|

市场调查报告书

商品编码

1690931

欧洲数位交易管理 (DTM):市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Europe Digital Transaction Management (DTM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

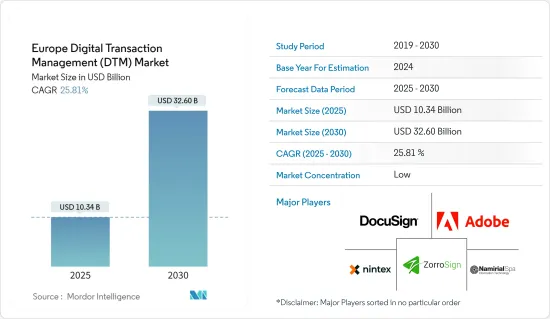

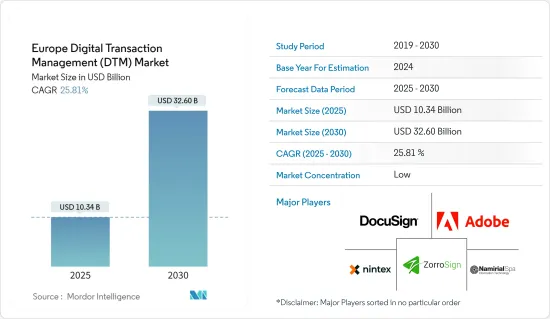

预计 2025 年欧洲数位交易管理市场规模为 103.4 亿美元,到 2030 年将达到 326 亿美元,预测期内(2025-2030 年)的复合年增长率为 25.81%。

欧洲的数位交易管理(DTM)已经成为管理基于文件的交易的数位工具。我们还透过减少文书工作、传真、归檔和储存问题,以及实施集中式储存解决方案数位签章来帮助简化业务交易。除了加快交易和核准之外,DTM 还允许多名员工和相关人员存取相同的文檔,而无需透过电子邮件或传真来回发送。

主要亮点

- 透过数位管道管理文件和基于文件的任务的主要好处之一是简化业务流程。因此,在终端用户产业中,自动化合约等常规文件相关业务不仅可以降低业务成本,还可以释放员工的时间来专注于其他重要业务。

- 现代电子签章解决方案除了提供电子签章的便利性之外,还提供了广泛的好处。透过实现销售、物流和人力资源等部门之间文件工作流程的自动化,电子签章可显着提高效率,帮助各种规模的企业消除管理瓶颈。与数位交易管理解决方案一起,电子签章软体将文件数位化,使其比传统的纸笔方法更有效率。

- 业务自动化是超越传统资料处理和记录保存业务的复杂业务流程和功能的自动化,通常透过云端服务和数位交易管理解决方案等先进技术实现。业务自动化使用技术在系统中执行重复性任务和流程,以取代体力劳动。这样做是为了提高效率、降低成本并简化业务。

- 在吸引新客户方面,与隐私和安全相关的威胁仍然是一个令人担忧的问题。欧洲 DTM 市场供应商越来越多地采用云端服务来提供对客户端所需硬体要求最低的解决方案。采用云端服务也涉及公司关键财务资料的共用。

欧洲数位交易管理 (DTM) 市场趋势

最大的终端用户是IT和通讯业

- 欧洲数位交易管理市场正在 IT 和通讯等多个行业中成长。数位交易管理涉及管理电子交易,包括建立、签署、验证和储存数位文件。

- IT 产业正在采用数位交易管理解决方案来数位化内部流程。这包括创建和核准数位文件、合约和计划相关文书,减少对传统纸本工作流程的依赖。与协作工具的整合使 IT 团队能够建立文件和协商合约。

- 欧盟提案在2021-2027年财政框架期间向数位技术投资约1,500亿欧元(1,607亿美元)。这笔金额分为三大项目,其中「地平线欧洲」计画投资额最大,达 976 亿欧元(1,041.5 亿美元),其中包括约 21.3 亿美元用于网路安全。

- 电信业者使用数位交易管理来管理服务协议、合约和其他法律文件。这加快了合约生命週期,减少了文书工作并提高了合规性。数位交易管理透过为服务协议和其他所需文件提供电子签章,简化了客户入职流程。

- 采用数位化和云端基础解决方案可以实现更快的文件核准和透过电子签章进行更有效的跟踪,这有可能改变通讯业。这些解决方案针对的是正在进行数位转型、需要升级工作流程、核准流程和保存数位记录的公司。

- 此外,数位解决方案可以减少传统的手动纸本流程以及相关人员、员工、承包商和客户之间的相关延误、错误和混乱。并自动化合约管理和付款等流程,使您的员工能够更快采取行动。

预计德国将占据较大市场占有率

- 区块链等分散式帐本技术(DLT)在德国和欧洲越来越重要。德国越来越多地采用云端运算技术和平台,加速该国的数位转型。

- 随着该地区越来越多的组织适应工业 4.0 标准并从纸本文件转向无纸化交易,电子签章文件被用来确保其完整性并提供签名者接受的证明。

- 根据欧洲央行的数据,2023年上半年欧洲非现金支付总额与2022年上半年相比成长10.1%,达到670亿笔,其中卡片付款占54%,信用转帐占22%,直接扣款占15%,电子货币付款7%。电子交易的大幅成长预计将为所研究的市场带来成长机会,使参与者能够开发新的数位交易管理解决方案和服务,获得新客户并扩大其在市场上的份额。

- 欧洲数位交易管理市场多方面的发展正在演变成一种普遍的经济格局,为西门子德国等市场参与企业提供了充足的机会,使他们能够在生产和消费模式变化、物流和尚未开发的机会等多种因素方面获得绝对的竞争优势,进一步加速了整个德国数位交易管理市场的成长和收益永续性。

- 行动电话和电子商务的快速成长刺激了数位付款的快速接受,尤其是在新冠疫情期间。数百万欧洲人选择无现金付款,而不是现金和信用卡。据Worldpay称,德国有几款网路购物应用程序,其中一些提供自己的支付方式。 2023年,使用电子钱包和数位/行动钱包的线上付款是德国最受欢迎的付款方式,占32%。

- 依赖纸本表格的机构需要签署和使用核准,造成效率低和浪费。转向数位化流程可以帮助政府更有效率地开展工作并改善流程。

欧洲数位交易管理产业概况

欧洲数位交易管理 (DTM) 市场较为分散,主要参与者包括 DocuSign Inc.、Adobe Inc.、ZorroSign Inc.、Nintex Group Pty Ltd 和 Namirial SpA。市场参与企业正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2023 年 11 月,领先的电子签章和联络人工作流程平台 Signeasy 宣布已整合 HubSpot CRM。对于使用 HubSpot 作为 CRM 的全球销售负责人,Signeasy 提供了一种直觉、安全的方式来发送、追踪和管理所有类型的合约、保密协议、协议和其他支援文件。

- 2023 年 9 月,基于区块链的资料安全解决方案的全球领导者 ZorroSign Inc. 宣布与 Vision Tech Solutions 建立策略伙伴关係。此次合作将把 ZorroSign 的资料安全平台和区块链技术融入 Vision Tech Solution 的IT基础设施和服务中。 Vision Tech Solutions 最初作为经销商,将随着伙伴关係的深化以及综合能力和技术协调,将 ZorroSign 带入新的业务和新市场。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业价值链分析

- 行业标准和法规

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 电子签章的兴起与云端服务的采用

- 继续关注自动化业务

- 市场限制

- 在吸引新客户方面,隐私和安全威胁仍然是令人担忧的问题

第六章 市场细分

- 按组件

- 解决方案

- 按服务

- 按组织规模

- 中小型企业

- 大型企业

- 按最终用户产业

- BFSI

- 卫生保健

- 零售

- 资讯科技/通讯

- 其他最终用户产业

- 按国家

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 丹麦

- 芬兰

- 挪威

- 冰岛

- 瑞典

第七章 竞争格局

- 公司简介

- DocuSign Inc.

- Adobe Inc.

- ZorroSign Inc.

- Nintex Group Pty Ltd

- Namirial SpA

- eOriginal Inc.

- SignEasy

- Mitratech Holdings Inc.

- AssureSign LLC

- Topaz Systems Inc.

- PandaDoc Inc.

- PactSafe Inc.(Ironclad)

- InfoCert SpA(Tinexta SpA)

- Scrive AB

第八章投资分析

第九章 市场机会与未来趋势

The Europe Digital Transaction Management Market size is estimated at USD 10.34 billion in 2025, and is expected to reach USD 32.60 billion by 2030, at a CAGR of 25.81% during the forecast period (2025-2030).

European digital transaction management (DTM) emerged as a digital tool to manage document-based transactions. It also helps streamline business transactions by reducing paperwork, faxing, filing, and storage issues and introducing centralized storage solutions and digital signatures. In addition to faster transactions and approvals, DTM allows multiple employees or parties to access the same documents without the need to email or fax documents back and forth.

Key Highlights

- One of the significant advantages of managing documents and document-based tasks through digital channels is business process streamlining. Thus, by automating routine document-related tasks, such as contracts, the end-user industries intend to free up employee time to focus on other essential business tasks, apart from reducing costs for doing business.

- Modern e-signature solutions offer a broad range of benefits, more than just the convenience of electronic signing. By automating document workflows across departments such as sales, logistics, and HR, e-signatures provide substantial efficiencies in helping businesses of all sizes eliminate paperwork bottlenecks. Along with digital transaction management solutions, e-signature software digitizes documents, which is far more efficient than the conventional pen-and-paper method.

- Business automation is the automation of complex business processes and functions beyond conventional data manipulation and record-keeping activities, generally through advanced technologies such as cloud services, digital transaction management solutions, etc. Business automation uses technology to execute recurring tasks or processes in the system where manual effort can be replaced. It is done to increase efficiency, minimize costs, and streamline operations.

- Privacy and security-related threats continue to remain a concern in terms of onboarding new customers. European DTM market vendors are increasingly adopting cloud services to provide their solutions with the minimum possible hardware requirements on the client premise. Adopting cloud services involves sharing the company's critical financial data as well.

Europe Digital Transaction Management (DTM) Market Trends

IT and Telecommunication Industry to be the Largest End User

- The European digital transaction management market has grown across various industries, including IT and telecommunications. Digital transaction management involves managing electronic transactions, including creating, signing, authenticating, and storing digital documents.

- Digital transaction management solutions are employed in the IT industry to digitize internal processes. This includes creating and approving digital documents, contracts, and project-related paperwork, reducing reliance on traditional paper-based workflows. Integration with collaboration tools allows IT teams to conduct documentation or contract negotiations.

- The European Union has proposed investments in digital technologies of approximately EUR 150 billion (USD 160.07 billion) over the financial framework period from 2021 to 2027. This amount is distributed over three main programs, of which the Horizon Europe program has the most significant investment sum of EUR 97.6 billion (USD 104.15 billion), and cybersecurity investment is approximately USD 2.13 billion.

- Telecommunication companies use digital transaction management to manage service agreements, contracts, and other legal documents. This helps accelerate contract lifecycles, reduce paperwork, and improve compliance. Digital transaction management streamlines customer onboarding processes by enabling the electronic signing of service contracts and other required documents.

- The adoption of digital solutions and cloud-based solutions that enable faster document authorization and more effective tracking through electronic signatures can transform the telecom industry. These solutions are aimed at businesses undergoing a digital transformation that requires upgrading their workflows and approval processes and keeping digital records.

- Additionally, digital solutions can reduce the traditional manual paper processes and associated delays, errors, and confusion between stakeholders, staff, contractors, and clients. This can also empower employees to act quickly by automating contract management, payments, and more processes.

Germany is Expected to Hold Significant Market Share

- Distributed ledger technology (DLT), such as blockchain, has been increasingly important in Germany and Europe. Germany is increasingly adopting cloud computing technologies and platforms to accelerate the country's digital transformation.

- As more organizations in the region adapt to industry 4.0 standards and move away from paper documentation to paperless transactions, electronically signed documents are used to guarantee their integrity and to be able to bring proof of acceptance by the signer.

- According to the European Central Bank, the total number of non-cash payments in Europe in the first half of 2023 increased by 10.1% to 67.0 billion compared to the first half of 2022; card payments accounted for 54% of total number of non-cash payments in the first half of 2023, credit transfers for 22%, direct debits for 15%, and e-money payments for 7%. Such a huge rise in electronic transactions is expected to create an opportunity for the market studied to grow and allow players to develop new digital transaction management solutions or services, allowing them to expand their market presence by capturing new customers.

- The multi-faceted developments in the European digital transaction management market are developing into the prevailing economic scenario, which adequately lends market participants such as Siemens Germany an absolute competitive edge about diverse elements such as production and consumption patterns, logistics alterations, and untapped dormant opportunities that further accelerate growth and revenue sustainability in the digital transaction management market across Germany.

- The rapid growth of mobile phones and e-commerce fueled the quick acceptance of digital payments, particularly during the COVID-19 pandemic. Millions of Europeans have chosen cashless payments over cash and credit cards. According to Worldpay, Germany has several online shopping apps available, some of which offer their own payment methods. In 2023, e-wallet, digital/mobile wallet online payment was the most popular payment method in Germany, accounting for 32%.

- Government agencies relying on paper-based forms need to be signed and used for approvals, resulting in inefficiencies and waste. Switching to digital processes can enable governments to do things more efficiently, improving the process.

Europe Digital Transaction Management Industry Overview

The European digital transaction management (DTM) market is fragmented, with the presence of major players like DocuSign Inc., Adobe Inc., ZorroSign Inc., Nintex Group Pty Ltd, and Namirial SpA. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- November 2023: Signeasy, one of the leading e-signature and contact workflow platforms, announced that it integrated the HubSpot CRM. For sales professionals across the globe using HubSpot as their go-to CRM, Signeasy would offer an intuitive and secure way to send, track, and manage all kinds of contracts, NDAs, agreements, and other supporting documents.

- September 2023: ZorroSign Inc., one of the global leaders in data security solutions built on blockchain, announced a strategic partnership with Vision Tech Solutions. This partnership would unite ZorroSign's data security platform and blockchain technologies with Vision Tech Solution's IT infrastructure and services. Initially, as a reseller, Vision Tech Solutions will bring ZorroSign to new companies and new markets as the partnership deepens with integrated capabilities and technology alignment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Standards and Regulations

- 4.5 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rise in E-signatures and Adoption of Cloud Services

- 5.1.2 Ongoing Focus on Automation of Businesses

- 5.2 Market Restraint

- 5.2.1 Privacy and Security-related Threats Continue to Remain a Concern in terms of On-boarding New Customers

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Organization Size

- 6.2.1 Small and Medium Enterprise

- 6.2.2 Large Enterprise

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 Retail

- 6.3.4 IT and Telecommunication

- 6.3.5 Other End-user Industries

- 6.4 By Country

- 6.4.1 United Kingdom

- 6.4.2 Germany

- 6.4.3 France

- 6.4.4 Spain

- 6.4.5 Italy

- 6.4.6 Denmark

- 6.4.7 Finland

- 6.4.8 Norway

- 6.4.9 Iceland

- 6.4.10 Sweden

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 DocuSign Inc.

- 7.1.2 Adobe Inc.

- 7.1.3 ZorroSign Inc.

- 7.1.4 Nintex Group Pty Ltd

- 7.1.5 Namirial SpA

- 7.1.6 eOriginal Inc.

- 7.1.7 SignEasy

- 7.1.8 Mitratech Holdings Inc.

- 7.1.9 AssureSign LLC

- 7.1.10 Topaz Systems Inc.

- 7.1.11 PandaDoc Inc.

- 7.1.12 PactSafe Inc. (Ironclad)

- 7.1.13 InfoCert SpA (Tinexta SpA)

- 7.1.14 Scrive AB