|

市场调查报告书

商品编码

1687757

自行车:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)Bicycle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

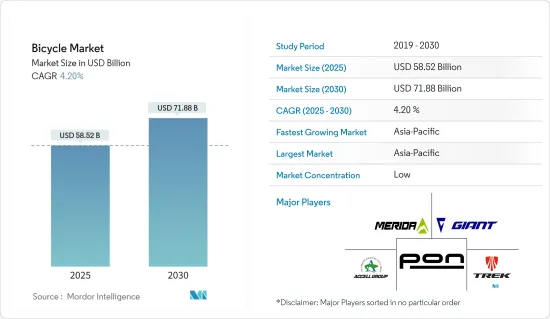

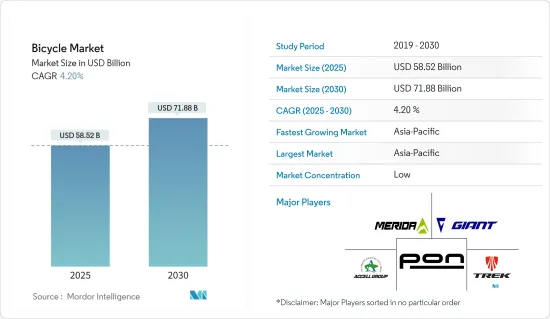

2025 年自行车市场规模估计为 585.2 亿美元,预计到 2030 年将达到 718.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.2%。

随着消费者健康意识的增强,骑自行车越来越被视为一种可靠且健康的移动方式。近年来,自行车赛事的数量不断增加,这有助于市场的成长。预计政府和雇主的积极倡议将在预测期内推动市场发展。在欧洲、亚太地区和非洲,尤其是南非,各管理机构都在推广公路赛、旅游赛、休閒自行车赛、场地赛、越野赛和山地自行车赛事。例如,2022年11月,荷兰交通部长宣布将拨款约12亿美元用于自行车基础建设。在德国,捷安特集团推出了其Momentum品牌电动自行车。一款是 Voya E+,一款适合城市骑乘的轻巧、简约且几乎免维护的电动自行车;另一款是 PakYak E+,一款适合探险的轻型电动货运自行车。

人工智慧 (AI) 的进步可以帮助自行车製造商更好地预测消费者需求、满足细分市场并改进建议引擎。电动自行车在中国和日本等国家非常受欢迎。健康益处、避免交通拥堵、环境效益以及对电动自行车作为体育用品的需求不断增加是这些国家采用和推广电动自行车的一些主要原因。此外,在新兴经济体中,各组织和政府正在积极建立必要的基础设施来支持向骑自行车的转变,从而鼓励人们选择骑自行车。例如,法国政府于2023年5月宣布,计划在2027年投资20亿欧元(22亿美元),用于改善自行车基础设施,并帮助人们购买自行车,以减少汽车使用并鼓励骑自行车。目标是将自行车道网路扩大一倍,政府计划在 2023 年至 2027 年期间每年投入 2.5 亿欧元用于建造新的自行车道。剩余的预算将用于其他推广骑自行车的措施。约5亿欧元将用于补贴购买自行车,包括二手自行车。所有这些因素都在推动自行车市场的成长。

自行车市场趋势

更多自行车赛事

预计徒步旅行和休閒活动中自行车的使用增加以及自行车运动的增加将增加对普通自行车和运动自行车的需求。名人代言的影响力日益增强以及媒体对此类活动的报告增加预计将促进自行车的销售。例如,根据德国大众汽车俱乐部 (ADFC) 在 2022 年进行的一项调查,在德国约有 96% 的受访者使用自行车。此外,欧洲各国的各类管理机构,如爱尔兰自行车协会,也积极推广公路赛、旅游赛、休閒自行车赛、场地赛和越野赛等赛事。据爱尔兰体育委员会称,爱尔兰体育委员会将于 2022 年向爱尔兰自行车运动协会投资约 52 万欧元,以鼓励消费者参与爱尔兰的一系列自行车活动。这项活动的最终目标是提高人们对骑自行车的认识并增加城市中骑自行车的普及率。此类意识提升宣传活动也将促进市场成长。

此外,自行车赛事可以支持提高人们对自行车运动的认识,并最终鼓励模式转换骑自行车。活动可以针对特定群体进行客製化,例如儿童、家庭、新骑乘者或特定组织或地点的员工。 2023 年 4 月,爱尔兰自行车协会将扩大其针对公路自行车赛车手的国家公路系列赛,并推出新的休閒国家系列赛,进军运动领域。 2023 年全国休閒系列赛旨在支持四个郡的休閒自行车赛事组织者,并协助爱尔兰岛各地的主办俱乐部及其成员。这是国家统筹机构首次以这种方式参与代表爱尔兰自行车运动最大群体的体育赛事,该赛事的骑手占爱尔兰自行车运动协会会员的最大份额。此外,自行车锦标赛等国际运动赛事也鼓励消费者参与骑自行车运动。这些因素正在推动市场的成长。

亚太地区占较大市场占有率

亚太地区是自行车市场规模最大、成长最快的地区。中国、日本、澳洲、印度和韩国是该地区的主要国家。 2022 年,印度每週至少骑车一次的常规骑乘者比例最高。紧随其后的是中国和荷兰,这两个国家约有三分之二的人口每週都骑自行车。此外,这些国家目前正在举办许多自行车比赛,这可能会增加运动型自行车的受欢迎程度和需求。例如,印度自行车联合会宣布将于2022年12月举办第27届成人、青少年及青少年以下公路自行车锦标赛。该锦标赛定于 2023 年 1 月在马哈拉斯特拉邦邦纳西克的辛纳尔举行。此外,由于印度成人和儿童肥胖现像日益严重,对帮助人们减重的自行车的需求也日益增长。

电动自行车在中国和日本等国家越来越受欢迎。亚太地区采用和骑乘电动自行车的主要原因包括健康益处、避免交通拥堵、环境效益以及对电动自行车作为一项体育活动的需求不断增加。该地区的主要企业主要致力于透过推出具有创新功能的自行车来扩大产品系列。例如,2022 年 4 月,旅游用户 Neuron Mobility 在澳洲雪梨推出了 250 辆电动自行车,并将安全性放在第一位。 Neuron 电动自行车配备了Google地图来协助骑乘者。这可以让您找到最近的 Neuron 电动自行车,还可以提供到达那里的路线以及需要多长时间。所有这些因素都促进了市场的成长。

竞争格局

自行车市场竞争激烈,有许多全球和本地参与者。市场上的一些主要参与者包括 Giant Manufacturing、Accell Group、Trek Bicycle Corporation、Merida Industry 和 Pon Holdings BV。这些主要企业正在冒险製造创新自行车,与其他公司建立合作伙伴关係和併购关係,并製定线上和线下行销策略以扩大其在全球市场的影响力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 更多自行车赛事

- 提高健康和环境意识

- 市场限制

- 替代交通途径的可用性

- 波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 企业之间的竞争

第五章市场区隔

- 按类型

- 公路自行车

- 油电混合自行车

- 全地形自行车

- 电动自行车

- 其他的

- 按分销管道

- 线下零售店

- 线上零售商

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 英国

- 德国

- 西班牙

- 法国

- 义大利

- 俄罗斯

- 荷兰

- 其他欧洲国家

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 其他亚太地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 北美洲

第六章竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- Accell Group NV

- Trek Bicycle Corporation

- Pon Holdings BV

- Giant Manufacturing Co. Ltd

- Bulls Bikes

- Pedego Inc.

- Benno Bikes LLC

- Hero Cycles Limited

- Ribble Cycles

- Riese Und Muller Gmbh

第七章 市场机会与未来趋势

The Bicycle Market size is estimated at USD 58.52 billion in 2025, and is expected to reach USD 71.88 billion by 2030, at a CAGR of 4.2% during the forecast period (2025-2030).

With the growing health consciousness among consumers, bicycles are seen as an increasingly dependable and healthy mobility option. The number of cycling events has increased in recent years, propelling the growth of the market studied. Over the forecast period, favorable government and employer initiatives are expected to drive the market studied. Various governing bodies in Europe, Asia-Pacific, and Africa, particularly South Africa, promote road racing, touring, leisure cycling, track racing, off-road racing, and mountain biking events. For instance, in November 2022, the transport ministers of the Netherlands announced that around USD 1.2 billion was allocated to cycle infrastructure. In Germany, the Giant Group launched Momentum brand e-bikes. One is the Voya E+, a lightweight, minimalist, and nearly maintenance-free e-bike for the city, and another one is the PakYak E+, an adventure light e-cargo bike.

Bicycle manufacturers can use artificial intelligence (AI) advancements to better predict consumer demand, cater to niche segments, and improve recommendation engines. E-bikes are gaining immense traction in countries such as China and Japan. Some significant reasons considered for adopting and driving e-bikes in these countries are their health benefits, avoidance of traffic congestion, environmental benefits, and increased demand for e-bikes as sports equipment. Various organizations and governments are also aggressively deploying the infrastructure in the developed economies needed to support the switch to bicycles, thereby encouraging people to opt for bicycles. For instance, in May 2023, the French government announced its plan to spend EUR 2 billion (USD 2.2 billion) through 2027 to improve cycle infrastructure and help people buy bikes to reduce car use and boost cycling. The aim is to double the cycle lane network, and the government plans to spend EUR 250 million a year on new bike lanes from 2023 to 2027. The rest of the budget will go toward other measures to boost bicycle use. About EUR 500 million will be allocated toward subsidies to buy bicycles, including second-hand bicycles. All these factors help in driving the growth of the bicycle market.

Bicycle Market Trends

Increasing Number of Cycling Events

The increasing application of bicycles in trekking and recreational activities, coupled with a rising number of cycling events, is expected to boost demand for both general and sports bicycles. The growing influence of celebrity endorsements and increased media coverage of such events are expected to boost the sales of bikes. For instance, according to a survey conducted by Allgemeiner Deutscher Fahrrad-Club (ADFC) in 2022, around 96% of respondents used their bikes in Germany. Furthermore, various governing bodies in European countries, such as Cycling Ireland, promote road racing, touring and leisure cycling, track racing, and off-road racing events. According to the Irish Sports Council, Sport Ireland invested approximately EUR 520 thousand in Cycling Ireland in 2022, encouraging consumers to participate in various cycling activities in Ireland. The event's ultimate goal was to raise cycling awareness and increase cycling adoption in the city. Such awareness campaigns also boost the growth of the market studied.

Furthermore, cycling events can help raise awareness about cycling and ultimately support efforts to encourage a modal shift toward bicycle use. Events may be tailored to specific groups, such as children, families, new cyclists, or employees of a specific organization or location. In April 2023, Cycling Ireland extended its National Road Series for road racing cyclists and moved on to the sportive sector with the launch of a new Leisure National Series. The 2023 Leisure National Series aimed to support leisure cycling event organizers in the four provinces and assist the host clubs and their members across the host clubs and its members in the Island of Ireland. This was the first time that a national governing body was involved in the sportive scene in this way, which is the largest part of Irish cycling and whose riders account for the biggest section of Cycling Ireland's membership. Moreover, international sports events, such as cycling championships, also encourage the involvement of consumers in cycling. These factors drive the growth of the market studied.

Asia-Pacific Holds Significant Market Share

Asia-Pacific is the largest and fastest-growing region in the bicycle market. China, Japan, Australia, India, and South Korea are some of the leading countries in the region. In 2022, India had the largest share of regular cyclists, who used their bikes at least once weekly. It was closely followed by China and the Netherlands, where around two-thirds of the population are weekly bicycle riders. Moreover, these countries have started hosting numerous cycling tournaments, which may increase the popularity and demand for sports bicycles. For instance, in December 2022, the Cycling Federation of India announced its 27th senior, junior, and sub-junior road cycling championship. The championship is supposed to be in January 2023 at Sinner, Nasik, Maharashtra. Furthermore, due to adult and child obesity in India, the demand for cycles is increased as it helps in weight loss.

E-bikes have become prominent in countries such as China and Japan. Some major reasons for adopting and driving e-bikes around Asia-Pacific are health benefits, avoidance of traffic congestion, environmental benefits, and increased demand for e-bikes as sports equipment. The major players across the region mainly focus on expanding their product portfolio by launching bikes with innovative features. For instance, in April 2022, mobility user Neuron Mobility launched its fleet of 250 of its safety-first e-bikes in Sydney, Australia. Neuron e-bikes have Google Maps to help the riders. Through this, the nearest Neuron E-bike can be spotted, including directions to get there and the time required to reach the destination. All these factors contribute to the growth of the market studied.

Competitive Landscape

The bicycle market is highly competitive, with many global and regional players. Major players in the market include Giant Manufacturing Co. Ltd, Accell Group, Trek Bicycle Corporation, Merida Industry Co. Ltd, and Pon Holdings BV. These key players are venturing into the manufacturing of innovative bicycles, embarking on partnerships with other players, mergers and acquisitions, and shaping up their online and offline marketing strategies to expand their presence in the global market. For instance, the company launched the Ribble Collective project to provide support and backing to a group of various British privateer riders across all cycling disciplines. With the brand's support, the new project aims for Ribble Collective riders to set out and achieve their own cycling goals across various events.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Number of Cycling Events

- 4.1.2 Growing Health Conscious and Environmentally Friendly Population

- 4.2 Market Restraints

- 4.2.1 Availability of Alternative Transport Solutions

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Road Bicycle

- 5.1.2 Hybrid Bicycle

- 5.1.3 All Terrain Bicycle

- 5.1.4 E-bicycle

- 5.1.5 Other Types

- 5.2 Distribution Channel

- 5.2.1 Offline Retail Stores

- 5.2.2 Online Retail Stores

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Spain

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Netherlands

- 5.3.2.8 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Chile

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Accell Group NV

- 6.3.2 Trek Bicycle Corporation

- 6.3.3 Pon Holdings BV

- 6.3.4 Giant Manufacturing Co. Ltd

- 6.3.5 Bulls Bikes

- 6.3.6 Pedego Inc.

- 6.3.7 Benno Bikes LLC

- 6.3.8 Hero Cycles Limited

- 6.3.9 Ribble Cycles

- 6.3.10 Riese Und Muller Gmbh