|

市场调查报告书

商品编码

1687875

亚太地区合约物流:市场占有率分析、行业趋势和成长预测(2025-2030 年)APAC Contract Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

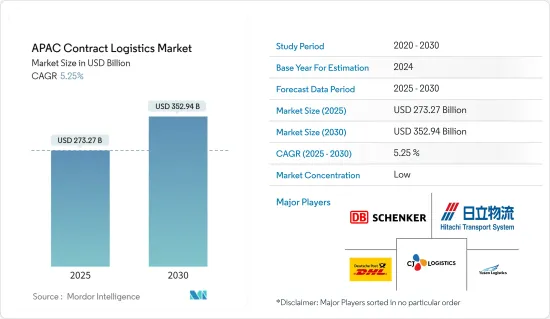

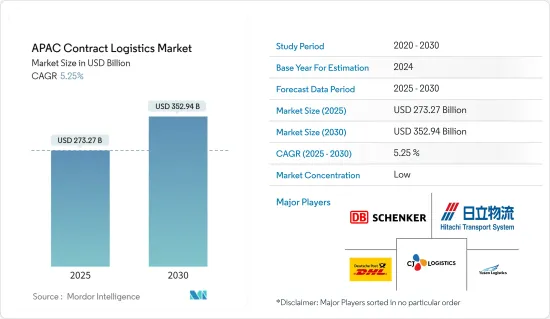

亚太合约物流市场规模预计在 2025 年为 2,732.7 亿美元,预计到 2030 年将达到 3,529.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.25%。

该地区抵御经济不确定性风暴的能力增强了其作为寻求更大稳定性的投资者和企业的首选目的地的地位。由东协主导的区域全面经济伙伴关係协定(RCEP)将于2022年1月生效,旨在加强区域经济一体化,并提供进入更大市场的机会,预计将刺激经济成长,同时帮助东南亚国协从最近的疫情中恢復过来。

亚太地区是该市场成长最快的地区,得益于其快速的经济发展和蓬勃发展的商业环境。亚太地区已超越欧洲,占据全球合约物流市场的首位。该地区的成长是由强劲的经济扩张、零售店率的上升和可支配收入的增加所推动的。

2022年,中国连续第七年维持全球最大物流市场地位,全国物流业收益达12.7兆元人民币(约1.83兆美元)。该国的基础设施建设得到了中国政府的大量资金支持。随着「一带一路」倡议的实施,预计中国将在不久的将来成为全球物流和运输领域的领导者:新兴亚洲地区的GDP成长率将在2022年和2023年分别达到5.2%和5.3%。

然而,不同次区域的復苏速度有所不同。不过,各经济体(尤其是南亚经济体)的国内需求仍在追赶疫情前的趋势,这支撑了该地区的成长。预计南亚地区 2022 年经济成长将保持强劲,达到 7.0%,2023 年将飙升至 7.4%。东亚地区 2023 年经济成长将正常化至 4.5%。

亚太合约物流市场趋势

製造业和汽车业的需求推动合约物流服务

亚太地区是世界製造业中心之一,占全球製造业产出的约48.5%。如今,世界各国都在建立先进的製造能力,以支持工业4.0的发展。工业 4.0 正在彻底改变全球製造商生产和分销产品的方式。人工智慧、云端运算、分析、人工智慧和机器学习只是主要企业正在融入其业务的一些技术。

2022年中国货运车辆出口额约9.88兆美元,成长约50.57%。越南的区域中心地位、高度的市场整合和低生产成本也使其成为对製造商越来越有吸引力的市场。三星、苹果、任天堂、LG、Panasonic和英特尔的总部均设在越南。越南也拥有强大的电子产业,使其成为中小企业提升价值链的有吸引力的市场。

国家统计局数据显示,2023年3月份,中国规模以上工业业增加值年增3.9%,显示中国经济在新冠肺炎疫情后復苏势头略有改善。工业业增加值年增3%,季增0.3个百分点。 2022年中国汽车产销分别完成2,702万辆和2,686万辆,较去年同期分别成长3.4%和2.1%。中国正在巩固其作为世界上最具吸引力的製造地的地位,而泰国则受益于成本状况的改善。

中国引领合约物流市场

随着中国客户需求的成长,企业被迫建立更先进的物流管道。这是因为对高价消费品和生鲜食品的需求不断增加,需要更好的物流管理,包括安全和处理。这只是中国和新兴经济体更显着的变化之一,显示未来几年这些经济体对高端服务的需求强劲。

预计中国将引领亚太地区的合约物流市场。中国合约物流市场正在稳步成长。这给该领域带来了新的挑战,包括扩大产品和服务范围、需要更有效率的网路以及需要控制变动成本。

中国合约物流市场主要集中在消费零售、汽车、医药、电子等产业,其中消费零售业约占50%。

2023年2月,电商巨头阿里巴巴集团控股旗下物流部门菜鸟网路宣布与德国领先的宅配公司德国邮政敦豪集团达成新协议,在波兰打造最广泛的小包裹快递柜网路。与德国邮政电子商务集团旗下的德国邮政电子商务解决方案公司达成的协议使这家中国科技巨头在欧洲成长最快的电子商务市场站稳了脚步。根据协议,德国邮政电子商务集团(DHL)与菜鸟网路(阿里巴巴集团控股的物流部门)将共同投资6,000万欧元(6,475万美元),在波兰各地建造小包裹柜。两家公司将整合现有网络,在战略位置安装宅配储物柜,并配备现代化、易于使用的介面,让消费者更方便地使用宅配储物柜。 DHL在波兰的宅配网点网路已覆盖1200个地点,DHL宅配柜的品质和速度在过去三年中提高了两倍。

亚太地区合约物流行业概览

亚太合约物流市场细分化,包括大型国际企业和本地企业。该地区的一些国家,如印尼和菲律宾,成长缓慢,拥有许多本土公司和一些大型国际公司。然而,新加坡、越南和泰国是竞争激烈的市场,拥有许多国际参与企业。企业不断面临降低成本和优化营运效率的压力。随着投资的转移和全球供应链的多样化,国际投资者对亚太物流市场的併购兴趣日益浓厚。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

- 分析方法

- 研究阶段

第三章执行摘要

第四章 市场动态与洞察

- 市场概览

- 市场动态

- 驱动程式

- 电子商务的成长

- 全球贸易与供应链弹性

- 限制因素

- 初期投资高

- 机会

- 跨境电子商务

- 驱动程式

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 替代品的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 竞争对手之间的竞争强度

- 价值链/供应链分析

- 政府法规和倡议

- 科技趋势

- 区域电商产业洞察(国内及跨境)

- 合约物流在售后服务/逆向物流中的洞察

- 合约物流参与企业提供的各种服务概述(综合仓储和运输、供应链服务和其他附加价值服务)

- 聚焦主要航线的货运成本/运费

- 货运走廊概况

- 深入了解主要经济特区 (SEZ) 和製造地

- COVID-19对市场的影响

第五章市场区隔

- 按类型

- 内部资源

- 委託

- 按最终用户

- 製造/汽车

- 消费品和零售

- 高科技

- 医疗药品

- 其他的

- 按国家

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 新加坡

- 马来西亚

- 印尼

- 泰国

- 其他亚太地区

第六章 竞争格局

- 公司简介

- Deutsche Post DHL Group

- DB Schenker

- Ceva Logistics

- United Parcel Services Inc.

- Logisteed Ltd

- CJ Logistics

- Nippon Express Co. Ltd

- Toll Group

- Nippon Express Co. Ltd

- Yusen Logistics Co. Ltd*

- 其他公司(关键资讯/概述)

- Hellmann Worldwide Logistics、SFHolding Co. Ltd、嘉里物流联网有限公司、Yamato holdings Co. Ltd、Leschaco Japan KK、Agility Logistics Ltd、Rhenus Logistics、GAC、Geodis、Linc Group、BCR Australia Pty Ltd、Silk Contract Logistics、DSV A/S*

第七章 市场机会与未来趋势

第 8 章 附录

- 各地区各活动GDP分布

- 洞察资本流动

- 对外贸易统计-主要国家进出口状况(分商品)

- 洞察主要国家主要出口目的地

- 洞察主要国家主要进口来源地

The APAC Contract Logistics Market size is estimated at USD 273.27 billion in 2025, and is expected to reach USD 352.94 billion by 2030, at a CAGR of 5.25% during the forecast period (2025-2030).

The region's ability to weather the storm of economic instability strengthens its position as a preferred destination for investors and companies looking for more stability. Enhancing regional economic integration and providing access to a larger market, the ASEAN-led Regional Comprehensive Economic Partnership Agreement, taking effect in January 2022, would help the ASEAN countries recover from the recent epidemic while spurring economic growth.

Asia-Pacific is the area that is gaining ground the fastest in this market due to its quick economic development and thriving business climate. Asia-Pacific has eclipsed Europe to take the top spot in the global market for contract logistics. The region's growth is fueled by robust economic expansion, rising retail enactment, and increasing disposable income.

For the seventh year in a row, China held the title of largest logistics market in the world in 2022, generating a revenue of CNY 12.7 trillion (about USD 1.83 trillion) from the country's logistics industry. The country's infrastructure is being developed with significant funding from the Chinese government. China will soon become the global leader in the logistics and transportation sectors thanks to the Belt and Road Initiative's execution: 5.2% and 5.3% of the region's GDP growth in emerging Asia in 2022 and 2023, respectively.

However, the rate of recovery differs amongst subregions. However, domestic demand in economies is still catching up to their pre-pandemic trend, particularly in South Asia, which supports regional growth. Growth in South Asia remained robust in 2022 at 7.0% before soaring to 7.4% in 2023. The growth rates in East Asia are normalized at 4.5% in 2023.

APAC Contract Logistics Market Trends

Demand From The Manufacturing And Automotive Sector Is Driving The Contract Logistics Services

Asia-Pacific is one of the world's manufacturing hubs, accounting for almost 48.5% of global manufacturing output. Today, more countries worldwide are building advanced manufacturing capabilities to support Industry 4.0 growth. Industry 4.0 is revolutionizing the way global manufacturers produce and distribute their products. AI, cloud computing, analytics, AI, and machine learning are just a few technologies leading businesses looking to incorporate into their operations.

In 2022, China exported around USD 9.88 trillion worth of motor vehicles for transporting goods, representing a growth of about 50.57%. Vietnam has also become an increasingly attractive market for manufacturers due to the country's regional centrality, high market integration, and low production costs. Samsung, Apple, Nintendo, LG, Panasonic, and Intel are all based in Vietnam. Vietnam is also making progress in the value chain by positioning itself as an attractive market for mid-tech due to its electronic sector.

In March 2023, China's industrial output increased by 3.9% YoY in the first quarter of 2023, according to the NBS, indicating a slight improvement in the country's economic recovery in the wake of the COVID-19 pandemic. Value-added industrial output grew by 3% Y-o-Y, representing a YoY increase of 0.3 percentage points compared to the previous quarter. In 2022, Chinese car manufacturers produced 27.02 million units, an increase of 3.4% YoY, while sales rose 2.1% Y-o-Y to 26.86 million. China is consolidating its position as the world's most attractive manufacturing hub, while Thailand benefits from cost profile improvements.

China Is Leading The Way In The Contract Logistics Market

Companies are pressed to create more advanced distribution channels as customer demand in China grows. It is due to the increased demand for higher-priced consumer goods and perishable foods that require logistics management, including better security and handling. It is only one of the more profound changes in these economies that point to a significant growth in the demand for high-end services in China and developing countries over the next few years.

China is expected to lead the Asia-Pacific contract logistics market. The contract logistics market in China is growing steadily. This has created new challenges for the sector, such as the need to expand product and service offerings, the need for more efficient networks, and the need to control variable costs.

The Chinese contract logistics market is mainly concentrated in consumer retail, automotive, medicine, electronics, and other industries, with the consumer retail industry making up about 50%.

In February 2023, Cainiao Network, a logistics arm of e-commerce giant Alibaba Group Holding, announced a new agreement to build Poland's most extensive parcel locker network with German courier giant Deutschlandpost DHL Group. The agreement with Deutsche Post ECommerce Solutions, a Deutsche Post E-commerce Group division, provides a foothold for the Chinese technology giant into one of Europe's fastest-growing e-commerce markets. According to the agreement, Deutsche Post ECommerce Group (DHL) and Cainiao Network (the logistics arm of Alibaba Group Holding) will jointly invest EUR 60 million (USD 64.75 million) in the construction of parcel lockers throughout Poland. The two companies will combine their existing networks to provide consumers with more convenient access to parcel lockers, which will be installed at critical locations with modern, easy-to-use interfaces. DHL's parcel shop network in Poland has already reached 1,200 locations, and DHL's parcel lockers have tripled in quality and speed in the past three years.

APAC Contract Logistics Industry Overview

The Asia-Pacific Contract logistics market is fragmented, with a mix of major international and local companies. Some of the countries in the region, like Indonesia and the Philippines, are moderately growing, with many local players and some major international players. However, Singapore, Vietnam, and Thailand are highly competitive markets, with the presence of a large number of international players. Companies are constantly under pressure to minimize costs and optimize operational efficiency. In the wake of investment shifts and diversification of global supply chains, international investors are increasingly interested in mergers and acquisitions in the APAC logistics market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 E-commerce Growth

- 4.2.1.2 Global Trade and Supply Chain Resilience

- 4.2.2 Restraints

- 4.2.2.1 High Initial Investment

- 4.2.3 Opportunities

- 4.2.3.1 Cross-Border E-commerce

- 4.2.1 Drivers

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Threat of Substitute Products

- 4.3.3 Bargaining Power of Buyers/Consumers

- 4.3.4 Bargaining Power of Suppliers

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Government Regulations and Initiatives

- 4.6 Technological Trends

- 4.7 Insights into E-Commerce Industry in the Region (Domestic and Cross-Border)

- 4.8 Insights into Contract Logistics in the Context of After-Sales/Reverse Logistics

- 4.9 Brief on Different Services Provided by Contract Logistics Players (Integrated Warehousing and Transportation, Supply Chain Services, and Other Value-added Services)

- 4.10 Spotlight on Freight Transportation Costs/Freight Rates for Key Routes

- 4.11 Brief on Freight Transport Corridors

- 4.12 Insights into Key Special Economic Zones (SEZs) and Manufacturing Hubs

- 4.13 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Insourced

- 5.1.2 Outsourced

- 5.2 By End User

- 5.2.1 Manufacturing and Automotive

- 5.2.2 Consumer Goods and Retail

- 5.2.3 High-Tech

- 5.2.4 Healthcare and Pharmaceuticals

- 5.2.5 Other End Users

- 5.3 By Country

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Japan

- 5.3.4 South Korea

- 5.3.5 Australia

- 5.3.6 Singapore

- 5.3.7 Malaysia

- 5.3.8 Indonesia

- 5.3.9 Thailand

- 5.3.10 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration, Major Players)

- 6.2 Company Profiles

- 6.2.1 Deutsche Post DHL Group

- 6.2.2 DB Schenker

- 6.2.3 Ceva Logistics

- 6.2.4 United Parcel Services Inc.

- 6.2.5 Logisteed Ltd

- 6.2.6 CJ Logistics

- 6.2.7 Nippon Express Co. Ltd

- 6.2.8 Toll Group

- 6.2.9 Nippon Express Co. Ltd

- 6.2.10 Yusen Logistics Co. Ltd*

- 6.3 Other companies (Key Information/Overview)

- 6.3.1 Hellmann Worldwide Logistics, S.F.Holding Co. Ltd, Kerry Logistics Network Limited, Yamato holdings Co. Ltd, Leschaco Japan K.K., Agility Logistics Ltd, Rhenus Logistics, GAC, Geodis, Linc Group, BCR Australia Pty Ltd, Silk Contract Logistics, DSV A/S*

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX

- 8.1 GDP Distribution, By Activity and By Region

- 8.2 Insights on Capital Flows

- 8.3 External Trade Statistics - Export and Import, By Product For Key Countries

- 8.4 Insights on Key Export Destinations of Key Countries

- 8.5 Insight on Key Import Origins of Key Countries