|

市场调查报告书

商品编码

1687467

瓦楞包装:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Corrugated Board Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

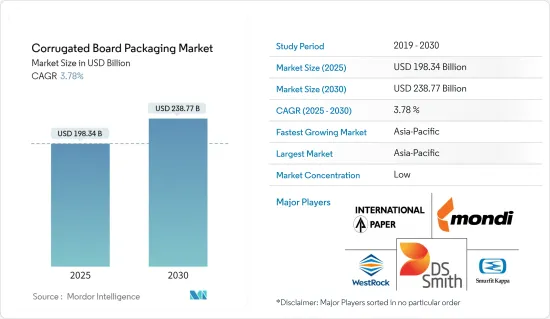

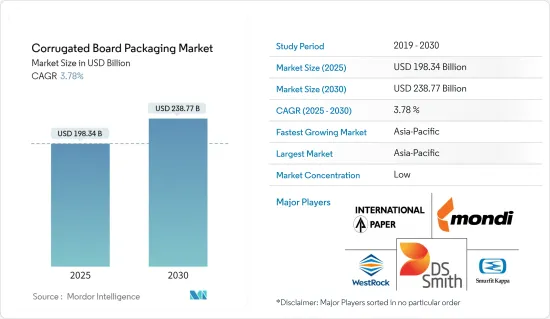

瓦楞包装市场规模预计在 2025 年为 1,983.4 亿美元,预计到 2030 年将达到 2,387.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.78%。

瓦楞纸板由于其对粗暴搬运的强大保护能力而成为首选的包装材料。瓦楞纸板的耐用性、多功能性和稳定性使其成为零售业的主要材料,而且随着全球电子商务销售额的飙升,其采用率也日益增长。

主要亮点

- 越来越多的公司将注意力转向不仅防潮而且还能承受长期运输的纸板包装。随着企业采用瓦楞纸板进行二次和三次包装,这一趋势显而易见。需求激增主要是因为麵包和肉品等加工食品和易腐食品需要一次性包装。此外,随着人们生活方式变得越来越忙碌,对方便食品的需求也越来越大。

- 纸板由纸浆和纸製成,比塑胶更可回收。瓦楞纸板可充当减震器,保护内容物免受外部衝击。瓦楞纸板可以承受巨大的压力,其不同厚度的层和凹槽提供了必要的缓衝作用。电子商务行业最近已成为纸板的主要消费领域。亚马逊和其他大公司使用纸板作为主要包装,但使用塑胶来包装单一物品。

- 这个市场也存在挑战和限制。纸板不像塑胶箱或木箱那么耐用,因此不适合承受重载或极端压力。它们通常更适合短期使用,而不是长期可重复使用的投资。

- 瓦楞纸板用途广泛,可以製成各种形状,包括盒子。随着人们对永续性的兴趣日益浓厚,纸板正逐渐被柔性塑胶袋所取代。此外,它与多种印刷技术的兼容性使其成为企业的一种有吸引力的行销工具,可以有效地充当行动广告牌,而无需产生额外的行销成本。

- 纸张和再生材料等原料的供应和价格波动会影响我们的生产和定价策略。纸包装产业正在努力应对森林砍伐、供应链脆弱性、环境问题、监管挑战以及永续创新的迫切动力等带来的挑战。

纸板包装市场的趋势

加工食品预计将占据主要市场占有率

- 瓦楞纸板是加工食品行业的流行包装选择。盒子有各种尺寸和形状。顾客可以用熟悉的容器享用零食。纸板包装的谷物、饼干和其他零嘴零食的消费历史可以追溯到几个世代以前。

- 由于瓦楞包装可以使产品远离湿气并能承受长时间的运输,因此公司越来越多地采用它以提供更好的客户结果,特别是在二次或三级包装中。麵包、肉品和其他生鲜产品等加工食品的需求量很大,因为这些包装材料只需一次性使用。

- 根据詹姆斯敦容器公司 2023 年 9 月发布的公告,纸板食品包装越来越被视为传统材料的环保替代品。它的多功能性延伸到各种食品,包括生鲜食品、烘焙点心、冷冻食品和罐头食品等。瓦楞包装的高度可自订性使企业能够创造出独特且具有视觉吸引力的设计。这包括将您的品牌标识、产品详细资讯和其他品牌元素直接印在盒子上,以提高品牌知名度并改善产品展示。

- 对许多食品来说,纸板包装正成为塑胶包装的可行替代品。随着高速网路服务的普及以及电子零售和电子商务管道的兴起,消费者现在可以更轻鬆地在线上订购各种包装食品。此外,丰厚的折扣和便利性吸引了许多消费者,推动了整个预测期内这一领域的成长。这包括起司、预製汤、罐头鱼等。瓦楞纸箱包装可以用可回收和可堆肥的材料更简单地製作。

- 消费者,尤其是千禧世代,越来越意识到食品包装、生产和废弃物对环境的影响。根据斯道拉恩索的一项调查,59% 的千禧世代认为包装应该在整个价值链中实现永续。对永续包装产品的需求是加工食品包装的主要驱动力,对瓦楞包装市场的成长产生了积极影响。

- 据巴西纸浆和造纸製造商 Suzanne 以及欧洲领先的工程、设计和咨询服务公司 AFRY 称,预计 2022 年全球纸和纸板消费量将达到 4.15 亿吨。预计未来十年消费量将进一步增加,到 2032 年将达到 4.76 亿吨。世界上大部分的纸和纸板产量都用于包装。

预计亚太地区将占很大份额

- 随着都市化以及人们对环保包装意识的不断增强,亚太地区瓦楞包装市场将会成长。主要的行业趋势包括瓦楞纸生产能力的提高和技术的进步。然而,严格的法规和产品品质问题可能会阻碍这种成长。

- 亚洲瓦楞包装市场加速成长的动力包括永续包装需求激增、电子商务产业蓬勃发展、电子产品和个人保健产品需求上升以及发展中经济体人均收入上升。

- 人均收入的提高和人口结构的变化正在改变中国瓦楞包装行业,需要新的包装材料和工艺。阿里巴巴等电子商务巨头准备推动瓦楞包装市场的发展。国际贸易部报告称,中国在全球电子商务市场占据主导地位,占全球贸易总额的 50% 左右。预计到 2024 年,线上零售贸易将达到 3.56 兆美元,这项繁荣将扩大对永续包装解决方案的需求,从而促进瓦楞包装的销售。

- 在印度、中国、日本等国家,食品饮料、IT电子、家电等严重依赖瓦楞包装的产业正经历消费升级趋势。主要终端用户产业的转变预计将推动中高阶瓦楞包装市场的发展。

- 此外,亚太国家原料的供应、政府对一次性塑胶的限制以及这些国家终端使用产业数量的增加也刺激了瓦楞包装市场的成长。

瓦楞包装行业概况

瓦楞包装市场分散,有许多参与者,包括:Mondi Group、DS Smith PLC、WestRock Company、Smurfit Kappa Group 等,提供多样化的解决方案。这些公司正在创新并推出环保包装产品以支持永续发展。此外,他们还推出了适合各终端用户产业的客製化瓦楞纸箱设计,抓住新兴机会。此外,随着主要参与者加强在瓦楞纸板包装领域的投资组合,市场正经历一系列合作和收购。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 环保材料的日益普及和瓦楞纸板数位印刷的发展

- 电子商务产业需求强劲

- 市场限制

- 增加可回收和可重复使用的包装

第六章 市场细分

- 按最终用户产业

- 加工食品

- 生鲜食品和蔬菜

- 饮料

- 个人及居家护理

- 电子商务

- 其他终端用户产业(电气和电子、医疗保健、工业、纺织、玻璃和陶瓷)

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 波兰

- 亚洲

- 中国

- 印度

- 日本

- 韩国

- 印尼

- 泰国

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿拉伯聯合大公国

- 北美洲

第七章 竞争格局

- 公司简介

- International Paper Company

- Mondi Group

- DS Smith PLC

- WestRock Company

- Smurfit Kappa Group

- Stora Enso Oyj

- Sealed Air Corporation

- Asia Pulp & Paper(APP)Sinar Mas

- Napco National

- Georgia-Pacific LLC

- Nine Dragons Paper Holdings Limited

- Oji Holdings Corporation

第八章投资分析

第九章:未来市场展望

The Corrugated Board Packaging Market size is estimated at USD 198.34 billion in 2025, and is expected to reach USD 238.77 billion by 2030, at a CAGR of 3.78% during the forecast period (2025-2030).

With its robust protection against harsh handling, the corrugated board has emerged as the packaging of choice. Its durability, versatility, and stability make it a staple in the retail sector, and with the global surge in e-commerce sales, its adoption is only intensifying.

Key Highlights

- Businesses increasingly turn to corrugated board packaging, not only for its moisture protection but also for its resilience during extended transportation. This trend is significantly pronounced as companies adopt it for secondary and tertiary packaging. The surge in demand is primarily driven by processed and perishable foods, like bread and meat products, which necessitate single-use packaging. Additionally, as people's lifestyles grow busier, the appetite for convenience foods rises.

- Crafted from pulp and paper, corrugated boards boast a recyclability edge over their plastic counterparts. The fluting medium acts as a shock absorber, safeguarding contents from external impacts. These boards can endure significant pressure, and their layered and varied-thickness flutes provide essential cushioning. The e-commerce sector has recently emerged as a dominant consumer of corrugated boards. Major players, including Amazon, utilize these boards for primary packaging while reserving plastic for individual items.

- The market also has challenges and limitations. The corrugated board lacks the durability of plastic or wooden boxes, making them less suitable for heavy items or extreme pressures. Typically, it's favored for short-term use rather than as long-term, reusable investments.

- Their versatility allows corrugated boards to be molded into various shapes, including boxes. As sustainability concerns mount, they're gradually replacing flexible plastic bags. Furthermore, their compatibility with diverse printing techniques makes them an attractive marketing tool for companies, effectively serving as mobile billboards without incurring extra marketing costs.

- Variations in the availability and pricing of raw materials, such as paper and recycled content, can influence production and pricing strategies. The paper packaging industry grapples with challenges stemming from deforestation, encompassing supply chain vulnerabilities, environmental issues, regulatory challenges, and an urgent push for sustainable innovations.

Corrugated Board Packaging Market Trends

Processed Food Segment Expected to Occupy Significant Market Share

- The corrugated board is a popular packaging choice in the processed food industry. There are many different sizes and shapes of boxes. Customers are given a well-known container to enjoy their snacking in. The consumption of cereal, crackers, and other snack foods packaged in corrugated boards spans several generations.

- The corrugated board packaging keeps moisture away from products and can withstand long shipping times, companies are increasingly adopting this packaging to offer better customer outcomes, especially for secondary or tertiary packaging. Processed foods, such as bread, meat products, and other perishable items, need these packaging materials to be used just once, thus driving the demand.

- According to Jamestown Container in September 2023, corrugated food packaging is increasingly considered an eco-friendly alternative to conventional materials. Its versatility spans various food products, including fresh produce, baked goods, and frozen and canned items. The high customizability of corrugated packaging allows businesses to craft distinctive and visually appealing designs. This includes printing brand logos, product details, and other branding elements directly onto the boxes, enhancing brand recognition, and elevating product presentation.

- Corrugated board packaging is becoming a viable alternative to plastic packaging for many food products. Due to the rising accessibility of high-speed internet services and the rise of e-retail and e-commerce channels has been sparked, making it more straightforward for customers to order various kinds of processed food goods online. In addition, the generous savings and convenience it offers draw more consumers, adding to the segment's growth throughout the forecast period. These include cheese, ready-made soups, and canned fish, among others. Corrugated box packaging can be created more simply from recycled or composted materials.

- Consumers, such as millennials, are becoming more aware of the environmental impact of food packaging, production, and waste. According to a Stora Enso survey, 59% of millennials think packaging should be sustainable throughout the value chain. Demand for sustainable packaging products is a key driver in processed food packaging, positively impacting corrugated board packaging market growth.

- According to Suzanne, a Brazilian pulp and paper producer, and AFRY, a critical European engineering, design, and advisory services firm, the global consumption of paper and paperboard was expected to be 415 million tonnes in 2022. Consumption will rise further over the next decade, reaching 476 million tonnes by 2032. Packaging consumes the majority of worldwide paper and paperboard production.

Asia Pacific is Expected to Hold a Significant Share

- Asia Pacific's corrugated board packaging market is set to grow, driven by an urbanizing population and heightened awareness of eco-friendly packaging. Key industry trends include increased containerboard capacity and technological advancements. However, stringent regulations and product quality concerns could hinder this growth.

- Accelerated growth in Asia's corrugated board packaging market is fueled by a surge in demand for sustainable packaging, a booming e-commerce sector, heightened demand for electronics and personal care products, and rising per capita income amid economic development.

- Rising per capita income and shifting demographics shape China's corrugated board packaging sector, necessitating new packaging materials and processes. E-commerce giants like Alibaba are poised to drive the corrugated packaging market. The International Trade Administration reported that China dominates the global e-commerce landscape, accounting for about 50% of total transactions. With projections of online retail transactions hitting USD 3.56 trillion by 2024, this boom is set to amplify the demand for sustainable packaging solutions, bolstering sales of corrugated board packaging.

- In countries like India, China, and Japan, industries such as food and beverage, IT electronics, and home appliances, which heavily rely on corrugated boxes, are experiencing a trend of consumption upgrading. This shift in leading end-user industries is anticipated to boost the market for mid to high-end corrugated cartons.

- Additionally, the growth of the corrugated board packaging market is spurred by the availability of raw materials in Asia Pacific nations, government regulations curbing single-use plastics, and a rising number of end-use industries across these countries.

Corrugated Board Packaging Industry Overview

The corrugated board packaging market is fragmented, with numerous players such as Mondi Group, DS Smith PLC, WestRock Company, Smurfit Kappa Group, and more offering diverse solutions. These companies are innovating and rolling out eco-friendly packaging products to support sustainability. Additionally, they're unveiling tailored corrugated box designs catering to various end-user industries, seizing emerging opportunities. Furthermore, the market is seeing a flurry of partnerships and acquisitions as key players bolster their portfolios in the corrugated board packaging arena.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Eco-friendly Materials and Evolution of Digital Print for Corrugated Boards

- 5.1.2 Strong Demand from the E-commerce Sector

- 5.2 Market Restraint

- 5.2.1 Increasing Usage of Returnable and Reusable Packaging

6 MARKET SEGMENTATION

- 6.1 By End-user Industry

- 6.1.1 Processed Foods

- 6.1.2 Fresh Food and Produce

- 6.1.3 Beverages

- 6.1.4 Personal and Household Care

- 6.1.5 E-commerce

- 6.1.6 Other End-user Industries (Electrical & Electronics, Healthcare, Industrial, Textile, Glass & Ceramics)

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.2.4 Italy

- 6.2.2.5 Spain

- 6.2.2.6 Poland

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 South Korea

- 6.2.3.5 Indonesia

- 6.2.3.6 Thailand

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.5.1 Brazil

- 6.2.5.2 Argentina

- 6.2.5.3 Mexico

- 6.2.6 Middle East and Africa

- 6.2.6.1 Saudi Arabia

- 6.2.6.2 South Africa

- 6.2.6.3 United Arab Emirates

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 International Paper Company

- 7.1.2 Mondi Group

- 7.1.3 DS Smith PLC

- 7.1.4 WestRock Company

- 7.1.5 Smurfit Kappa Group

- 7.1.6 Stora Enso Oyj

- 7.1.7 Sealed Air Corporation

- 7.1.8 Asia Pulp & Paper (APP) Sinar Mas

- 7.1.9 Napco National

- 7.1.10 Georgia-Pacific LLC

- 7.1.11 Nine Dragons Paper Holdings Limited

- 7.1.12 Oji Holdings Corporation