|

市场调查报告书

商品编码

1687431

浮体式海上风电-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Floating Offshore Wind Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

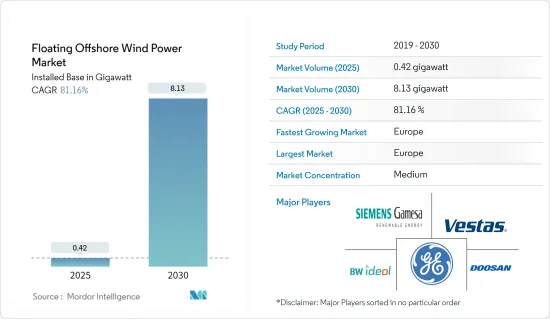

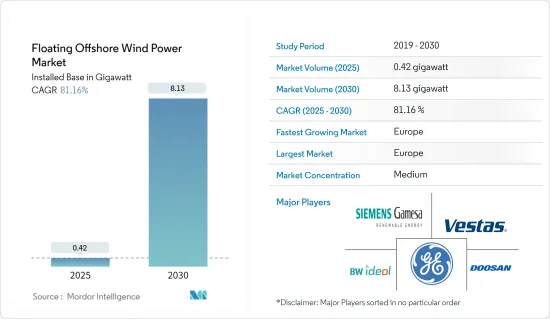

预计浮体式海上风电装置规模将从 2025 年的 0.42 吉瓦扩大到 2030 年的 8.13 吉瓦,预测期内(2025-2030 年)的复合年增长率为 81.16%。

主要亮点

- 从中期来看,预计对海上可再生风力发电计划的投资增加以及先进且易于获得的海上风力发电技术将成为预测期内浮体式海上风电市场的主要驱动力。

- 然而,在预测期内,来自替代可再生能源市场的激烈竞争将抑制浮体式海上风电市场的发展。

- 然而,由于尚未开发的深水区有利于浮体式结构的发展,浮体式海上风电越来越受欢迎,为市场参与者提供了充足的机会。

- 预计预测期内欧洲将主导浮体式海上风电市场。这是因为该地区目前正在建造和规划浮体式海上发电工程。

浮体式海上风电市场趋势

过渡水深(30 公尺至 60 公尺深度)段预计将成长

- 由于水深较大、计划经济性较高,浮体式海上风电(FOWT)技术正在过渡水深(30-60公尺深度)中开发。驳船型是浅水区最具商业性可行性的浮体式风力发电机设计。此型号适用于30公尺以上的作业,是所有浮体式基础中吃水最浅的。

- 基于驳船的浮体式风力发电机占地面积为方形,而其他设计则采用月池来减少波浪载荷造成的压力。据 GWEC 称,一台典型的 6 兆瓦浮体式驳船风力发电机重量在 2,000 至 8,000 吨之间。然而,BW Ideol 凭藉其阻尼池驳船浮动子结构技术,是唯一部署兆瓦级驳船型 FOWT 的公司。

- 由于水深较浅,FOWT 技术从商业角度来看不如固定基座技术实用。预计在预测期内,驳船技术将占据 FOWT 市场的一小部分。根据美国环保署的数据,截至 2021 年,全球运作的驳船 FOWT 容量仅为 5 兆瓦。基于驳船的FOWT容量约为1,932兆瓦,占全球未来计划宣布的离岸风电基础技术总量的2.1%。

- 大多数公司正尝试将可以在深水域中使用的FOWT设计推向市场。然而,一些半潜式技术也可以在过渡深度使用。几种基于半潜式设计的商业性FOWT 模型允许它们在过渡水深下运作。其中一些模型最初用于实验计划,而其他一些模型则经过改进后用于商业项目。

- 美国能源局风力发电技术办公室(WETO)于2024年4月24日宣布,打算发布一份意向通知,其中包含4800万美元的资助机会,用于区域和国家浮体式海上风电技术的研究和开发,包括浮动离岸风电平台的研究和开发。这为该市场的未来成长潜力提供了良好的基础。

- 根据国际可再生能源机构 (IEA) 的《2024 年可再生能源容量报告》,全球离岸风力发电装置容量将在 2023-24 年增长 17.26%,即 2023 年增加 10,696 兆瓦,到 2022 年装置容量将达到 61,967 兆瓦。这样的发展为不久的将来的市场先驱者带来了光明的前景。

- 大多数处于转型期的 FOWT计划可能位于欧洲,特别是英国、斯堪地那维亚和法国,其中大型计划正处于规划阶段。预计预测期内该领域的大部分部署将在这些地区进行。

- 因此,预计预测期内过渡水深(30 公尺至 60 公尺深度)段将大幅成长。

预计欧洲将主导市场

- 欧洲占据全球离岸风力发电装置容量的最大份额。根据欧盟统计,欧洲占全球离岸风力发电装置容量的四分之一。该国(主要是北海国家)很可能成为离岸风力发电市场的推动力量。

- 全球整体约85%的离岸风力发电电场安装在欧洲海域。北海地区的政府尤其为在其领海内建立离岸风力发电设定了雄心勃勃的目标。

- EolMed计划是法国在地中海的首个浮体式试验风力发电厂。 2022 年 5 月,道达尔能源宣布开始该计划建设,目标是在 2024 年运作。该计划由三台 10MW浮体式涡轮机组成,固定在 62 公尺深的海床上。该涡轮机将采用带有阻尼池的驳船设计。

- 根据国际可再生能源机构的《2024年再生能源容量报告》,欧洲离岸风力发电装置容量将在2023-24年间成长9.58%,从2023年的2830兆瓦增加到2022年的29539兆瓦。这些发展趋势预示着市场相关人员在不久的将来将拥有光明的前景。

- 2023年8月,全球最大的浮体式风力发电厂Hywind Tampen计划在挪威海岸约140公里处270-310公尺深的水域开始运作。 Hywind Tampen 将使用 11 台浮体式风力发电机,系统容量为 88MW。我们为海上石油和天然气平台的电力供应做出贡献。

- 2024 年 5 月,着名可再生能源公司 Invenergy 宣布计划在拉科鲁尼亚建设一个 552 兆瓦的浮体式海上风电发电工程。该计划名为“O Boi”,位于离岸 45.7 至 60 公里处,该地区被国家政府认定为具有巨大风力发电潜力。一旦运作,O Boi'计划将满足加利西亚约 15% 的电力需求,并为超过 60住宅供电。

- 这些趋势很可能使欧洲在预测期内成为浮体式海上风力发电厂的关键参与者。

浮体式海上风电产业概况

浮体式海上风电市场较为分散。市场的主要企业包括通用电气、斗山能源、西门子歌美飒可再生能源、BW Ideaol SA 和维斯塔斯风力系统 AS。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究范围

- 市场定义

- 调查前提

第二章执行摘要

第三章调查方法

第四章 市场概述

- 介绍

- 截至2029年浮体式海上风电累积设置容量预测

- 主要计划资讯

- 现有主要计划

- 未来计划

- 近期趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 加大对海上风力发电计划的投资

- 先进、随时可用的海上风力发电技术

- 限制因素

- 来自替代可再生能源市场的激烈竞争

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 投资分析

第五章市场区隔

- 依深度(仅定性分析)

- 浅水区(水深小于30公尺)

- 瞬时水深(水深30m至60m)

- 深水域(水深超过60公尺)

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 俄罗斯

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 越南

- 泰国

- 印尼

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 埃及

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章竞争格局

- 合併、收购、合作及合资

- Strategies and SWOT Adopted by Leading Players

- 公司简介

- Vestas Wind Systems AS

- General Electric Company

- Siemens Gamesa Renewable Energy SA

- BW Ideol AS

- Equinor ASA

- Marubeni Corporation

- RWE AG

- Doosan Enerbility Co. Ltd

- 市场排名分析

- List of Other Prominent Companies

第七章 市场机会与未来趋势

- 在未开发的深海近海区域开发浮体式海上发电工程

简介目录

Product Code: 62712

The Floating Offshore Wind Power Market size in terms of installed base is expected to grow from 0.42 gigawatt in 2025 to 8.13 gigawatt by 2030, at a CAGR of 81.16% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, rising investments in offshore renewable wind energy projects, coupled with advanced and readily accessible offshore wind turbine technologies, are expected to be major drivers of the floating offshore wind market during the forecast period.

- On the other hand, tough competition from alternate renewable energy markets will restrain the floating offshore wind market during the forecast period.

- Nevertheless, floating offshore wind energy is becoming more popular in developing untapped deep-water prospects favorable for floating structures, providing ample opportunities for the market players.

- Europe is expected to dominate the floating offshore wind market during the forecast period. Owing to ongoing and upcoming floating offshore wind energy projects in the region.

Floating Offshore Wind Power Market Trends

The Transitional Water (30 m to 60 m depth) Segment is Expected to Grow

- Due to the greater water depth and favorable project economics, floating offshore wind turbine (FOWT) technology is more developed in transitional water depths (30-60 meters). The barge variant is the most commercially viable floating wind turbine design at shallow depths. This model is appropriate for activities higher than 30 meters (m) and has the shallowest draft of any floating foundation.

- Barge-style floating wind turbines have a square footprint, while other designs incorporate a moonpool to lessen stresses brought on by wave-induced loads. According to GWEC, a typical 6-megawatt floating barge wind turbine weighs between 2,000 and 8,000 tons. However, BW Ideol, with its Damping Pool Barge Floating Substructure Technology, is the only company that has deployed barge-type FOWT at the MW scale.

- Since the water depth is shallower, FOWT technology is less practical from a business point of view than fixed-base technology. During the forecast period, barge technology is expected to make up a small part of the FOWT market. According to the US EPA, only 5 MW of barge FOWT capacity operated globally as of 2021. Around 1,932 MW of FOWT capacity on barges, or 2.1% of all announced offshore wind substructure technologies for future projects worldwide, was announced.

- Most companies attempt to market FOWT designs that can be used in deeper waters. However, some semi-submersible technologies can also be used at transitional water depths. They can function at transitional depths due to several commercial FOWT models that are built on the semi-submersible design. A few of these models were initially used in experimental projects, while others were modified for use in ventures for profit.

- The US Department of Energy's Wind Energy Technologies Office (WETO) announced on April 24, 2024, that it intended to issue a Notice of Intent involving a USD 48 million funding opportunity for regional and national research and development of offshore wind technologies, including floating offshore wind platform research and development. This promises future growth potential for the market.

- According to the International Renewable Energy Agency RE Capacity 2024, the global installed offshore wind energy capacity increased by 17.26% in FY 2023-24, adding 10,696 MW in 2023 to the earlier installed capacity of 61,967 MW in 2022. Such developments show promising outlooks for the market players in the near future.

- Most of the FOWT projects in transitional depths are likely to be in Europe, especially in the United Kingdom, Scandinavia, and France, where large projects are in the planning stages. During the forecast period, most of the deployments in this segment are likely to happen in these regions.

- Thus, the transitional water (30 m to 60 m depth) segment is expected to grow significantly during the forecast period.

Europe is Expected to Dominate the Market

- Europe holds the largest share of offshore wind energy installations globally. According to the European Union, Europe represents a quarter of global offshore wind installations. The country (primarily North Sea countries) is likely to be at the helm of the offshore wind market.

- Around 85% of offshore wind installations are globally in European waters. Governments, particularly in the North Sea area, have set ambitious targets for installing offshore wind farms in their territorial waters.

- The EolMed project is France's first floating pilot wind farm in the Mediterranean Sea. In May 2022, TotalEnergies announced the start of the project's construction, which is expected to be operational by 2024. The project consists of three 10 MW floating turbines on the bathymetry of the 62-meter depth and anchored to the seabed. The turbines will use a barge design with a damping pool.

- According to the International Renewable Energy Agency RE Capacity 2024, the installed offshore wind energy capacity in Europe increased by 9.58% in FY 2023-24, adding 2,830 MW in 2023 to the earlier installed capacity of 29,539 MW in 2022. Such developments show promising outlooks for the market players in the near future.

- In August 2023, the world's largest floating wind farm, the Hywind Tampen Project, started operating around 140 kilometers off the coast of Norway in depths ranging from 270 to 310 meters. Hywind Tampen uses 11 floating wind turbines and has a system capacity of 88 MW. It helps power operations at offshore oil and gas platforms.

- In May 2024, Invenergy, a prominent player in the renewable energy sector, unveiled its plans for a 552 MW floating offshore wind project in A Coruna. Dubbed 'O Boi', the project will be situated 45.7 to 60 kilometers offshore, in a zone recognized by the central government for its significant wind potential. Once operational, the 'O Boi' project aims to meet approximately 15% of Galicia's electricity demand, sufficient to energize over 600,000 residences.

- During the forecast period, these trends should make Europe a significant players involved in floating offshore wind farms.

Floating Offshore Wind Power Industry Overview

The floating offshore wind power market is semi-fragmented. Some major players in the market include General Electric Company, Doosan Energy, Siemens Gamesa Renewable Energy, BW Ideaol SA, and Vestas Wind Systems AS.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Floating Offshore Wind Power Cumulative Installed Capacity Forecast, till 2029

- 4.3 Key Projects Information

- 4.3.1 Major Existing Projects

- 4.3.2 Upcoming Projects

- 4.4 Recent Trends and Developments

- 4.5 Government Policies and Regulations

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.1.1 Rising Investments in Offshore Wind Energy Projects

- 4.6.1.2 Advanced and Readily Accessible Offshore Wind Turbine Technologies

- 4.6.2 Restraint

- 4.6.2.1 Tough Competition from Alternate Renewable Energy Markets

- 4.6.1 Drivers

- 4.7 Supply Chain Analysis

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Water Depth (Qualitative Analysis Only)

- 5.1.1 Shallow Water (less than 30 m depth)

- 5.1.2 Transitional Water (30 m to 60 m depth)

- 5.1.3 Deep Water (higher than 60 m depth)

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 France

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 Nordic Countries

- 5.2.2.7 Russia

- 5.2.2.8 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Malaysia

- 5.2.3.6 Vietnam

- 5.2.3.7 Thailand

- 5.2.3.8 Indonesia

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 Egypt

- 5.2.5.4 South Africa

- 5.2.5.5 Nigeria

- 5.2.5.6 Rest of the Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies and SWOT Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Vestas Wind Systems AS

- 6.3.2 General Electric Company

- 6.3.3 Siemens Gamesa Renewable Energy SA

- 6.3.4 BW Ideol AS

- 6.3.5 Equinor ASA

- 6.3.6 Marubeni Corporation

- 6.3.7 RWE AG

- 6.3.8 Doosan Enerbility Co. Ltd

- 6.4 Market Ranking Analysis

- 6.5 List of Other Prominent Companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Developing Floating Offshore Wind Projects in Untapped Offshore Deep-water Prospects

02-2729-4219

+886-2-2729-4219