|

市场调查报告书

商品编码

1687367

奈米纤维素:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Global Nanocellulose - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

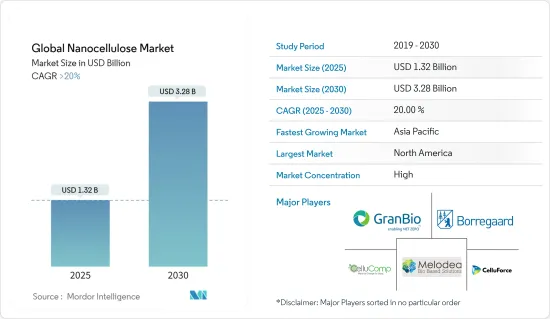

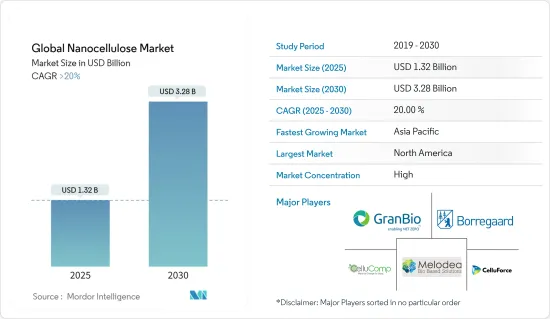

预计 2025 年全球奈米纤维素市场规模为 13.2 亿美元,到 2030 年将达到 32.8 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 20%。

随着对石油和天然气的需求不断增加,纺织领域多种产品的使用范围正在扩大,从而增加了各个应用领域的需求。

主要亮点

- 短期内,软包装的日益普及和奈米纤维素的优良性能预计将推动市场成长。

- 然而,消费者意识的缺乏和经济障碍预计将阻碍市场成长。

- 製造商增加技术创新活动、研发投资和产能扩张以利用广泛的潜在应用预计将为市场创造新的机会。

- 北美是奈米纤维素消费量最高的地区,占据着全球市场的主导地位。

奈米纤维素市场趋势

复合材料领域预计将主导市场

- 由于对包装材料和生物分解性塑胶的需求不断增加,复合材料领域将成为2023年奈米纤维素的最大应用领域,这导致政府对此类材料开发的支持和投资增加。

- 奈米纤维素复合材料具有生物分解性和无毒的特性,是塑胶的替代品。由于分散相尺寸小且在聚合物基质中分散性良好,这些材料与纯聚合物和传统复合材料相比表现出明显改善的性能。

- 奈米纤维素复合材料在汽车工业中发挥着至关重要的作用,它作为聚合物基质中的增强剂,有助于製造更轻、更坚固的材料,改善机械性能,并永续性的车载零件和製造过程。

- 由于各国政府推行摆脱石化燃料的计划,电动车的发展预计将继续获得动力,特别是在北美、欧洲和亚洲。

- 根据联邦机动车运输局(Kraftfahrt-Bundesamt-KBA)的数据,2023年德国註册的电池电动车总数为1,013,009辆,与上一年的资料相比有所增长。

- 同样,根据中华人民共和国海关总署的数据,预计2023年中国纯电动车出口总额将增加70%,达341亿美元。

- 随着全球对聚合物的需求不断增加,预计未来几年印度、日本和越南等新兴经济体的复合材料应用对奈米纤维素的需求将持续成长。

- 印度有 30 多个医院计划(包括扩建和新建)处于规划和建设阶段。例如,在安得拉邦维沙卡帕特南区,Care Hospitals正在建造价值140万美元的健康城医院计划。

- 因此,考虑到这些因素,预计预测期内研究领域对奈米纤维素的需求将大幅成长。

北美预计将主导市场

- 北美占据奈米纤维素市场的主导地位。预计其主导地位将在预测期内持续下去。

- 在北美,基础设施计划和商业建筑维修的增加,主要由于政府在公共基础设施维修上投入巨资,将推动复合材料应用区域市场的成长。

- 预计到 2027 年,食品和饮料、石油和天然气、油漆和涂料以及建筑等不断增长的区域性产业将进一步促进奈米纤维素业务的成长。

- 2024年第一季,美国石油和天然气交易额创下510亿美元的历史新高。能源公司渴望增加石油和天然气钻探库存,尤其是在产量丰富的二迭纪盆地,那里生产商的损益平衡成本约为每桶64美元。

- 奈米纤维素在食品和饮料行业中可用作增稠剂、稳定剂、调质剂和可食用被覆剂,具有降低脂肪含量、延长水果和蔬菜保质期等优点,但需经过监管部门核准以确保食用时的安全。

- 根据美国人口普查局的数据,2023年美国零售和食品服务年销售额将达到8.33兆美元,与2022年的8.7兆美元相比有所成长。

- 同样,在造纸业,奈米纤维素用于增强纸张性能,由于其可再生和永续的特性,具有提高强度、改善印刷性和减少环境影响等优点。

- 根据粮食及农业组织的数据,加拿大的纸和纸板生产能力将在 2023 年达到 920 万吨,而 2022 年则为 910 万吨,创下历史最高产量记录。

- 2023 年 9 月,韩国美容集团兰芝 (Laneige) 进军墨西哥。该护肤品牌进军墨西哥是该美容集团与墨西哥领先美容零售商丝芙兰合作的一部分。该公司表示,该品牌在北美继续保持令人瞩目的成长势头,2023 年第二季兰芝在该地区的销售额成长了 105%。

- 由于各个终端用户产业的成长,北美奈米纤维素市场预计在预测期内将呈指数级增长,这主要归因于美国的需求。

奈米纤维素产业概况

奈米纤维素市场是一个整合的市场,主要企业(不分先后顺序)是 CelluForce、GranBio、Melodea Ltd、CelluComp Ltd 和 Borregaard。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 奈米纤维素的优异性能

- 软包装的采用日益增多

- 其他的

- 限制因素

- 市场成长的经济障碍

- 提高消费者意识

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 按最终用户产业

- 纸张加工

- 油漆和涂料

- 石油和天然气

- 饮食

- 复合材料

- 药品和化妆品

- 其他的

- 依产品类型

- 奈米原纤纤维素(NFC)

- 结晶纤维素(NCC)

- 细菌纤维素

- 微纤化纤维素(MFC)

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 卡达

- 埃及

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 市场排名分析

- 主要企业策略

- 公司简介

- GranBio Technologies

- Axcelon Biopolymers Corporation

- Borregaard

- CelluComp

- CelluForce

- Chuetsu Pulp and Paper Co. Ltd

- Daicel Finechem Ltd

- Fiberlean Technologies

- Melodea Ltd

- Nippon Paper Industries Co. Ltd

- Norske Skog ASA

- Oji Holdings Corporation

- Sappi Ltd

- University of Maine

第七章 市场机会与未来趋势

- 增加创新活动和研发投资

- 製造商扩展能力以利用更广泛的适用性

The Global Nanocellulose Market size is estimated at USD 1.32 billion in 2025, and is expected to reach USD 3.28 billion by 2030, at a CAGR of greater than 20% during the forecast period (2025-2030).

With the rising demand from oil and gas, the textile segment is witnessing an increased demand from various application segments, owing to the growing utilization of multiple products.

Key Highlights

- Over the short term, the increasing adoption of flexible packaging and the superior properties of nanocellulose are expected to drive the growth of the studied market.

- However, a shortage of consumer awareness and economic barriers are expected to hinder the market's growth.

- Increasing innovation activities, research and development investments, and capacity expansions by manufacturers to capitalize on the broad applicability are expected to unveil new opportunities for the market studied.

- North America dominated the market across the world with the most substantial consumption of nanocellulose.

Nanocellulose Market Trends

The Composites Segment is Expected to Dominate the Market

- The composites segment accounted for the largest application of nanocellulose in 2023, owing to the increased demand for packaging materials and biodegradable plastics, which resulted in increased government support and investment in developing such materials.

- Nanocellulose composites have heavily replaced plastics due to their biodegradable and non-toxic nature. Due to the reduced size of the dispersed phase and its good dispersion in the polymer matrix, these materials exhibit markedly improved properties when compared to pure polymers or their traditional composites.

- Nanocellulose composites play a crucial role in the automotive industry by serving as reinforcing agents in polymer matrices, contributing to lightweight and strong materials, improved mechanical properties, and enhanced sustainability in-vehicle components and manufacturing processes.

- The development of electric vehicles is expected to continue to gain momentum in the future, especially in North America, Europe, and Asia, owing to government programs promoting the move away from fossil fuels.

- According to the Federal Motor Transport Authority (Kraftfahrt-Bundesamt - KBA), the total number of battery electric cars registered in Germany was 1,013,009 in 2023, registering growth compared to previous years data.

- Similarly, as per the General Administration of Customs of the People's Republic of China, China's overall BEV exports rose by 70% in 2023, reaching USD 34.1 billion.

- With the increasing demand for polymers worldwide and in majorly developing economies such as India, Japan, and Vietnam, the demand for nanocellulose is expected to grow from composite applications in the coming years.

- In India, more than 30 hospital projects, including expansions and new construction projects, are in the planning or construction phase. For instance, the Health City hospital project worth USD 1.4 million is being built by Care Hospitals in the Visakhapatnam district of Andhra Pradesh.

- Therefore, considering these factors, the demand for nanocellulose from the segment studied is expected to grow substantially during the forecast period.

North America is Expected to Dominate the Market

- North America dominates the nanocellulose market. It is expected to continue its dominance during the forecast period.

- Increased infrastructure projects and the renovation of commercial buildings in North America will drive the regional market's growth for composite applications, mainly due to huge government spending on public infrastructure upgrades.

- Growing regional industries, such as food and beverage, oil and gas, paints and coatings, and construction, are expected to further complement nano cellulose business growth by 2027.

- Oil and gas deals in the United States reached an all-time high of USD 51 billion during the first quarter of 2024. Energy companies have been eager to build up their oil and gas drilling inventories, particularly in the prolific Permian Basin, with a producer break-even cost of around USD 64 per barrel.

- Nanocellulose finds application in the food and beverage industry as a thickening agent, stabilizer, texture enhancer, and in edible coatings, offering benefits such as reduced fat content and extended shelf life for fruits and vegetables, contingent upon regulatory approval for safety in consumption.

- According to the US Census Bureau, the annual sales of retail and food services in the United States amounted to USD 8.33 trillion in 2023 and registered growth compared to USD 8.07 trillion in 2022.

- Similarly, in the paper industry, nanocellulose is utilized to enhance paper properties, offering benefits such as increased strength, improved printability, and reduced environmental impact due to its renewable and sustainable nature.

- According to the Food and Agriculture Organization, the production capacity of paper and paperboard in Canada reached 9,200 thousand metric tons in 2023 and registered the highest production compared to 9,100 thousand metric tons in 2022.

- In September 2023, Laneige, the Korean beauty conglomerate, launched in Mexico. The skincare brand's expansion into Mexico comes as part of a partnership between the beauty conglomerate and Sephora, Mexico's leading beauty retailer. According to the company, the brand continues to experience remarkable growth across North America, adding that sales of Laneige in the region increased by 105% during the second quarter of 2023.

- With such growth from various end-user industries, the North American nanocellulose market is expected to grow rapidly during the forecast period, mainly spurred by the United States.

Nanocellulose Industry Overview

The nanocellulose market is consolidated in nature, with the major players (in no particular order) comprising CelluForce, GranBio, Melodea Ltd, CelluComp Ltd, and Borregaard.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Superior Properties of Nanocellulose

- 4.1.2 Increasing Adoption of Flexible Packaging Aids

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Economic Barriers Hindering Market Growth

- 4.2.2 Growing Consumer Awareness

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 End-user Industry

- 5.1.1 Paper Processing

- 5.1.2 Paints and Coatings

- 5.1.3 Oil and Gas

- 5.1.4 Food and Beverage

- 5.1.5 Composites

- 5.1.6 Pharmaceuticals and Cosmetics

- 5.1.7 Other End-user Industries

- 5.2 Product Type

- 5.2.1 Nanofibrillated Cellulose (NFC)

- 5.2.2 Nanocrystalline Cellulose (NCC)

- 5.2.3 Bacterial Cellulose

- 5.2.4 Microfibrillated Cellulose (MFC)

- 5.2.5 Other Product Types

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 GranBio Technologies

- 6.4.2 Axcelon Biopolymers Corporation

- 6.4.3 Borregaard

- 6.4.4 CelluComp

- 6.4.5 CelluForce

- 6.4.6 Chuetsu Pulp and Paper Co. Ltd

- 6.4.7 Daicel Finechem Ltd

- 6.4.8 Fiberlean Technologies

- 6.4.9 Melodea Ltd

- 6.4.10 Nippon Paper Industries Co. Ltd

- 6.4.11 Norske Skog ASA

- 6.4.12 Oji Holdings Corporation

- 6.4.13 Sappi Ltd

- 6.4.14 University of Maine

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Innovation Activities and R&D Investments

- 7.2 Capacity Expansions by Manufacturers to Capitalize the Wide Applicability