|

市场调查报告书

商品编码

1687426

不干胶标籤:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Self-adhesive Labels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

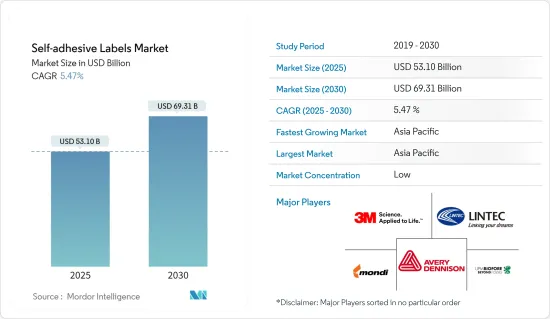

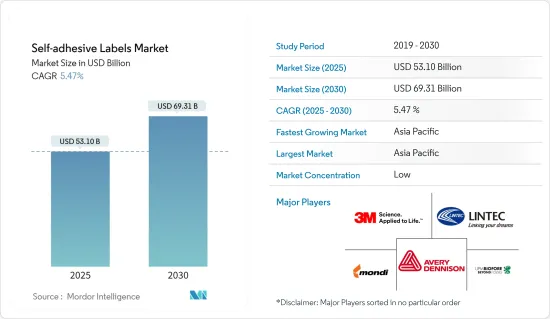

不干胶标籤市场规模预计在 2025 年为 531 亿美元,预计到 2030 年将达到 693.1 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.47%。

COVID-19 疫情爆发以及随后的全国封锁、製造业活动和供应链中断以及生产停顿对 2020 年的市场产生了负面影响。然而,情况在 2021 年开始復苏,在预测期内恢復了市场成长轨迹。

主要亮点

- 预计快速成长的电子商务行业和不断增长的食品饮料消费将推动市场需求。

- 相反,政府监管的日益严格以及无底纸标籤等替代品的出现可能会阻碍市场的成长。

- 由于向永续实践的转变,对生物基自黏剂的需求不断增加,这将为所研究的市场带来机会。

- 亚太地区占据了市场的大部分份额,预计在预测期内将继续保持主导地位。

不干胶标籤市场趋势

食品和饮料行业的需求增加

- 众所周知,不干胶标籤可以增强食品和饮料包装品牌的美感。包装和标籤在销售产品中起着至关重要的作用,因为它们有助于吸引消费者的注意力。负责人主要使用标籤来鼓励潜在消费者购买产品。标籤告知如何使用、运输、回收和处理包装或产品。

- 标籤提供食品和饮料领域的成分资讯、产品标识和警告。不干胶标籤製造商必须遵守法律要求,确保其黏合剂不会影响食品成分。

- 此外,预计到年终全球食品包装市场价值将达到约 3,620 亿美元,到 2027 年将达到 4,636.5 亿美元。因此,食品包装市场的成长可能会在未来几年增加对不干胶标籤的需求。

- 根据美国商务部的数据,2023 年 1 月零售和餐饮服务机构的总销售额为 782.7 亿美元。而2022年1月,这一数字为749.8亿美元。已经有约4.39%的大幅成长,预计还会进一步增加。

- 此外,各食品加工公司都在投资新工厂并扩大包装食品业务的产能。根据生产连结奖励(PLI) 计划,印度政府已收到 60 家包装食品公司的投资提案,包括印度斯坦联合利华、Amul、雀巢、Dabur、ITC、Parle 和 Britannia。

- 因此,上述因素将在预测期内增加对不干胶标籤的需求。

亚太地区占市场主导地位

- 亚太地区占据市场主导地位,预计在预测期内将大幅成长。中国、印度、日本和韩国等国家的包装、电子和个人护理行业的成长正在推动不干胶标籤的消费。

- 2022年,中国个人护理及化妆品出口总额为56.3亿美元,2021年为48.5亿美元,与前一年同期比较增长16.08%,预计未来将进一步成长。

- 中国是最大的电子产品生产中心。智慧型手机、电视和其他个人设备等电子产品在电子产品中成长最快。该国不仅满足了国内对电子产品的需求,还将其电子产品出口到其他国家。随着中产阶级可支配收入的增加,对电子产品的需求预计会增加。

- 根据ZEVI预测,2021年亚洲电子产品市场规模将达到3.11兆欧元(3.674兆美元),成长10%。预计2022年市场将成长13%,2023年将成长7%。中国市场是世界上最大的市场,比工业国家市场的总合还要大。此外,预计中国电子产业2022年将成长14%,2023年将成长8%。

- 不干胶标籤广泛应用于各国进出口的药品及医疗设备的包装。据印度政府称,到2030年,印度医药市场规模预计将达到1,300亿美元。印度向200多个国家供应药品,未来有潜力继续这样做。

- 受经济成长、人口红利和电子商务不断发展的推动,印度第五大包装产业正在经历强劲成长。例如,2022 年 1 月,Flipkart 宣布将扩大其杂货服务至印度 1,800 个城市。 2022 年 6 月,亚马逊印度公司与曼尼普尔邦政府企业曼尼普尔邦手工织布及手工艺品发展有限公司(MHHDCL)签署了一份谅解备忘录,以支持全邦工匠和织工的发展。

- 这些因素可能会在预测期内推动所研究市场的需求。

不干胶标籤行业概况

该研究涉及的市场较为分散。市场的主要企业包括(不分先后顺序)3M、艾利丹尼森公司、UPM、Mondi 和 LINTEC 公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 蓬勃发展的电子商务产业

- 食品和饮料业对加工食品的需求不断增加

- 其他驱动因素

- 限制因素

- 政府监管不断加强

- 其他限制因素

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场区隔

- 胶合剂类型

- 热熔胶

- 乳液丙烯酸

- 溶剂

- 表面材质

- 纸

- 塑胶

- 聚丙烯

- 聚酯纤维

- 乙烯基塑料

- 其他塑料

- 应用

- 饮食

- 药品

- 物流与运输

- 个人护理

- 耐久财

- 其他用途

- 地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 其他中东和非洲地区

- 亚太地区

第六章 竞争格局

- 併购、合资、合作、协议

- 市场占有率(%)**/排名分析

- 主要企业策略

- 公司简介

- 3M

- Asteria Group

- Avery Dennison Corporation

- CPC Haferkamp GmbH & Co. KG

- Fuji Seal International, Inc.

- HB Fuller Company

- HERMA

- LECTA

- LINTEC Corporation

- Mondi

- Optimum Group

- Symbio, Inc.

- Thai KK Group

- UPM

第七章 市场机会与未来趋势

- 将重点转向生物基不干胶标籤

- 其他机会

The Self-adhesive Labels Market size is estimated at USD 53.10 billion in 2025, and is expected to reach USD 69.31 billion by 2030, at a CAGR of 5.47% during the forecast period (2025-2030).

The COVID-19 outbreak and the subsequent nationwide lockdowns, disruption in manufacturing activities and supply chains, and production halts negatively impacted the market in 2020. However, the conditions started recovering in 2021, restoring the market's growth trajectory for the forecast period.

Key Highlights

- The rapidly growing e-commerce industry and increased consumption of food and beverage products will likely drive the market demand.

- Conversely, increasing government regulations and the availability of substitutes like linerless labels will likely hinder market growth.

- The increasing demand for bio-based self-adhesives with a shift to sustainable practices will act as an opportunity for the market studied.

- Asia-Pacific dominated the market with a significant share and is expected to continue its dominance during the forecast period.

Self Adhesive Labels Market Trends

Increasing Demand from the Food and Beverage Industry

- Self-adhesive labels are known to improve the aesthetic characteristics of food and beverage packaging brands. Packaging and labeling play an essential role in the sale of products, as they help grab consumers' attention. Marketers mainly use them to encourage potential consumers to purchase the product. Labels communicate how to use, transport, recycle, and/or dispose of the package or product.

- Labeling provides ingredient information, product identification, and cautionary notifications in the food and beverage sector. Self-adhesive label manufacturers must comply with the legal requirements to ensure the adhesive does not affect the food ingredients.

- Furthermore, the global food packaging market is estimated to reach around USD 362 billion by the end of this year and USD 463.65 billion in 2027. Thus, the growing food packaging market will increase the demand for self-adhesive labels in the coming years.

- According to the US Department of Commerce, in January 2023, the total sales of retail and food services stores stood at USD 78.27 billion. In contrast, in January 2022, the figure stood at USD 74.98 billion. There is a substantial increase of approximately 4.39%, which is expected to increase further.

- Moreover, various food processing companies invest in new plants and capacity expansions of the packaged food business. Under the Production Linked Incentive (PLI) scheme, the Indian government received investment proposals from 60 processed food companies, including Hindustan Unilever, Amul, Nestle, Dabur, ITC, Parle, and Britannia.

- Thus, the abovementioned factors will likely increase the demand for self-adhesive labels in the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the market and is expected to grow significantly over the forecast period. With the growing packaging, electronics, and personal care industries in countries like China, India, Japan, and South Korea, the consumption of self-adhesive labels is increasing.

- In 2022, the total export of personal care and cosmetics from China stood at USD 5.63 billion; in 2021, the figure was USD 4.85 billion. There is an increase of 16.08% compared to the previous year, which is expected to increase further.

- China is the largest base for electronics production. Electronic products, such as smartphones, TVs, and other personal devices, recorded the highest growth in electronics. The country serves the domestic demand for electronics and exports electronic output to other countries. With an increase in disposable incomes of the middle-class population, the demand for electronic products is projected to increase.

- According to ZEVI, the Asian electro market reached EUR 3.11 trillion (USD 3.674 trillion) in 2021, a 10% rise. The market increased by 13% in 2022 and estimated a 7% growth rate for 2023. China's market is the largest in the world, even larger than the combined markets of all industrialized countries. Additionally, the Chinese electronic industry expanded by 14% in 2022, and the sector is expected to grow by 8% in 2023

- Self-adhesive labels are widely used in packaging medicines and medical equipment imported or exported to different countries. According to the government of India, the Indian pharma industry market size is expected to reach USD 130 billion by 2030. India provides pharmaceutical products to more than 200 countries and may continue to do so.

- India's fifth-largest packaging industry is growing significantly, led by economic growth, demographic dividend, and growing e-commerce. For instance, in January 2022, Flipkart announced expanding its grocery services and will offer services to 1,800 Indian cities. In June 2022, Amazon India signed an MoU with Manipur Handloom & Handicrafts Development Corporation Limited (MHHDCL), a Government of Manipur Enterprise, to support the growth of artisans and weavers across the state.

- Such factors will likely drive the market demand studied during the forecast period.

Self Adhesive Labels Industry Overview

The market studied is fragmented. Some key players in the market include (not in any particular order) 3M, Avery Dennison Corporation, UPM, Mondi, and LINTEC Corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rapidly Growing E-commerce Industry

- 4.1.2 Increasing Demand for Packed Foods from Food and Beverage Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Increasing Government Regulations

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Adhesive Type

- 5.1.1 Hot-melt

- 5.1.2 Emulsion Acrylic

- 5.1.3 Solvent

- 5.2 Face Material

- 5.2.1 Paper

- 5.2.2 Plastic

- 5.2.2.1 Polypropylene

- 5.2.2.2 Polyester

- 5.2.2.3 Vinyl

- 5.2.2.4 Other Plastics

- 5.3 Application

- 5.3.1 Food and Beverage

- 5.3.2 Pharmaceutical

- 5.3.3 Logistics and Transport

- 5.3.4 Personal Care

- 5.3.5 Consumer Durables

- 5.3.6 Other Applications

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Asteria Group

- 6.4.3 Avery Dennison Corporation

- 6.4.4 CPC Haferkamp GmbH & Co. KG

- 6.4.5 Fuji Seal International, Inc.

- 6.4.6 H.B. Fuller Company

- 6.4.7 HERMA

- 6.4.8 LECTA

- 6.4.9 LINTEC Corporation

- 6.4.10 Mondi

- 6.4.11 Optimum Group

- 6.4.12 Symbio, Inc.

- 6.4.13 Thai KK Group

- 6.4.14 UPM

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus Toward Bio-based Self-adhesive Labels

- 7.2 Other Opportunities