益于雄厚的创业投资和接近性超大规模云端总部的地理优势。光是德克萨斯州就正在经历一项由英伟达超级电脑驱动的5,000亿美元资料中心扩建项目,同时德克萨斯投资300亿美元的晶片工厂也将新增数千个技术职缺。联邦和州政府机构正在使用「汉弗莱」等人工智慧助理来自动化行政任务,这进一步推动了市场需求。美墨加协定下的跨国合作将有助于加拿大和墨西哥实现製造业的数位化。

亚太地区将以22.4%的复合年增长率实现最快成长,这主要得益于政府大规模的基础设施项目和行动优先的消费行为。数位钱包在电子商务结帐中占近70%,凸显了该地区数位钱包的指数级成长。印度、日本和韩国都已启动国家人工智慧战略,澳洲昆士兰州也已累计12亿澳元(约8亿美元)用于发展自主云端服务。这些发展共同扩大了数位转型市场的潜在规模。

欧洲透过 eIDAS 2.0 强调数位主权,强制要求在 2027 年实现欧洲数位身分钱包的普遍认可。德国的 EuroStack 计画预测,到 2035 年,将有 3000 亿欧元投资用于计算堆迭本地化。石勒苏益格-荷尔斯泰因州正逐步淘汰专有软体,将主权理念转化为现实。儘管南美洲和中东及非洲地区落后于主要区域,但外国对光纤骨干、云端区域和 5G 部署的投资不断增加,正在创造新的服务机会。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 云端优先企业IT支出激增

- 加强人工智慧/机器学习在各业务职能中的集成

- 5G赋能的即时资料用例

- ESG报告强制数位化

- 「数位主权」:一波公共资金浪潮

- 一个低程式码/无程式码平台,让数位转型惠及大众

- 市场限制

- 遗留技术债锁定

- 网路人才短缺和薪资上涨

- 数位身分监管碎片化

- 第三类ESG审核的数据品质差距

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 生态系分析

- 评估市场的宏观经济因素

第五章 市场规模与成长预测

- 透过技术

- 人工智慧和机器学习

- 扩增实境(VR/AR)

- 物联网 (IoT)

- 工业机器人

- 区块链

- 数位双胞胎

- 积层製造/工业3D列印

- 边缘运算

- 其他的

- 按部署模式

- 云

- 本地部署

- 杂交种

- 按组织规模

- 大公司

- 中小企业

- 按行业

- BFSI

- 医疗保健和生命科学

- 製造业和工业

- 零售与电子商务

- 能源与公共产业

- 汽车与运输

- 政府和公共机构

- 其他(媒体、教育等)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Accenture

- Microsoft

- IBM

- Google(Alphabet)

- AWS(Amazon)

- SAP

- Oracle

- Adobe

- Salesforce

- Cisco Systems

- Dell Technologies

- Siemens

- Hewlett Packard Enterprise

- Cognex

- Apple

- ServiceNow

- Infosys

- Capgemini

- Wipro

- Schneider Electric

- Honeywell

- Hitachi

- Fujitsu

- Huawei

第七章 市场机会与未来展望

The digital transformation market is valued at USD 1.65 trillion in 2025 and is projected to climb to USD 4.46 trillion by 2030, advancing at a 21.93% CAGR.

Strong growth stems from enterprise AI adoption, cloud-first spending priorities, and regulatory mandates that compel organizations to digitize operations. Sovereign-AI policies push companies to localize computing, while 5G networks open real-time use cases in manufacturing and healthcare. Low-code platforms extend application development beyond IT departments, and ESG reporting rules accelerate data-driven compliance investments. Incremental modernization strategies gain favor as enterprises balance innovation goals with legacy-system cost pressures. Competitive intensity remains moderate because businesses pursue multi-vendor cloud and AI strategies to avoid lock-in, yet hyperscale-provider capital expenditure is redefining scale economics in the digital transformation market.

Global Digital Transformation (DX) Market Trends and Insights

Cloud-first enterprise IT spending boom

Organizations are reallocating budgets from on-premise hardware toward cloud-native platforms that support AI workloads and hybrid work models. For example, Amazon Web Services resolved more than 1 million internal developer questions with its AI assistant Amazon Q, saving 450,000 hours of manual effort. Cloud economics shorten procurement cycles and shift spending from capital to operating budgets, allowing faster experimentation. Strategic deals, such as Microsoft's partnership with Coca-Cola, show how generative-AI services ride atop scalable cloud foundations. As enterprises view cloud infrastructure as essential, vendors expand regional data centers to comply with sovereign-data rules.

Rising AI/ML integration across business functions

AI moves from pilots to production at scale. Goldman Sachs rolled out AI assistants across multiple departments, and UnitedHealth Group manages more than 1,000 AI use cases that automate claims and clinical decisions. Defense, industrial, and retail leaders replicate the pattern, embedding generative models in design, maintenance, and customer-experience workflows. Workforce upskilling and data-governance frameworks mature in tandem, making AI a core competency rather than an experimental add-on.

Legacy technical-debt lock-ins

Enterprises still devote up to 80% of IT budgets to maintain decades-old systems, reducing funds for innovation. ServiceNow found that aging applications cost USD 40,000 annually per system and drain 17 employee hours weekly.Government agencies illustrate the problem, spending the majority of their USD 100 billion IT outlay on legacy assets. The resulting technical debt inflates cybersecurity risk because outdated software lacks modern controls.

Other drivers and restraints analyzed in the detailed report include:

- 5G-enabled real-time data use-cases

- Mandatory ESG reporting digitisation

- Cyber-talent scarcity and wage inflation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

AI and ML claimed 27.8% of digital transformation market share in 2024, and the segment is expected to grow at 24.5% CAGR, reinforcing that data-driven automation is a strategic differentiator. This portion of the digital transformation market size is fueled by enterprises scaling chatbots, recommendation engines, and predictive-maintenance models. Production deployments at Goldman Sachs and Lockheed Martin exemplify the shift from pilots to mission-critical systems. Extended-Reality tools deliver 275% training-retention gains for industrial employees, while blockchain solutions such as Walmart's food-traceability network cut provenance checks from 7 days to 2.2 seconds.

A parallel wave of edge-computing clusters processes data near sensors to avoid cloud-latency penalties. Industrial robotics synchronized with digital twins allow continuous process optimization in automotive and electronics plants. Additive-manufacturing lines use real-time prints of tooling components to shrink downtime. Together these technologies deepen the digital transformation market penetration across heavy industries.

Cloud solutions owned 63.4% of digital transformation market share in 2024 and will expand at 22.8% CAGR through 2030. This share of the digital transformation market size correlates with hyperscalers' multi-billion-dollar data-center builds. AWS's Project Rainier clusters Trainium 2 chips into the world's most powerful AI training computer. Microsoft's USD 80 billion infrastructure spend underscores escalating investment cycles. Enterprises retain on-premises nodes for regulated workloads, yet hybrid architectures flourish; Oracle's pact with Google Cloud allows bidirectional low-latency links with no egress fees.

Cloud economics also attract small businesses that lack capital budgets for servers. Pay-as-you-go models align costs with usage, and regional availability zones satisfy data-residency regulations. Over time, platform lock-in concerns lead many firms to distribute microservices across multiple clouds, creating demand for cross-plane orchestration tools.

Digital Transformation Market is Segmented by Technology (AI and ML, Extended Reality (VR/AR), and More), Deployment Model (Cloud, On-Premises, Hybrid), Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)), Industry Vertical (BFSI, Healthcare and Life-Sciences, Manufacturing and Industrial, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America secured 32.3% of digital transformation market share in 2024, anchored by deep venture capital pools and proximity to hyperscale-cloud headquarters. Texas alone hosts a USD 500 billion data-center expansion featuring NVIDIA supercomputers, plus Texas Instruments' USD 30 billion chip plant that adds thousands of tech jobs. Federal and state agencies adopt AI assistants like "Humphrey" to automate administrative tasks, further boosting demand. Cross-border initiatives under USMCA support manufacturing digitisation throughout Canada and Mexico.

Asia-Pacific delivers the fastest growth at 22.4% CAGR due to extensive government infrastructure programs and mobile-first consumer behavior. Digital wallets account for nearly 70% of e-commerce checkouts, highlighting the region's leapfrog adoption curves. India, Japan, and South Korea each articulate national AI strategies, while Australia's Queensland earmarked AUD 1.2 billion (USD 800 million) for sovereign-cloud services. Combined, these moves expand the addressable digital transformation market.

Europe emphasizes digital sovereignty under eIDAS 2.0, mandating universal acceptance of European Digital Identity Wallets by 2027. Germany's EuroStack program predicts EUR 300 billion investment to localize compute stacks by 2035. Schleswig-Holstein's migration away from proprietary software shows practical implementation of sovereignty ideals. South America and the Middle East and Africa trail the leading regions but experience rising foreign investment in fiber backbones, cloud regions, and 5G rollouts, unlocking new service opportunities.

- Accenture

- Microsoft

- IBM

- Google (Alphabet)

- AWS (Amazon)

- SAP

- Oracle

- Adobe

- Salesforce

- Cisco Systems

- Dell Technologies

- Siemens

- Hewlett Packard Enterprise

- Cognex

- Apple

- ServiceNow

- Infosys

- Capgemini

- Wipro

- Schneider Electric

- Honeywell

- Hitachi

- Fujitsu

- Huawei

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-first enterprise IT spending boom

- 4.2.2 Rising AI/ML integration across business functions

- 4.2.3 5G-enabled real-time data use-cases

- 4.2.4 Mandatory ESG reporting digitisation

- 4.2.5 "Digital-sovereignty" public-sector funding waves

- 4.2.6 Low-code / no-code platforms democratising DX

- 4.3 Market Restraints

- 4.3.1 Legacy technical-debt lock-ins

- 4.3.2 Cyber-talent scarcity and wage inflation

- 4.3.3 Digital-identity regulatory fragmentation

- 4.3.4 Scope-3 data-quality gaps for ESG audits

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Industry Ecosystem Analysis

- 4.9 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 AI and ML

- 5.1.2 Extended Reality (VR/AR)

- 5.1.3 Internet of Things (IoT)

- 5.1.4 Industrial Robotics

- 5.1.5 Blockchain

- 5.1.6 Digital Twin

- 5.1.7 Additive Manufacturing / Industrial 3-D Printing

- 5.1.8 Edge Computing

- 5.1.9 Others

- 5.2 By Deployment Model

- 5.2.1 Cloud

- 5.2.2 On-Premise

- 5.2.3 Hybrid

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By Industry Vertical

- 5.4.1 BFSI

- 5.4.2 Healthcare and Life-Sciences

- 5.4.3 Manufacturing and Industrial

- 5.4.4 Retail and E-commerce

- 5.4.5 Energy and Utilities

- 5.4.6 Automotive and Transportation

- 5.4.7 Government and Public Sector

- 5.4.8 Others (Media, Education, etc.)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Accenture

- 6.4.2 Microsoft

- 6.4.3 IBM

- 6.4.4 Google (Alphabet)

- 6.4.5 AWS (Amazon)

- 6.4.6 SAP

- 6.4.7 Oracle

- 6.4.8 Adobe

- 6.4.9 Salesforce

- 6.4.10 Cisco Systems

- 6.4.11 Dell Technologies

- 6.4.12 Siemens

- 6.4.13 Hewlett Packard Enterprise

- 6.4.14 Cognex

- 6.4.15 Apple

- 6.4.16 ServiceNow

- 6.4.17 Infosys

- 6.4.18 Capgemini

- 6.4.19 Wipro

- 6.4.20 Schneider Electric

- 6.4.21 Honeywell

- 6.4.22 Hitachi

- 6.4.23 Fujitsu

- 6.4.24 Huawei

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment