|

市场调查报告书

商品编码

1687819

安全资讯与事件管理 (SIEM) - 市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Security Information and Event Management (SIEM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

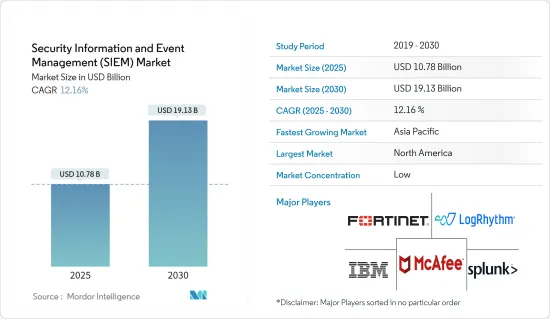

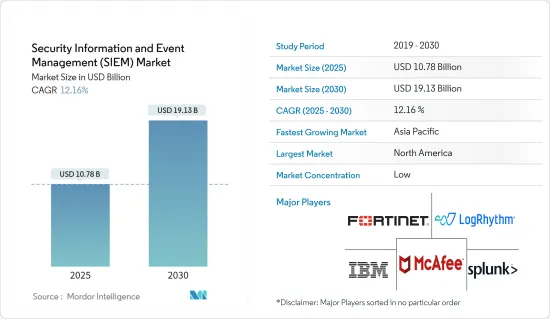

安全资讯和事件管理市场规模预计在 2025 年为 107.8 亿美元,预计到 2030 年将达到 191.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 12.16%。

安全资讯和事件管理 (SIEM) 工具对于资料安全生态系统都至关重要。它汇总来自多个系统的资料并进行分析以检测异常行为和可能的网路攻击。 SIEM 从网路设备、伺服器、网域控制器等收集安全资料。 SIEM 储存规范化、聚合和分析资料以发现趋势、侦测威胁并使组织能够调查警报。

主要亮点

- 第一代 SIEM 于 2005 年推出,结合了先前独立的日誌管理和事件管理系统。过去,SIEM 要求在资料管道的每个阶段进行仔细的管理:资料提取、策略、警报审查和异常分析。透过从更多组织来源收集资料并使用 AI 技术来了解哪些行为构成安全事件,SIEM 变得越来越聪明。

- 目前的 SIEM 趋势由三种功能定义:云端处理(按需、可扩展服务)、协作(共用威胁情报和分析)和认知技术(有助于做出更智慧、更快决策的人工智慧和自动化)。

- 网路犯罪分子正在开发更复杂的威胁,并使用自动化手段大规模传播这些威胁。组织正在部署更多的安全工具来侦测和应对这些威胁。然而,安全工具使得提供组织安全态势的整体视图变得困难。这项挑战正在推动安全资讯和事件管理 (SIEM) 工具的采用率不断提高。

- 企业采用自带设备 (BYOD) 的趋势是 SIEM 市场的强大推动力,预计将产生长期重大影响。在当今的行动世界中,员工希望能够使用行动电话、平板电脑、笔记型电脑和穿戴式装置在任何地方自由地工作。各组织正在采用 BYOD 计划来实现这一目标。

- 安全资讯和事件管理 (SIEM) 是一项关键的安全投资。 SIEM 有助于记录、收集和关联整个组织的安全事件。然而,SIEM 是一种昂贵的工具,而且价格不菲。安全公司 Lokker 在 2023 年对 248 名技术决策者进行的一项调查发现,超过三分之二的受访者认为 SIEM 定价是一个重大问题。然而,SIEM 仍然很受欢迎,许多企业将其视为管理网路威胁的关键技术。此外,近三分之二的公司已经采用了 SIEM 工具,主要用于快速威胁侦测。

安全资讯和事件管理 (SIEM) 市场趋势

云端运算正在蓬勃发展

- 随着云端基础的工具和解决方案被企业 IT 和安全团队越来越广泛地采用,SIEM 继续快速发展。根据业内专家预测,到 2024 年,超过 90% 的 SIEM 解决方案将在云端提供日誌储存、分析和事件管理等功能,而 2020 年这一比例仅为 20%。目前,提供云端解决方案的主要厂商包括 LogRhythm、Splunk、IBM、Eventsentry、Microsoft、McAfee、Securonix 和 ACE Cloud。

- 云端 SIEM 解决方案的灵活性、可存取性和价值实现时间均优于内部部署 SIEM 系统。云端 SIEM 系统可让组织扩大规模以满足大量日誌量需求的最后期限。

- 公司必须按照隐私法律法规的要求保存日誌。因此,公司必须确保在必要时储存安全、防篡改的日誌。云端 SIEM 解决方案可以以经济的方式实现这一点。例如,Log360 Cloud 存檔旧日誌并将其迁移到压缩的冷资料储存,从而保持日誌完整性并有效利用储存空间。

- 由于您的云端安装始终是最新的,因此云端 SIEM 解决方案还可以为您省去处理频繁的产品升级和修补的麻烦。透过这种方法,您的员工无需花时间维护和升级 SIEM,而是有更多时间专注于其他重要任务,例如监控网路中的潜在威胁。

- 这项调查由领先的技术解决方案供应商 Unisys 进行,受访者来自美国、英国、德国、澳洲和纽西兰,共有 2,264 人参与。受访者由商业和技术领导者组成 - 70%是IT决策者和开发人员,30%是C级高管 - 调查发现,37%的科技公司计划在2023年大幅增加其云端运算投资。

北美占据主要市场占有率

- 人们对IT安全和网路犯罪日益增长的担忧促使企业寻求更强大的安全解决方案。这种迫切性是由行动装置使用量的急剧增长、云端服务的采用以及日益复杂的威胁情势所驱动。 BYOD(自带设备)的日益增长的趋势正在推动美国云端 SIEM 市场的扩张。

- 随着向云端迁移的不断推进,企业面临平台过时的挑战。许多企业现在正在转向云端原生 SIEM 技术。这些解决方案可以增强您对网路攻击的防御能力,并为您的云端基础架构提供关键的可视性,使您能够以所需的速度、灵活性和规模应对安全挑战。

- 市场正在见证显着的技术创新,以解决安全问题并提高对网路攻击的反应速度。例如,2022 年 6 月,下一代 SIEM 和 XDR 领导者 Exabeam 宣布计划在 Google Cloud 上为其云端原生 SIEM 和网路安全分析解决方案提供支援。此举为全球安全团队提供了更强的资料撷取能力、速度和扩充性,以应对日益复杂的网路威胁。

- 加拿大网路攻击呈上升趋势,专家强调采取主动措施的重要性。 2023年,加拿大网路攻击明显增加,对我们的数位基础设施和国家安全构成重大风险。随着加拿大进入数位时代,网路犯罪分子利用漏洞发动高调攻击。

- 2023 年 11 月,网路安全全球领导者 ForeScout Canada 在渥太华开设了新的研发办公室。该设施旨在帮助公司更好地管理网路威胁和风险,特别是在 IT、OT 和 IoT 领域。 Forescout 的业务遍布全球,其中包括为加拿大公司服务十年,并与金融、医疗保健和能源领域的领先公司合作。 Forescout 旨在透过基于 SaaS 的 SIEM 解决方案满足最终用户不断变化的需求。

- 展望未来,在技术进步、法规合规要求和不断变化的威胁情势的推动下,加拿大 SIEM 市场预计将经历显着的成长和创新。

安全资讯与事件管理(SIEM)市场概览

安全资讯和事件管理市场较为分散,并由大型企业主导。主要市场公司包括 IBM Corporation、Splunk Inc.、Fortinet Inc.、LogRhythm Inc.、McAfee LLC 等。各种正在进行的收购和技术创新正在推动市场成长。此外,为了增加市场占有率,SIEM 供应商正在与各种最终用户公司伙伴关係开发客製化解决方案。

- 2024 年 2 月,Gem Security 宣布与 IBM Security 领先的安全资讯和事件管理 (SIEM) 平台 QRadar 整合。 Gem Security 的 QRadar 整合旨在帮助客户简化保全行动并提高其事件回应能力。 Gem Security 与 QRadar 集成,在 QRadar 领先的 SIEM 技术中提供统一的侦测、警报和回应功能。

- 2023 年 11 月,LogRhythm Inc. 宣布扩建其在印度的研发设施。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查结果和先决条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章市场动态

- 市场驱动因素

- 对安全的兴趣增加

- BYOD 采用率提升

- 市场挑战

- 实施成本高且扩充性

第六章市场区隔

- 按部署

- 本地

- 云

- 按组织类型

- 中小型企业

- 大型企业

- 按最终用户产业

- 零售

- BFSI

- 製造业

- 政府

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 亚洲

- 中国

- 日本

- 印度

- 澳洲和纽西兰

- 拉丁美洲

- 巴西

- 阿根廷

- 中东和非洲

- 阿拉伯聯合大公国

- 北美洲

第七章竞争格局

- 公司简介

- IBM Corporation

- Splunk Inc.

- Fortinet Inc.

- LogRhythm Inc.

- McAfee LLC

- Open Text Corporation

- RSA Security LLC(Dell Technologies)

- Rapid7 Inc.

- Exabeam Inc.

- Securonix Inc.

- AlienVault Inc.

- Hewlett Packard Enterprise Company

第八章投资分析

第九章 市场机会与未来趋势

The Security Information and Event Management Market size is estimated at USD 10.78 billion in 2025, and is expected to reach USD 19.13 billion by 2030, at a CAGR of 12.16% during the forecast period (2025-2030).

Security information and event management (SIEM) tools are vital to the data security ecosystem. They aggregate data from multiple systems and analyze it to catch abnormal behavior or potential cyberattacks. They collect security data from network devices, servers, domain controllers, and more. SIEM stores normalize, aggregate, and apply analytics to that data to discover trends, detect threats, and enable organizations to investigate alerts.

Key Highlights

- The first generation of SIEMs, introduced in 2005, combined log management and event management systems, which were previously separate. In the past, SIEMs required diligent management at every stage of the data pipeline, like data ingestion, policies, reviewing alerts, and analyzing anomalies. Increasingly, SIEMs are getting smarter toward pulling data together from more organizational sources and using AI techniques to understand what type of behavior constitutes a security incident.

- The current trend for SIEM has been defined by three capabilities, namely cloud computing (on-demand, extensible services), collaboration (sharing of threat intelligence and analytics), and cognitive technology (artificial intelligence and automation to help in arriving at smarter, faster decision-making).

- Cybercriminals are developing more sophisticated threats and using automation to launch them in high volumes. Organizations are adopting more security tools to help them detect and respond to these threats. However, security tools make it difficult to get a holistic view of the organization's security posture. This challenge drives an increased adoption of security information and event management (SIEM) tools.

- The trend of adopting your own devices (BYOD) in enterprises is a strong driver for the SIEM market, which is expected to have a significant impact in the long term. In the current mobile world, employees want the freedom to work from anywhere using their mobile phones, tablets, laptops, or wearables. Organizations are adopting BYOD programs to make it happen.

- Security information and event management (SIEM) is one of the major crucial security investments. It helps log, collect, and correlate security events across an organization. However, SIEM is an expensive tool that has always come with a steep price tag. In a survey of 248 tech decision-makers conducted in 2023, the security firm Lokker discovered that over two-thirds of respondents perceive SIEM pricing as a critical issue. However, SIEM is still popular and is viewed by many firms as an important technology for managing cyber threats. Furthermore, almost two-thirds of companies have adopted an SIEM tool and use it mostly for faster threat detection.

Security Information and Event Management (SIEM) Market Trends

Cloud to Witness Significant Growth

- SIEM continues to evolve rapidly as cloud-based tools and solutions have gained greater acceptance among enterprise IT and security teams. As per industry experts, in 2024, more than 90% of SIEM solutions are expected to offer capabilities delivered exclusively in cloud-log storage, analytics, and incident management, up from 20% in 2020. Major players offering cloud solutions include LogRhythm, Splunk, IBM, Eventsentry, Microsoft, McAfee, Securonix, and ACE Cloud.

- The flexibility, accessibility, and time value of cloud SIEM solutions are superior to those of on-premises SIEM systems. Organizations can handle scaling up to meet deadlines for massive log volume requirements using a cloud SIEM system.

- Organizations must keep logs as required by privacy laws and regulations. As a result, businesses must guarantee safe, tamper-proof log-keeping for as long as needed. A cloud SIEM solution can accomplish this affordably. For instance, Log360 Cloud enables the user to archive older logs and shift them to compressed cold storage to maintain their integrity and efficient use of the storage space.

- Since cloud installations are always up to date, cloud SIEM solutions eliminate the hassle of dealing with frequent upgrades and patches to the product. In this approach, instead of spending time on SIEM maintenance and upgrades, staff would have more time to concentrate on other crucial tasks like monitoring the network for potential threats.

- A survey by Unisys, a prominent technology solutions provider, polled 2,264 respondents across the United States, United Kingdom, Germany, Australia, and New Zealand. The respondents, comprising business and technology leaders, including 70% IT decision-makers and developers and 30% C-suite executives, revealed that 37% of technology firms planned a significant uptick in cloud computing investments in 2023.

North America to Hold Significant Market Share

- Rising concerns over IT security and cybercrime have prompted organizations to seek more robust security solutions. This urgency has been fueled by the surge in mobile device usage, the adoption of cloud services, and the increasingly intricate threat landscape. The growing acceptance of the Bring Your Own Device (BYOD) trend is propelling the expansion of the cloud SIEM market in the United States.

- As organizations increasingly shift to the cloud, they face challenges with outdated platforms. Many businesses are now turning to cloud-native SIEM technologies. These solutions bolster their defenses against cyberattacks and provide crucial visibility into their cloud infrastructure, enabling them to tackle security issues with the required speed, flexibility, and scale.

- The market has witnessed notable innovations to address security concerns and enhance cyberattack response speed. For instance, in June 2022, Exabeam, a leader in next-gen SIEM and XDR, announced plans to enhance its cloud-native SIEM and cybersecurity analytics solutions on Google Cloud. This move offers global security teams enhanced data ingestion capabilities, speed, and scalability in their battle against increasingly sophisticated cyber threats.

- Canada has seen a surge in cyber attacks, prompting experts to stress the importance of proactive measures. In 2023, the country witnessed a notable uptick in cyber attacks, posing significant risks to its digital infrastructure and national security. As Canada embraced the digital era, cyber criminals capitalized on vulnerabilities, launching high-profile attacks.

- In November 2023, Forescout Canada, a global cybersecurity leader, opened a new R&D office in Ottawa. This facility is dedicated to helping enterprises enhance their management of cyber threats and risks, particularly in their IT, OT, and IoT domains. With a global presence, including a decade-long service to Canadian enterprises, Forescout has collaborated with major players in the finance, healthcare, and energy sectors. Leveraging its SaaS-based SIEM solution, Forescout aims to cater to the evolving needs of its end users.

- Looking ahead, the Canadian SIEM market is poised for substantial growth and innovation, driven by technology advancements, regulatory compliance demands, and the evolving threat landscape.

Security Information and Event Management (SIEM) Market Overview

The security information and event management market is fragmented and dominated by the major players. Some major market players are IBM Corporation, Splunk Inc., Fortinet Inc., LogRhythm Inc., and McAfee LLC. The various ongoing acquisitions and innovations are leading to the market's growth. In addition, SIEM providers are forming partnerships with different end-user companies and developing customized solutions to increase their market share.

- In February 2024, Gem Security announced the integration of Gem Security with QRadar, IBM Security's leading security information and event management (SIEM) platform. Gem Security's QRadar integration is designed to help customers streamline their security operations and improve their incident response capabilities. Gem Security integrates with QRadar to provide consolidated detection, alerts, and response capabilities within QRadar's leading SIEM technology.

- In November 2023, LogRhythm Inc. announced the expansion of its R&D facilities in India, a move aimed at bolstering cyber resilience in the region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Security Concerns

- 5.1.2 Increasing Adoption of BYOD

- 5.2 Market Challenge

- 5.2.1 High Cost of Deployment and Scalability

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Organisation Type

- 6.2.1 Small and Medium Enterprises (SMEs)

- 6.2.2 Large Enterprises

- 6.3 By End-user Industry

- 6.3.1 Retail

- 6.3.2 BFSI

- 6.3.3 Manufacturing

- 6.3.4 Government

- 6.3.5 Healthcare

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Splunk Inc.

- 7.1.3 Fortinet Inc.

- 7.1.4 LogRhythm Inc.

- 7.1.5 McAfee LLC

- 7.1.6 Open Text Corporation

- 7.1.7 RSA Security LLC (Dell Technologies)

- 7.1.8 Rapid7 Inc.

- 7.1.9 Exabeam Inc.

- 7.1.10 Securonix Inc.

- 7.1.11 AlienVault Inc.

- 7.1.12 Hewlett Packard Enterprise Company