|

市场调查报告书

商品编码

1687890

雷射焊接机:市场占有率分析、产业趋势与统计、成长预测(2025-2030)Laser Welding Machines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

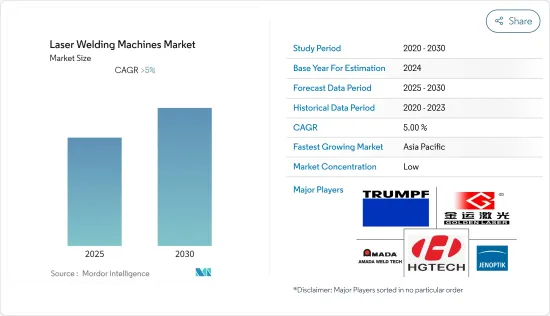

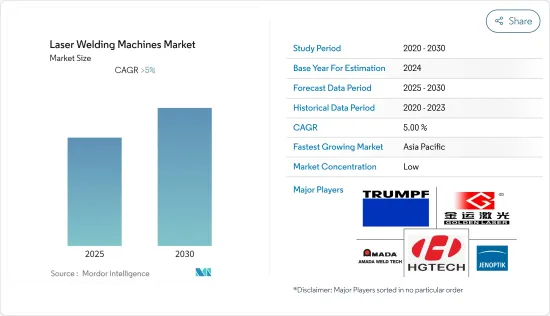

预测期内,雷射焊接机市场预计将以超过 5% 的复合年增长率成长

关键亮点

- 事实证明,COVID-19 疫情对各种企业都造成了极其严重的衝击,迫使世界各国政府实施严格的封锁措施,并强制要求保持社交距离,以遏制病毒的传播。受新冠疫情影响,各国不得不暂停彼此间的焊接作业,严重影响了货物供应,导致供应链中断。市场成长主要受到全球汽车、医疗和电子等多个终端用户产业需求不断增长的推动。

- 北美和欧洲等已开发地区比其他新兴经济体更早将雷射焊接技术应用于许多应用。由于自动化趋势的上升和焊接技术的不断进步等因素,这些新兴市场预计将极大地推动市场发展。

- 如今,雷射焊接已应用于许多不同的领域,从医疗设备中的高精度微焊接到医疗珠宝行业的小规模手工焊接,从模具和工具製造和修理到汽车和重工业领域的全自动雷射焊接。

- 此外,对金属製品的需求不断增加、重型工业设备的发展、日益先进的製造流程以及最新技术的采用也在推动市场的发展。此外,一些地区缺乏熟练劳动力,也增加了对自动化设备的需求。

雷射焊接机市场趋势

汽车产业需求增加

过去几年,雷射在汽车製造的应用呈指数级增长。儘管雷射最初主要用于切割应用,但其在焊接领域的应用已显着增长。

零件製造中的雷射应用涵盖引擎零件、传动零件、交流发电机、螺线管、燃油喷射器、燃油滤清器等。提高生产率、缩短週期时间在现代工业生产中扮演越来越重要的角色。特别是在汽车行业,每辆车的雷射焊缝总长度可能超过 50 米,因此高焊接速度对于最大限度地缩短加工时间至关重要。与传统焊接相比,雷射焊接还可以实现热传导焊接和深熔焊接。

据业内人士透露,全球轻型汽车产量令人印象深刻,未来将持续成长。就产量而言,预计亚太地区将创下最高成长率,其次是北美。预计这种情况将产生对雷射焊接机和其他与汽车製造过程相关的机械的需求。

成长最快的市场—亚太地区

分析称,预测期内亚太地区预计成长速度将快于其他地区。该地区拥有最多的製造工厂,引进雷射焊接机对于提高生产率至关重要。

由于中国拥有庞大的製造业,预计将成为该地区的主要参与者。此外,汽车产业是中国的重点产业之一,中国仍是全球最大的汽车市场。

纵观东南亚国协,製造业是该地区成长要素之一。该地区经济运营成本低,吸引了许多来自大型製造地的企业。

近年来,中国工资上涨,监管趋严,导致製造业向高附加价值方向转变,导致营运成本上升。为了取代中国曾经扮演的角色,企业正在转向东协地区附加价值较低的生产网络,这些网络已基本融入全球製造业价值链。分析认为,焊机生产企业应聚焦成长市场,服务新兴製造业,调整分销管道,提高销售量。

雷射焊接机产业概况

雷射焊接机市场高度分散,大量参与企业占据市场占有率,其中包括大型全球参与企业和中小型本地企业。对主要国家製造业基地的分析表明,许多跨国公司在主要国家都有业务。对主要企业的详细分析包括公司概况、财务状况、产品供应、最新发展等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

- 分析方法

- 研究阶段

第三章执行摘要

第四章 市场概述

- 当前市场状况

- 市场动态

- 驱动程式

- 限制因素

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- 全球製造业(概况、趋势、研发、关键统计等)

- 政府针对製造业的主要法规和倡议

- 焊接行业概况(概述、关键指标、发展等)

- 技术简介(例如机器人技术)

- 3D列印与积层製造洞察

- 雷射塑胶焊接聚光灯

第五章市场区隔

- 依技术

- 纤维

- Co2

- 固态

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章竞争格局

- 公司简介

- TRUMPF Group

- The Emerson Electric Co

- Wuhan Golden Laser Co

- Jenoptik AG

- Huagong Laser Engineering Co.,Ltd

- LaserStar Technologies Corporation

- Shenzhen HeroLaser Equipment Co.,Ltd

- IPG Photonics Corporation

- Amada Miyachi

- EMAG GmbH & Co. KG

- FANUC Robotics

- LASAG

第七章:市场的未来

第 8 章 附录

- GDP分布(依活动)- 主要国家

- 资本流动洞察 – 主要国家

- 经济统计资料-製造业对经济的贡献(主要国家)

- 全球製造业统计数据

The Laser Welding Machines Market is expected to register a CAGR of greater than 5% during the forecast period.

Key Highlights

- The COVID-19 outbreak proved very drastic for a variety of businesses and forced governments across the globe to implement strict lockdowns and led to social distancing being made mandatory to contain the spread of the virus, which disrupted the supply chain and halted welding activities across the world. As a consequence of the COVID-19 epidemic, countries were left with no alternative but to temporarily halt their welding operations with one another, which significantly impacted the supply of commodities, consequently producing a disruption in the supply chain. The growth of the market is majorly driven by the increasing demand from several end-user industries such as automotive, medical, electronics, etc., across the world.

- Developed regions like North America and Europe adopted laser welding techniques long back for many applications when compared to other developing economies. These developed regions are expected to fuel the growth of the market significantly owing to factors such as the rising trend of automation, and continuous advancements in welding technology.

- Currently, laser welding is used in numerous different fields, ranging from highly precise micro-welding of medical devices to small-scale manual welding in the medical and jewelry industries, from the manufacture and repair of dies and tools to fully automated laser welding in the automotive and heavy manufacturing sectors.

- Furthermore, the market is also driven by the growing demand for fabricated metal products, development of heavy industrial equipment, advancement in the manufacturing processes, and adoption of latest technologies. Additionally, the demand for automated equipment is also increasing due to the shortage of skilled personnel in some of the regions studied

Laser Welding Machines Market Trends

Increasing Demand from the Automotive Industry

The use of laser in automotive manufacturing has increased intensely over recent years. Although the lasers are initially developed mainly to cutting applications, a significant and growing proportion of lasers is being applied to welding.

The application of lasers in the manufacture of components covers engine parts, transmission parts, alternators, solenoids, fuel injectors, fuel filters, etc. Improved productivity and reduction of cycle time play an increasing role in current industrial manufacturing. Especially within the automotive industry, where the total length of laser welded seams can add up to more than 50 meters per car, it is important to minimize processing time by means of high welding speeds. Compared to conventional welding, laser welding allows for heat conduction welding and deep penetration welding, as well.

According to industry sources, global light vehicle production units have been remarkable and it only continues to grow. APAC is expected to register the highest growth rates in terms of production volumes followed by North America. This scenario is expected to create demand for the laser welding machines and other related machines associated with the automotive manufacturing process.

Fastest Growing Market- Asia-Pacific Region

As per the analysis, Asia-Pacific (APAC) is estimated to grow faster than other regions during the forecast period. The region has the highest number of manufacturing plants where the adoption of laser welding machines, which focus on improved productivity is essential.

China is expected to be the major country in the region owing to its vast manufacturing sector. Additionally, automotive is one of China's pillar industries, and it continues to be the largest vehicle market in the world.

Coming to ASEAN countries, the manufacturing sector has been one of ASEAN's key economic growth drivers. Economies in this region have low operating costs, which attract many businesses from larger manufacturing bases.

In recent times, China has seen rising wages and tighter regulations, which has led to an increase in operating costs as it shifts towards higher-value manufacturing. In order to replace the role that PRC once played, companies are looking to the ASEAN region for lower-value production networks which have also been largely integrated into global manufacturing value chains. As per the analysis, welding machine manufacturers should align their distribution channels to focus on the growing markets by serving the emerging manufacturing sectors to increase their sales.

Laser Welding Machines Industry Overview

The laser welding machines market is fairly fragmented in nature with the presence of large global players and small and medium sized local players with quite a few players who occupy the market share. When analyzing major countries' manufacturing establishments, it is revealed that many of the global companies have footprint in the major countries. Detailed analysis of major companies, which include company overview, financials, products offerings, recent developments, etc. are covered in the report.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.2 Restraints

- 4.3 Industry Attractiveness- Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Industry Value Chain Analysis

- 4.5 Global Manufacturing Sector (Overview, Trends, R&D, Key Statistics, etc.)

- 4.6 Key Government Regulations and Initiatives for Manufacturing Sector

- 4.7 Welding Industry Snapshot (Overview, Key Metrics, Developments, etc.)

- 4.8 Technology Snapshot (Robotics, etc.)

- 4.9 Insights on 3D Printing and Additive Manufacturing

- 4.10 Spotlight on Laser Plastic Welding

5 MARKET SEGMENTATION

- 5.1 By Technology

- 5.1.1 Fiber

- 5.1.2 Co2

- 5.1.3 Solid-State

- 5.1.4 Others

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Overview (Market Concentration, Major Players)

- 6.2 Company Profiles

- 6.2.1 TRUMPF Group

- 6.2.2 The Emerson Electric Co

- 6.2.3 Wuhan Golden Laser Co

- 6.2.4 Jenoptik AG

- 6.2.5 Huagong Laser Engineering Co.,Ltd

- 6.2.6 LaserStar Technologies Corporation

- 6.2.7 Shenzhen HeroLaser Equipment Co.,Ltd

- 6.2.8 IPG Photonics Corporation

- 6.2.9 Amada Miyachi

- 6.2.10 EMAG GmbH & Co. KG

- 6.2.11 FANUC Robotics

- 6.2.12 LASAG

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 GDP Distribution, by Activity-Key Countries

- 8.2 Insights on Capital Flows-Key Countries

- 8.3 Economic Statistics-Manufacturing Sector, Contribution to Economy (Key Countries)

- 8.4 Global Manufacturing Industry Statistics