|

市场调查报告书

商品编码

1687896

欧洲自行车:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Bicycle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

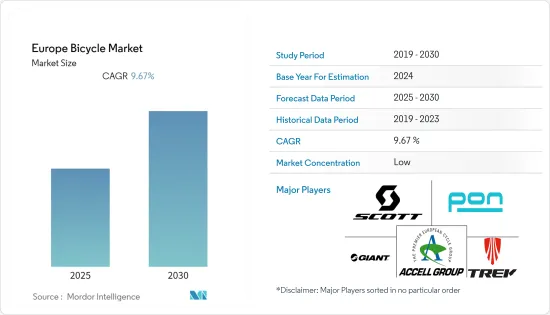

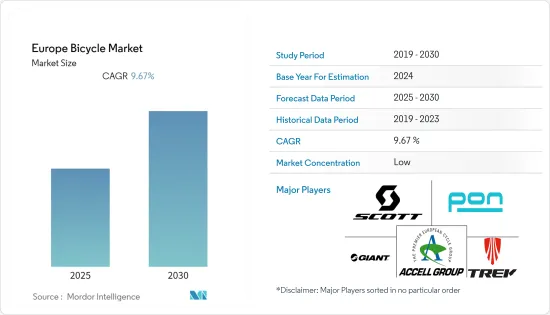

预计预测期内欧洲自行车市场的复合年增长率将达到 9.67%

关键亮点

- 在一些欧洲国家,例如法国、义大利、德国和荷兰,电动自行车的需求超过了传统自行车的需求。健身和休閒领域正在推动欧洲自行车市场的发展,随着越来越多的人选择骑自行车进行休閒和锻炼,预计该市场将在中长期内稳步增长。此外,自行车运动的日益普及以及自行车在健行和休閒活动中的多种应用也有望推动市场成长。

- 在日益增长的环境问题和积极的营销宣传活动的推动下,环保交通趋势使得更多的人选择骑自行车作为通勤方式。消费者对健身和健康的日益关注推动了电动自行车需求的成长。据西班牙自行车产业协会(AMBE)称,电动自行车是西班牙最受欢迎的电动车,预计2021年销量将超过22万辆。

- 该行业的主要企业正致力于透过合併、收购、合作和新产品开发来扩大其在该地区的品牌影响力。例如,Hero Motors Company集团旗下品牌Hero Cycles于2021年6月向欧洲交付了印度製造的电动自行车,标誌着其进入欧洲市场。

欧洲自行车市场的趋势

更多自行车赛事

- 由于徒步旅行、休閒和骑行活动的增加,未来几年对运动自行车的需求可能会增加。名人代言在推动需求方面也扮演着重要角色。

- 根据义大利摩托车配件协会(ANCMA)的资料,2021年义大利自行车产量超过320万辆。电动自行车类别实现了25%的显着成长,而标准自行车的产量与前一年同期比较去年同期成长5%,达到290万辆。比安奇宣布了雄心勃勃的计划,到 2022 年 8 月将其在义大利的产量提高两倍,轮胎製造商 Vittoria 和倍耐力也扩大了在义大利的工厂。

- 2021 年英国进行的一项调查按性别统计了每月至少骑自行车一次的人群百分比。调查发现,18% 的男性每月至少骑一次自行车,而每月出于任何目的骑一次自行车的女性和男性的比例分别为 8.5% 和 13.2%。

- 自行车赛事在推广自行车运动、刺激自行车市场成长方面也扮演关键角色。这些活动面向各类受众,包括儿童、成人、家庭和组织员工。例如,欧洲交通週是欧洲协调办公室、国家协调机构和欧盟委员会的倡议,旨在促进清洁交通,改善公众健康和整体生活品质。 2021 年 7 月,西班牙自行车爱好者推出了quierounabici.eu,旨在将阿姆斯特丹风格的自行车进口到西班牙。此外,自行车锦标赛等国际运动赛事鼓励消费者骑自行车,从而推动市场成长。

德国电动自行车需求不断成长

- 电动自行车技术的兴起正在将消费者的偏好从传统自行车转向电动自行车。全球和本地製造商都致力于透过采用防盗功能和智慧监控系统等新技术来满足日益增长的需求,以在市场上获得竞争优势。领先的製造商正在不断创新其电动自行车产品,正如 Dott 于 2021 年在德国推出的电动自行车所示,该电动自行车提供清洁的出行方式和单一应用技术。

- 政府推动电动自行车销售的措施也促进了市场需求。根据自行车产业协会统计,2021年自行车及电动自行车总合销量达237万辆,与前一年同期比较成长10%。其中,电动自行车产量143万辆,成长8%,自2019年起产量就超过了传统自行车。

- 一条连接德国 10 个城市和 4 所大学的 62 英里无车自行车高速公路的建设预计将在不久的将来进一步促进销售。消费者被高速公路的便利性和为更清洁的环境做出贡献的机会所吸引。所有这些因素都促进了电动自行车市场的成长。

欧洲自行车产业概况

欧洲自行车市场高度细分,有许多国际和区域参与企业。市场的主要参与企业包括 Accell Group NV、Trek Bicycle Corporation、Pon Holdings BV、Scott Corporation SA 和 Giant Manufacturing。这些公司占据市场主导地位,并利用合併、扩张、收购、合作和新产品开发等策略方法来提高其在该地区的品牌影响力。

欧洲自行车市场的其他主要参与者也在该地区占有重要地位。决定市场参与企业地位的关键因素是不断推出技术先进、品质优良的新产品。每个品牌都在设计、技术、品质和创新方面使其产品与众不同,以在市场上获得竞争优势。因此,产品差异化对于企业在欧洲自行车市场保持竞争力至关重要。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场驱动因素

- 市场限制

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 类型

- 公路自行车

- 油电混合自行车

- 全地形自行车

- 电动自行车

- 其他的

- 分销管道

- 线下零售店

- 线上零售商

- 地区

- 西班牙

- 英国

- 德国

- 法国

- 义大利

- 荷兰

- 其他欧洲国家

第六章竞争格局

- 主要企业策略

- 市场占有率分析

- 公司简介

- Accell Group NV

- Trek Bicycle Corporation

- Pon Holdings BV

- Giant Manufacturing Co. Ltd

- Bulls Bikes

- Ribble Cycles

- Riese und Muller GmbH

- Merida Industry Co. Ltd

- Scott Corporation SA

- Simplon Fahrrad GmbH

第七章 市场机会与未来趋势

The Europe Bicycle Market is expected to register a CAGR of 9.67% during the forecast period.

Key Highlights

- The demand for e-bikes has surpassed that of conventional bikes in certain European countries, such as France, Italy, Germany, and the Netherlands. The fitness and leisure segments have driven the European bicycle market, as more people are using bikes for recreation and exercising, leading to steady growth in the medium to long term. Moreover, the increasing popularity of cycling events and the versatile application of bikes in trekking and recreational activities are also expected to propel the market's growth.

- With growing environmental concerns and aggressive marketing campaigns, the trend towards eco-friendly transportation is encouraging more people to opt for cycling as a means of commuting. The increasing demand for e-bicycles is driven by the growing focus on body fitness and health consciousness among consumers. According to the Spanish Bicycle Industry Association (Spanish: Asociacion de Marcas y Bicicletas de Espana ((AMBE)), e-bicycles are the most popular electric vehicles in Spain, with over 220,000 units sold in 2021.

- Leading companies in the industry are focused on expanding their brand presence in the region through mergers, acquisitions, partnerships, and new product developments. For example, Hero Cycles, a brand under the Hero Motors Company Group, delivered its Made in India e-bikes to Europe in June 2021, marking the company's entry into the European market.

Europe Bicycle Market Trends

Increasing Number of Cycling Events

- The demand for sports bicycles may experience a boost in the upcoming years due to the increasing use of bicycles for trekking, recreational activities, and the growing number of cycling events. Celebrity endorsements also play a significant role in driving demand.

- According to the data by Associazione Ciclo Motociclo Accessori (ANCMA), over 3.2 million bicycles were manufactured in Italy in 2021. The e-bike category experienced exceptional growth of 25%, while the production of regular bicycles increased by 5% year-on-year, reaching 2.9 million units. Bianchi announced its ambitious plan to triple its Italian output by August 2022, and tire producers Vittoria and Pirelli expanded their Italian facilities.

- A survey conducted in 2021 in England distinguished the share of people who went cycling at least once a month by gender. The survey found that 18% of male participants cycled at least once a month, whereas 8.5% of females and 13.2% of individuals identifying as other genders cycled once a month for any purpose.

- Cycling events also play a vital role in promoting cycling and driving the bicycle market's growth. These events cater to different segments of the population, such as children, adults, families, and employees of organizations. For example, European Mobility Week is an initiative by the European Coordination, National Coordinators, and the European Commission to improve public health and the overall quality of life by promoting clean mobility. In July 2021, Spanish cycling enthusiasts launched quierounabici.eu, an initiative that imports Amsterdam-style bicycles to Spain. Additionally, international sports events like cycling championships encourage consumers to take up cycling, thus driving market growth.

Rising Demand of E bicycles in Germany

- The rise of e-bike technology has led to a shift in consumer preference from traditional bicycles to e-bikes. Both global and regional manufacturers are focused on meeting the growing demand by incorporating new technologies such as anti-theft features and smart monitoring systems to gain a competitive advantage in the market. Major manufacturers are continuously innovating their e-bike products, as demonstrated by Dott's recent launch of its e-bikes in Germany in 2021, which provide clean mobility and single-app use technology.

- Government initiatives to promote e-bike sales have also contributed to market demand. According to the Bicycle Industry Association, bicycles and e-bikes reached a total of 2.37 million units in 2021, a 10% increase from the previous year. Of these, 1.43 million were e-bikes, which experienced an 8% growth in manufacturing, surpassing the production of traditional bicycles since 2019.

- The construction of a car-free bicycle highway spanning 62 miles and linking ten cities and four universities in Germany is expected to further drive sales in the near future. Consumers are attracted to the convenience of this highway and the opportunity to contribute to a cleaner environment. All of these factors contribute to the growth of the e-bike market.

Europe Bicycle Industry Overview

The European bicycle market consists of many international and regional players, making it highly fragmented. Key players in the market include Accell Group NV, Trek Bicycle Corporation, Pon Holdings BV, Scott Corporation SA, and Giant Manufacturing Co. Ltd. These companies dominate the market and utilize strategic approaches such as mergers, expansions, acquisitions, partnerships, and new product developments to enhance their brand presence across the region.

Other leading players in the European bicycle market also hold a dominant presence in the region. The key factors determining the market players' position are the continuous launch of new products with advanced technology and high quality. Brands differentiate their products in terms of design, technology, quality, and innovation to gain a competitive advantage in the market. Thus, product differentiation is crucial for companies to maintain a competitive edge in the European bicycle market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Road Bicycles

- 5.1.2 Hybrid Bicycles

- 5.1.3 All Terrain Bicycles

- 5.1.4 E-bicycles

- 5.1.5 Other Types

- 5.2 Distribution Channel

- 5.2.1 Offline Retail Stores

- 5.2.2 Online Retail Stores

- 5.3 Geography

- 5.3.1 Spain

- 5.3.2 United Kingdom

- 5.3.3 Germany

- 5.3.4 France

- 5.3.5 Italy

- 5.3.6 Netherlands

- 5.3.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Strategies Adopted by Leading Players

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Accell Group NV

- 6.3.2 Trek Bicycle Corporation

- 6.3.3 Pon Holdings BV

- 6.3.4 Giant Manufacturing Co. Ltd

- 6.3.5 Bulls Bikes

- 6.3.6 Ribble Cycles

- 6.3.7 Riese und Muller GmbH

- 6.3.8 Merida Industry Co. Ltd

- 6.3.9 Scott Corporation SA

- 6.3.10 Simplon Fahrrad GmbH