|

市场调查报告书

商品编码

1687805

美国冷冻卡车:市场占有率分析、行业趋势和成长预测(2025-2030 年)United States Refrigerated Trucking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

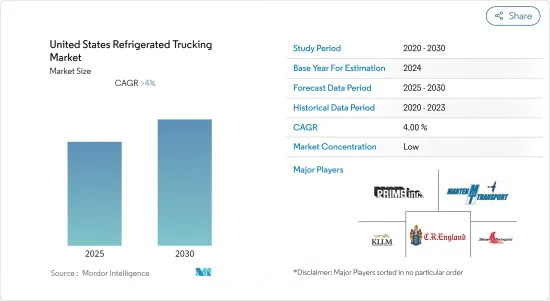

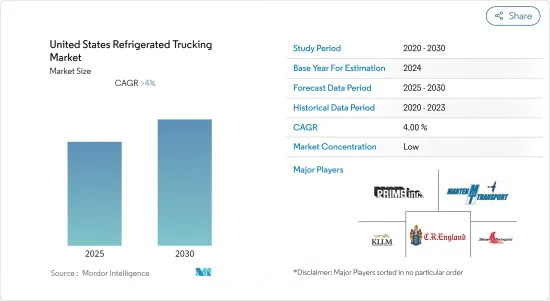

预计预测期内美国冷冻车市场复合年增长率将超过 4%。

主要亮点

- 由于送货上门的限制、劳动力短缺等原因,COVID-19 危机严重影响了国内冷藏卡车运输。根据美国经济研究局 (ERS) 的数据,停工和消费者需求的变化对生鲜食品市场产生了影响。消费者的恐慌性抢购导致对新鲜蔬菜、水果和包装食品的需求激增。该行业正在从疫情的影响中恢復。

- 农业是美国冷藏车产业的主要终端用户之一。农产品的成长和贸易的增加导致对冷藏卡车行业的依赖性增加。 2021年农场总数超过200万个,美国典型农场规模为445英亩,约8,900万英亩农地。美国农地总价值约2.9兆美元。

- 由于冷藏运输业在食品供应链中的重要性,该行业正在復苏。不过,疫情期间医药运输业对冷藏车的需求也十分巨大。

美国冷冻卡车运输市场趋势

消费者对包装食品的需求激增

美国包装食品消费强劲成长,导致人均冷冻食品消费支出增加,进而推动了冷冻车的需求。米饭、义式麵食、麵条、零嘴零食和罐头食品等包装食品的销量正在增加,因为它们的保质期很长。产品创新、自有品牌营运商推出的新产品以及从非专利到高端产品的重大转变(包括无麸质和有机替代品),正在推动该国包装食品的消费。此外,随着年轻一代购买力的增强,预计到 2022 年美国有机产品销售将成长 5-10%。随着有机食品供应量的增加,非有机食品和有机食品之间的价差也在缩小。

新冠疫情导緻美国的食品消费习惯发生了巨大变化。消费者普遍增加了在杂货店和其他零售食品店购买食品的支出,但减少了在外购买食品的支出。食品储藏室的购买量适中,而家庭对零嘴零食、乳製品、家常小菜和烘焙产品等包装食品的消费量增加。

2020 年,透过On-Trade管道的饮料销售额大幅下降,可能是由于疫情期间餐厅、酒吧和酒馆暂时关闭导致收入减少。儘管盈利出现波动,但保存食品和包装商品的销售量仍有所增加。大型包装食品公司已经开始透过网路管道推广其产品。 2021年,国内线上包装食品销售额与前一年同期比较增12%。

医疗保健和製药业需求强劲

冷藏或冷冻卡车通常用于运送药品和药物。医疗领域的重大改革为新药进入市场铺平了道路。许多药物必须保存在特定的温度范围内才能保持有效。这些对温度敏感的药品产量的增加为温控运输服务创造了机会。

美国约占全球医药市场的45%和全球产量的22%。由于全球疫苗的持续推广以及对基本和非基本治疗的需求不断增长,预计 2022 年美国药品产量和销售额将会增加。药品受有关药品储存、运输和分销的联邦法律和法规的约束。食品药物管理局(FDA) 制定这些法规是为了满足日益提高的安全标准。

然而,大多数技术供应商正在创新新系统以安全处理对温度敏感的生物製药。我们在美国专利商标局註册了多项专利。这些领域的技术创新意味着越来越多的产品需要温控环境来维持其效能。 2021年,美国在品牌新药上的支出达到464多亿美元,与前一年同期比较成长140%以上。

美国冷冻车产业概况

美国冷冻卡车市场高度分散,许多本地公司希望透过併购来抢占大量市场占有率。预计市场将在预测期结束时巩固。主要公司包括 CR England Inc.、Prime Inc.、KLLM Transport Services、Stevens Transport Inc. 和 Marten Transport Ltd.。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概览

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 技术趋势与自动化-开发冷冻车市场

- 深入了解冷冻货物流动

- 生物製药领域对低温运输产业的影响

- 温度敏感度如何影响某些产品

- 冷冻最后一英里配送概述

- 冷藏车运输费率回顾及说明

- 聚焦-冷藏仓库产业

- COVID-19对市场的影响

第五章市场区隔

- 目的地

- 国内的

- 国际的

- 按最终用户

- 食品和饮料

- 农业

- 医疗保健和製药(包括生物製药)

- 其他最终用户

第六章竞争格局

- 市场集中度概览

- 公司简介

- CR England Inc.

- Prime Inc.

- JB Hunt Transport Inc.

- KLLM Transport Services

- Stevens Transport Inc.

- Swift Transportation Company

- Marten Transport Ltd

- TransAm Trucking Inc.

- Emerald Transportation Solutions

- ATS

- XPRESS CARGO

- FFE Transportation Services Inc.

- FST Logistics

- Hirschbach Motor Lines

- Navajo Express*

- 其他公司

- Black Horse Carriers Inc., Southern Refrigerated Transport, Roadrunner Transportation Systems Inc., J&R Schugel Trucking, Decker Truck Line Inc., WEL Companies, National Carriers Inc., Bay & Bay Transportation, Freymiller Inc., and Roehl Transport Inc.

第七章 市场机会与未来趋势

第 8 章 附录

- 冷藏仓储年度统计数据

- 冷冻食品进出口贸易资料

- 深入了解食品运输法规结构

The United States Refrigerated Trucking Market is expected to register a CAGR of greater than 4% during the forecast period.

Key Highlights

- The COVID-19 crisis significantly impacted refrigerated truck transportation in the country due to lockdown restrictions, labor shortages, etc. As per the USDA's Economic Research Service (ERS), the combination of shutdowns and shifts in consumer demand has affected fresh produce markets. The increasing demand for fresh vegetables, fruits, and packaged foods surged due to panic-buying behaviors among consumers. The sector is recovering from the effects of the pandemic.

- Agriculture is one of the major end users of the refrigerated trucking industry in the United States. The growth in agriculture products and increasing trade have led to a growing dependence on the refrigerated trucking industry. The overall number of farms was over two million in 2021. Farms in the United States are typically 445 acres in size, with around 89 million acres of farmland. The total real estate value of farmed land in the United States was approximately USD 2.9 trillion.

- The refrigerated transport sector is reviving due to its importance in the food supply chain. However, the pharmaceutical transportation industry also registered huge demand for refrigerated trucking during the pandemic.

US Refrigerated Trucking Market Trends

Consumer Demand for Packaged Foods is Surging

Packaged foods consumption is witnessing significant growth in the country, and the rising per capita consumer spending on frozen food in the United States is fueling the demand for refrigerated vehicles. Packaged food goods, such as rice, pasta, noodles, snacks, and canned food, have a long shelf life, thus boosting their sales. Product innovation, the launch of new products from private label businesses, and a significant shift from generic to premium items such as gluten-free and organic alternatives are boosting the consumption of packaged food in the country. In addition, with the younger generation acquiring more purchasing power, the sales of organic products in the United States were estimated to increase by 5-10% in 2022. The price difference between non-organic and organic foods has also decreased due to the increased availability of organic food.

The COVID-19 pandemic caused dramatic transformations in the food-spending habits of Americans. Consumers generally increased their spending on food at grocery stores and other retail food venues while decreasing their spending on food away from home. With modest pantry loading, at-home consumption of packaged food such as snacks, dairy products, prepared meals, and bakery goods increased.

Sales of drinks through on-trade channels declined significantly in 2020, most likely due to revenue loss caused by the temporary closure of restaurants, pubs, and bars during the pandemic. Even though the profitability fluctuated, sales of preserved and packaged goods increased. Packaged food giants started promoting their product sales through their online channels. In 2021, the sales of online packaged food in the country witnessed a growth rate of 12% compared to the previous year.

Strong Demand from the Healthcare and Pharmaceutical Industries

A refrigerated or insulated truck is typically used to deliver pharmaceutical products or medications. The significant reforms in the healthcare sector have created a way for new medicines to enter the market. Many pharmaceuticals must be kept within a specific temperature range to maintain efficiency. The increased production of these temperature-sensitive pharmaceutical products creates opportunities for temperature-controlled transportation services.

The United States accounts for around 45% of the worldwide pharmaceutical market and 22% of the global output. US pharmaceutical output and sales were expected to increase in 2022 due to the ongoing global rollout of vaccines and pent-up demand for necessary and non-essential medical treatments. Pharmaceuticals are subject to federal laws and regulations concerning medicines' storage, transportation, and distribution. The Food and Drug Administration (FDA) sets these rules to meet the increasing safety standards.

However, most technology providers are innovating new systems for safely handling temperature-sensitive biological products. Many patents have been registered in the US patent and trademark office. Technological innovations in these fields have created more products that need temperature-controlled environments to maintain their effectiveness. In 2021, the US spending on new brand medicines reached more than USD 46.4 billion, up by more than 140% compared to the previous year.

US Refrigerated Trucking Industry Overview

The US refrigerated trucking market is highly fragmented, with many local players trying to acquire significant market share through mergers and acquisitions. The market is expected to move toward consolidation by the end of the forecast period. Some major players are C.R. England Inc., Prime Inc., KLLM Transport Services, Stevens Transport Inc., and Marten Transport Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technological Trends and Automation - Developments in the Refrigerated Trucking Market

- 4.6 Insights on Refrigerated Freight Flow

- 4.7 Impact of the Biopharma Sector on the Cold Chain Industry

- 4.8 Impact of Temperature Sensitivity on Selected Goods

- 4.9 Brief on Refrigerated Last-mile Delivery

- 4.10 Review and Commentary on Refrigerated Trucking Rates

- 4.11 Spotlight - Refrigerated Warehousing Sector

- 4.12 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 By End User

- 5.2.1 Food and Beverages

- 5.2.2 Agriculture

- 5.2.3 Healthcare and Pharmaceuticals (Including Biopharma)

- 5.2.4 Other End Users

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 C.R. England Inc.

- 6.2.2 Prime Inc.

- 6.2.3 J.B. Hunt Transport Inc.

- 6.2.4 KLLM Transport Services

- 6.2.5 Stevens Transport Inc.

- 6.2.6 Swift Transportation Company

- 6.2.7 Marten Transport Ltd

- 6.2.8 TransAm Trucking Inc.

- 6.2.9 Emerald Transportation Solutions

- 6.2.10 ATS

- 6.2.11 XPRESS CARGO

- 6.2.12 FFE Transportation Services Inc.

- 6.2.13 FST Logistics

- 6.2.14 Hirschbach Motor Lines

- 6.2.15 Navajo Express*

- 6.3 Other Companies

- 6.3.1 Black Horse Carriers Inc., Southern Refrigerated Transport, Roadrunner Transportation Systems Inc., J&R Schugel Trucking, Decker Truck Line Inc., WEL Companies, National Carriers Inc., Bay & Bay Transportation, Freymiller Inc., and Roehl Transport Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX

- 8.1 Annual Statistics on Refrigerated Storage Facilities

- 8.2 Import and Export Trade Data of Frozen Food Products

- 8.3 Insights on Regulatory Framework on Food Transportation