|

市场调查报告书

商品编码

1687870

机器人感测器-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Robotic Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

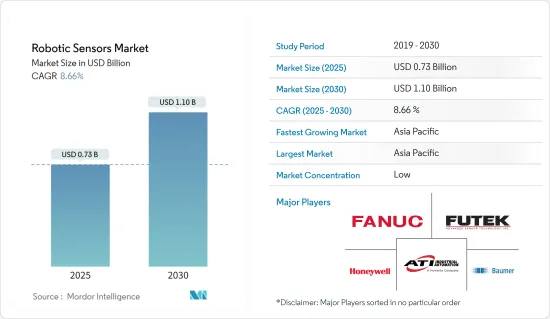

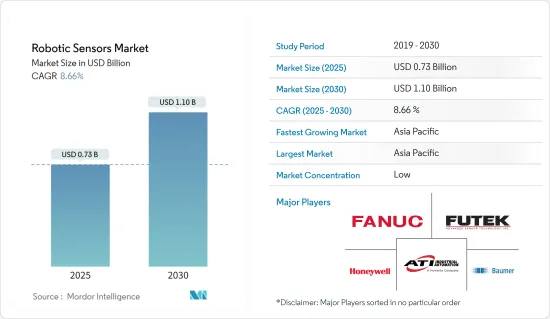

机器人感测器市场规模预计在 2025 年为 7.3 亿美元,预计到 2030 年将达到 11 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.66%。

由于各终端用户产业采用工业 4.0 和 IIoT 解决方案,预计该市场将会成长。此外,政府对研发的投资和对永续性的日益重视进一步推动了研究市场的需求。此外,研究市场的各个参与企业都专注于汽车和製造业等高成长领域,以继续在研究市场发展业务。

关键亮点

- 许多因素推动市场成长,包括自动化、人工智慧、能源储存、工程和机器学习等技术的快速进步。技能短缺是影响机器人技术广泛应用的一个主要因素。除了劳动力短缺之外,劳动力收入的提高也影响着全部区域对机器人的需求动态。此外,还需要经常对员工进行培训以适应新技术。这促使组织采用机器人系统,并促使市场供应商对系统组件进行创新。

- 此外,机器人技术现已成为开发中国家和低度开发国家製造业的重要力量。然而,工人将继续进入服务业,降低工资,并导致服务业就业和薪资停滞,而不是普遍失业,至少在短期和中期内是如此。数位技术使日常任务自动化并取代人力的前景有时似乎对开发中国家的製造业构成了生存威胁。这种预测往往受到技术可行性的驱动。然而,工作自动化也取决于经济和製度的可行性,在低度开发国家,这可能比技术方面更重要。

- 机器人在自动化领域的日益普及预计将推动机器人感测器市场的发展。机器人是一种经过编程来执行任务并配备各种感测器、致动器和控制系统的机器。这些感测器使机器人能够与环境互动并有效地执行任务。根据国际机器人联合会 (IFR) 10 月发布的一项机器人调查,美国食品和饮料行业去年部署的机器人数量增加了 25%,预计到 2021 年将达到 3,402 台。 IFR 表示,机器人提供的高水准卫生可能是导致 COVID-19 疫情后病例激增的原因之一。

- 然而,高昂的安装成本对市场成长是一项挑战。此外,需要高级技术人员来操作和维护自动化和机器人基础设施,进一步增加了整体成本,阻碍了大规模采用,特别是在中小型企业中。

- 新冠疫情的爆发,加速了各药厂对医院和药局需求的快速反应。新冠疫情迫使企业在有限的劳动力下运营,进而影响了全球企业的营运能力。一些公司已经开始投资自动化技术,以克服劳动力短缺并减少对人力的依赖。製药业对机器人系统的需求不断增长,推动了对机器人感测器的需求,对市场研究产生了积极影响。

机器人感测器市场趋势

最大的终端用户产业是製造业

- 工业物联网和协作机器人的出现有望推动机器人感测器市场的发展。到2023年,物联网设备将占所有连网设备的50%(147亿),高于2018年的33%(61亿)。此类物联网设备的增加预计将推动市场的成长。

- 随着工业IoT、增强智慧(AR)、云端运算等技术的进步,全球製造业企业正在组装智慧工厂,实现工业生产的自动化、资讯化、智慧化。例如,工业机器人有望在智慧製造转型中发挥关键作用。

- 此外,许多国家构想的多项工厂自动化和智慧製造倡议预计将为机器人感测器市场的成长提供丰厚的机会。例如,中国政府雄心勃勃的「中国製造2025」计划,部分受到德国工业4.0的启发,旨在提高中国在製造业的竞争力。

- 韩国政府非常重视智慧製造,并计划在 2025 年之前拥有 30,000 家全自动製造公司。政府旨在透过采用最新的自动化、资料交换和物联网技术来实现这一目标。

- 根据日本机器人工业预测,2022年日本製造商的工业机器人订单将达到创纪录的9,558亿日圆(73.5亿美元),与前一年同期比较增长1.6%。由于向电动车的转变以及全球劳动力短缺,对生产线自动化的强劲需求支撑了订单的成长。

- 下一代工业机器人的发展以多种新型感测器技术的快速和持续引入为标誌。新的感测器技术使机器人能够准确感知周围环境、精确执行任务并避开包括人在内的障碍物。同样,整合独特的力和触觉感测器可以增强机器人的触觉和感觉,使其能够执行更精确的任务并更安全地移动。

亚太地区占市场主导地位

- 由于中国、日本、印度、韩国和台湾等多个国家/地区显着采用工业机器人,预计亚太地区将在预测期内实现最高成长率。由于汽车和半导体製造业的大规模采用,中国在机器人应用感测器的区域采用率方面占据主导地位。

- 中国是製造业的领导者,拥有强大的电子产品和相关组件消费基础,这是推动机器人感测器市场发展的主要因素。该国在汽车、电子、航太和国防、食品和饮料以及其他产业拥有重要的製造业基础,预计将进一步推动市场成长。

- 政府加强对先进製造业的支持力度可能会对市场成长产生正面影响。中国政府推出了一项名为「中国製造2025」的国家主导的工业计划,旨在让中国在全球高科技製造业中占据优势。

- 此外,中国工业与资讯化部、国家发展与改革委员会、科技部等12个部门于2021年12月公布了《机器人产业「十四五」发展计画》。这是中国机器人产业的第二个五年发展计画,将对推动和鼓励产业高品质发展发挥重要作用。

- 到2025年,我们的目标是让机器人产业的营业利润复合年增长率超过20%。这项五年计画旨在拓宽和深化机器人应用范围,不断增加全国机器人数量。它还旨在促进更稳定和强大的供应链并推进行业标准化。由于机器人技术涉及各种类型的感测器,如触摸、接近感应等,该领域的整体成长将推动市场成长。

- 由于韩国、日本和印度等新兴经济体也在汽车、电子和製造业领域以显着的成长率领先,该地区市场具有巨大的成长潜力。地方政府也是机器人市场感测器发展的重要因素。

机器人感测器产业概况

机器人感测器市场细分化,包括霍尼韦尔国际公司、FUTEK 先进感测器技术公司、发那科公司、堡盟集团和 ATI 工业自动化公司(Novanta 公司)等多家全球和区域参与企业。这些拥有竞争性市场份额的公司正致力于扩大其在基本客群。这些公司正在利用策略合作计划来增加市场占有率和区域影响力。

- 2023 年 10 月-堡盟推出一款新型感测器,让定位和检查更加便利。随着 OX 感测器系列的推出,堡盟现在可以提供易于实施的品管和定位解决方案。借助 OX 系列轮廓分析,以前在组装和处理过程中遇到的困难定位和检查问题现在可以透过智慧 2D 轮廓感测器经济地解决。

- 2023 年 8 月 - ATI 工业自动化宣布将 F/T 感测器与 FANUC 机器人和 FANUC 力控制软体整合。这种集合成为机器人应用中的先进自动化和精确控制开闢了新的可能性。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 评估宏观经济因素和新冠疫情对市场的影响

第五章市场动态

- 市场驱动因素

- 工业机器人需求快速成长

- 机器人在物流和运输应用的应用日益增多

- 协作机器人(cobots)的技术进步

- 市场限制

- 欠发达地区普及率较慢

第六章市场区隔

- 按类型

- 力和扭矩感测器

- 温度感测器

- 压力感测器

- 位置感测器

- 接近感测器

- 视觉感测器

- 其他感测器

- 按最终用户

- 製造业

- 车

- 工艺与包装

- 后勤

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第七章竞争格局

- 公司简介

- ATI Industrial Automation(Novanta Inc.)

- Baumer Group

- FANUC Corporation

- FUTEK Advanced Sensor Technology Inc.

- Honeywell International Inc.

- Infineon Technologies AG

- OMRON Corporation

- Sensata Technologies Inc.

- TE Connectivity Ltd

- Tekscan Inc.

第八章投资分析

第九章 市场机会与未来趋势

The Robotic Sensors Market size is estimated at USD 0.73 billion in 2025, and is expected to reach USD 1.10 billion by 2030, at a CAGR of 8.66% during the forecast period (2025-2030).

The market studied is anticipated to grow due to the adoption of Industry 4.0 and IIoT solutions across the various end-user industries. Also, government investments in research and development and a growing emphasis on sustainability further drive the demand of the market studied. In addition, various players in the examined market are focusing on high-growth sectors such as automotive and manufacturing to keep their business growing in the market studied.

Key Highlights

- Many factors, including rapid technological advancements in automation, artificial intelligence, energy storage, engineering, and machine learning, drive the growth of the market. The skill shortage is the primary factor impacting the increasing adoption of robots. Coupled with the lack of labor, the rising earnings of the workforce are also influencing the demand dynamics of robots across geographies. Moreover, the workforce needs to be trained frequently to adapt to new technologies. As a result, it drives organizations to adopt robotic systems, encouraging the market vendors to innovate on the components of the systems.

- Furthermore, manufacturing in developing and underdeveloped nations is currently undergoing a constant robotic evolution. However, workers are expected to continue to enter the service business, lowering wages and resulting in job growth and pay stagnation in the service sector rather than widespread unemployment, at least in the near and medium term. The prospect of digital technologies to automate routine tasks and replace human labor can sometimes appear like an existential threat to manufacturing in developing countries. Such predictions tend to be based on technical feasibility. However, the automation of jobs also depends on economic and institutional feasibility, and these factors can outweigh the technical aspects in underdeveloped countries.

- The growing adoption of robots for automation is expected to drive the robotic sensors market. Robots are machines programmed to perform tasks and are equipped with various sensors, actuators, and control systems. These sensors enable robots to interact with their environment and perform tasks effectively. In October 2022, according to robotics research published by the International Federation of Robotics, the food and beverage industry in the United States deployed 25% more robots last year, intending to reach 3,402 units by 2021. The higher level of hygiene provided by robotics, according to IFR, may have contributed to the surge in the aftermath of the COVID-19 pandemic.

- However, a high installation cost is the primary factor challenging the market's growth. In addition, the requirement of a highly skilled workforce to operate and maintain the automation or robotics infrastructure further adds to the overall cost, restraining mass adoption, especially in small and medium-scale industries.

- With the outbreak of the COVID-19 pandemic, various pharmaceutical manufacturers increasingly felt the substantial need to react promptly to the need for hospitals and pharmacies. The COVID-19 pandemic induced restrictions that forced the companies to operate with limited labor onboard, subsequently affecting the operational capacities of the companies across the world. Several enterprises started to invest in automation technologies to overcome this labor shortage and reduce their dependence on human labor. The increasing demand for robotic systems in the pharmaceutical industry propels the need for robotic sensors, positively influencing the market studied.

Robotic Sensors Market Trends

Manufacturing to be the Largest End-user Industry

- The emergence of the Industrial Internet of Things and collaborative robots are expected to drive the robotic sensors market. By 2023, IoT devices are expected to make up to 50% (14.7 billion) of all networked devices, up from 33% (6.1 billion) in 2018. Such an increase in IoT devices would drive the growth of the market studied.

- With technical advancements in Industrial IoT, Augmented Reality (AR), cloud computing, and other technologies, global manufacturing organizations have assembled intelligent factories to realize automation, information, and intelligent industrial production. Industrial robots, for example, will play a vital role in this smart manufacturing transformation.

- Moreover, several factory automation and smart manufacturing initiatives devised by numerous countries are expected to offer lucrative opportunities for the growth of the robotic sensors market. For instance, the Chinese government's ambitious 'Made in China 2025' initiative, partially inspired by Germany for Industry 4.0, aims to boost the country's competitiveness in the manufacturing sector.

- The Korean government focuses on smart manufacturing and plans to have 30,000 fully automated manufacturing companies by 2025. The government aims to achieve this by incorporating the latest automation, data exchange, and IoT technologies.

- According to the Japan Robot Association, 2022, the orders for industrial robots from Japanese manufacturers hit a record JPY 955.8 billion (USD 7.35 billion) in 2022, up by 1.6% from the previous year. Strong demand for production line automation due to the shift to electric vehicles and global labor shortage underpinned the growth in orders.

- The rapid and continuous introduction of several new sensor technologies is prominent in developing next-generation industrial robots. New sensor technologies are enabling robots to see and sense their surroundings accurately, perform tasks precisely, and avoid obstacles, including people. Similarly, the integration of unique force and tactile sensors is facilitating robots to have improved touch and feel capabilities that allow them to perform more precise tasks and operate more safely.

Asia Pacific to Dominate the Market

- Asia-Pacific is anticipated to record the highest growth rate during the forecast period, pertaining to the noteworthy installation of industrial robots in several countries, including China, Japan, India, South Korea, and Taiwan. China is dominating the regional adoption rate of sensors for robotic applications due to the massive deployment in the country's dominating automotive and semiconductor manufacturing industries.

- China is a manufacturing leader and has a strong consumer base for electronics and related components, which is a major factor contributing to the robotic sensors market. The country has a significant manufacturing base in automotive, electronics, aerospace and defense, food and beverage, and other industries, which is expected to boost the market's growth further.

- The growing government aid in the improvement of the advanced manufacturing sector is set to positively impact the market's growth. The government of China launched "Made in China 2025", a state-led industrial policy that seeks to make China dominant in global high-tech manufacturing.

- Furthermore, China's Ministry of Industry and Information Technology, the National Development and Reform Commission, the Ministry of Science and Technology, and 12 other agencies released "The 14th Five-Year Development Plan for the Robotics Industry" in December 2021. This is China's second five-year growth plan for the robotics industry, and it serves a critical role in facilitating and encouraging the industry's high-quality development.

- By 2025, the country aims to exceed its average annual growth rate of operating income by 20% in the robotics industry. The five-year plan set out objectives to expand the breadth and depth of robotic applications to continue to increase the number of robots in the country. It also aims to promote a more stable and robust supply chain and to standardize the industry better. As robotics involve various types of sensors in touch, proximity detection, and so on, the sector's growth as a whole is set to boost the market's growth.

- As the automotive, electronics, and manufacturing sectors are also developing at a significant growth rate in other economies such as South Korea, Japan, and India, there is massive potential for growth in this regional market. The regional government is also one of the major factors in the development of sensors in the robotics market.

Robotic Sensors Industry Overview

The robotic sensors market is fragmented and consists of several global as well as regional players, including Honeywell International Inc., FUTEK Advanced Sensor Technology Inc., FANUC Corporation, Baumer Group, and ATI Industrial Automation (Novanta Inc.). These players with a competitive share in the market are focusing on expanding their customer base across global regions. These companies are leveraging strategic collaborative initiatives to increase their market share and regional presence.

- October 2023 - Baumer launched a new sensor class for easy positioning and inspection. By introducing the OX sensor series, Baumer enables quality control and positioning solutions with ease. With profile analysis in the OX series, previously challenging positioning and inspection tasks in assembly and handling can now be solved more economically with smart 2D profile sensors.

- August 2023 - ATI Industrial Automation announced the integration of its F/T sensors with FANUC robots and FANUC's Force Control Software. The integration opens new opportunities for advanced automation and precise control in robotic applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Degree of Competition

- 4.4 An Assessment of the Impact of Macroeconomic Factors and COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Surge in Demand for Industrial Robotics

- 5.1.2 Increased Adoption of Robots in Logistics and Transportation Application

- 5.1.3 Technological Advancements in Collaborative Robots (Cobots)

- 5.2 Market Restraints

- 5.2.1 Slow Adoption Rate in Underdeveloped Regions

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Force and Torque Sensor

- 6.1.2 Temperature Sensor

- 6.1.3 Pressure Sensor

- 6.1.4 Position Sensor

- 6.1.5 Proximity Sensor

- 6.1.6 Vision Sensor

- 6.1.7 Other Type of Sensors

- 6.2 By End User

- 6.2.1 Manufacturing

- 6.2.2 Automotive

- 6.2.3 Process and Packaging

- 6.2.4 Logistics

- 6.2.5 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ATI Industrial Automation (Novanta Inc.)

- 7.1.2 Baumer Group

- 7.1.3 FANUC Corporation

- 7.1.4 FUTEK Advanced Sensor Technology Inc.

- 7.1.5 Honeywell International Inc.

- 7.1.6 Infineon Technologies AG

- 7.1.7 OMRON Corporation

- 7.1.8 Sensata Technologies Inc.

- 7.1.9 TE Connectivity Ltd

- 7.1.10 Tekscan Inc.