|

市场调查报告书

商品编码

1687774

石墨电极:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Graphite Electrode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

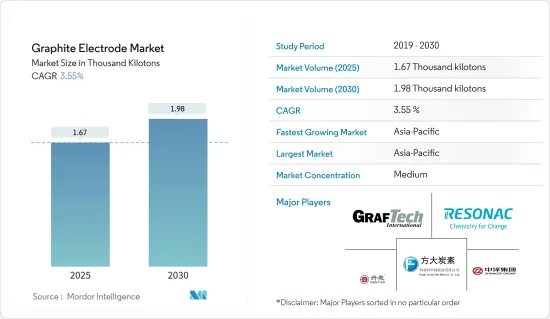

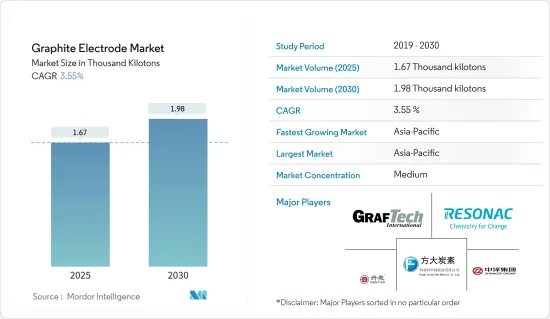

石墨电极市场规模预计在 2025 年为 1,670 千吨,预计在 2030 年达到 1,980 千吨,预测期内(2025-2030 年)的复合年增长率为 3.55%。

新冠疫情阻碍了石墨电极市场的发展,多个国家实施全国停工和严格的社交距离措施,影响了粗钢和粗铝的生产。然而,由于粗钢和粗铝製造业的需求增加,市场在放鬆管制后实现了显着的成长率。

主要亮点

- 短期内,预计中国对电弧炉炼钢技术的强劲需求和废钢供应量的增加将推动市场需求。

- 另一方面,对钢铁业的高度依赖预计将阻碍市场成长。

- 石墨电极在钢铁以外应用领域的使用日益增多,可能为所研究市场的成长提供各种机会。

- 预计亚太地区将主导市场并在预测期内呈现最高的复合年增长率。

石墨电极市场趋势

电弧炉领域占市场主导地位

- 石墨电极主要应用于电弧炉(EAF)炼钢,约占总消费量的70-80%。

- 在电弧炉内,石墨电极可作为电能的导管。石墨电极在废铁的熔化和提炼中起着至关重要的作用,最终生产出高品质的钢。这些电极由特殊等级的针状焦和其他原料製成,具有优异的导热性和导电性。这使得它能够承受炼钢过程中所遇到的极端温度和恶劣条件。

- 石墨电极有利于电弧炉高效、环保地炼钢,在现代钢铁工业中发挥至关重要的作用。随着钢铁製造商越来越接受技术进步并优先考虑永续性,对高品质石墨电极的需求可能会保持强劲。预计这将推动未来几年电炉炼钢的创新和进步。

- 塔塔钢铁英国公司于 2024 年 1 月宣布将关闭两座高排放气体高炉,标誌着公司向更环保的炼钢方向转变。该公司计划于 2027 年在塔尔伯特港投入使用电弧炉,这是 12.5 亿英镑(15.9 亿美元)重大投资的一部分。

- 日本第二大钢铁製造商 JFE 钢铁公司在其位于日本西部的仓敷厂破土动工,建造一座大型电弧炉(EAF),预计于 2027 年左右完工。此举旨在减少碳排放并应对气候变迁问题。 2023 年 6 月,安赛乐米塔尔卢森堡公司宣布在其贝尔瓦尔工厂投资一座新的电弧炉 (EAF),作为其脱碳努力的一部分。

- 中国是世界钢铁大国,占全球钢铁产量的55%。世界钢铁协会强调,中国的钢铁产量稳定,2023 年产量将达到 10.191 亿吨,与 2022 年的数字一致。其中,2023年1-10月产量达8.747亿吨,比2022年同期成长1.4%。由于中国钢铁企业计画透过产能置换机制每年新增产能高达1.18亿吨,预计2023年中国粗钢产能将缓慢成长。

- 因此,由于上述因素,预计预测期内电弧炉应用领域将主导石墨电极市场。

亚太地区占市场主导地位

- 预计预测期内亚太地区将主导石墨电极市场。中国和印度等国家的碱性氧气转炉和电弧炉对石墨电极的需求正在增加。

- 在中国,钢铁生产中电弧炉(EAF)的采用率不断提高,推动了对石墨电极的需求。中国製造商认识到国家致力于透过电弧炉技术提高钢铁生产率。这种转变主要是受环境问题和对更永续的炼钢方法的追求所推动。

- 石墨电极不仅用于炼钢,还用于加工铝和硅。中国是全球最大的铝和硅生产国,2023年中国铝年产量将大幅成长。根据中国国家统计局的报告,产量与前一年同期比较增3.43%,达到4159万吨,创历史新高。这一增长是由新生产能力的增加和电力供应限制的放宽所推动的。根据美国地质调查局预测,2023年中国硅产量将达660万吨。

- 印度对石墨电极的需求正在快速增长,这主要归因于近年来钢铁产量的稳定增长。这些电极在钢铁和非铁金属生产中发挥着至关重要的作用,并用于电弧炉和钢包炉製程。

- 印度是世界第二大钢铁生产国,年钢铁产能超过1.61亿吨,超过中国。其中,高炉-碱性氧气转炉(BF-BoF)路线产能为6,700万吨,电弧炉(EAF)路线产能3,600万吨,感应炉(IF)路线产能5,800万吨。

- 韩国钢铁业满足汽车、建筑和造船等行业的需求,在推动国家经济成长方面发挥关键作用。根据韩国钢铁协会报告,钢铁业占韩国GDP的1.5%,占製造业的4.9%。其中,韩国是世界第六大钢铁生产国。

- 由于上述因素,预计亚太地区石墨电极市场在预测期内将大幅成长。

石墨电极产业概况

石墨电极市场部分整合。市场的主要企业(不分先后顺序)包括 Resonac Holdings Corporation、GrafTech International、方大炭素新材料、中泽集团和辽宁丹炭科技集团(丹炭)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 驱动程式

- 电弧炉炼钢技术需求强劲

- 中国废钢供应量不断增加

- 限制因素

- 对钢铁业的依赖程度较高

- 产业价值链分析

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场区隔

- 电极级

- 高功率(UHP)

- 高功率(SHP)

- 正常输出(RP)

- 按应用

- 电弧炉

- 转炉

- 有色金属应用

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲国家

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章竞争格局

- 合併、收购、合资、合作和协议

- 市场占有率(%)分析

- 主要企业策略

- 公司简介

- EL 6 LLC

- Fangda Carbon New Material Technology Co. Ltd

- GrafTech International

- Graphite India Limited

- HEG Limited

- Kaifeng Pingmei New Carbon Materials Technology Co. Ltd

- Liaoning Dantan Technology Group Co. Ltd(Dan Carbon)

- Nantong Yangzi Carbon Co. Ltd

- Nippon Carbon Co. Ltd

- Sangraf International Inc.

- SEC Carbon Limited

- Resonac Holdings Corporation

- Tokai Carbon Co. Ltd

- Zhongze Group

第七章 市场机会与未来趋势

- 石墨电极在有色金属应用中的使用日益增多

The Graphite Electrode Market size is estimated at 1.67 thousand kilotons in 2025, and is expected to reach 1.98 thousand kilotons by 2030, at a CAGR of 3.55% during the forecast period (2025-2030).

The COVID-19 pandemic hampered the graphite electrodes market, as nationwide lockdowns in several countries and strict social distancing measures affected the production of crude steel and crude aluminum. However, the market registered a significant growth rate after the restrictions were lifted due to the increasing demand from crude steel and aluminum manufacturing industries.

Key Highlights

- In the short term, the strong demand for EAF technology for steelmaking and the rising availability of steel scrap in China is expected to drive the market demand.

- On the other hand, high dependency on the steel industry is expected to hinder the market's growth.

- The rising usage of graphite electrodes in non-steel applications may offer various opportunities for the growth of the market studied.

- Asia-Pacific is expected to dominate the market and is anticipated to witness the highest CAGR during the forecast period.

Graphite Electrode Market Trends

The Electric Arc Furnace Segment to Dominate the Market

- Graphite electrodes find their primary application in electric arc furnace (EAF) steelmaking, accounting for around 70% to 80% of their total consumption.

- Within the EAF, graphite electrodes serve as conduits for electrical energy. They play a crucial role in the melting and refining scrap steel, ultimately yielding high-quality steel. These electrodes, crafted from specialized grades of needle coke and other raw materials, boast exceptional thermal and electrical conductivity. This enables them to withstand the extreme temperatures and demanding conditions encountered during steelmaking.

- Graphite electrodes play a pivotal role in the contemporary steel industry, facilitating efficient and eco-conscious steelmaking in electric arc furnaces. As steel producers increasingly embrace technological advancements and prioritize sustainability, the demand for high-quality graphite electrodes is poised to remain robust. This, in turn, is expected to drive innovation and progress in EAF steelmaking in the years ahead.

- Tata Steel UK, in January 2024, announced the closure of two high-emission blast furnaces, signaling a shift toward greener steelmaking. The company plans to commence operations at its proposed electric arc furnace in Port Talbot by 2027, with a substantial investment of GBP 1.25 billion (~USD 1.59 billion).

- Japan's second-largest steelmaker, JFE Steel, broke ground on a large-scale electric arc furnace (EAF) at its Kurashiki plant in western Japan, slated for completion around 2027. This move is aimed at curbing carbon dioxide emissions and addressing climate change concerns. In June 2023, ArcelorMittal Luxembourg, as part of its decarbonization efforts, announced an investment in a new electric arc furnace (EAF) at its Belval site.

- China, the global steel giant, accounts for 55% of the world's steel production. The World Steel Association highlights China's consistent output, with 1,019.1 million tons in 2023, matching the 2022 figure. Notably, the country's production in the first 10 months of 2023 reached 874.7 million metric tons, marking a 1.4% uptick from the same period in 2022. China's crude steel capacity witnessed modest growth in 2023, driven by plans from Chinese steelmakers to introduce up to 118 million MT/year of new capacity through a capacity swap mechanism.

- Hence, owing to the above-mentioned factors, the electric arc furnace application segment is expected to dominate the graphite electrode market during the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the graphite electrode market during the forecast period. The demand for graphite electrodes is increasing from basic oxygen furnaces and electric arc furnaces in countries like China and India.

- The demand for graphite electrodes is increasing in China due to the rising adoption of electric arc furnaces (EAFs) in steel production. Chinese manufacturers recognize the country's commitment to higher steel production rates via EAF technology. This shift was primarily driven by environmental concerns and the push for more sustainable steelmaking methods.

- Graphite electrodes find applications not only in steelmaking but also in aluminum and silicon processing. China, being the world's largest producer of both aluminum and silicon, witnessed a significant surge in its annual aluminum output in 2023. The output climbed by 3.43% from the previous year, hitting a record high of 41.59 million tonnes, as reported by the National Bureau of Statistics of China. This growth was fueled by the addition of new capacities and the relaxation of power supply restrictions. According to the US Geological Survey, China's silicon production in 2023 was estimated at 6.6 million metric tons.

- India is witnessing a robust surge in the demand for graphite electrodes, primarily driven by the steady uptick in iron and steel production over recent years. These electrodes play a pivotal role in steel and non-ferrous metal production and are employed in both the electric arc furnace and ladle furnace processes.

- India, the world's second-largest steel producer, has a steel capacity of over 161 million tons annually, trailing only China. This capacity is distributed with 67 million tons via the blast furnace-basic oxygen furnace (BF-BoF) route, 36 million tons via electric arc furnace (EAF), and 58 million tons via the induction furnace (IF) route.

- The steel sector in South Korea holds significance, driving the nation's economic growth by catering to industries like automotive, construction, and shipbuilding. As reported by the Korean Iron & Steel Association, the steel industry accounts for 1.5% of the nation's GDP and 4.9% of its manufacturing sector. Notably, South Korea ranks as the sixth-largest steel producer globally.

- Owing to the factors mentioned above, the market for graphite electrodes in Asia-Pacific is projected to grow significantly during the forecast period.

Graphite Electrode Industry Overview

The graphite electrode market is partially consolidated. Some of the major players (not in any particular order) in the market include Resonac Holdings Corporation, GrafTech International, Fangda Carbon New Material Co. Ltd, Zhongze Group, and Liaoning Dantan Technology Group Co. Ltd (Dan Carbon).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Strong Demand for EAF Technology for Steelmaking

- 4.1.2 Rising Availability of Steel Scrap in China

- 4.2 Restraints

- 4.2.1 High Dependency on the Steel Industry

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Electrode Grade

- 5.1.1 Ultra High Power (UHP)

- 5.1.2 High Power (SHP)

- 5.1.3 Regular Power (RP)

- 5.2 Application

- 5.2.1 Electric Arc Furnace

- 5.2.2 Basic Oxygen Furnace

- 5.2.3 Non-steel Application

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 Qatar

- 5.3.5.3 United Arab Emirates

- 5.3.5.4 Egypt

- 5.3.5.5 South Africa

- 5.3.5.6 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 EL 6 LLC

- 6.4.2 Fangda Carbon New Material Technology Co. Ltd

- 6.4.3 GrafTech International

- 6.4.4 Graphite India Limited

- 6.4.5 HEG Limited

- 6.4.6 Kaifeng Pingmei New Carbon Materials Technology Co. Ltd

- 6.4.7 Liaoning Dantan Technology Group Co. Ltd (Dan Carbon)

- 6.4.8 Nantong Yangzi Carbon Co. Ltd

- 6.4.9 Nippon Carbon Co. Ltd

- 6.4.10 Sangraf International Inc.

- 6.4.11 SEC Carbon Limited

- 6.4.12 Resonac Holdings Corporation

- 6.4.13 Tokai Carbon Co. Ltd

- 6.4.14 Zhongze Group

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rising Usage of Graphite Electrodes in Non-steel Applications