|

市场调查报告书

商品编码

1687820

工业感测器:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Industrial Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

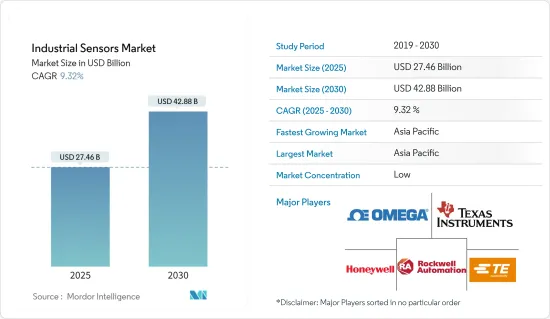

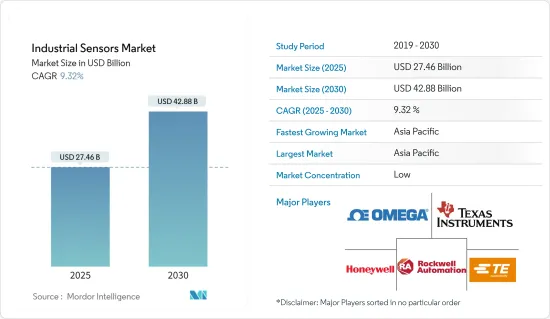

预计 2025 年工业感测器市场规模为 274.6 亿美元,预计到 2030 年将达到 428.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.32%。

主要亮点

- 工业感测器在现代製造和生产过程中至关重要,可提供提高效率、安全性和生产力的许多好处。这些感测器的主要优点是它们能够即时监测和收集资料。此功能使企业能够快速追踪绩效指标,识别异常并做出明智的决策。感测器提供持续的回馈,使公司能够微调流程、最大限度地减少停机时间并提高整体营运效率。

- 工业感测器在确保职场安全方面也发挥着至关重要的作用。透过监测温度、压力和气体水平等环境参数,这些感测器可以在危险情况发生之前识别它们。例如,气体洩漏感测器可以快速向工人发出警报,以便及时干预,防止事故发生并保护工人。

- 此外,这些感测器将开启预测性维护的时代。透过检查感测器的资料,公司可以识别机器的磨损情况,并在故障发生之前规划维护。这种积极主动的策略不仅可以避免昂贵的维修,还可以延长设备的使用寿命,从长远来看可以节省大量成本。

- 工业感测器也处于自动化和製造业采用智慧技术的前沿。蓬勃发展的物联网 (IoT) 使感测器能够与其他设备交互,从而创建互联繫统,从而增强流程自动化和资料共用。这种协同效应不仅简化了运营,而且还增强了资源管理和能源效率,从而降低了营运成本。

- 工业自动化的激增正在推动工业感测器市场的发展。从机器人到流程自动化,随着製造商寻求提高效率和降低营运成本,自动化技术正在获得发展动力。在这些情况下,感测器至关重要,它提供即时资料,有助于决策并提高业务效率。随着智慧工厂和工业 4.0 的发展势头日益强劲,对监控、控制和改进流程的感测器的需求比以往任何时候都高。

- 虽然感测器整合增强了工业自动化,但也有成本,限制了其在预算敏感型应用中的采用。此外,新产品开发所需的高额研发成本也是一个重大挑战,特别是对于融资有限的中小型感测器製造商而言。这些製造商通常发现很难投入足够的资源进行创新和保持市场竞争力所必需的广泛研究和开发。因此,他们有可能落后于那些有财力大力投资新兴科技的大公司。

工业感测器市场趋势

影像感测器类型预计将占据主要市场占有率

- 工业影像感测器在各种工业环境中获取视觉资料方面发挥关键作用。这些设备对于自动检查、品管和监控系统至关重要。透过将光转换为电子讯号,它们可以实现缺陷检测、尺寸测量、物体识别和生产线监控。这些感测器主要用于製造业、汽车业、机器人和电子业等领域,是机器视觉系统的基础,使自动化系统能够解释视觉资料并做出反应。

自动化和机器视觉系统的采用日益增多

- 随着自动化的进步,特别是製造业和品管产业,对工业影像感测器的需求也不断增加。这些感测器对于机器视觉系统至关重要,可以快速检查产品缺陷,确保组装的准确性并全面提高生产效率。此外,随着工业 4.0 的到来和智慧工厂的兴起,自动化环境中对这些感测器的需求只会增长。

- 根据国际机器人联合会(IFR)预测,2023年全球工业机器人出货量将达到约59.3万台,较前一年大幅成长。预测到 2026 年出货量将成长至约 718,000 台。

- 此外,2023 年 5 月,康耐视宣布推出 Advantage 182 视觉系统,这是一款由人工智慧驱动的解决方案,旨在简化生命科学OEM 的定位、分类和检查等复杂任务。为了满足日益增长的需求,许多供应商正在推出新产品,凸显影像感测器在先进工业机器人和机器视觉系统中的重要性。

- 在工业环境中,检查已变得至关重要。影像感测器使工厂操作员能够更快地检查并更好地发现缺陷。例如,ams Osram 于 2023 年 1 月扩展了其 Mira 系列高灵敏度全球百叶窗CMOS 影像感测器,推出了 2.3mm x 2.8mm、0.5M 像素的 Mira050。

- 2024 年 4 月,OMNIVISION 推出了两款专为机器视觉应用设计的新型 CMOS World 百叶窗 (GS) 影像感测器。该公司还成立了专门的机器视觉部门,主导工业自动化、机器人、物流条码扫描和智慧型运输系统(ITS)等领域的创新。

- 这些新推出的感测器因其影像处理性能而脱颖而出,适合需要高动态、高精度和快速响应时间的应用。 OG05B1B 拥有 500 万像素 (MP) 解析度和 1/2.53 吋光学格式 (OF),而专为工厂自动化和 ITS 设计的 OG01H1B 则提供 1.5MP 解析度和 1/4.51 吋 OF。预计这些战略倡议和进步将在可预见的未来推动该行业的成长。

预计亚太地区市场将大幅成长

- 中国迅速采用机器人取代人类工人预计将推动市场成长。在中国,製造效率依赖自动化,导致对确保机器人功能的感测器的需求激增。

- 日本正面临日益严重的劳动力短缺问题,製造商开始转向自动化、机器人和工业 4.0 解决方案等最尖端科技。经济合作暨发展组织(OECD)强调了日本的人口挑战。日本是世界上老化程度最高的国家,过去10年日本老龄人口减少了270多万人。预测表明,到 2065 年,总劳动人口将下降 40%。因此,可以使用先进的製造技术来提高生产力和能源效率,同时减少产品缺陷。这种方法直接解决了劳动力短缺的问题,并扩大了自动化工厂对工业感测器的需求。

- 日本处于自动化工业革命的前沿,正迅速拥抱工业4.0。作为工厂自动化产品的製造地,日本不仅满足国内需求,也供应亚太地区的其他市场。韩国的多元化产业进一步凸显了其重要性,其中包括多家汽车製造公司、电子公司和食品加工公司。

- 韩国汽车业从最初的政府主导型发展成为大型跨国公司主导的产业。随着起亚汽车、现代汽车、雷诺集团等产业领导企业的地位稳固,韩国汽车需求正走在持续成长的道路上。

- 在印度和东南亚,各领域的大量投资正在推动工业感测器需求的激增。

- 随着东南亚汽车製造商对具有自动驾驶功能的电动车 (EV) 日益增长的需求做出反应,战略伙伴关係变得至关重要。 2024 年 1 月,电动车充电器製造先驱、全球汽车巨头的重要盟友 Exicom 与泰国能源创新公司 InnoPower Company Limited 签署了分销协议。此次合作将彻底改变泰国的电动车格局,InnoPower 现已销售 Exicom 的 AC/DC 充电器。透过建立本地销售和分销网络,Exicom 将巩固其在东南亚的地位。此外,感测器整合到生产线中预计将推动对具有更长检测范围的接近感测器的需求。

工业感测器产业概况

工业感测器市场分散,主要企业包括德州仪器公司、TE Connectivity 公司、Omega Engineering 公司、霍尼韦尔国际公司、罗克韦尔自动化公司、西门子股份公司和义法半导体公司。市场参与企业正在推出各种创新产品,以满足消费者不断变化的需求。此外,市场也建立了重要的联盟和伙伴关係。市场参与者希望扩大影响力以满足日益增长的工业感测器需求,而扩张和收购可能会推动未来的市场成长。

此外,随着自动化在所有终端用户行业中获得认可,预计未来几年市场将显着增长。这提高了该行业的盈利。因此,新进入者的威胁很高。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 和其他宏观经济因素将如何影响市场

- 技术简介

第五章 市场动态

- 市场驱动因素

- 物联网的日益普及推动对感测元件的需求

- 更重视预测性维护和远端监控

- 市场限制

- 成本和营运问题

第六章 市场细分

- 依感测器类型

- 流动

- 压力

- 邻近度(区域)

- 液位测量

- 温度测量

- 影像

- 光电

- 其他感测类型

- 按最终用户产业

- 化工和石化

- 矿业与金属

- 力量

- 饮食

- 生命科学

- 航太和军事

- 用水和污水

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 亚洲

- 中国

- 日本

- 韩国

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

- 北美洲

第七章 竞争格局

- 公司简介

- Texas Instruments Incorporated

- TE Connectivity Inc.

- Omega Engineering Inc.

- Honeywell International Inc.

- Rockwell Automation Inc.

- Siemens AG

- STMicroelectronics Inc.

- ams AG

- NXP Semiconductors NV

- Infineon Technologies AG

- Bosch Sensortec GmbH

- Sick AG

- ABB Limited

- Omron Corporation

第8章 限位开关分析

- 当前市场状况

- 市场动态

第九章投资分析

第十章 市场机会与未来趋势

The Industrial Sensors Market size is estimated at USD 27.46 billion in 2025, and is expected to reach USD 42.88 billion by 2030, at a CAGR of 9.32% during the forecast period (2025-2030).

Key Highlights

- In modern manufacturing and production processes, industrial sensors are indispensable, offering numerous advantages that boost efficiency, safety, and productivity. A key benefit of these sensors is their capability to monitor and gather real-time data. This feature empowers businesses to swiftly track performance metrics, identify anomalies, and make informed decisions. With sensors delivering continuous feedback, organizations can fine-tune processes, minimize downtime, and enhance overall operational efficiency.

- Industrial sensors also play a pivotal role in ensuring workplace safety. By monitoring environmental parameters like temperature, pressure, and gas levels, these sensors can preemptively identify hazardous situations. For example, gas leak sensors can promptly alert personnel, facilitating timely interventions that prevent accidents and safeguard workers.

- Furthermore, these sensors usher in the era of predictive maintenance. By scrutinizing data from sensors, companies can pinpoint machinery wear and tear and scheduling maintenance before failures strike. This forward-thinking strategy not only curtails expensive repairs but also prolongs equipment lifespan, culminating in substantial long-term savings.

- Industrial sensors are also at the forefront of automation and the adoption of smart technologies in manufacturing. With the burgeoning Internet of Things (IoT), sensors can interact with other devices, forging an interconnected system that amplifies process automation and data sharing. This synergy not only streamlines operations but also bolsters resource management and energy efficiency, leading to reduced operational costs.

- The surge in industrial automation is propelling the industrial sensors market. As manufacturers chase heightened efficiency and leaner operational costs, automation technologies, from robotics to process automation, are gaining traction. In this landscape, sensors are vital, offering real-time data that sharpens decision-making and boosts operational efficiency. With the momentum towards smart factories and Industry 4.0, the appetite for sensors that can monitor, control, and refine processes is witnessing an unprecedented surge.

- While integrating sensors enhances industrial automation, it also incurs costs, restricting their adoption in budget-sensitive applications. Additionally, the substantial R&D expenses associated with new product development present a major challenge, particularly for small and medium-sized sensor manufacturers with limited cash flow. These manufacturers frequently find it challenging to dedicate adequate resources to extensive research and development, which is vital for innovation and maintaining market competitiveness. Consequently, they risk falling behind larger firms that have the financial capacity to invest significantly in emerging technologies.

Industrial Sensors Market Trends

Image Sensors Type Segment is Expected to Hold Significant Market Share

- Industrial image sensors play a crucial role in capturing visual data across various industrial environments. These devices are essential for automated inspections, quality control, and monitoring systems. By converting light into electronic signals, they facilitate defect detection, dimension measurement, object identification, and production line monitoring. While primarily used in sectors like manufacturing, automotive, robotics, and electronics, these sensors are fundamental to machine vision systems, allowing automated systems to interpret and respond to visual data.

Rising Adoption of Automation and Machine Vision Systems

- As industries, especially in manufacturing and quality control, increasingly embrace automation, the demand for industrial image sensors is on the rise. These sensors are pivotal to machine vision systems, enabling swift product inspections for defects, ensuring precision on assembly lines, and enhancing overall production efficiency. Furthermore, with the advent of Industry 4.0 and the rise of smart factories, the demand for these sensors in automated environments is set to grow.

- According to the International Federation of Robotics (IFR), global shipments of industrial robots hit around 593,000 units in 2023, showing a significant increase from the previous year. Forecasts suggest these shipments will climb to approximately 718,000 units by 2026.

- Additionally, in May 2023, Cognex unveiled its Advantage 182 vision system, an AI-driven solution designed for OEMs in the life sciences sector, aimed at simplifying complex tasks like location, classification, and inspection. Given the rising demand, many vendors are rolling out new products, underscoring the importance of image sensors in advanced industrial robots and machine vision systems.

- Inspections have gained paramount importance in industrial environments. With image sensors, factory operators can more adeptly spot defects during rapid inspections. For instance, in January 2023, ams OSRAM expanded its Mira family of high-sensitivity, global shutter CMOS image sensors by launching the 2.3mm x 2.8mm, 0.5Mpixel Mira050.

- In April 2024, OMNIVISION unveiled two state-of-the-art CMOS global shutter (GS) image sensors designed for machine vision applications. The company has also set up a specialized machine vision unit to lead innovations in areas like industrial automation, robotics, logistics barcode scanning, and intelligent transportation systems (ITS).

- These newly launched sensors stand out in imaging performance, particularly for applications that require high dynamics, precision, and quick responsiveness. The OG05B1B boasts a 5-megapixel (MP) resolution in a 1/2.53-inch optical format (OF), while the OG01H1B, designed for factory automation and ITS, offers a 1.5MP resolution in a 1/4.51-inch OF. Such strategic initiatives and advancements are anticipated to drive the segment's growth in the foreseeable future.

Asia Pacific Expected to Witness Significant Growth in the Market

- China's swift embrace of robots to supplant human workers is poised to propel market growth. As manufacturing efficiency hinges on automation in China, the demand for sensors ensuring robot functionality is set to surge.

- Japan's pressing workforce shortages are steering manufacturers towards cutting-edge technologies, including automation, robotics, and Industry 4.0 solutions. The Organisation for Economic Co-operation and Development (OECD) highlights Japan's demographic challenges: the nation boasts the world's oldest population and has seen a decline of over 2.7 million in the last decade. Projections indicate a staggering 40% drop in the total workforce by 2065. Consequently, leveraging advanced manufacturing technologies not only boosts productivity and energy efficiency but also curtails product defects. This approach directly addresses workforce shortages, amplifying the demand for industrial sensors in automated factories.

- Japan stands at the forefront of the automated industrial revolution, rapidly embracing Industry 4.0. As a manufacturing nexus for factory automation products, Japan not only caters to its domestic needs but also supplies to other markets across the Asia-Pacific. The nation's significance is further underscored by its diverse industries, including multiple automobile manufacturers, electronics, and food processing.

- South Korea's automotive sector, now a global heavyweight, has evolved from its humble, government-controlled beginnings to a landscape dominated by multinational giants. With industry leaders like Kia Corporation, Hyundai Motor Company, and Renault Group firmly established, South Korea is on a trajectory of sustained automobile demand growth.

- Significant investments across diverse sectors are fueling a burgeoning demand for industrial sensors in India and Southeast Asia.

- As Southeast Asian automotive manufacturers navigate the surging demand for electric vehicles (EVs) with automated driving features, strategic partnerships are becoming pivotal. In January 2024, Exicom, a trailblazer in EV charger manufacturing and a vital ally to global automotive giants, inked a distribution deal with Thailand's energy innovation firm, InnoPower Company Limited. This collaboration is set to reshape Thailand's EV landscape, with InnoPower distributing Exicom's AC/DC chargers. By establishing a local sales and distribution network, Exicom fortifies its foothold in Southeast Asia. Furthermore, as production lines meld human workers with sensors, the appetite for proximity sensors boasting extended sensing ranges is anticipated to rise.

Industrial Sensors Industry Overview

The industrial sensors market is fragmented, with several prominent players like Texas Instruments Incorporated, TE Connectivity Inc., Omega Engineering Inc., Honeywell International Inc., Rockwell Automation Inc., Siemens AG, and STMicroelectronics Inc. The market players are launching various innovative products that cater to consumers' evolving requirements. Further, the market has been registering significant collaborations and partnerships. Expansions and acquisitions among the market players to expand their presence to address the increasing demand for industrial sensors would fuel future market growth.

Furthermore, the market is expected to grow at a significant rate in the future due to the increasing acceptance of automation across all end-user industries being captured. This is improving industry profitability. Thus, the threat of new entrants is high.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 and Other Macroeconomic Factors on the Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of IoT Leading to Demand for Sensing Components

- 5.1.2 Growing Emphasis on the Use of Predictive Maintenance and Remote Monitoring

- 5.2 Market Restraints

- 5.2.1 Cost and Operational Concerns

6 MARKET SEGMENTATION

- 6.1 By Sensor Type

- 6.1.1 Flow

- 6.1.2 Pressure

- 6.1.3 Proximity (Area)

- 6.1.4 Level Measurement

- 6.1.5 Temperature

- 6.1.6 Image

- 6.1.7 Photoelectric

- 6.1.8 Other Sensing Types

- 6.2 By End User Vertical

- 6.2.1 Chemical and Petrochemicals

- 6.2.2 Mining and Metal

- 6.2.3 Power

- 6.2.4 Food and Beverage

- 6.2.5 Life Sciences

- 6.2.6 Aerospace and Military

- 6.2.7 Water and Wastewater

- 6.2.8 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 South Korea

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Texas Instruments Incorporated

- 7.1.2 TE Connectivity Inc.

- 7.1.3 Omega Engineering Inc.

- 7.1.4 Honeywell International Inc.

- 7.1.5 Rockwell Automation Inc.

- 7.1.6 Siemens AG

- 7.1.7 STMicroelectronics Inc.

- 7.1.8 ams AG

- 7.1.9 NXP Semiconductors NV

- 7.1.10 Infineon Technologies AG

- 7.1.11 Bosch Sensortec GmbH

- 7.1.12 Sick AG

- 7.1.13 ABB Limited

- 7.1.14 Omron Corporation

8 ANALYSIS OF LIMIT SWITCHES

- 8.1 Current Market Scenario

- 8.2 Market Dynamics