|

市场调查报告书

商品编码

1687424

船用燃料:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Bunker Fuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

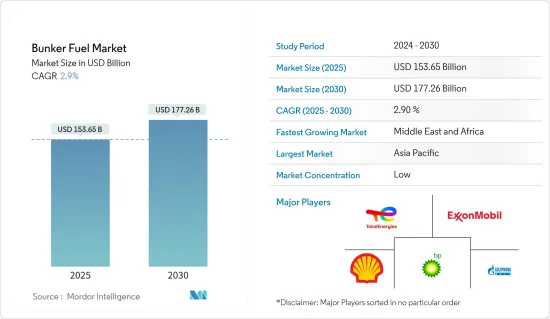

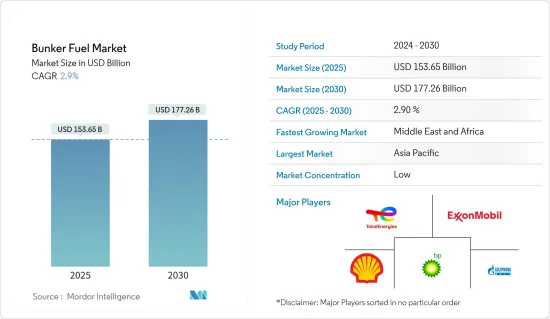

预计 2025 年船用燃料市场规模为 1,536.5 亿美元,到 2030 年将达到 1,772.6 亿美元,预测期内(2025-2030 年)的复合年增长率为 2.9%。

主要亮点

- 从中期来看,液化天然气贸易的成长预计将推动船用燃料油的需求。 LNG 交易主要用于工业、商业和住宅电力领域。中国和印度等依赖煤炭的国家正在透过从中东和俄罗斯、澳洲和奈及利亚等其他一些国家进口更多天然气,逐步转型为清洁能源。

- 另一方面,预计在预测期内,环境问题和对航运业排放气体的严格规定将限制重质船用燃料的使用,尤其是高硫燃料油。

- 然而,随着亚太、中东和非洲等地区新兴国家经济表现的改善,海上运输需求和营运船舶数量预计将增加,为未来几年船用燃料油市场参与者提供巨大的成长机会。

- 预计预测期内亚太地区将占据市场主导地位,大部分需求预计来自中国和印度等国家。

船用燃料油市场趋势

液化天然气作为船用燃料的市场预计将大幅成长

- 过去十年,全球液化天然气燃料库市场不断发展,推动力是全球液化天然气使用量不断增加,以及清洁能源具有减少温室气体排放的潜力,导致清洁能源需求不断增长。

- 将目前营运的船舶改装成基于液化天然气的船舶的成本非常高。因此,从经济上来说这是不可行的。然而,一旦新的排放法规实施,预计液化天然气船舶的营运成本将成为所有替代燃料中最低的。此外,逐步过渡到液化天然气推进系统比使用重质燃料油、船用燃气油和船用柴油的传统船舶燃料方法具有优势。基于液化天然气的推进系统将显着减少二氧化碳排放并提高船舶运作效率。

- 预计到 2030 年,液化天然气燃料需求将成长到 3,000 万吨,欧洲、亚洲和北美正在建造更多的液化天然气加油船,以满足不断增长的燃气引擎船队的需求。这些从船厂订购的大容量液化天然气加註船(LNGBV)旨在在主要LNG接收站加註货物并为燃气引擎远洋船舶加註燃料。

- 截至 2024 年 2 月,将有 48 艘 LNG 活跃加油船,比 2022 年增加 11 艘。其中近一半在欧洲运营,其余在亚洲和北美运营。到 2024年终,LNG燃料库船队预计将达到 55 艘,仅 2024 年就将增加总合容量 67,900 立方公尺。

- 船东,尤其是在欧洲和美国水域运营的船东,现在更倾向于使用液化天然气的船舶,而不是传统船舶。此外,液化天然气燃料船舶尚未大规模渗透散装货船市场。散装船用于运载重物,而 LNG 技术在该类船舶上的应用相对较新。散装船占运作中船队的最大份额。

- 此外,使用液化天然气作为燃料是一种经过验证且具有商业性可行性的解决方案。 LNG 具有巨大的优势,特别是对于面临日益严格的排放气体法规的船舶而言。虽然预计传统石油燃料在中期内仍将是大多数船舶的主要燃料选择,但从长期来看,液化天然气可能会成为主流选择。

- 2024 年 4 月,科技集团瓦锡兰 (Wärtsilä) 旗下的瓦锡兰天然气解决方案公司 (Wärtsilä Gas Solutions) 宣布将为西班牙船东 Scale Gas(Enagas 的子公司,拥有并运营西班牙天然气管网)建造的 12,500 立方米液化天然气燃料库新船提供装卸系统。该船由永续交通支援计画共同资助,该计画是西班牙交通、流动和城市规划部復苏、转型和復原力计画的一部分。

- LNG较传统燃料相对便宜,与石油基航运燃料相比可减少23%的温室气体排放,有助于实现全球脱碳目标。由于这些因素,预计 LNG 将成为未来最受欢迎的船用燃料。

亚太地区可望主导市场

- 由于印度、中国、新加坡和日本等国家拥有巨大的海运贸易潜力,亚太地区预计将主导船用燃料油市场。

- 截至2023年,中国出口量位居第一,进口量位居第二。 2023年,中国进口商品约2.5兆美元,出口约3.3兆美元。中国主要出口产品包括机械及电气设备、汽车零件、化学品及塑胶、钢铁产品、家具等。

- 澳洲是世界上最大的液化天然气出口国之一。液化天然气出口的增加支持了澳洲日益增长的国际贸易。全球对液化天然气的需求正在大幅增长,因此未来几年出口量可能会增加。

- 为了增加海运业在国际和国内贸易中的份额,印度政府宣布计划在 2035 年投资 220 亿美元对现有港口进行现代化改造并建造新港口。预计预测期内,港口基础建设将提振亚太地区海运业和船用燃料供应商的需求。

- 2024年2月,LNG加註船承租人Pavilion Energy宣布,LNG加註船Brassavola号已完成首次船对船(STS) LNG加註作业。 Brassavola 将液化天然气运送至力拓租赁的双燃料散装货船 Mount Api 号。

- 因此,由于上述因素,预计亚太地区将在预测期内主导船用燃料油市场。

船用燃料油产业概况

全球船用燃料油市场较为分散。市场的主要企业(不分先后顺序)包括 Gazpromneft Marine Bunker LLC、埃克森美孚公司、壳牌公司、道达尔能源公司和英国石油公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测(美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 全球液化天然气贸易不断成长

- 越来越依赖天然气发电

- 限制因素

- 环境问题和严格的船舶排放规定

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 投资分析

第五章 市场区隔

- 燃料类型

- 高硫燃料油 (HSFO)

- 极低硫燃料油 (VLSFO)

- 船用瓦斯油 (MGO)

- 液化天然气(LNG)

- 其他燃料

- 船舶类型

- 容器

- 油船

- 杂货船

- 散货船

- 其他船型

- 地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 奈及利亚

- 卡达

- 埃及

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作、协议

- 主要企业策略

- 公司简介

- 燃料供应商

- ExxonMobil Corporation

- Shell PLC

- Gazpromneft Marine Bunker LLC

- BP PLC

- PJSC Lukoil Oil Company

- TotalEnergies SE

- Chevron Corporation

- Clipper Oil

- Gulf Agency Company Ltd

- Bomin Bunker Holding GmbH & Co. KG

- 船东

- AP Moeller Maersk AS

- Mediterranean Shipping Company SA

- China COSCO Shipping Corporation Limited

- CMA CGM Group

- Hapag-Lloyd AG

- Ocean Network Express

- Evergreen Marine Corp Taiwan Ltd

- Yang Ming Marine Transport Corporation

- HMM Co. Ltd

- Pacific International Lines Pte Ltd

- 其他主要企业名单

- 市场排名分析

- 燃料供应商

第七章 市场机会与未来趋势

- 海上运输需求不断成长,营运船舶数量不断增加

简介目录

Product Code: 62667

The Bunker Fuel Market size is estimated at USD 153.65 billion in 2025, and is expected to reach USD 177.26 billion by 2030, at a CAGR of 2.9% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, increasing LNG trade is expected to boost the demand for bunker fuel. LNG is majorly traded for the power sector in industrial, commercial, and residential segments. Countries with high coal dependencies, such as China and India, are gradually moving toward cleaner energy by increasing the import volume of natural gas from the Middle East and a few other nations, like Russia, Australia, and Nigeria.

- On the other hand, environmental concerns and the strict regulations related to emissions from the maritime industry are anticipated to limit the usage of heavy bunker fuels, especially high sulfur fuel oil, during the forecast period.

- Nevertheless, with the improved economic performance of developing countries across regions such as Asia-Pacific and Middle East and Africa, the demand for marine transportation and the number of ships in operation are expected to increase, offering significant growth opportunities for players in the bunker fuels market over the coming years.

- Asia-Pacific is expected to dominate the market during the forecast period, with the majority of the demand being generated from countries like China and India.

Bunker Fuel Market Trends

LNG Likely to Witness Significant Market Growth as a Bunker Fuel

- The global LNG bunkering market has evolved over the past decade, driven by the increase in global LNG usage amid growing demand for clean energy due to its ability to reduce greenhouse gas emissions.

- The conversion of the current operating vessels into LNG-based vessels is highly expensive. Hence, it is not economically viable. However, the operational cost of LNG-based vessels is expected to be the lowest among all the fuel alternatives once the new emission regulations become applicable. Further, a gradual shift to LNG for propulsion is more advantageous than the traditional methods of fueling ships with heavy fuel oil, marine gas oil, marine diesel oil, etc. LNG-based propulsion reduces the carbon footprint significantly and increases a ship's operational efficiency.

- With demand for LNG as a fuel expected to rise to 30 million tonnes by 2030, Europe, Asia, and North America are adding LNG bunkering vessels to keep pace with the swelling gas-powered fleet. These larger capacity LNG bunker vessels (LNGBVs) on order at shipyards are designed to load at major LNG terminals and refuel gas-powered ocean-going tonnage.

- As of February 2024, there were 48 LNG active bunkering vessels, 11 more than in 2022. Out of the total fleet, nearly half operate in Europe, while the rest operate in Asia and North America. By the end of 2024, the number of LNG bunkering vessel fleets is likely to reach 55 units, with a total added capacity of 67,900 cm in 2024 alone.

- Shipowners, particularly those operating in the European or American Sea, now prefer LNG-based vessels over conventional vessels. Furthermore, LNG-fueled ships have not penetrated the market for bulk carriers to a significant extent, as these ships are designed to carry heavy loads, and LNG technology is relatively new to apply for this type of vessel. The bulk carriers amount to the largest share of the in-operation ships.

- Moreover, the use of LNG as a fuel is both a proven and commercially available solution. LNG offers enormous advantages, especially for ships in the light of ever-tightening emission regulations. Conventional oil-based fuels are expected to remain the primary fuel option for most ships in the mid-term, while LNG is likely to become a popular choice in the long-term scenario.

- In April 2024, Wartsila Gas Solutions, part of the technology group Wartsila, announced that it would supply the cargo handling system for a new 12,500 m3 LNG bunkering vessel being built for Spanish shipowner Scale Gas, a subsidiary of Enagas, the owner and operator of Spain's gas grid. The vessel is co-financed by the Support for Sustainable and Digital Transport Programme, part of the Recovery, Transformation and Resilience Plan from the Spanish Ministry of Transport, Mobility and Urban Agenda.

- LNG demand is likely to increase significantly in the forecast period as the order book for LNG vessels continues to increase due to it being relatively cheaper than conventional fuels and offering a 23% reduction in greenhouse gas emissions over oil-based marine fuel, which will aid in meeting global decarbonization goals. These factors project LNG to be the most popular marine fuel in the future.

Asia-Pacific Expected to Dominate the Market

- Asia-Pacific is expected to dominate the bunker fuels market due to the immense maritime trade potential of countries like India, China, Singapore, and Japan.

- As of 2023, China ranked first in terms of exported goods and second for imported goods by value. In 2023, China imported goods worth around USD 2.5 trillion and exported USD 3.3 trillion. China's major exports are mechanical and electric machinery and equipment and automotive products, including vehicle parts, chemicals and plastics, iron and steel articles, and furniture.

- Australia is among the biggest exporters of LNG globally. Rising LNG exports have supported the growth in international trade in Australia. The export volume is likely to rise in the coming years as the demand for LNG is increasing significantly worldwide.

- To increase the share of the marine sector in international and domestic trade, the Indian government announced an investment of USD 22 billion by 2035 to modernize its existing ports and build new ports. The port infrastructure development is expected to increase the demand from the maritime industry and marine fuel suppliers in Asia-Pacific during the forecast period.

- In February 2024, Pavilion Energy, charterer of LNG bunker vessels, announced that LNG bunker vessel Brassavola had completed its first ship-to-ship (STS) LNG bunkering operation. In its maiden STS LNG bunkering operation, Brassavola delivered LNG to Rio Tinto chartered dual-fueled bulk carrier Mount Api.

- Therefore, in line with the aforementioned factors, Asia-Pacific is expected to dominate the bunker fuels market during the forecast period.

Bunker Fuel Industry Overview

The global bunker fuels market is fragmented. Some of the major players in the market (in no particular order) include Gazpromneft Marine Bunker LLC, ExxonMobil Corporation, Shell PLC, TotalEnergies SE, and BP PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increased LNG Trade Worldwide

- 4.5.1.2 Increasing Dependencies over Natural Gas for Power Generation

- 4.5.2 Restraints

- 4.5.2.1 Environmental Concerns and the Strict Regulations Related to Emissions from the Maritime Industry

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 High Sulfur Fuel Oil (HSFO)

- 5.1.2 Very Low Sulfur Fuel Oil (VLSFO)

- 5.1.3 Marine Gas Oil (MGO)

- 5.1.4 Liquefied Natural Gas (LNG)

- 5.1.5 Other Fuel Types

- 5.2 Vessel Type

- 5.2.1 Containers

- 5.2.2 Tankers

- 5.2.3 General Cargo

- 5.2.4 Bulk Carriers

- 5.2.5 Other Vessel Types

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 France

- 5.3.2.3 United Kingdom

- 5.3.2.4 Spain

- 5.3.2.5 NORDIC

- 5.3.2.6 Turkey

- 5.3.2.7 Russia

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Malaysia

- 5.3.3.6 Thailand

- 5.3.3.7 Indonesia

- 5.3.3.8 Vietnam

- 5.3.3.9 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Nigeria

- 5.3.5.5 Qatar

- 5.3.5.6 Egypt

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Fuel Suppliers

- 6.3.1.1 ExxonMobil Corporation

- 6.3.1.2 Shell PLC

- 6.3.1.3 Gazpromneft Marine Bunker LLC

- 6.3.1.4 BP PLC

- 6.3.1.5 PJSC Lukoil Oil Company

- 6.3.1.6 TotalEnergies SE

- 6.3.1.7 Chevron Corporation

- 6.3.1.8 Clipper Oil

- 6.3.1.9 Gulf Agency Company Ltd

- 6.3.1.10 Bomin Bunker Holding GmbH & Co. KG

- 6.3.2 Ship Owners

- 6.3.2.1 AP Moeller Maersk AS

- 6.3.2.2 Mediterranean Shipping Company SA

- 6.3.2.3 China COSCO Shipping Corporation Limited

- 6.3.2.4 CMA CGM Group

- 6.3.2.5 Hapag-Lloyd AG

- 6.3.2.6 Ocean Network Express

- 6.3.2.7 Evergreen Marine Corp Taiwan Ltd

- 6.3.2.8 Yang Ming Marine Transport Corporation

- 6.3.2.9 HMM Co. Ltd

- 6.3.2.10 Pacific International Lines Pte Ltd

- 6.3.3 List of Other Prominent Companies

- 6.3.4 Market Ranking Analysis

- 6.3.1 Fuel Suppliers

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Risisng Demand for Marine Transportation and Increasing Number of Ships in Operation

02-2729-4219

+886-2-2729-4219