|

市场调查报告书

商品编码

1687469

类比积体电路(IC)产业-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Analog Integrated Circuit (IC) Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

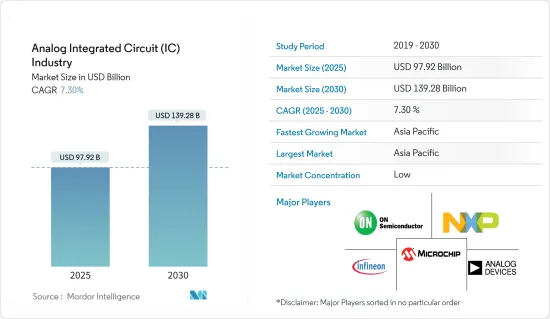

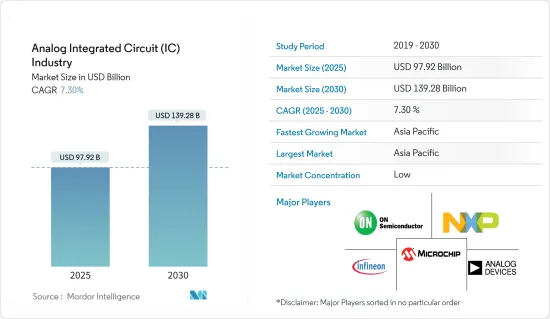

类比积体电路产业预计将从 2025 年的 979.2 亿美元成长到 2030 年的 1,392.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.3%。

主要亮点

- 类比积体电路 (IC) 包含在单一半导体晶片上製造的互连组件。与仅在两个电压等级下工作的数位电路不同,类比元件对连续的输入讯号频谱作出反应。这些电路对于电子设备至关重要,可以处理和形成不同的能量输出等级。振盪器、直流放大器、多谐振盪器和音频放大器等设备依靠类比电路来确保一致的输入和输出电平。

- 物联网(IoT)等技术的兴起凸显了类比IC在各种即时连接设备中的优势,推动了市场成长。特别是,随着高速连接、云端采用和资料分析的普及,物联网的覆盖范围正在不断扩大。例如,《富比士》杂誌预测,到2024年底,全球连网设备数量将超过2,070亿台,对市场来说是一个积极的成长机会。

- 近年来,受智慧型手机、电脑、家用电器和电动车蓬勃发展的推动,类比IC的需求激增。智慧型手机使用各种 IC,包括充电 IC、显示器 PMIC、SoC PMIC 和摄影机 PMIC。苹果、高通、英特尔和三星S.LSI等产业巨头占据主导地位。由于技术先进的智慧型手机产量不断增加以及 5G 和 6G 的持续融合,全球类比IC市场预计将大幅成长。

- 然而,由于通货膨胀、个人消费下降以及未来的不确定性,预计 2023 年全球智慧型手机需求将比 2022 年下降。这种下降可能会对市场成长产生负面影响。不过,由于5G智慧型手机需求的成长以及全球5G网路的扩张,尤其是5G智慧型手机和折迭式智慧型手机的普及,预计2024财年将逐步復苏。根据GSMA预测,2025年,5G网路可望覆盖全球三分之一的人口。

- 对熟练的类比晶片设计工程师的依赖程度很高。然而,半导体产业存在严重短缺。英特尔的辛迪哈珀强调,该行业的人才需求超过了供应。西门子EDA公司的Ruchir Dixit表示,预计未来五年美国将面临25万名半导体工程师的短缺。预计中国大陆和台湾将分别面临30万和5万名工程师的短缺。这种不平衡为市场成长带来了挑战。

- 俄乌战争对包括电子产业在内的多个产业产生了连锁反应。这些地缘政治紧张局势加剧了现有半导体供应链的中断和晶片短缺。这种中断导致镍、钯、铜、硅和钛等重要原料的价格波动,造成材料短缺。

- 根据SEMI统计,俄罗斯供应了全球45%至50%的钯,钯是半导体封装的重要材料。随着全球贸易大门对俄罗斯关闭,半导体製造商将越来越多地寻找替代原料来源,进一步延长半导体生产延迟。预计这将阻碍市场成长。

类比积体电路(IC)产业趋势

行动电话子区隔预计将占据主要份额

- 在我们这个充满活力的科技世界中,专用类比积体类比IC已经成为行动电话和功能丰富的手持装置中不可或缺的一部分,而语音通讯是这些装置的主要功能。这些设备专为 2G、3G 和 Wimax 等各种蜂巢式网路而开发,采用 CDMA、GSM 及其扩充等传输格式。

- 人口成长和都市化推动了智慧型手机的普及,尤其是在发展中国家。例如,根据GSMA的报告,预计2023年底,将有56亿人(占世界人口的69%)订阅行动通讯,比2015年增加16亿人。

- 5G技术的出现,带动了5G智慧型手机的广泛普及。根据爱立信行动报告,预计到 2028 年底,5G 行动用户将达到 50 亿。这些 5G 网路预计将覆盖 85% 的人口,并承载约 70% 的行动流量。

- 所有这些因素都归因于行动电话子区隔的份额不断增加。智慧型手机对于诸如出色的相机影像品质、AR 和 VR 等先进功能的需求日益增长,而这些功能均由类比IC实现。类比IC的重要性在于其能够高精度地处理类比讯号。因此,它们在讯号处理、电源管理和资料转换等应用中至关重要。此外,将多个类比电路组合到单一晶片上可以实现更小、更有效率、更具成本效益的设备。

- GSMA预测,到2025年,北美智慧型手机用户将成长至3.28亿,行动普及率将达到86%,网路存取率将达到80%。根据爱立信行动报告,到 2024 年,中东和非洲 (MEA) 的 5G用户预计将达到 6,000 万,占行动用户总数的 3% 左右。 GSMA 估计,到 2025 年,中东和北非地区将拥有约 5,000 万个 5G 连接,其中仅阿拉伯国家就将拥有 2,000 万个。这些数字凸显了行动电话的快速普及,推动了子区隔的发展。

中国可望成为亚太地区成长最快的市场

- 在大型半导体製造商、快速工业化和大量消费性电子产品的推动下,中国正在寻求巩固其作为类比IC市场主要参与者的地位。该地区以半导体的大规模生产和类比IC在汽车、家用电器、IT 和通讯等各个行业的广泛应用而闻名。这些动态正在推动中国类比IC市场的成长,为市场相关人员提供了诱人的前景。

- 中国蓬勃发展的IT和资料中心产业是对每年产生的资料量不断增长的直接反应。中国在全球科技领域地位的不断提升进一步促进了这一成长,这主要归功于其充满活力的资料中心生态系统。中国的互联网和资料中心行业是世界上技术最先进的行业之一,许多公司都拥抱数位化平台。

- 随着资料中心的投资和互联网的广泛应用,对感测器设备的需求也在增加。这些与实体空间互动的感测器需要模拟处理将类比讯号转换为数位讯号。将这些功能与数位技术结合,可以创造出不仅经济高效、功耗更低而且高度可靠的解决方案。因此,预计这些因素将在未来几年推动市场成长。

- 扩大5G网路能力将大大推动对类比IC模组的需求。中国在5G领域取得了长足进步,拥有庞大的5G基地台网路。根据工信部资料显示,截至2024年2月底,我国已建成5G基地台超过350万个。由于大量的基础设施投资和雄心勃勃的部署策略,中国已经实现了广泛的5G覆盖范围。根据预测,到2024年底,我国5G基地台数量可能突破600万个。

- 根据《南华早报》报道,2023年中国智慧型手机产业呈现復苏迹象,出货量将较上年成长6.5%。在这一反弹出现之际,全球最大的行动电话市场正努力应对经济復苏的初步迹象和国内竞争加剧,尤其是华为技术有限公司在 5G 领域取得显着突破。

- 据ITA称,中国继续主导全球汽车市场,年销量和产量均位居世界第一。据预测,到2025年,国内汽车产量可能达到3,500万辆。此外,中国汽车工业协会(CAAM)的报告显示,在强大的工业基础的支持下,中国汽车产业正在加强其全球影响力,出口量年增81%,达到176万辆。鑑于这种发展能力,预计中国现代工业对类比IC的需求将会很大。

类比积体电路(IC)产业概况

- 类比积体电路(IC)市场预测呈现出一幅半独特的图景。厂商以产品创新、技术差异化为武器,展开激烈竞争。许多公司正在策略性地投资类比IC的开发,以确保先发优势并保持竞争优势。该领域的知名公司包括 ADI 公司、英飞凌科技公司、微晶片科技公司、恩智浦半导体公司和安森美半导体公司。

- 类比IC的最新进展集中于提高效能同时降低功耗。特别值得注意的是混合讯号积体电路,它在单晶片上整合了类比和数位电路。

- 这种集成为复杂、更有效率的系统铺平了道路,特别是在资料转换器和感测器介面等应用领域。此外,也利用硅锗(SiGe)和绝缘体上硅(SOI)等先进製造技术来提升类比电路的性能。

- 未来,将出现明显的转变,超越 IC 级别,转向系统级别的类比和数位电路整合。这种转变被称为系统晶片(SoC)技术,有望带来更有效率、更具成本效益的设备。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 宏观经济趋势如何影响市场

第五章市场动态

- 市场驱动因素

- 智慧型手机、功能手机和平板电脑的普及率不断提高

- 市场挑战

- 类比IC设计日益复杂

第六章市场区隔

- 按类型

- 通用IC

- 介面

- 电源管理

- 讯号转换

- 放大器/比较器(讯号调理)

- 专用积体电路

- 消费者

- 音讯/视讯

- 数位相机/摄影机

- 其他消费品

- 车

- 资讯娱乐

- 其他资讯娱乐

- 通讯设备

- 行动电话

- 基础设施

- 有线通讯

- 近距离通讯

- 其他无线

- 电脑

- 电脑系统和显示器

- 电脑周边设备

- 贮存

- 其他计算机

- 工业及其他

- 通用IC

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

7.供应商市场占有率分析

第八章竞争格局

- 公司简介

- Analog Devices Inc.

- Infineon Technologies AG

- Microchip Technology Inc.

- NXP Semiconductors NV

- ON Semiconductor

- Richtek Technology Corporation(MediaTek Inc.)

- Skyworks Solutions Inc.

- STMicroelectronics NV

- Renesas Electronics Corporation

- Texas Instruments Inc.

- Qorvo Inc.

第九章类比IC市场定价分析

第十章投资分析

第11章:投资分析市场的未来

简介目录

Product Code: 63830

The Analog Integrated Circuit Industry is expected to grow from USD 97.92 billion in 2025 to USD 139.28 billion by 2030, at a CAGR of 7.3% during the forecast period (2025-2030).

Key Highlights

- Analog integrated circuits (ICs) include interconnected components crafted on a single semiconducting wafer. Unlike digital circuits, which operate on just two voltage levels, analog components react to a continuous spectrum of input signals. These circuits are integral to electronic devices, processing and forging various energy output levels. Appliances such as oscillators, DC amplifiers, multi-vibrators, and audio amplifiers rely on analog circuits to ensure consistent input and output levels.

- The rise of technologies like the Internet of Things (IoT) is set to drive market growth, highlighting the advantages of analog ICs in a wide array of real-time connected devices. Notably, IoT's footprint is expanding with the surge in high-speed connectivity, cloud adoption, and data analytics. For example, Forbes projects over 207 billion devices will be globally networked by the closing of 2024, which presents a positive growth opportunity for the market.

- The demand for analog ICs has surged in recent years, fueled by the boom in smartphones, computers, consumer electronics, and electric vehicles. Smartphones utilize various ICs, including charge ICs, display PMICs, SoC PMICs, and Camera PMICs. Industry giants like Apple, Qualcomm, Intel, and Samsung S.LSI dominate this landscape. Given the rising production of technologically advanced smartphones and the integration of 5G and 6G, the global analog IC market is poised for significant growth.

- However, a dip was witnessed in global smartphone need in 2023 compared to 2022, attributed to inflation, waning consumer spending, and a subdued outlook. This downturn is likely to influence market growth negatively. However, a modest recovery is expected in FY 2024 owing to the rising demand for 5G smartphones and the global expansion of 5G networks, especially with the surge in 5G and foldable smartphones. According to GSMA forecasts, by 2025, 5G networks are expected to encompass a third of the global population.

- The reliance on skilled analog chip design engineers is pronounced. However, there is a substantial scarcity in the semiconductor industry. Cindi Harper from Intel highlighted that industry demand for talent outstrips supply. According to Ruchir Dixit of Siemens EDA, a shortfall of 250,000 semiconductor engineers is expected to be seen in the United States over the next five years. In China and Taiwan, deficits of 300,000 and 50,000 engineers are expected, respectively. Such imbalances pose challenges to market growth.

- The Russia-Ukraine War reverberated across multiple industries, including electronics. This geopolitical tension intensified existing semiconductor supply chain disruptions and chip shortages. Such disturbances have led to price volatility in essential raw materials like nickel, palladium, copper, silicon, and titanium, resulting in material shortages.

- According to SEMI, Russia supplied 45-50% of the world's palladium, a crucial material for semiconductor packaging. With global trading doors closing on Russia, semiconductor manufacturers are increasingly pursuing alternative raw material sources, further prolonging semiconductor production delays. This is expected to hamper the growth of the market.

Analog Integrated Circuit (IC) Industry Trends

The Cell Phone Sub-segment is Expected to Hold a Major Share

- In the dynamic world of technology, application-specific analog ICs have become essential for cellular phones and multifunctional handheld devices, where voice communication remains a primary function. These devices, developed for extensive cellular networks like 2G, 3G, and Wimax, utilize transmission formats such as CDMA, GSM, and their enhanced versions.

- Rising smartphone adoption, particularly in developing countries, is driven by population growth and urbanization. For instance, by the end of 2023, GSMA reported that 5.6 billion people, or 69% of the global population, had subscribed to mobile benefits, marking a proliferation of 1.6 billion since 2015.

- The emergence of 5G technology has led to the adoption of 5G smartphones. According to Ericsson Mobility Report, 5 billion 5G mobile subscriptions are expected to be recorded by the end of 2028. These 5G networks are anticipated to cover 85% of the population and operate about 70% of mobile traffic.

- All these factors can be attributed to the continuously increasing share of the cell phone sub-segment of the market as there is an increasing need for advanced features in smartphones, such as great camera quality, AR, and VR, all of which are made possible by analog ICs. The importance of analog ICs lies in their ability to process analog signals with high precision and accuracy. This makes them critical for signal processing, power management, and data conversion applications. Additionally, combining multiple analog circuits on a single chip permits for smaller, more efficient, and cost-effective devices.

- GSMA projects that North America will see smartphone subscribers rise to 328 million by 2025, with mobile penetration at 86% and internet users at 80%. According to Ericsson Mobility Report, Middle East and Africa (MEA) is expected to have 60 million 5G subscribers by 2024, accounting for roughly 3% of total mobile subscriptions. GSMA estimates that there will be about 50 million 5G connections in MENA by 2025, with 20 million in the Arab states alone. These figures highlight the rapid adoption of cell phones, propelling the sub-segment forward.

China is Expected to be the Fastest-growing Market in Asia-Pacific

- China is set to solidify its position as a critical player in the analog IC market, driven by major semiconductor manufacturers, swift industrialization, and a sprawling consumer electronics landscape. The region is celebrated for its high-volume semiconductor production and the widespread adoption of analog ICs across various industries, including automotive, consumer electronics, and telecommunications. These dynamics are poised to propel the growth of the analog IC market in China, offering enticing prospects for market players.

- China's burgeoning IT and data center industry directly responds to the ever-increasing annual data generation. This growth is further underscored by China's rising stature in the global tech arena, primarily fueled by its vibrant data center ecosystem. China's internet data center industry is among the world's most technologically advanced, with many organizations leveraging digital platforms.

- With the increase in investments in data centers and internet penetration, the demand for sensor-enabled devices is also rising. These sensors, which interact with the physical space, necessitate analog processing to convert analog signals to digital ones. Merging these functionalities with digital technology yields a solution that is not only cost-effective and low-power but also reliable. Consequently, these elements are anticipated to bolster the market's growth in the coming years.

- The expanding 5G networking capabilities are set to drive significant demand for analog IC modules. Having made substantial strides in the 5G domain, China boasts a vast network of 5G base stations. Data from MIIT indicates that by the close of February 2024, China had established over 3.5 million 5G base stations. Owing to its hefty infrastructure investments and ambitious rollout strategies, the nation achieved widespread 5G coverage. Projections suggest that by the end of 2024, the number of 5G base stations in China might exceed six million.

- According to a report from South China Morning Post, China's smartphone industry showed signs of rejuvenation in 2023, witnessing a 6.5% uptick in shipments from the prior year. This rebound came as the world's largest handset market grappled with a tentative economic recovery and heightened domestic competition, especially with Huawei Technologies making notable strides in the 5G domain.

- According to ITA, China continues to dominate the global automotive landscape, leading in annual sales and manufacturing output. Projections indicate domestic vehicle production could reach 35 million by 2025. Furthermore, bolstered by a robust manufacturing base, China's automotive industry amplified its global presence, with exports soaring 81% year-on-year, totaling 1.76 million vehicles in the initial five months of 2023, as reported by the China Association of Automobile Manufacturers (CAAM). Given this development prowess, the demand for analog ICs in modern Chinese industries is anticipated to be substantial.

Analog Integrated Circuit (IC) Industry Overview

- The analog Integrated Circuit (IC) market forecast indicates a semi-consolidated landscape. Manufacturers are committed to fierce competition, leveraging product innovation and technological differentiation. Many companies strategically invest in developing analog ICs to secure a first-mover advantage and maintain competitiveness. Notable players in this arena include Analog Devices Inc., Infineon Technologies AG, Microchip Technology Inc., NXP Semiconductors NV, and ON Semiconductor.

- Recent advancements in analog ICs have centred on enhancing performance while curbing power consumption. A notable stride has been in mixed-signal ICs, which merge analog and digital circuits onto a single chip.

- This integration paves the way for intricate and efficient systems, especially for applications like data converters and sensor interfaces. Additionally, advanced fabrication technologies, including silicon-germanium (SiGe) and silicon-on-insulator (SOI), have been harnessed to elevate analog circuit performance.

- Looking ahead, there's a pronounced shift towards integrating analog and digital circuits at the system level, moving beyond the confines of the IC level. This change, termed system-on-a-chip (SoC) technology, promises more efficient and cost-effective devices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Economic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Penetration of Smartphones, Feature Phones, and Tablets

- 5.2 Market Challenges

- 5.2.1 Increasing Design Complexity of Analog IC

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 General-Purpose IC

- 6.1.1.1 Interface

- 6.1.1.2 Power Management

- 6.1.1.3 Signal Conversion

- 6.1.1.4 Amplifiers/Comparators (Signal Conditioning)

- 6.1.2 Application-Specific IC

- 6.1.2.1 Consumer

- 6.1.2.1.1 Audio/Video

- 6.1.2.1.2 Digital Still Camera and Camcorder

- 6.1.2.1.3 Other Consumers

- 6.1.2.2 Automotive

- 6.1.2.2.1 Infotainment

- 6.1.2.2.2 Other Infotainment

- 6.1.2.3 Communication

- 6.1.2.3.1 Cell Phone

- 6.1.2.3.2 Infrastructure

- 6.1.2.3.3 Wired Communication

- 6.1.2.3.4 Short Range

- 6.1.2.3.5 Other Wireless

- 6.1.2.4 Computer

- 6.1.2.4.1 Computer System and Display

- 6.1.2.4.2 Computer Periphery

- 6.1.2.4.3 Storage

- 6.1.2.4.4 Other Computers

- 6.1.2.5 Industrial and Others

- 6.1.1 General-Purpose IC

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

7 VENDOR MARKET SHARE ANALYSIS

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Analog Devices Inc.

- 8.1.2 Infineon Technologies AG

- 8.1.3 Microchip Technology Inc.

- 8.1.4 NXP Semiconductors NV

- 8.1.5 ON Semiconductor

- 8.1.6 Richtek Technology Corporation (MediaTek Inc.)

- 8.1.7 Skyworks Solutions Inc.

- 8.1.8 STMicroelectronics NV

- 8.1.9 Renesas Electronics Corporation

- 8.1.10 Texas Instruments Inc.

- 8.1.11 Qorvo Inc.

9 PRICING ANALYSIS OF ANALOG IC MARKET

10 INVESTMENT ANALYSIS

11 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219