|

市场调查报告书

商品编码

1687913

数位交易管理 (DTM) - 市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Digital Transaction Management (DTM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

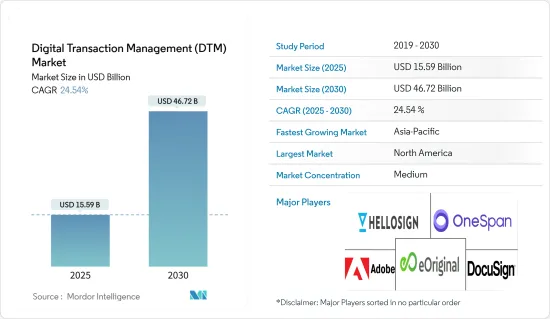

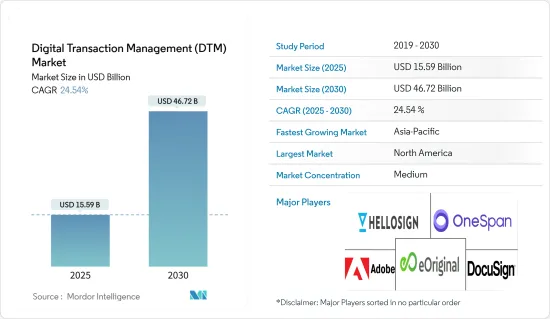

预计 2025 年数位交易管理市场规模为 155.9 亿美元,到 2030 年将达到 467.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 24.54%。

由于远距办公的增加和企业数位转型的加强,COVID-19 的传播最初对市场产生了积极影响。公司希望能够以无缝、高效的方式在任何地方开展业务。

关键亮点

- DTM 的采用正在增加,预计未来将吸收部分纸本文件。大多数企业正在采用数位平台来增加收益和利润率。例如,Salesforce 采用了数位交易管理,帮助其销售部门每份文件节省 20 美元,并将交付时间缩短 60%。此外,透过在销售流程中引入电子签章,成交时间从之前平均两天增加到一天内可完成约 90%,一小时内可完成约 71%。

- 业务自动化是一种透过使用数位技术以最少的人工干预执行任何业务流程来提高组织效率的方法。 RPA 和低程式码自动化等技术进步正在为更安全的贸易管理解决方案铺平道路。例如,区块链技术包含一系列带有时间戳记的资料记录,这些记录以链的形式将所有文件连结在一起。每笔交易都可以被视为发起交易的用户使用数位签章给予的同意证明。基于区块链技术建构的数位交易管理解决方案采用去中心化的网路进行交易管理,防止恶意攻击。

- 云端基础的解决方案的日益普及可能会进一步对数位交易管理市场产生积极影响。每个企业,无论规模大小,都需要在某种程度上管理其工作流程。跨部门和跨机构的工作流程是一项挑战,因为员工和经理可能使用不同的系统,而且可能需要大量出差。拥有一个云端基础的解决方案,允许所有团队成员与文件进行交互,使得管理数位交易的过程变得无缝且成本更低。这种云端基础的解决方案透过数位化流程,使业务协议和合约的达成更快、更安全、更准确,从而加快了业务协议和合约的达成。

- 与网路攻击和欺诈性数位交易相关的漏洞的增加可能会抑制市场的成长。中小企业保护其资产和网路安全的能力不如大公司,这使得它们更无力抵御诈骗和网路攻击的风险。为了避免这种潜在风险,公司透过提供最新材料和定期进行网路安全检查来保护客户。

- 新冠疫情迫使消费者和企业调整消费模式,对市场产生了负面影响。为了防止疫情蔓延,使用行动钱包进行非接触式付款的需求日益增加。亚马逊、Flipkart 和 Myntra 等电子商务巨头也已限制现金付款。这推动了数位交易管理的成长。预计即使在疫情爆发后,这一趋势仍将持续下去。公司正在寻求提供更好的价值以在竞争激烈的市场中保持领先地位。

数位交易管理市场趋势

BFSI产业预计将占据主要市场占有率

- 传统银行正在转型成为新型态、弹性、具有策略重点的金融机构。复杂多变的法规、激烈的竞争以及苛刻的客户所带来的各种挑战促使人们齐心协力推动数位转型。此外,随着云端基础的解决方案的采用率不断提高,BFSI 产业将在预测期内经历重大变化。

- 银行业正在经历数位转型之旅。今年 12 月,Zimpler 推出了 PayLink 解决方案,该解决方案可以增强发票功能并帮助企业透过重定向到其银行应用程式的付款连结发送数位发票。该金额将自动从您的帐户中扣除,您的客户无需使用卡片来付款帐单,从而加速您的数位转型。

- 疫情及相关发展以及对数位化日益增长的关注,对银行业的趋势产生了重大影响。据印度储备银行称,上一财年印度全国的数位交易额超过 60 兆印度卢比(7,280 亿美元),预计在预测期内将增至 385 兆印度卢比(4.7 兆美元)。银行业金融交易的大幅增加正在推动数位交易管理市场的需求。

- 此外,Finastra 最近的一项调查显示,企业银行客户正将重点转向即时执行能力、改进的线上平台存取和附加价值服务。作为回应,银行正从传统的关係管理模式转向数位平台,以便能够快速、灵活、敏捷地回应客户需求。

- 随着消费者对数位银行解决方案的倾向性不断增强,在该领域运营的公司也在增加对数位解决方案的采用。例如,Raiffeisen Bank International (RBI) 已与 Moxtra 合作宣布推出 RaiConnect,这是一项配备协作模组和电子纸工作流程的虚拟分店服务,旨在为客户提供数位体验。

预计北美将占据较大的市场占有率

- 数位交易管理服务可以帮助企业加速交易完成,从电子签章和无纸化程序等基本任务到工作流程和内容自动化等更复杂的 DTM 流程。该服务透过可靠、快速和保密的方式将整个流程数位化,实现了许多企业传统上在纸上进行的活动(例如提案、协作、查询、资料聚合和合约)的自动化。由于企业日益向自动化转变、云端运算的采用、行动装置的快速采用以及大型企业占据相当大的市场占有率,北美占据了很大的市场占有率。

- 政府推出的与电子签章电子签章相关的倡议,例如《统一电子交易法》(UETA)和《全球和国家商务电子签名法》(E-SIGN),允许在所有交易中使用电子签章,在促进市场发展方面发挥着重要作用。 《美国-墨西哥-加拿大协定》(USMCA)等贸易协定也鼓励使用电子签章。

- 一些主要供应商正在推出创新服务以保持竞争力。这些公司正致力于技术进步,例如推出美国签章检验平台 Mitek 的 Check Intelligence。随着技术的快速进步,加上政府监管的不断加强,改进的数位身分法律将满足该地区对数位交易管理的需求。

- 伙伴关係正在塑造该地区的市场格局。 Lone Wolf Technologies 与 Minnesota Realtors 签署了一项新协议,提供房地产交易管理解决方案,包括 Lone Wolf Transactions(zipForm 版)和 Lone Wolf Transactions(TransactionDesk 版)。

数位交易管理产业概览

全球数位交易市场竞争激烈,许多地区和全球参与企业都参与其中,例如 DocuSign、OneSpan 和 Adobe。

- 2022年11月,尼日利亚金融科技公司Pivo筹集了200万美元的种子资金,用于升级现有产品并开发新产品,以改善供应链中的数位交易管理。 Pivo 还计划资金筹措扩大在拉各斯办事处以外的东非地区的影响力和团队。

- 2022 年 10 月,值得信赖的房地产经纪人交易管理平台 Skyslope 与美国房地产公司 Allen Tate Realtors 合作,向 1,700 名经纪人提供 Skyslope 的服务。该合作伙伴代表 3,000 家房地产办公室和超过 117,000 名代理商,并提供一流的交易体验,包括 DTM 和 Skyslope Forms 等工具和功能。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 电子签章的兴起与云端服务的采用

- 专注于业务自动化

- BFSI产业预计将占据主要市场占有率

- 市场问题

- 网路攻击和诈欺性数位交易的脆弱性日益增加

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场区隔

- 按组件

- 解决方案

- 按服务

- 按组织规模

- 中小企业

- 大型企业

- 按最终用户产业

- BFSI

- 医疗保健

- 零售

- 资讯科技/通讯

- 其他的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 其他的

第六章竞争格局

- 公司简介

- DocuSign Inc.

- Adobe Inc.

- ZorroSign Inc.

- Nintex Group Pty Ltd

- Namirial SpA

- HelloSign Inc.(Dropbox Inc.)

- OneSpan Inc.

- eOriginal Inc.

- SignEasy

- Mitratech Holdings Inc.

- AssureSign LLC

- Topaz Systems Inc.

- PandaDoc Inc.

- PactSafe Inc.

- InfoCert

第七章投资分析

第八章 市场机会与未来趋势

The Digital Transaction Management Market size is estimated at USD 15.59 billion in 2025, and is expected to reach USD 46.72 billion by 2030, at a CAGR of 24.54% during the forecast period (2025-2030).

The spread of COVID-19 positively impacted the market initially due to the rise in remote working and growing digital transformation across businesses. Enterprises are seeking business methods that are seamless and efficient and can be done from anywhere.

Key Highlights

- The adoption of DTM is increasing, and it is expected to absorb several parts of paper documents in the future. Most companies are embracing digital platforms to increase revenue and profitability. For instance, Salesforce adopted digital transaction management, and the company's sales organization experienced a USD 20 savings per document and a 60% reduction in turnaround times. The company also adopted electronic signature within their sales process, and the deal close time from an average of around two days down to about 90% of deals closing in one day and 71% closing in one hour.

- Business automation is a way to increase organizational efficiency by leveraging digital technologies to carry out all business processes with minimal human intervention. Technological advancements such as RPA and low-code Automation are paving the way for more secure transaction management solutions. For instance, Blockchain Technology provides a series of timestamped data records in the form of a chain linking all the documents. Every transaction can be considered proof of consent given by the user who initiated the transaction using digital signatures. The digital transaction management solutions built on blockchain technology use a decentralized network for transaction management to prevent malicious attacks.

- Increased adoption of cloud-based solutions would further positively impact the digital transaction management market. Small and large businesses must manage workflows on some level. Interdepartmental and cross-agency workflows are challenging as employees and managers may be on different systems that might perform substantial transfers. A cloud-based solution that allows every team member to interact with documents would make the digital transaction management process seamless and less costly. These cloud-based solutions speed up signing business agreements and contracts by digitalizing the process quickly, securely, and accurately.

- Increasing vulnerability related to Cyber-attacks and fraudulent digital transactions could restrain the market growth. Small businesses counter the risk of fraud and cyber-attacks because they lack the assets and cybersecurity safety measures compared to larger organizations. To avoid this potential risk, companies protect clients by providing them with the most up-to-date materials and regular cybersecurity check-ins.

- The COVID-19 pandemic negatively impacted the market with a forced adjustment in consumer and business spending patterns. The demand for contactless payments have increased through the use of mobile wallets to prevent the spread of the pandemic. Further e-commerce giants like Amazon, Flipkart, Myntra, etc., have also restricted cash payments. Such things strive for the growth of Digital Transaction Management. This trend is expected to continue even after the pandemic's impact. The companies look forward to offering higher values to gain a competitive edge in a highly competitive market.

Digital Transaction Management Market Trends

BFSI Industry is Expected to Hold a Significant Market Share

- Traditional banks have been turning to new and strategically focused agile institutions. The diverse challenges related to the ever-changing complex regulations, intense competition, and demanding customers have resulted in an alignment toward digital transformation. Also, along with the rise in cloud-based solution adoption, the BFSI industry is set to witness a significant change over the forecast period.

- The banking sector was moving towards digital transformation initiatives. In December this year, Zimpler launched a pay link solution to augment invoices and help businesses to send digital invoices through a payment link that redirects to the banking app. The amount will be auto-debited from the account, and the customer does not need cards to pay for the invoice to accelerate their digital transformation.

- The pandemic and related developments, along with a growing focus on digitization, have significantly impacted trends in the banking industry. According to the Reserve Bank of India, during the last fiscal year, over 35 billion digital transactions worth INR 60 trillion (USD 728 billion) across India were done and are projected to rise to INR 385 trillion (USD 4.7 trillion) over the forecast period. The vast increase in the rise of financial transactions in the banking sector drives the demand for Digital Transaction Management Market.

- Moreover, a recent Finastra study showcased that corporate banking clients have been shifting their focus towards real-time execution capabilities, better access to online platforms, and value-added services. In response, the banks are moving away from the traditional relationship management model toward a digital platform that can meet the client's needs faster, more flexibly, and agilely.

- With the growing consumer propensity towards digital banking solutions, enterprises operating in the space are increasingly adopting digital solutions. For instance, to provide a digital experience for customers, Raiffeisen Bank International (RBI) announced the launch of RaiConnect, a virtual branch service featuring a full suite of collaborative modules and ePaper workflows in partnership with Moxtra.

North America is Expected to Hold a Significant Market Share

- Digital transaction management services can accelerate signing corporate contractual agreements from basic tasks like e-Signatures and paperless procedures to more intricate DTM processes like workflow and content automation. It automates activities that many businesses have traditionally done on paper, such as proposals, collaborations, inquiries, data compiling, and agreements, by digitizing the entire process in a reliable, rapid, and confidential manner. North America holds a significant market share, primarily owing to the increasing shift of enterprises toward automation, cloud adoption, exponential mobile adoption, and the presence of major players occupying a significant market share.

- Government initiatives related to e-signatures, such as the Uniform Electronic Transactions Act (UETA) and Electronic Signatures in Global and National Commerce Act (E-SIGN), permit e-sign usage for every transaction, thereby playing a significant role in driving the market. Trade deals, such as the United States-Mexico-Canada Agreement (USMCA), also encourage using e-signatures.

- Multiple key vendors are rolling out innovative offerings to remain competitive. The companies are involved in technological advancements, such as the launch of Check Intelligence by Mitek, a US-based signature verification platform. With such rapid technological advancement, alongside increased regulation by the government Improving Digital Identity Act strives to meet the Digital Transaction Management demand in the region.

- Partnerships are shaping the market landscape in the region. Lone Wolf Technologies signed a new agreement with Minnesota Realtors to provide transaction management solutions for real estate, including Lone Wolf Transactions (zipForm Edition) and Lone Wolf Transactions (TransactionDesk Edition).

Digital Transaction Management Industry Overview

The Global Digital Transaction Market is significantly competitive with many regional and global players such as DocuSign, OneSpan, Adobe, etc. The presence of well-diversified players characterizes the market. The vendors consistently provide innovative solutions in line with the advancement in technologies that eventually cater to customers' increasing needs across various end-user industry verticals. Many Startups, such as EthSign, and ThinkSmart LLC, have also entered the market.

- In November 2022, Pivo, a Nigerian-based fintech firm, raised USD 2 million in seed funding to upgrade its existing products and develop new products to improve digital transaction management in the supply chain. Pivo also plans to expand its presence to East Africa outside its Lagos office and grow its team with this funding.

- In October 2022, Skyslope, a trusted realtor transaction management platform, partnered with USA-based real estate agency Allen Tate Realtors to offer SkySlope services to 1700 agents. The alliance represents more than 117,000 agents in 3,000 real estate offices to provide best-in-class transaction experience that includes DTM and tools and features like SkySlope Forms.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise in E-signatures and Adoption of Cloud Services

- 4.2.2 Focus on Business Automation

- 4.2.3 BFSI Industry is Expected to Hold a Significant Market Share

- 4.3 Market Challenges

- 4.3.1 Increasing Vulnerability Related to Cyber-attacks and Fraudulent Digital Transactions

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitutes

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Valuechain Analysis

- 4.6 Assessment of COVID-19 Impact of on the Market

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solution

- 5.1.2 Service

- 5.2 By Organization Size

- 5.2.1 Small and Medium Enterprise

- 5.2.2 Large Enterprise

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 Retail

- 5.3.4 IT and Telecommunication

- 5.3.5 Other End-user Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 DocuSign Inc.

- 6.1.2 Adobe Inc.

- 6.1.3 ZorroSign Inc.

- 6.1.4 Nintex Group Pty Ltd

- 6.1.5 Namirial SpA

- 6.1.6 HelloSign Inc. (Dropbox Inc.)

- 6.1.7 OneSpan Inc.

- 6.1.8 eOriginal Inc.

- 6.1.9 SignEasy

- 6.1.10 Mitratech Holdings Inc.

- 6.1.11 AssureSign LLC

- 6.1.12 Topaz Systems Inc.

- 6.1.13 PandaDoc Inc.

- 6.1.14 PactSafe Inc.

- 6.1.15 InfoCert