|

市场调查报告书

商品编码

1687780

中国金融科技:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)China Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

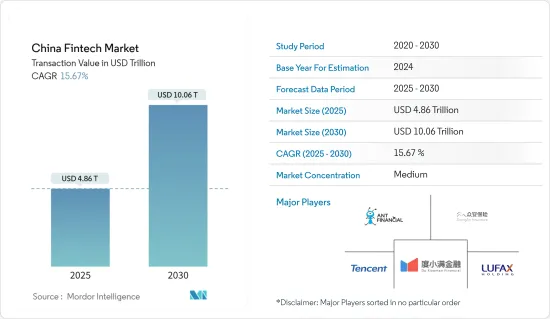

根据交易价值,中国金融科技市场规模预计将从 2025 年的 4.86 兆美元增长到 2030 年的 10.6 兆美元,预测期内(2025-2030 年)的复合年增长率为 15.67%。

付款管道主导中国的金融科技市场,其用户群的很大一部分来自中国不断增长的社群媒体和电子商务领域。从交易金额来看,数位付款类别最大。中国的金融科技解决方案和技术虽然创新性不强,但更好地改编了国外模式。中国现在公开宣称希望在金融科技的采用和发展上引领世界。在金融科技业,特别是市场借贷领域出现了多起诈骗案件后,法律开始收紧。

在中国,腾讯控股有限公司的微信和蚂蚁金服的支付宝等应用程式占据了全球数位付款的一半以上。中国消费者俱备数位技能,愿意共用个人资讯,因此他们已准备好接受金融科技提供的服务。这为渴望数位转型的现有企业和金融科技公司打开了大门。预计银行帐户的消费者和需求未满足的中小型企业 (SME) 群体将呈现这种前景。金融科技公司也致力于满足日益壮大的中阶在私人银行、财富管理和保险等领域日益增长的需求。

中国金融科技市场趋势

金融科技业数位化投资的增加正在推动市场发展

中国已成为金融科技领域的全球领导者,这得益于多种因素,包括大量银行帐户人口、不断壮大的中阶以及支持技术创新的政府。数位投资为中国金融科技公司提供了大量资金,使其能够开发和推出尖端金融服务和产品。创业投资公司、私募股权投资者甚至老牌金融机构都在投资中国金融科技新兴企业,推动其发展。金融科技的数位化投资对于促进中国的金融包容性至关重要。透过创新产品和服务,金融科技公司为以前服务不足的人群提供服务,包括农村地区和小型企业。透过利用数位技术,这些公司正在改善贷款和保险等金融服务的管道,并为传统上被排除在银行体系之外的企业和个人提供投资选择。

数位付款的兴起推动了市场

中国正经历向付款和数位付款的快速转变,这主要得益于金融科技领域的数位投资。支付宝和微信支付等公司正在彻底改变中国的付款格局,为消费者提供便利、安全的付款解决方案。这些数位付款管道的出现促进了电子商务、线上交易和数位金融服务的成长。数位付款的激增正在推动中国电子商务的成长。随着越来越多的人意识到透过数位平台购物的便利,网路购物的趋势日益增长。这种成长为金融科技公司创造了机会,使其能够提供创新的付款解决方案、贷款服务和其他针对电子商务生态系统的金融产品。

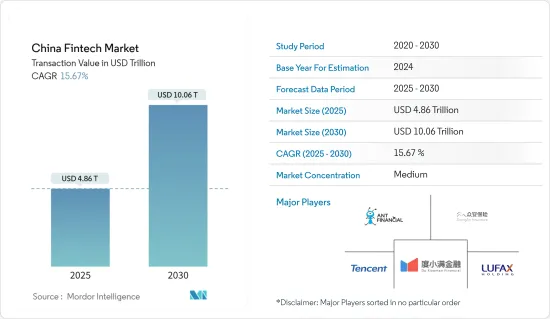

中国金融科技业概况

中国的金融科技市场中等程度分散。该研究概述了在中国和一个或多个其他国家运营的金融科技公司。本书对几家关键公司进行了深入的介绍,包括它们提供的产品资讯、管理它们的法律、它们的总部以及它们所在的行业。目前,蚂蚁金服、众安、腾讯、度小满、陆金所等是占据市场主导地位的一些关键公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概况

- 中国金融科技市场规模及成长率

- 中国金融科技的历史

- 市场驱动因素

- 智慧型手机普及率不断提高推动市场

- 科技的快速进步为金融科技创新铺平了道路

- 市场限制

- 资料安全和隐私问题

- 竞争加剧阻碍了市场发展

- 市场机会

- 与传统金融机构合作

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 深入了解影响市场的各种监管发展

- 洞察技术对市场的影响

- 中国各行业对金融科技的采用

- 中小企业在中国金融科技发展中的作用

- 资金筹措统计:中国金融科技公司的投资流入

- 深入了解区块链和其他技术的市场采用情况

- COVID-19 对市场的影响

第五章 市场区隔

- 中国交易

- 数位付款

- 个人财务

- 另类贷款

- 替代性融资

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Ant Financial

- ZhongAn

- Du Xiaoman

- Tencent

- Lufax

- JD Finance

- Dianrong

- Ping An Technology

- Tiger Brokers*

第七章 市场趋势

第八章 免责声明及发布者

The China Fintech Market size in terms of transaction value is expected to grow from USD 4.86 trillion in 2025 to USD 10.06 trillion by 2030, at a CAGR of 15.67% during the forecast period (2025-2030).

Payment platforms dominate the fintech market in China, drawing a substantial portion of their user base from the country's growing social media and e-commerce sectors. In terms of transaction values, the digital payment category is the largest. Though not very innovative, China's fintech solutions and technologies are more successful adaptions of foreign models. China has now made it known that it wants to lead the world in adopting and developing financial technology. Following a few instances of fraud in the fintech industry, particularly in marketplace lending, the laws started to tighten.

In China, apps like Tencent Holdings' WeChat and Alipay, owned by Ant Financial, account for over half of all digital payments worldwide. Chinese consumers are ready for FinTech offerings due to their digital expertise and willingness to share personal information. This opens doors for incumbents and FinTech companies eager to take on digital transformation. Underbanked or unbanked consumers with unmet demands and small- and medium-sized business (SME) populations are expected to present these prospects. FinTech companies also aim to fulfill the growing needs of the expanding middle class in terms of private banking, wealth management, and insurance.

China Fintech Market Trends

Increase in Digital Investments in the Fintech Industry is Fueling the Market

China has become a global leader in the fintech industry, driven by various factors such as a large unbanked population, a growing middle class, and a government supportive of technological innovation. Digital investments have given Chinese fintech companies access to significant capital, allowing them to create and implement cutting-edge financial services and products. Venture capital firms, private equity investors, and even established financial institutions have invested in Chinese fintech startups, fueling their growth. Digital investments in fintech have been crucial in promoting financial inclusion in China. Through innovative products and services, fintech companies have reached previously underserved populations, such as rural communities and small businesses. By leveraging digital technologies, these businesses have made financial services, such as loans and insurance, accessible and investment options to companies and people previously shutting out of the conventional banking system.

Increase in Digital Payments is Fueling the Market

China has witnessed a rapid shift toward mobile and digital payments, primarily driven by digital investments in fintech. Companies like Alipay and WeChat Pay have revolutionized the payment landscape in China, providing convenient and secure payment solutions to consumers. The availability of these digital payment platforms has fueled the growth of e-commerce, online transactions, and digital financial services. The surge in digital payments has fueled the growth of e-commerce in China. The trend of online shopping is growing as more and more people realize how convenient it is to make purchases via digital platforms. This growth has created opportunities for fintech companies to offer innovative payment solutions, lending services, and other financial products tailored to the e-commerce ecosystem.

China Fintech Industry Overview

The fintech market in China is moderately fragmented. An overview of fintech businesses operating in China and one or more other countries is included in the study. A few significant companies are thoroughly profiled, including information on their product offerings, the laws that govern them, their headquarters, and their industry of business. Currently, Ant Financial, ZhongAn, Tencent, Du Xiaoman, and Lufax are a few of the significant companies ruling the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.1.1 Market Size and Growth Rate of the Fintech Market in China

- 4.1.2 History of Fintechs in China

- 4.2 Market Drivers

- 4.2.1 Increasing Smartphone Penetration is Driving the Market

- 4.2.2 The Rapid Progress in Technology has Paved the Way for Fintech Innovation

- 4.3 Market Restraints

- 4.3.1 Concerns about Data Security and Privacy

- 4.3.2 Increasing Competition is Restraining the Market

- 4.4 Market Opportunities

- 4.4.1 Partnerships with Traditional Financial Institutions

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Insights on Various Regulatory Trends Shaping the Market

- 4.7 Insights on the Impact of Technology on the Market

- 4.8 Fintech Adoption Across Various Sectors in China

- 4.9 Role of SMEs in Fintech Growth in China

- 4.10 Funding Statistics - Investment Flow Into Fintech Companies in China

- 4.11 Insights into Blockchain and Other Technologies' Adoption into the Market

- 4.12 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 China Transaction Volumes

- 5.1.1 Digital Payments

- 5.1.2 Personal Finance

- 5.1.3 Alternative Lending

- 5.1.4 Alternative Financing

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Ant Financial

- 6.2.2 ZhongAn

- 6.2.3 Du Xiaoman

- 6.2.4 Tencent

- 6.2.5 Lufax

- 6.2.6 JD Finance

- 6.2.7 Dianrong

- 6.2.8 Ping An Technology

- 6.2.9 Tiger Brokers*